The countdown to Bitcoin halving is one week away.

bitcoin  BTC

BTC

-3.50%

According to The Block’s, the next halving event is now just one week away, or about 1,000 blocks away. Bitcoin halving countdown page.

The estimated countdown is based on Bitcoin’s average block creation time of 10 minutes, and as things stand, the potential date for reaching the next halving block height of 840,000 is April 20th at 9am ET (5am ET). Set to . Bitcoin’s next halving event will see the subsidy reward for miners on the network decrease from 6.25 BTC to 3.125 BTC per block.

Bitcoin halving is programmed to occur automatically every 210,000 blocks, or approximately every four years. When a halving event occurs, miners receive 50% less Bitcoin as a subsidy reward for every block of transactions they mine and add to the blockchain. However, they continue to earn additional transaction fee rewards for each block mined normally.

There have been three halving events in Bitcoin history. Block subsidy inflation was reduced from 50 BTC to 25 BTC in 2012, then to 12.5 BTC in 2016, and then to 6.25 BTC at the last halving on May 11, 2020. In the long term, there are only 21 million Bitcoins in existence.

The halving event will continue until the last Bitcoin is expected to be mined around 2140. After that, miners only earn money from transaction fees.

Bitcoin mining difficulty hit an all-time high in the final adjustment before the halving.

Bitcoin mining difficulty increased 3.9% this week, reaching a new all-time high in the final adjustment ahead of the halving. This is because miners appear to be increasing their hash rate in preparation for a drop in block subsidy rewards.

Bitcoin mining difficulty measures how difficult it is to mine a new block, and is adjusted every 2016 blocks (approximately every two weeks) so that, on average, a new block is discovered every 10 minutes, regardless of how many miners are currently mining. The higher the difficulty, the more computational power miners need to find the next block.

Bitcoin’s hash rate, which measures the total computing power miners have allocated to the network, hit an all-time high of 629.75 EH/s on a seven-day moving average ahead of Wednesday’s difficulty adjustment, according to The Block’s data dashboard. I did.

The rise in Bitcoin prices this year has also increased miner revenue, but the impact of the halving on less efficient mining operations and the impact on overall network metrics from reduced subsidies are not yet known.

Is Bitcoin Halving a ‘News Selling’ Event?

Historically, Bitcoin halvings have been associated with significant fluctuations in the price of the cryptocurrency. Although not a direct cause and effect relationship, these events often occurred prior to significant upturns in the Bitcoin market.

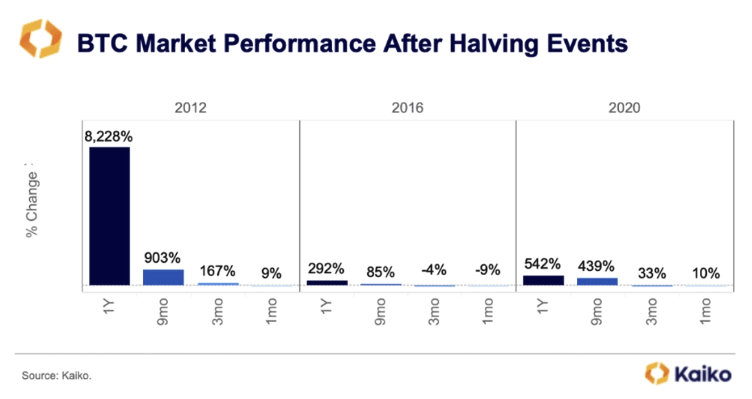

“Two of the three previous halvings saw price spikes one and three months later. In all three halvings, prices soared after nine and 12 months,” analysts at Kaiko noted earlier this week.

Performance after Bitcoin halving. Image: Kaiko.

Analysts said the sample size of three is not large enough to draw conclusions, adding that other factors also contributed to gains following previous Bitcoin halvings. However, Bitcoin’s inherent volatility over various option expirations suggests market turmoil in the near term. “IVs expiring in the next two weeks saw the largest increase, from 59% to 71% in just two days,” they said.

The new US spot Bitcoin exchange-traded fund saw strong inflows of $12.6 billion overall, which may suggest that new supply could have a positive impact on the price as it declines after the halving. “In case of a bearish reversal, BTC could flood the market. It creates uncertainty,” Kaiko analysts warned.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.