TELUS: Main causes of poor performance (T:CA)

2027, when TD Bank acquires TELUS NurPhoto/NurPhoto via Getty Images

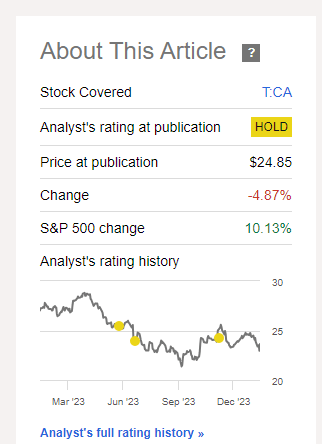

About the last update about TELUS Corporation (New York Stock Exchange:TU) (TSX:T:CA), we’ve made the case to continue breaking away from the wireless giants. At the center of our paper Inflated valuations and relatively weak earnings further supported this. We chose “Hold” but also kept the short price in mind.

We will see stiff competition in the quarter ahead in the telecom sector. At 17-18x free cash flow and 23x earnings, TELUS’s valuation doesn’t seem very attractive. We would consider a Sell/Short Sell rating above $27.00.

Source: About that incredible one-putt

TELUS has not tested that upper limit and has lowered it slightly since the last update.

pursue alpha

Review and update recently published results. This is a valuation model using numbers for 2024 and 2025.

last 2 years

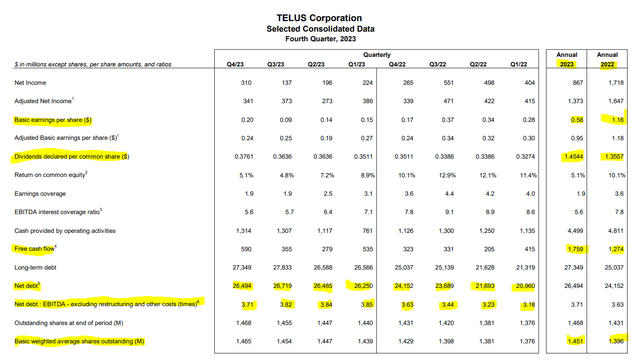

There’s a lot to unpack in the quarterly numbers, but first let’s look at the two-year trend for some basics. As you can see below, underlying earnings per share were quite weak in both 2022 and 2023. Neither was listed in the distribution zip code.

TELUS Q4 2023 Supplement

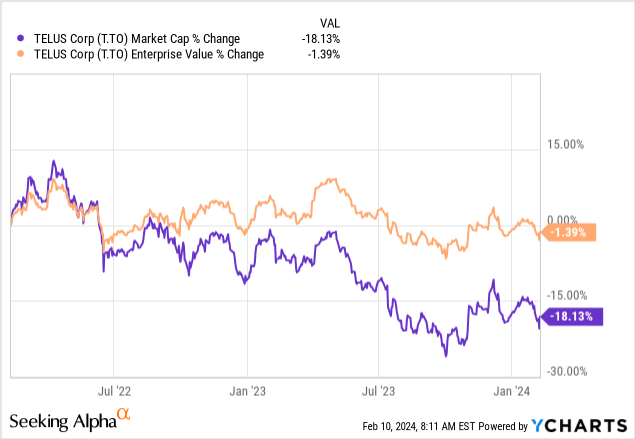

In fact, return coverage for dividends was less than 40%. In other words, the dividend payout ratio through earnings is close to 250%. Before we move on to the free cash flow aspect, it’s important to note that this coverage stands in stark contrast to the numbers for A&T (T) and Verizon (VZ). Both comfortably cover their dividends through earnings. Therefore, there is no need to ignore these poor ratios as industry standards. Free cash flow is closer to dividends. 2023 free cash flow per share was $1.21. It’s still below the dividend of $1.4544, but certainly within striking distance. Of course, over the past two years you’ve heard nothing but praise for the numbers and comments added by subscribers. But did anyone mention that net debt has increased by $5.5 billion since the first quarter of 2022? Did you hear that net debt to EBITDA increases from 3.18X to 3.71X? This is a big move, and when people complain that the stock price doesn’t react to these “great results,” it actually reacted exactly as it should. The market is taking away the market capitalization that TELUS is adding to its debt load.

‘TELUS’ has had almost the same enterprise value over the past two years. High debt burden has weighed on market capitalization.

4th quarter 2023

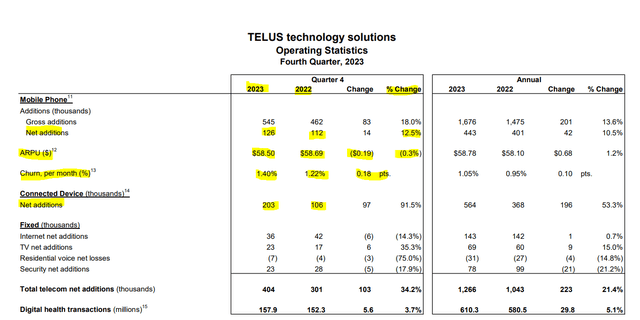

Okay, so let’s take a look at the numbers for the fourth quarter of 2023. Net additions were once again impressive, reaching 126,000.

TELUS Q4 2023 Supplement

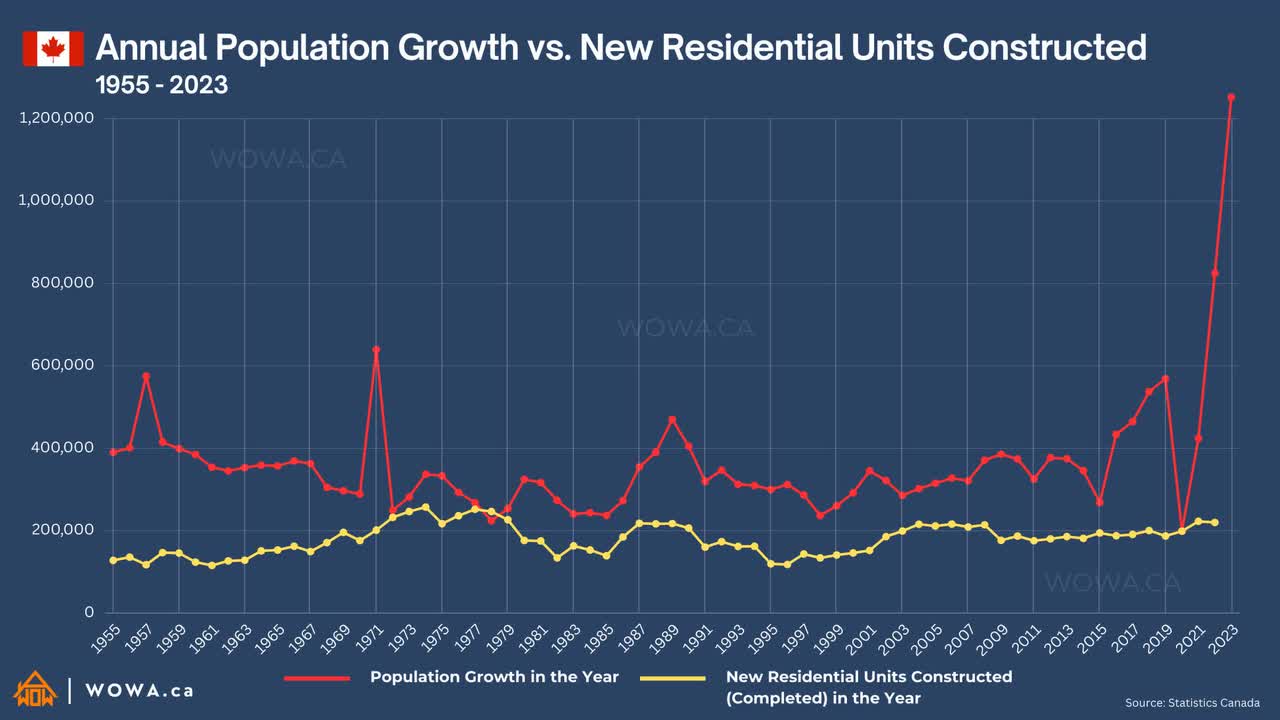

This has been a consistent theme for every telecommunications company in Canada since we completely messed up our immigration policy. For those of you who want to argue that we haven’t completely messed up our immigration policy, I’ll leave you with the following chart.

WOWA via Hanif Bayat of X

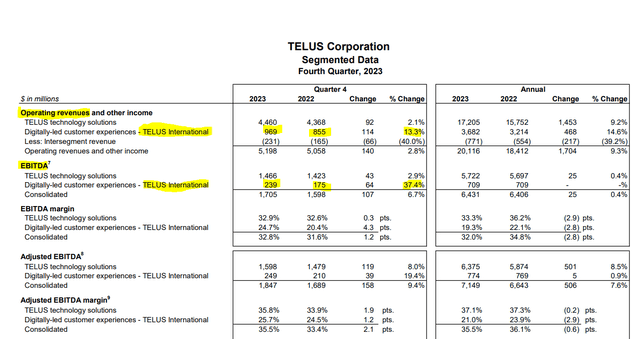

Of course, that chart is why TELUS stock isn’t completely in the gutter. If they had increased their debt load too much and paid much more in dividends than their free cash flow, you can bet TELUS would have been 30% lower without the above benefits. However, despite all these benefits that new subscribers bring, average revenue per subscriber declined to $58.50 in the fourth quarter of 2023. This trend is likely to taper off further in Q1 2024 and Q2 2024 as these large year-end promotions finally take full effect. Even in the fourth quarter of 2023, it was clear that things weren’t too lively once you remove the influence of TELUS International (TIXT) (TIXT:CA).

TELUS Q4 2023 Supplement

eyesight

The good news is that TELUS will cover its dividend through free cash flow in 2024.

Finally, 2024 consolidated free cash flow is expected to be $2.3 billion, driven by higher EBITDA and stable CapEx. The strong growth includes increased cash restructuring payments related to efforts undertaken in 2023 and progressive restructuring targeted for 2024, as previously discussed.

Putting all of this together, combined with TI’s outlook released earlier today, we expect operating revenue and adjusted EBITDA to grow similar to TTech on a consolidated basis.

Source: TELUS Q4 2023 conference call transcript

That leaves nothing left to service the debt, and debt to EBITDA of 3.7x seems unwieldy. This is higher than BCE Inc. (BCE) (BCE:CA) but lower than Rogers Communications Inc. (RCI.B:CA). The market is not paying attention at the moment, but we can expect that to put a lot of pressure on the company. AT&T, for example, has felt this for several years and is finally close to lowering its debt to below 3.0X EBITDA in 2025. Therefore, we could see more valuation compression in the year ahead and higher downside risks in the event of a recession. Yes, the labor report looks strong, but there’s a lot of noise beneath the surface, and the last report was very strange (read more here).

verdict

Back in March 2022 (see One Growth Bubble Waiting to Burst), TELUS was trading at a huge premium to fair value. I had to look all the way out to 2025 to even remotely understand the valuation, and even then it was confusing. Fast forward to today and we are now starting to come to our senses somewhat. EV to EBITDA is currently 8.0X and free cash flow yield is close to 6.2%. If you want to bet that low interest rates will return, this isn’t the worst play. But back to the AT&T comparison. He has a free cash yield of 14%. You can argue all you want about the mistakes and errors AT&T made, but TELUS increasing its debt to EBITDA to 3.7X is also likely an error. Before downgrading a buy rating, we need to make sure it has a cushion of free cash flow coming in to service its debt. We rate this as a Hold and consider a Buy for under $20.00.

Please note that this is not financial advice. It may look and sound like it, but surprisingly, it isn’t so. Investors should conduct their own due diligence and consult with professionals who are aware of their objectives and constraints.