TC Energy Floating Preferred Shares: Double-Digit Yield With Relatively Low Risk

HAKINMHAN/iStock via Getty Images

Investment case

The post-COVID spike in inflation, followed by the Bank of Canada’s (BOC) massive increase in interest rates, resulted in an outstanding dividend yield for TC Energy Series 2 preferred shares (TSX:TRP.PR.F:CA) (OTCPK:TNCAF) and TransAlta preferred shares, Series B (TA.PR.E:CA). Currently, the annual yield for these floating dividend preferred shares is 10.4% for TRP.PR.F:CA and 10.8% for TA.PR.E:CA. Combined with the relatively low-risk profile of their respective companies, this is a rare-to-find investment opportunity.

Even though their floating yields do not seem to have much upside, as a decrease in the interest rates is “within the realm of possibilities” according to the BOC, I believe that over the next two years, these floating dividend preferred shares will provide investors with a better dividend yield than fixed dividend preferred shares of a similar risk profile. In addition, switching from floating to fixed dividend preferred shares after two years should not result in a significantly lower capital appreciation.

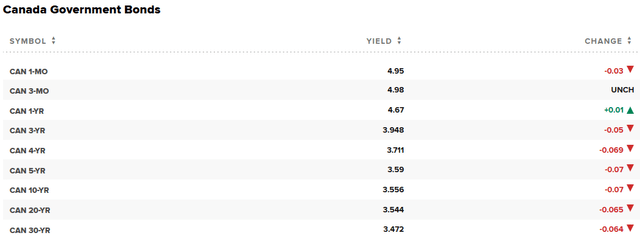

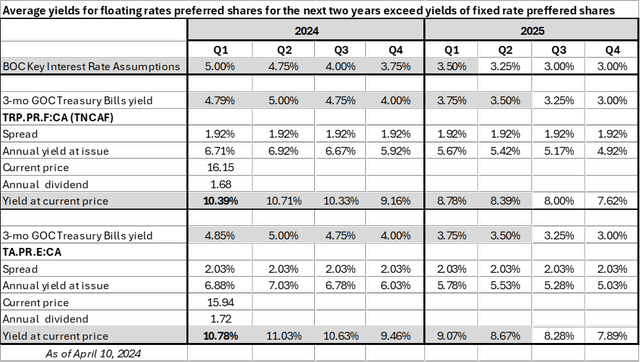

The dividend payments for these preferred shares are reset quarterly and based on a sum of their respective spreads and 3-month BOC treasury yields. According to the prospectus for TRP.PR.F:CA, the spread is 1.92%. For TA.PR.E:CA, the spread is set at 2.03%. As of April 9th, the 3-month BOC treasury bill’s yield was 4.98%.

CNBC, Canada Government Bonds

Outlook for Canadian interest rates

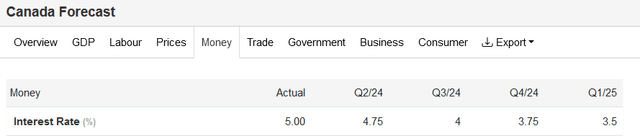

The main question for investing in these two ‘northern stars’ is the Bank of Canada’s long-term plan of action. According to the Trading Economics forecast, the BOC will implement three rate cuts in 2024 and at least another two in 2025. In the long term, the Trading Economics econometric model projects Canada’s interest rates to reach 3% in 2025. The rate cut in Q3 is projected to be a massive 0.75%, perhaps explained by a significant deterioration of the Canadian economy later this year.

TradingEconomics interest rates forecast

The factors supporting the BOC’s first-rate cut in June include lower-than-projected inflation and rising unemployment. In February, Canadian annual inflation increased by 2.8% compared to the 2.9% increase in January. Annual inflation for February was expected at 3.1%. At the same time, Canadian unemployment in March increased to 6.1% from 5.8% in February, the highest level over the last three years.

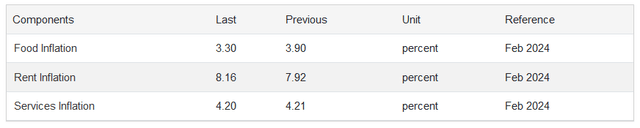

The factors that point towards the BOC delaying a decrease in rates to Q3 or even Q4 include the potential turnaround of food inflation due to growing oil prices, sticky rent, and services inflation. Another important reason to keep interest rates higher for longer is the Canadian housing bubble, which would be inflated even more by a cut in interest rates.

TradingEconomics inflation components

The monetary policy measures implemented by the US Bank of Federal Reserve (Fed) also play a paramount role in the BOC’s decision. Historically, the interest rate decisions by both banks ‘rhyme.’ This is easy to understand, as an interest rate cut by the BOC ahead of the Fed would weaken the Canadian dollar, which would increase US export and import prices and push Canadian inflation up. As the US economy is preparing for a ‘soft landing,’ or even ‘no landing,’ it seems sensible for the BOC to delay, if not the first, then the following rate cuts until the Fed makes its move.

As was widely expected, the April 10th Bank of Canada decision resulted in the BOC keeping the key rate at 5%, indicating that to start cutting interest rates, the bank would need to see more evidence of the inflation sustaining ‘downward momentum.’ The following press conference produced similar sentiments as the BOC Governor Macklem stated that although the latest data pointed to some progress in slowing underlying inflation, it is still not sufficient to loosen monetary policy. However, he has also stated that the interest rate cut in June is “within the realm of possibilities.”

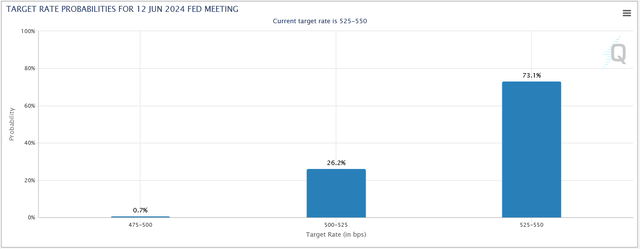

On the same day, the further acceleration of annual inflation in the US, which went up 3.5% in March after a 3.2% increase in February, dramatically reduced the probability of a Fed rate hike in June from above 50% to 26.2%. The higher-than-expected inflation not only almost completely ruled out the June rate cut in the US but also made future interest rate cuts by the BOC more difficult.

CME FedWatch Tool

Implications for the Canadian floating rate preferred shares

Using the forecast from Trading Economics, I created the following schedule for Canadian key interest rates in 2024 and 2025. Trading Economics assumptions are in gray, and my assumptions for 2025 are not highlighted. I assume that the BOC key interest rate and the Canadian 3-month Treasury Bills are fully correlated. (All dollar figures are in CAD unless otherwise stated).

I moved the 3-month GOC rate to the following quarter, as the calculation of the floating dividends typically happens 30 days prior to the “first day of the… Quarterly Floating Rate Period.”

Author analysis

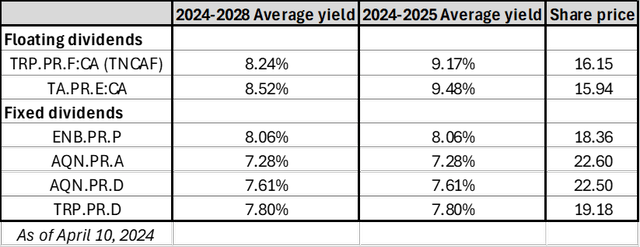

The table shows that the projected changes in the interest rates for the rest of 2024 and 2025 would result in the yield for the TRP.PR.F:CA and TA.PR.E:CA going down to 7.62% and 7.89%, respectively, at the end of next year. The average dividend yield for this period would be 9.17% for TRP.PR.F:CA and 9.48% for TA.PR.E:CA. If we were to assume that the 3-month GOC rates will remain at 3% for the next three years (until the end of 2028), the average yield for these investments would be 8.24% and 8.52% for the TRP.PR.F:CA and TA.PR.E:CA respectively.

Comparing the calculated average floating dividend yield for the next 5 years to the recently reset preferred shares with a 5-year fixed dividend, it is clear that the average floating dividend yields are higher than the fixed ones. During the first two years, while interest rates are likely to remain high, preferred shares with variable rates will pay much higher dividends.

Author analysis

Effect on price of floating yield preferred share when interest rates change

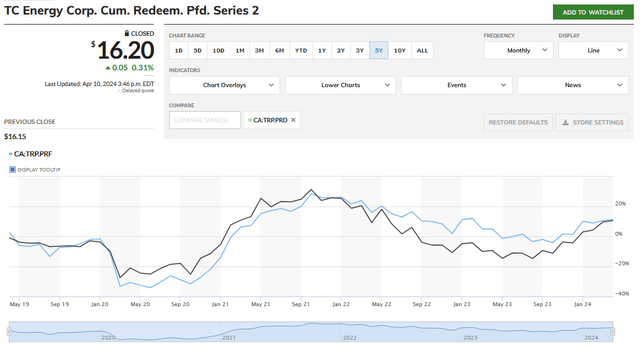

The ‘apples-to-apples’ comparison of the 5-year chart of floating dividend TRP.PR.F:CA and fixed dividend TRP.PR.D:CA shows that the performance of these preferred shares is highly correlated.

MarketWatch

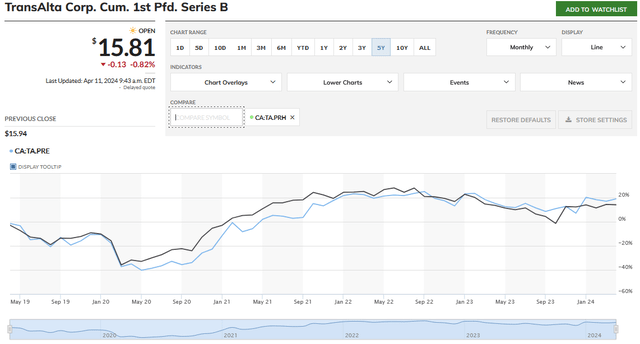

The 5-year performance of TransAlta floating and fixed dividend preferred shares, TA.PR.E:CA and TA.PR.H:CA presents similar dynamics.

MarketWatch

Based on their historic performance, it is likely that going forward, floating dividend and fixed dividend preferred shares with similar risk profiles will experience comparable changes in share prices when influenced by changes in interest rates. As interest rates are expected to decrease, both types of preferred shares will see comparable capital appreciation.

This indicates that holding preferred shares with a floating dividend for two years, then switching to fixed dividend ones after interest rates decrease significantly, should not result in a substantial difference in capital gain.

Risks to the TRP.PR.F:CA, TNCAF, and TA.PR.E:CA floating dividend preferred shares

- Macroeconomic problems resulting in faster than projected cut of key rates by the Bank of Canada.

- In case of stubbornly high inflation, the BOC’s higher-for-longer, or even an increase in interest rates, would result in a lower price for preferred shares.

- Critical operating problems related to various factors, such as regulation, force majeure, and a change in a supply-demand dynamic, result in lower profitability, decreased cash flows, and reduced dividend coverage.

- Decoupling between preferred share prices with fixed and floating dividends at the time of substantial changes in key interest rates by the Bank of Canada.

- Unsuccessful development and M&A activities, resulting in dilutionary effects on the share prices and undermining profitability.

TC Energy is a low-risk investment with above-average growth

As a Canadian ‘dividend aristocrat,’ TC Energy increased its dividends for 24 consecutive years. The latest dividend increase was on February 16, 2024, when the company announced a 3.2% rise in quarterly common share dividends. In 2023, the company had a dividend EPS payout ratio of 88%.

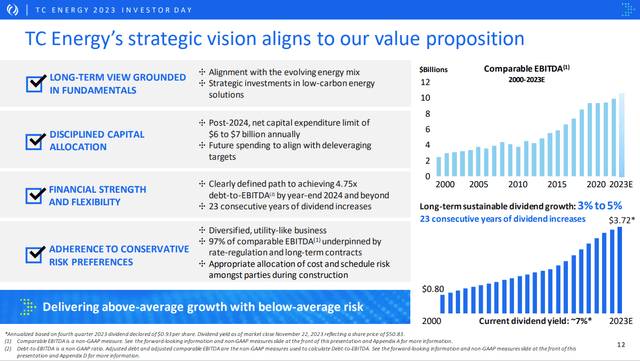

TC Energy company presentation

The company is one of the leaders in the Canadian infrastructure sector, with a growing portfolio of gas pipelines diversified across North America. The three natural gas pipeline businesses are long-term rate-regulated with take-or-pay contracts. Liquid pipelines and storage businesses are also highly contracted, low-risk operations. TC Energy also owns and operates 4.6 GW of power generation assets, with the majority of generation represented by hydro and nuclear power plants.

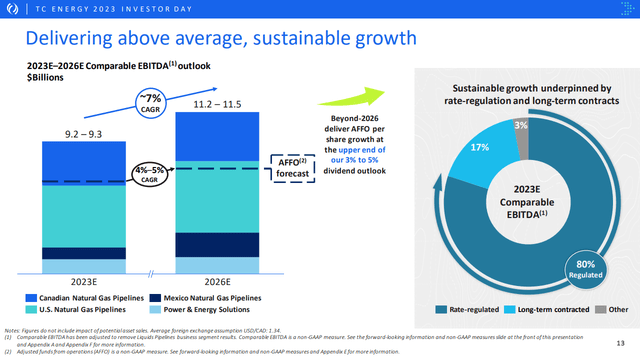

Recently, TC Energy reported solid annual 2023 financial results, showing growth in revenues and EBITDA. Earnings per share in 2023 went up by 5.1% year over year. The long-term outlook was also strong, with the CAGR for the next three years (until 2026) expected to reach 7%. The adjusted funds from operations are likely to achieve a 4%-5% CAGR over the same period of time. The growth is characterized by low risk, as 80% of EBITDA is based on regulated revenues, and 97% of the contracts are take-or-pay and/or have regulated rates.

TC Energy company presentation

TC Energy is focused on improving its debt position by selling some assets and lowering capex. The company has a balanced debt profile. 89% of its debt is fixed rate with a weighted average interest of 5%. The company’s rate-regulated contracts include interest rate pass-through mechanisms. The average debt term to maturity is approximately 18 years. In addition to a disciplined approach to leverage, TC Energy is also planning to decrease its Capex significantly over the next three years, from $12-12.5 billion in 2023 to $5-5.5 billion in 2026.

All these factors show that TC Energy is a solid long-term investment with above-average growth (compared to utilities and midstream companies) and below-average risk.

As I wrote in my recent article on Series 7 TRP.PR.D:CA, TC Energy preferred shares Series 2 TRP.PR.F:CA is also a low-risk investment. They are PFD-2L rated by DBRS. According to Canadian Preferred Shares, this rating means “substantial protection of dividend and principal” that “corresponds with the companies whose senior bonds are rated in the “A” category”.

Investment in TransAlta is riskier but pays a premium

Investing in TransAlta Preferred Shares, Series B carries a higher risk than the TRP.PR.F:CA, which explains a yield premium of approximately 0.4%. TransAlta preferred shares are PFD-3L rated by DBRS. As described in Canadian Preferred Shares, though this is not an Investment Grade rating, it is still adequate with “medium credit quality while protection of dividends and principal is still considered.” TransAlta also has a strong track record of dividend payments. Starting in 2019, the company increased its common shares dividends for 6 consecutive years, with a CAGR exceeding 10%.

TransAlta is one of the largest players in the Canadian power generation sector, with 5.7 GW of generating assets in Canada and internationally. Renewable generation amounts to 40.5% of the portfolio, with gas power generation representing the remaining 59.5%. The company has a large pipeline of renewable projects under development. Recent annual results point to a solid financial position, with 2023 revenues, EBITDA and earnings significantly growing year-over-year. Net Debt to EBITDA at the end of 2023 was 2.26x, indicating a solid balance sheet. The ratio of dividends (common and preferred) to Cash Flow after paying all financial obligations was 68%. The company is allocating its Free Cash Flow to strengthen the balance sheet, pay dividends, invest in the development of renewable energy, and continue to buy back shares.

Conclusion

After the publication of articles on investing in preferred shares prior to their yield reset, TC Energy Series 7 TRP.PR.D:CA and Enbridge Series R ENB.PR.T:CA, I received a number of questions related to the comparison between the fixed dividend yield preferred shares and those paying floating dividends. My analysis indicates that based on the current macroeconomic assumptions related to the Bank of Canada’s key interest rate decisions, over the next two years, floating rate preferred shares, TRP.PR.F:CA, TNCAF and TA.PR.E:CA, are likely to significantly outperform preferred shares of similar risk profiles with recently reset fixed dividends.

Moreover, the strong historical correlation between the market prices of these two types of preferred shares points to the possibility of exchanging floating dividends with similar fixed-dividend preferred shares after two years. This should not result in any meaningful negative impact on capital gains from lower interest rates.

In other words, investors can sell floating and buy fixed-dividend preferred shares when the sum of the spread and 3-mo GOC yield (used to calculate the floating dividends) would be lower than that of the fixed-dividend preferred shares.

TC Energy is a low-risk investment opportunity with potential above-average long-run returns. This article favours investing in TC Energy’s floating dividend preferred shares over the next two years compared to the company’s fixed dividend preferred shares. At the same time, investing in TransAlta’s floating dividend preferred shares is more risky due to the nature of the company’s business. This is reflected in a 0.4% yield premium. However, over the next two years, TA.PR.E:CA is also likely to outperform fixed dividend preferred shares of the companies in the Canadian utilities and infrastructure sectors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.