Teller’s TRB liquidation surges to $70 million due to market manipulation concerns

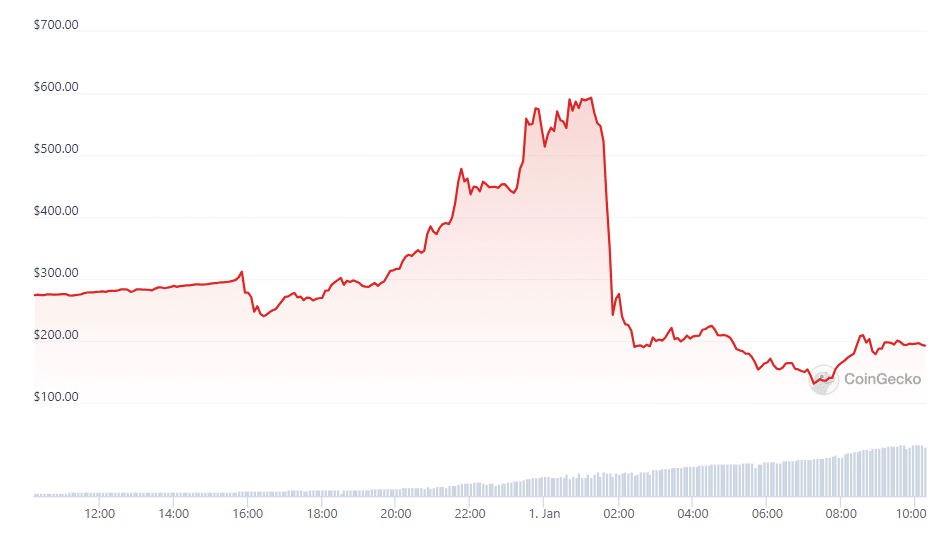

The whales reportedly eliminated both long and short TRB positions, causing the token price to plummet from $600 to $135 within a matter of hours.

On January 1, Teller’s native token, TRB, plunged 70% from its all-time high of $600 earlier in the day, according to data from CoinGecko. Market turmoil ensued after whales executed significant liquidations of both long and short positions, as reported by cryptocurrency tracking service Spot On Chain.

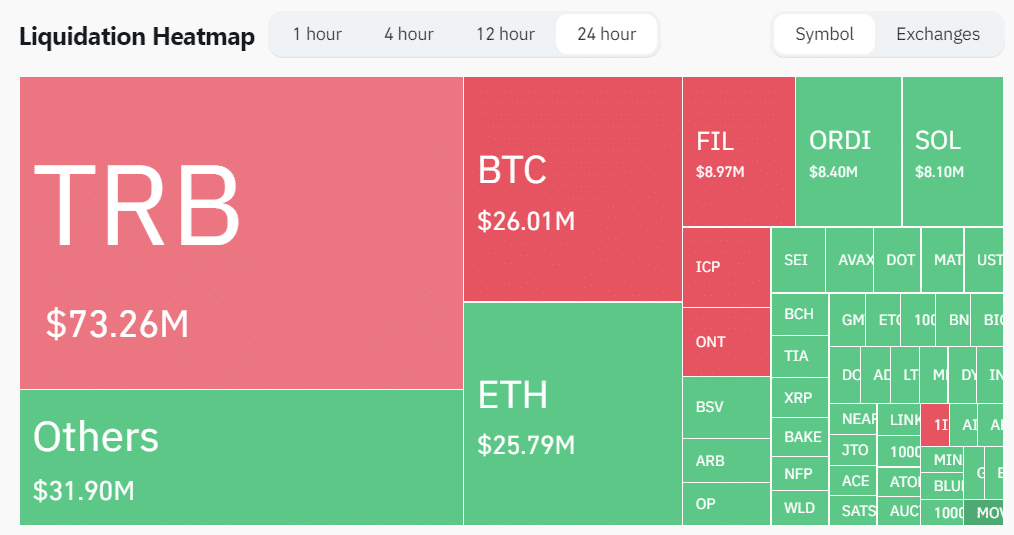

In the past 24 hours, Coinglass recorded a total of $233 million in liquidations, of which TRB recorded more than $73 million.

In particular, HTX (formerly Huobi) emerged as the biggest dumper of TRB positions as of December 31, with over $15 million worth of TRB shorts open on the exchange. OKX and Binance recorded $12.1 million and $6.69 million, respectively. Spot On Chain suggests that these dramatic price movements could be a sign of market manipulation, noting that while TRB whales control most of the liquidity, on-chain activity remained low during the pump-and-dump scheme.

At press time, Teller’s team had not made a public statement on the matter.

Launched in 2019, Tellor is a decentralized oracle network built on the Ethereum blockchain that aims to provide a decentralized alternative for obtaining real-world data that can be used in smart contracts. The Tellor network encourages participants, known as miners, to submit and verify data through the process of staking TRB, the project token.

Source: https://crypto.news/tellors-trb-liquidations-soar-to-70m-amid-market-manipulation-concerns/