Text: Commoditization and Disappointing Growth (OTCMKTS:LCHTF)

sankai/E+ via Getty Images

proposition

I rate Text (OTC:LCHTF) a ‘sell’ due to commoditization, shrinking margins, and stagnant growth in its LiveChat and ChatBot products.

Company Overview

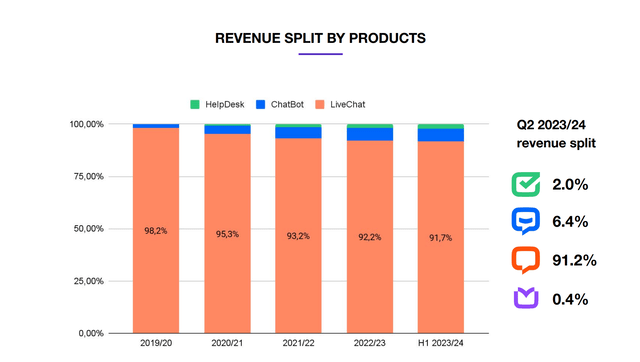

text is developer Text-based customer service software. It offers five main products: LiveChat, ChatBot, HelpDesk, KnowledgeBase, and OpenWidget. LiveChat, our built-in customer service widget for interacting with agents, is by far our biggest product. As of the end of 2023, LiveChat had approximately 37,000 customers, accounting for 91.2% of the company’s total revenue. For context, its second largest product, ChatBot, has about 2,800 customers and brings in 6.4% of the company’s revenue.

text investor presentation

Text was founded in 2002 and is headquartered in Poland. Mariusz Ciepły, one of the company’s co-founders, still serves as CEO and Chairman of the Board. According to Seeking Alpha Our data shows that individuals and insiders still own 38.7% of the shares outstanding. Additionally, the company’s rebrand The transition from LiveChat to Text will become official in January 2024.

It is important to note that Text’s shares are traded on the Warsaw Stock Exchange in Poland’s native currency and not on the major exchanges in the United States. Investors who want to purchase stocks in USD can do so by purchasing over-the-counter securities through a brokerage firm. However, investors should be aware that OTC securities carry inherent risks and should invest accordingly. My analysis is based on the latest OTC prices.

finance

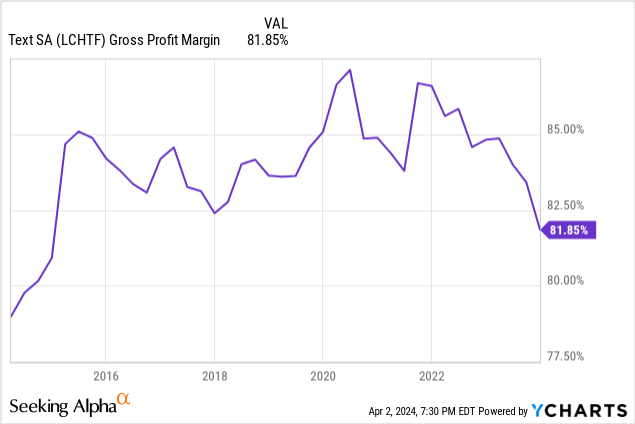

Text generated revenue of $90.6 million in 2023, representing 45.4% growth over its 2022 total revenue. Total profits in 2023 were $75 million. This corresponds to a gross profit margin of 82.7%. In reality, this is a healthy margin. But it also signals the first trend for Text: shrinking margins.

Since OpenAI launched ChatGPT, the number of chat-based customer service solutions has skyrocketed. Numerous startups have promoted themselves as “Chatbot for X” or “Chatbot for Y.” This surge in supply leaves potential customers with a variety of options. And because suppliers have few ways to differentiate, they must compete on the one thing few companies want to compete on: price.

This trend is evident in the text. Gross margin in 2021 and 2022 was 86.6% and 84.5%, respectively. This figure is significantly higher than the 2023 gross margin of 82.7%. Margin erosion at this rate is a concern. And unless Text can find a way to meaningfully differentiate its product from the competition, this trend will likely continue.

Margin pressure is of particular concern because Text has a history of being a reliable and strong dividend payer. The company paid out 80.3% of its net profit in 2023 as dividends. This is no exception. The payment rates in 2021 and 2022 were 81.8% and 80.7%. Overall, dividends per share for 2021-2023 were $1.04, $1.15, and $1.18. If Text’s margins become too thin while also struggling to grow its flagship product, it may be difficult to maintain dividend growth. And failing to maintain dividend growth will be a difficult pill for investors to swallow. Ultimately, the company is branding itself as a ‘dividend company with a track record of sharing profits with shareholders.’

Dividends were part of the company’s identity and played an important role in its appeal to investors. Without consistency and stability in dividends, investors will move away from Text and start looking elsewhere to invest their money.

Aside from gross margin trends, Text boasts strong financials. Net margin in 2023 was 53.5% and total debt on the balance sheet was only $100,000. Cash from operations in 2023 was $47 million, with capital expenditures of just $7.5 million. To top it off, Text’s 2023 leveraged free cash flow was $42.3 million.

evaluation

From past appearances, Text seems like a great company. They have a sizable customer base, strong recurring revenue and responsible management. But I’m worried about the company’s future.

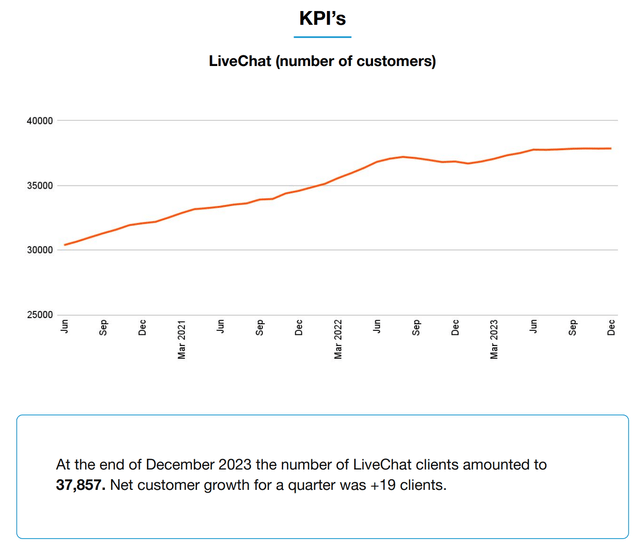

Management reported in its 2023 investor presentation that LiveChat’s net customer growth for the quarter was just over 19, or about 80 on an annualized basis.

text investor presentation

Hypothetically, adding 80 customers to a customer base of about 37,000 would mean growth of just 0.2%. This slow growth is especially concerning considering that LiveChat accounts for more than 90% of Text revenue.

So what caused LiveChat’s growth to stall? Slowing demand for human agent customer service solutions is one reason. This lack of demand has led to increased churn. In January, executives noted that customer churn last quarter was “well above average.” Additionally, these headwinds also impacted average revenue per user. LiveChat ARPU has fallen from $160 a year ago to about $156.

With LiveChat quickly becoming a legacy technology, it’s hard to see a bright future for Text. By changing the company’s name from LiveChat to Text, I believe management signaled that there would soon be a time when LiveChat would no longer be its flagship product.

This begs the question of what will take LiveChat’s place. Well, it would make sense for ChatBot to do that. Ultimately, this is an AI-powered customer service chatbot, which in 2024 will be a much more preferable alternative to LiveChat’s manual human agent customer service. But ChatBot’s growth hasn’t been spectacular.

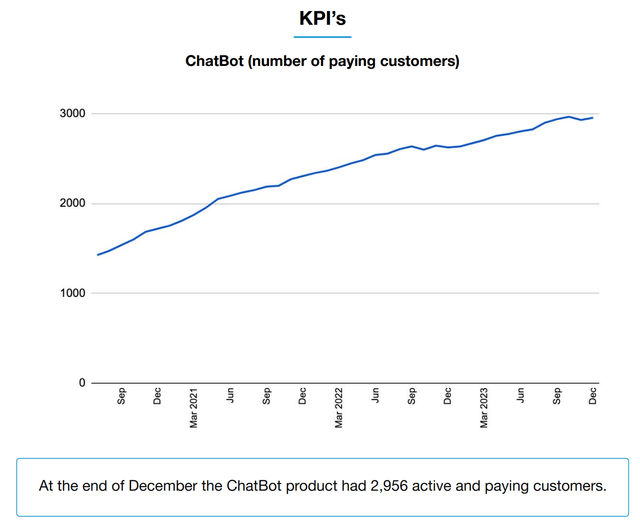

ChatBot ended 2023 with about 2,950 customers, up about 10% from 2022’s total of about 2,700 customers.

text investor presentation

Considering that the global chatbot market is expected to grow at a CAGR of 23.3% from 2023 to 2030, it is clear that Text’s ChatBot product is not generating alpha. Rather, it is simply riding the wave. But with ChatBot’s growth being less than half that of the market, it’s clear that ChatBot is indeed behind the curve.

If LiveChat isn’t the future of Text and ChatBot hasn’t grown fast enough to become a flagship product, what are investors buying today? This is why I rate Text a ‘Sell’. The company’s heyday appears to have passed. Investors investing now seem confident that the company can replicate LiveChat’s success with ChatBot.

Using the latest OTC price of $22.99, Text’s EV/Revenue multiple is 6.1x. This appears high considering the competitive pressures the company faces and that it trades as an OTC security.

The company that Text can be compared to is, coincidentally, Yext (NYSE:YEXT). Yext is a software developer that provides text-based marketing, support, and commerce solutions to its customers. Yext’s EV/Revenue multiple is just 1.6x. Yext has many of its own challenges and is certainly not a perfect comparison to Text, but it can provide some insight.

One could argue that using Yext as a benchmark for Text is selling Text short. Text’s higher revenue growth, profitability, and dividend history support this claim. Conversely, Yext’s larger revenue scale and the advantage of operating on a major US exchange can be seen as reasons to use it as a benchmark for Text. Nonetheless, there are clear differences in the valuation multiples of the two companies. And if you’re looking to invest money in SMB-focused software companies, you have a better chance than investing in OTC securities with EV/Revenue multiples of 6x or more.

danger

Bulls argue that the growth in demand for digital customer service solutions is far greater than the growth in supply. They also argue that Text’s difficulties are due to macroeconomic factors rather than a fundamental slowdown in business. These are just a few factors that could support the optimistic thesis.

If the volatility trend returns to historical levels and the company can differentiate ChatBot from its competitors in a meaningful way, Text could spark a turnaround. But until then, it’s hard to believe that Text will perform better in the long run.

conclusion

I like what Text has built, and it’s refreshing to see a growing software company focusing on returning cash to investors through dividends. But they found themselves in the crosshairs of one of the biggest technological revolutions in recent years. The emergence of text-based artificial intelligence commoditizing customer service solutions makes it difficult for companies to stay behind in the long run. A ‘sell’ rating seems appropriate for Text, combined with recent margin declines and disappointing growth in its LiveChat and ChatBot products.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.