The analyst highlights the positive bias of ETH options across all expiration periods.

Recent developments in the cryptocurrency market indicate strong bullish sentiment among Ethereum traders, especially in the options market.

Amid growing anticipation of the potential approval of a spot Ethereum exchange-traded fund (ETF), there has been a notable shift in option prices. Ethereum call options have become more expensive than put options across all expiration periods.

This price pattern suggests that the market is optimistic about Ethereum’s price outlook. Specifically, a call option gives the holder the right, but not the obligation, to purchase an asset at a specific price within a specific period of time.

Related Reading

This type of option is typically purchased by traders who believe that the price of an asset will rise. Conversely, a put option gives the holder the right to sell an asset at a predetermined price and is often used as protection against falling asset prices.

Market indicators point to bullish Ethereum.

Deribit CEO Luuk Strijers highlighted this trend in a communication with The Block. He noted, “Put minus call skewness is negative across all maturities and increases further after the end-June expiration, which is a very bullish sign.”

Additionally, the basis, or the annual premium of futures prices over spot prices, has increased to approximately 14%, further strengthening the optimistic outlook.

The analysis shows that traders prefer to buy call options at a premium compared to put options, especially for options expiring after the end of June.

This pattern is a sign of a bullish market, indicating that traders are not as interested in securing protection against a potential price drop as they are expecting the value of Ethereum to continue rising.

Meanwhile, optimism about the potential approval of a spot Ethereum ETF is rising again after the U.S. Securities and Exchange Commission (SEC) unexpectedly requested filing changes.

This optimism has led to significant market activity, with Deribit experiencing almost unprecedented trading volume. “We had almost unprecedented trading volume of $12.5 billion in nominal terms in the last 24 hours,” Strijers said.

The surge in trading volume and market interest reflects how traders and investors are positioning themselves to take advantage of the potential acceptance of a spot Ethereum ETF.

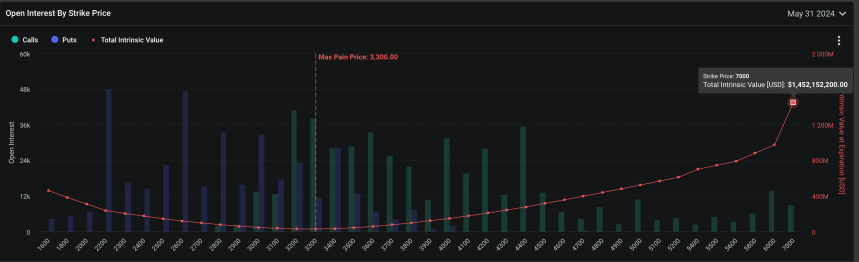

More than $480,000 worth of calls will expire by the end of the month, with a notional value of more than $1.7 billion, according to data from Deribit.

Data shows strike prices reaching up to $7,000 and a total intrinsic value of $1.452 billion, indicating that many Ethereum options traders are very bullish on ETH.

ETH Price Performance and Forecast

Meanwhile, Ethereum is experiencing a minor retracement, down 2.4% over the last 24 hours and trading at $3,690. Despite this downturn, the asset maintained a strong upward trend, up almost 25% over the past seven days.

As market expectations for a spot ETH ETF grow, a prominent cryptocurrency analyst said: suggested Potential price action for Ethereum indicates a brief dip at around $4,000 before surging to a new all-time high.

Related Reading

According to the analyst, it seems “inevitable” that Ethereum will reach its all-time high of $5,000, although there may be a bit of a crash.

$ETH: I think we’ll see a brief pullback from around 4,000, but once the ETF gets approved, this will definitely set a new all-time high. This still looks like a free trade with ETH going to ATH at 5,000. There may be some bumps along the way, but they seem inevitable.

I have both SOL and ETH… pic.twitter.com/IznlJ0RAyl

— Altcoin Sherpa (@AltcoinSherpa) May 22, 2024

Featured image created with DALL·E, TradingView chart