Tether partners with Swan to expand Bitcoin mining operations.

Stablecoin issuer Tether has expanded its mining efforts as follows: Collaboration with Swan Managed bitcoin Mining services.

According to a press statement, the company has invested an undisclosed amount of significant capital to build its Bitcoin mining business through Swan.

Swan’s managed Bitcoin mining allows institutional investors to invest at least $100 million into the Bitcoin mining ecosystem. Through this service, the company plans to provide customized mining operations tailored to customers’ specific needs.

Since August 2023, Swan Mining has spent more than $330 million to increase mining capacity to 7.5EH. However, we plan to increase capacity to 19.5EH this year and to approximately 100EH by 2026.

Paolo Ardoino, CEO of Tether said:

“Our collaboration with Swan in the mining sector has exceeded our expectations. Swan’s team demonstrated a strong commitment to transparency and operational excellence while achieving rapid deployment of hashrate.”

Tether is the largest stablecoin issuer and has announced plans to invest approximately $500 million in mining. The company holds approximately 75,354 BTC, valued at $5.23 billion, making it the seventh-largest BTC holder in the world.

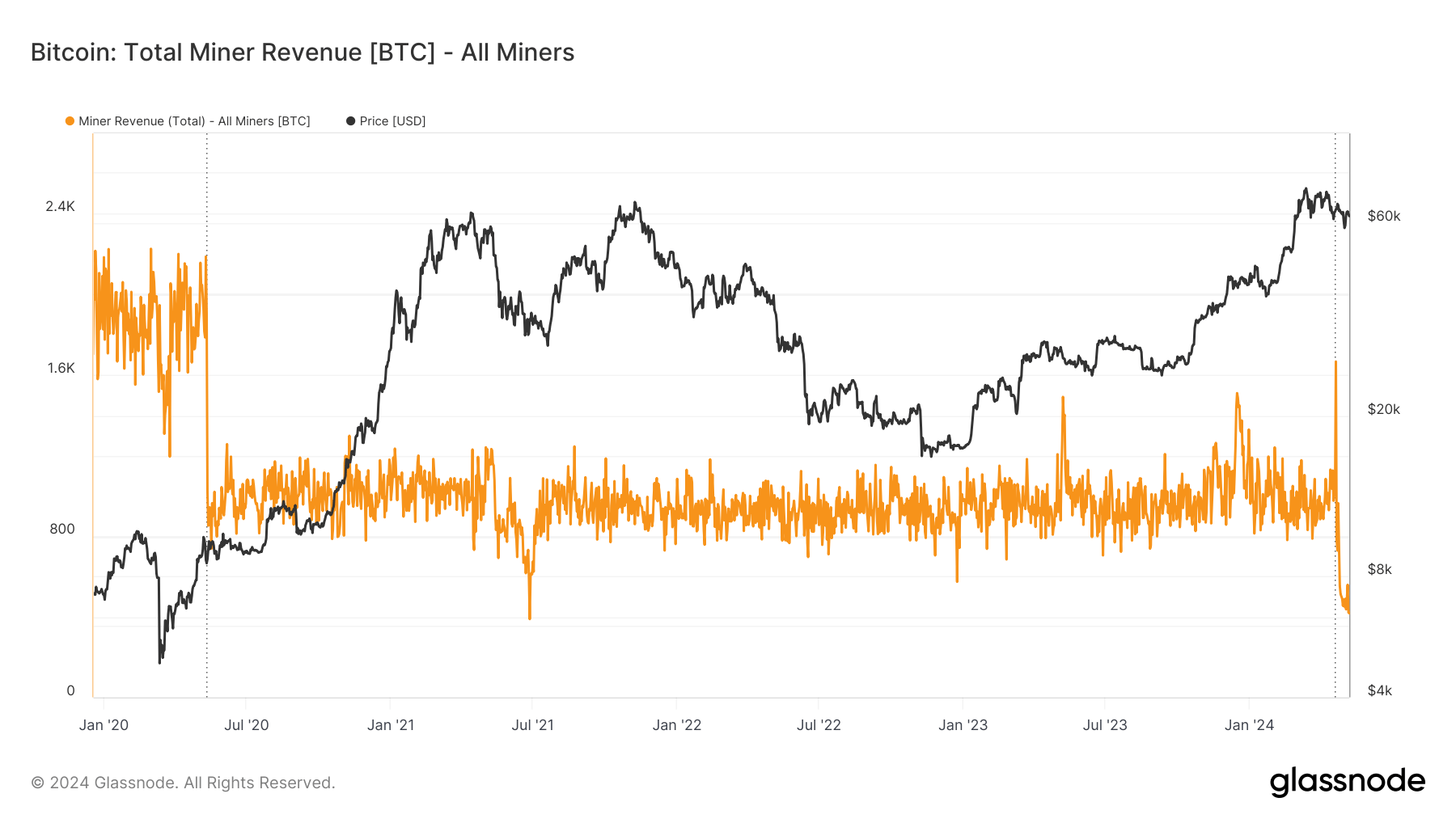

Mining revenue declines

Tether’s foray into mining comes while daily profits for BTC miners have declined significantly following the halving. According to Glassnode data, total revenue from block rewards and transaction fees has fallen sharply, hitting a low of 417 BTC as of May 7.

This stagnation stands in sharp contrast to the initial excitement surrounding the halving and the emergence of innovative protocols such as ordinal inscriptions and runes. These protocols are gaining more and more attention, generating interest in the blockchain environment and contributing to miners’ revenue.

CryptoQuant CEO Joo Ki-young highlighted the transformative impact these applications are having on miners’ income streams. He said:

“Building Bitcoin-based apps has significantly changed miners’ income streams. Trading fees now account for more than 7% of total revenue, up from 1% two years ago. This trend has continued over the past four weeks and could potentially strengthen the fundamentals of the network.