Technology stocks rise, but market internals look fragile | chart watcher

key

gist

- The Nasdaq Composite Index rose 1.35% thanks to semiconductor stocks and Apple upgrades.

- The Nasdaq Composite Index is trading close to a 52-week high, but market breadth does not share the bullish mood.

- Market breadth indicators such as bullish problem and percentage of moving averages do not confirm upward movement in the technology sector.

It becomes clear that today is Technology Day when you are notified of the following two alerts:

- The technology sector bullish percentage index rose above 70.

- Nasdaq surpassed 15000

memo: Here’s how to access it: Predefined technical alerts.

- select charts and tools tab

- find Predefined technical alerts card

- Choose View latest notifications

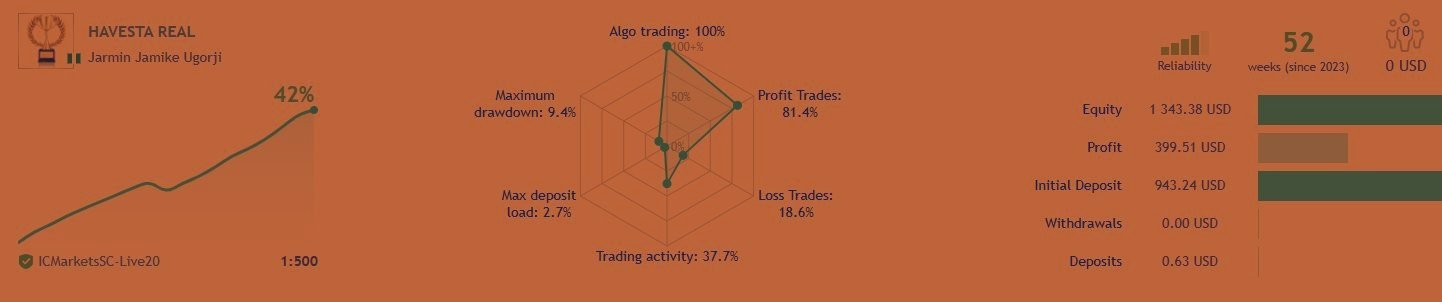

An upgrade from Apple (AAPL) and a better-than-expected earnings report from Taiwan Semiconductor (TSM) gave the technology sector a boost. The Nasdaq Composite Index ($COMPQ) ended the trading day up 1.35%. The index is trading above its 21-day exponential moving average and close to its 52-week high (see chart below).

Chart 1. The Nasdaq Composite Index rose and reached a 52-week high. Nasdaq showed signs of revival with semiconductor stocks rising significantly. How much higher can it go?Chart source: StockCharts.com. For educational purposes.

As indices, stocks and exchange-traded funds (ETFs) approach annual highs, one of the biggest fears for investors is a surge in stock prices. This is a valid concern. After all, how many times have you bought a stock only to see its price fall?

A Look Under the Hood

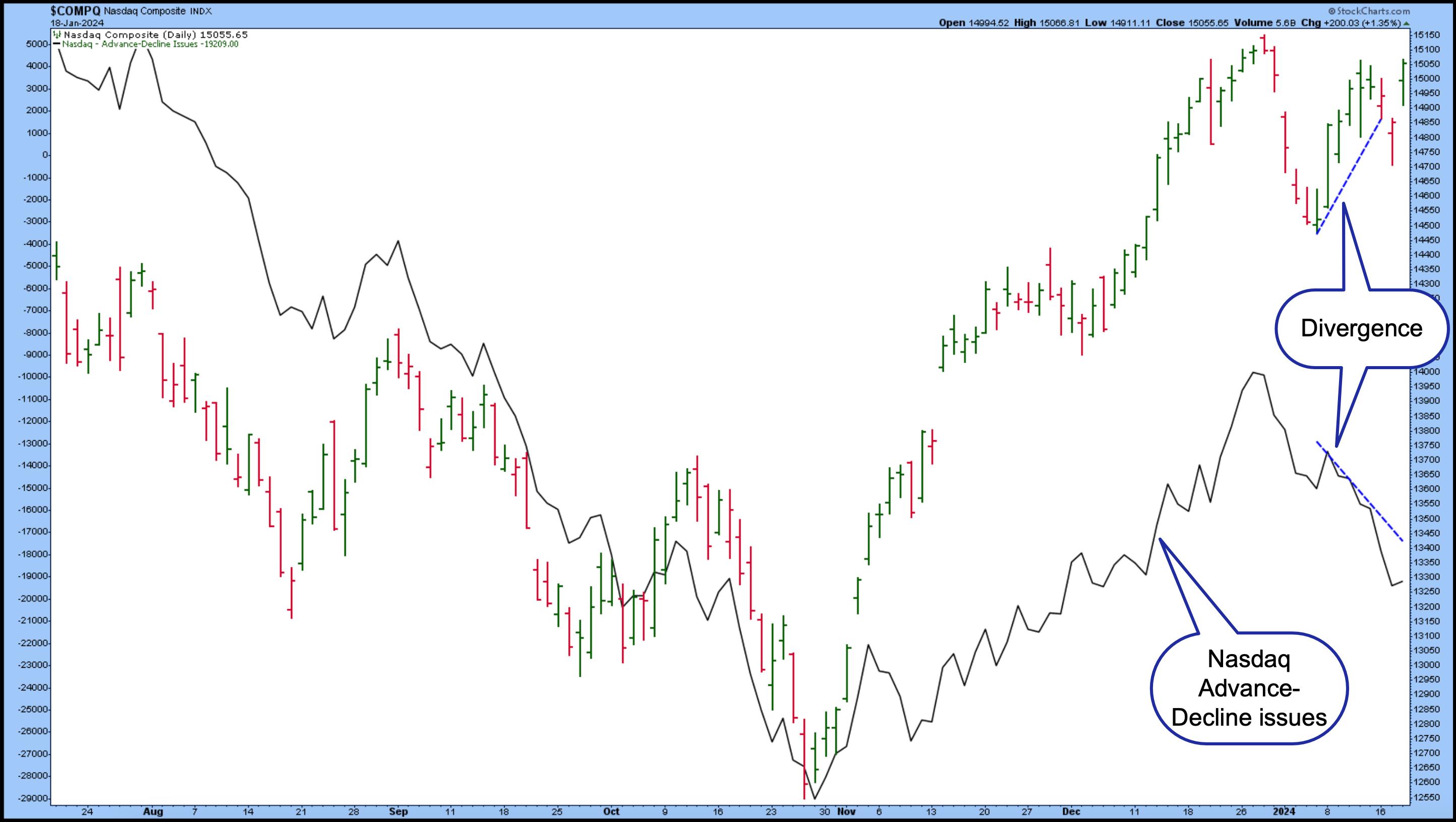

To understand what’s going on beneath the surface, it helps to look at the breadth of the market. One widely used breadth indicator is the Advance-Decline indicator.. In the chart below, you can see a daily chart of the Nasdaq Composite with the Nasdaq Advance-Decline Issues ($NAAD) indicator behind the price chart.

StockCharts Tips: Select Next to add this metric to your chart. price Add $NAAD from the indicator drop-down menu. parameter Box.

StockCharts Tips: Select Next to add this metric to your chart. price Add $NAAD from the indicator drop-down menu. parameter Box.

Chart 2. The Nasdaq Composite Index rises while rising and falling issues fall. The difference between the two can be a bearish signal, especially if the number of open issues continues to decline.Chart source: StockCharts.com. For educational purposes.

Something to note is that there is a difference between an index and an indicator. The Nasdaq composite index is rising and the Nasdaq pre-decline issue is falling. This does not mean that the index will fall significantly any time soon. Recall that the Technology Sector Bullish Percentage Index just crossed 70. This means that only when indicators suggesting bearish sentiment reverse in a positive direction can one feel more confident about initiating a long position.

StockCharts includes a large collection of market range indicators.Examples include the McClellan Oscillator, DecisionPoint Breadth, and Volume Momentum Oscillator, 52-Week Net Highs, and Percentage of Moving Averages.

The $COMPQ weekly chart below has the Nasdaq’s 200-day moving average stock ratio ($NAA200R) added to the bottom panel. This means that 44.76% of Nasdaq stocks are above their 200-day moving average. On a day when the Nasdaq closed 1.35% higher, we would have been more optimistic if that percentage had been higher.

StockCharts Tips: Select Next to add this metric to your chart. price Add $NAA200R from the Indicator drop-down menu. parameter Box.

StockCharts Tips: Select Next to add this metric to your chart. price Add $NAA200R from the Indicator drop-down menu. parameter Box.

Chart 3. Look at the market size. The percentage of Nasdaq stocks trading above their 200-day moving average began to decline in February 2021, while the Nasdaq Composite continued to hit higher highs. It was in early 2022 that the Nasdaq began to decline. The difference this time is that there is a lower percentage of stocks trading above their 200-day moving average.Chart source: StockCharts.com. For educational purposes.

What’s even more interesting about the weekly chart is that while the Nasdaq has risen in 2021, the percentage of stocks trading above their 200-day moving average has fallen. This was an early sign that selling pressure could be at work, but it took nearly a year for the Nasdaq to begin its decline. The difference is that at the beginning of 2021, that percentage was around 80%.

conclusion

If the market seems volatile and overall sentiment is uncertain, it can be helpful to look inside the market. See if there is more buying or selling pressure. If buying pressure intensifies as the market rises, sustainability is more likely. As the market rises, selling pressure increases and the potential for a decline increases. Trading is about probability, looking for scenarios that are more likely to occur.

So, if you are considering owning some technology stocks, it may be better to wait for the breadth indicator to rise and show follow-through before hitting the buy button.

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as Technical Analysis Editor for Stocks & Commodities magazine for over 15 years. Learn more