The Federal Reserve will allow emergency bank lending programs to expire, a senior official said.

This story has been updated to remove incorrect details about the types of loan rates Barr discussed and when banks can refinance under the Bank Term Funding program.

The Federal Reserve has no plans to extend an emergency lending program it launched last year to bolster capacity in the banking system following the collapse of Silicon Valley Bank.

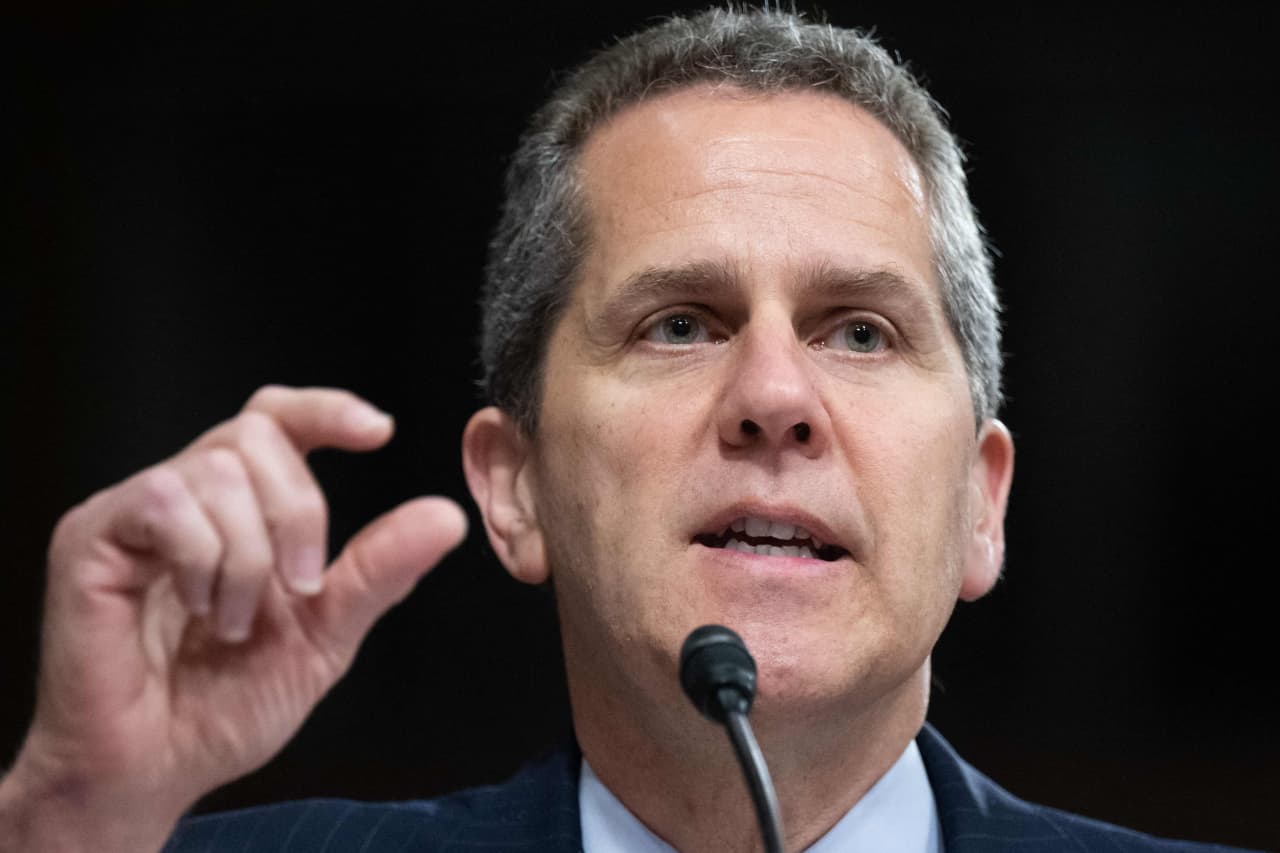

The Bank Term Funding Program will expire on March 11, having reached its original one-year limit, Federal Reserve Vice Chairman for Supervision Michael Barr said during a panel appearance Tuesday.

“The program worked as intended,” Barr said. “We dramatically reduced the stress on the system very quickly. “It was very effective,” he said, adding, “It really established it as an emergency program.”

Banks currently have $141.2 billion in outstanding loans in banking programs, according to the latest data from the Federal Reserve.

Banks can refinance debt until the last day of the program in March, with a maximum repayment period of one year.

The government allocated $25 billion last year to prepare for an emergency program established to stem a surge in deposit outflows from banks following the collapse of Silicon Valley Bank in March 2023.

On other regulatory topics, Barr said the extended comment period on the proposed Basel III capital requirements ends Jan. 16, but did not provide details on what the final proposal would look like.

“We’ve had a lot of input,” he said. “It will help you get the balance right.”

Barr pushed back against claims from the banking industry that higher capital requirements would raise the prices of mortgages and other loans to consumers.

If all costs were passed on to borrowers under the proposed system, typical consumer lending rates would rise from 5% to about 5.03%, he said, adding that the proposed rule would have a “very negligible” impact on costs. Of credit.

Barr said banking officials “talk all the time” about the potential risks to the banking system posed by private credit and other alternative lenders and how to regulate those risks.

Although private lenders operate outside the regulated banking system, banks still act as counterparties and provide loans to them, he said.

“There’s no easy answer,” Barr said, about how to regulate the entire system. If regulations are too onerous, it’s like “squeezing a balloon,” he said, and risks can pop up elsewhere.

At the same time, the banking system needs regulation to ensure a “strong core” of the financial world, Barr said.

Barr’s comments came during a conversation in Washington, D.C., with Women in Housing and Finance, a membership organization of women in housing, finance and development.

Also read: Fed community banking advocate Michelle Bowman said the proposed banking reforms go beyond what the law intends.

Also read: Fed cop Michael Barr advocates higher capital requirements as bankers play hardball.