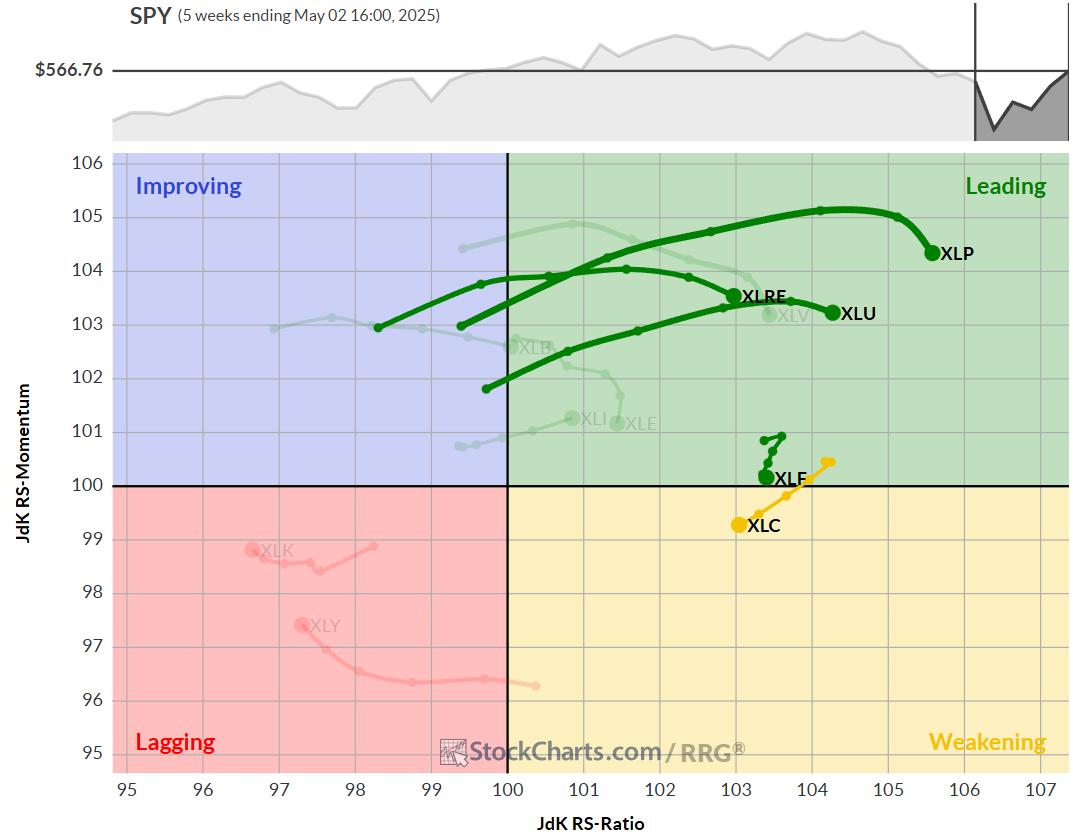

The best five categories, #18 | RRG chart

key

Takeout

- The top five sectors are kept in an unchanged state and have some location movement.

- The main sectors show signs of losing propulsion

- The daily RRG shows the best sector of the quadrant weakening.

- Communication service at risk of dropping out of the top five

Communication service falls to #5

The composition of the top five categories is generally stable this week and the positioning is slightly adjusted. Consumer Staple continues to lead the pack, followed by utility, finance, real estate (moved above 1 digit) and communication services (5th). This defense lineup continues despite the rally market, presenting an interesting dilemma on the sector’s rotation strategy.

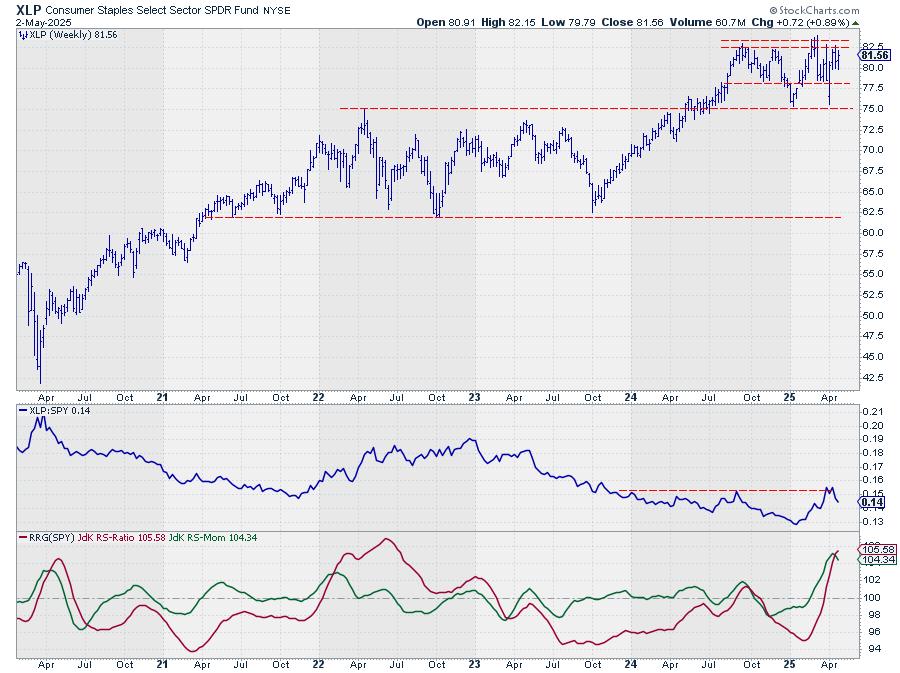

- (1) Consumer Staple- (XLP)

- (2) Utility- (XLU)

- (3) Finance- (XLF)

- (5) Real Estate- (XLRE)*

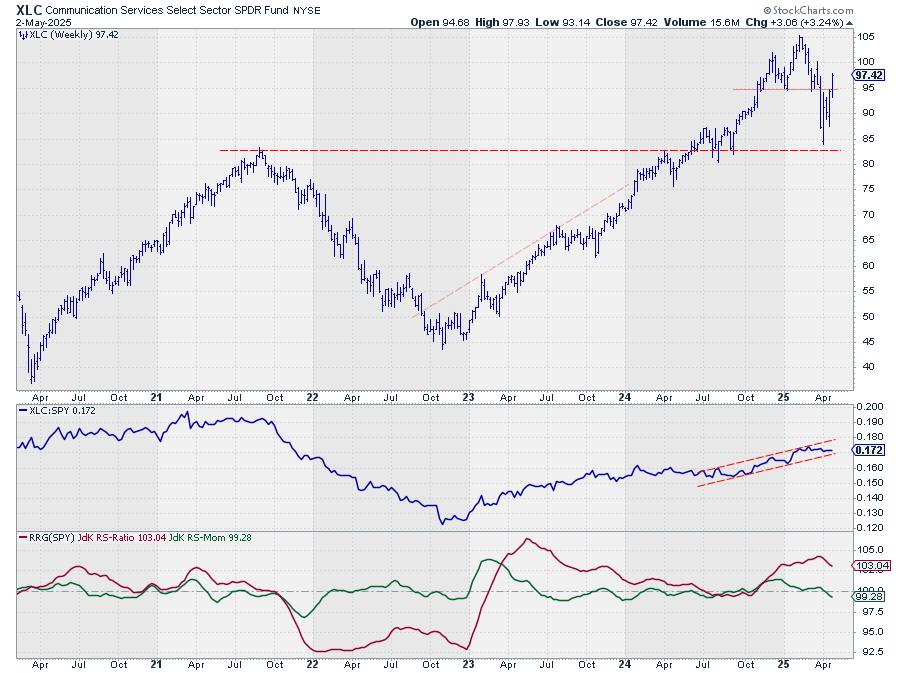

- (4) Communication Service- (XLC)*

- (6) Health Care- (XLV)

- (7) Industrial- (XLI)

- (8) Material- (XLB)

- (11) Technology- (XLK)*

- (10) Energy- (XLE)

- (9) Consumer discretion- (xly)*

Weekly RRG

The weekly relative rotating graph (RRG) draws a picture of the potential change of the horizon.

Staples, utility, real estate and finance maintain their position in major quadrants, but show signs of losing relative momentum over the last few weeks.

In particular, finance is on the edge of weakening.

Communication services have already been firmly changed in weakened and have moved to negative RRG titles. This exercise describes the fall to fifth place in our sector rankings.

Daily RRG

If you switch to Daily RRG, there is a slightly different picture of the best sector.

All staples, utility, real estate and finance are all located in the weakening quadrant that travels with negative RRG titles.

This short -term view indicates that we must monitor our guy in this section and make sure that we can restore momentum before they are potentially dropped out of the top 5.

Interestingly, communication services are showing signs of life on a daily chart. In general, even if it falls to the fifth position, the tail is now improving and heading.

warning? It is a very short tail close to the benchmark. It is so consistent with the market. Through this, communication services make the most risk of losing the top fifth place in the short term.

Consumer staple

Consumer staples are conflicting over overhead resistance between $ 82.50 to $ 83.

Hesitation in the rise of the rising price caused a weakness in the RS line, which began to be locked.

As a result, the RS Momentum line is rolled. However, the high RS ratio, which shows a strong opponent trend, has a staple at the top of the current list.

utility

The utility has been tempted since early 2025 and has already pushed about $ 80 overhead resistance four times.

If we broke, we will see acceleration at the highest high, over $ 82.50.

Like the staple, if the resistance cannot be cut off, the rollover of the stable and the relative momentum occurs in the RS line.

Finance

After a strong rally at the $ 42 support level, before resistance (old technical proverb is true). Finance is now faced with a challenge.

The rally is approaching the level of upward support that marks the uptrend channel. This can cause some hesitation in both price and relative force.

The RS Line remains in the upward channel, but the momentum has been reduced, resulting in a green RS momentum line.

real estate

Real estate has risen to fourth place and is still emerging as a long relative decline that began in April 2022.

The RS ratio line chose the relative robbery rally that started in early 2025, but now it has stopped.

This led to the green RS momentum line. In the price chart, real estate has a space where the intermediate range can be higher.

Communication service

Communication services have fallen to the fifth position, but the price chart has an interesting development.

Last week, the price rose above the old neckline of small hair and shoulder patterns. The fact that we are rally over the neckline now can show failed head and shoulder patterns, especially very strong optimism.

However, the recent weakness of relative intensity was deeply pushed by the RRG’s weakening quadrant.

This section must be picked up quickly to maintain the top 5 in the next few weeks.

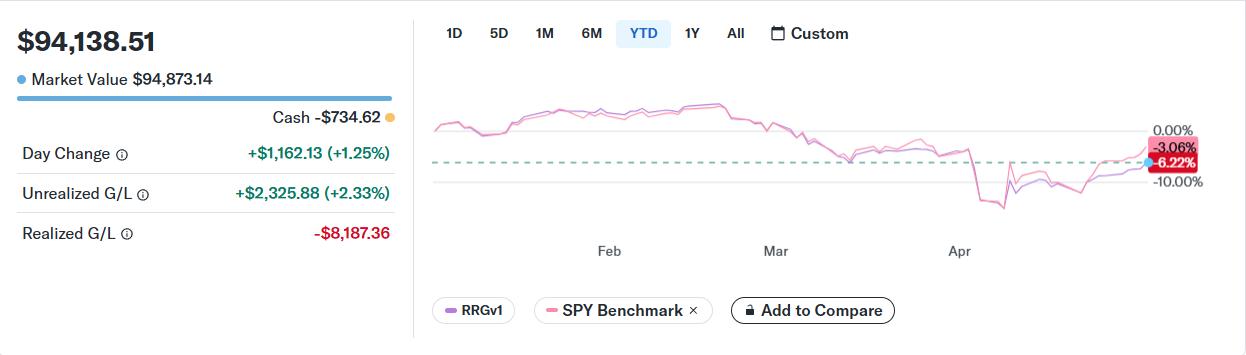

Portfolio performance

Defense positioning in the top five sectors is decreasing due to a wider market rally.

At present, we are maintained at about 3% lower performance than spies like last week.

But from the point of view of the sector rotation, we must still think that this rally of S & P 500 is temporary.

The default message keeps emphasizing defense.

It is important to remember that there is always a delay in the RRG Yi strategy.

If the market truly changes, we will see the change reflected in our sector, and at some point we will start to make up for the difference.

This performance gap can change the market and change the RRG portfolio as it is pressure on the market and the defense sector begins to lead again.

Send a good Lord with #stayalert -Julius

Julius Chemphene

Senior technology analystStockcharts.com

creatorRelative rotation graph

founderRRG research

Host: Sector spotlight

Please find my handle Social Media Channel Below bio.

Juliusdk@stockCharts.com Welcome feedback, opinion or question. I can’t promise to respond to each message, but I will read them and read them reasonably, use feedback and opinion or answer questions.

Discuss the scans of RRGTag to me using a handle Julius_RRG.

RRG, relative rotation graph, JDK RS-RATIO and JDK RS-MOMENTUM are registered trademarks of RRG Research.