The Future of Binance Led by Richard Teng

After losing its founder and CEO and paying the largest fine in cryptocurrency history, Binance has begun a new chapter of operations. But what does this mean for Binance investors, especially now that founder CZ has been replaced by the relatively unknown Richard Teng?

In our opinion, Binance is at a similar inflection point as Uber. When controversial founder Travis Kalanick left the company, he was replaced by a more “mature” CEO, Dara Khosrowshahi. As we’ll explore in more detail below, he was the right CEO at the right time.

This is our study into Binance’s present and future, the ramifications of a leadership change, and what this could mean for both long-term BNB investors and enthusiasts.

Uber Story

As an analogy, it might be helpful to look again at the story of Uber.

In its early days, under founder Travis Kalanick, Uber was a brash disruptor, cutting corners, playing fast and loose with the rules, and clashing with regulators to conquer the established taxi industry.

Kalanick was a fan of aggressive expansion, legal battles, and a fierce “win at all costs” mentality. Success was the goal. It even meant breaking rules, pressuring employees and facing scandals.

Rapid growth has come at the price of a toxic culture marred by accusations of sexism, sexual harassment and unethical practices. (There’s also a Wikipedia page on the Uber controversy.)

Bowing to investor and government pressure, the board pushed out Travis Kalanick in 2017 and brought in CEO Dara Khosrowshahi, who was antithetical to Kalanick’s firebrand brand style.

Khosrowshahi inherited a company mired in controversy and faced the difficult task of cleaning house. He emphasized transparency, accountability and improving relationships with drivers, regulators and the public.

He apologized for past mistakes, improved Uber’s culture and prioritized ethical business practices.

Change didn’t happen overnight. However, rather than reckless growth, Khosrowshahi has made a conscious move toward ‘growth’ by navigating challenges through diplomacy, building trust, and focusing on sustainable success.

While Uber still faces obstacles, Khosrowshahi’s leadership has paved the way for a more mature company that aims to navigate the future with accountability and a renewed focus on stakeholders.

Looking at the history of Binance, led by founder CZ and new CEO Richard Teng, it is impossible not to draw comparisons with Kalanick and Khosrowshahi.

Binance’s Aggressive Growth Under CZ

Binance began its journey in China as an emerging cryptocurrency exchange at the height of the ICO craze in 2017. Binance was soon able to overtake its competitors thanks to its young and ambitious executive and founder, Changpeng Zhao (aka “CZ”).

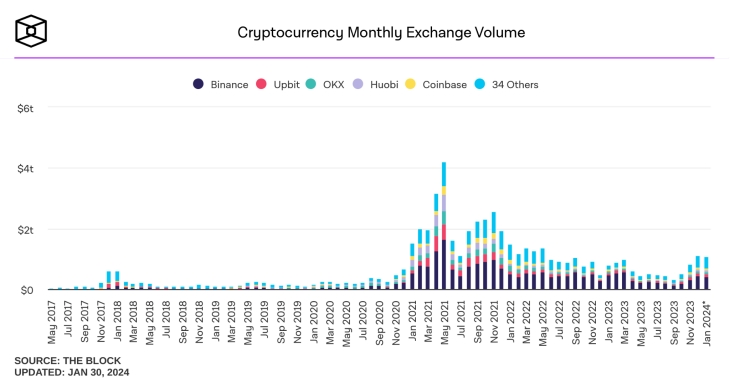

Six months after launch, Binance has already become the world’s largest cryptocurrency exchange by trading volume. Users have praised Binance for its intuitive interface, wide selection of digital assets, and low fees.

Since its impressive beginnings, Binance has quickly grown into a broad ecosystem that includes a public blockchain with native coin (BNB), digital wallets, stablecoins, futures trading platform, NFT marketplace, and various services. more.

This makes CZ one of the richest people on the planet in terms of net worth, rivaling Mark Zuckerberg in his prime.

CZ has been a key player in Binance’s rapid development, but the company must move on without him following a dramatic legal battle with U.S. regulators.

The End of the CZ Era: A Major Upheaval for Binance

In 2019, Binance opened a US branch to serve US customers. This will open the door for regulators to discover signs of disturbing and illegal activity.

In June 2023, the SEC filed a complaint listing 13 charges against the U.S. branch of Binance and CZ itself, accusing them of operating a “web of deception.” In November of that year, the U.S. Department of Justice (DoJ) announced three criminal charges against the company:

- Conspiracy to violate the Bank Secrecy Act (BSA) by failing to implement an effective anti-money laundering (AML) program.

- Operating an unlicensed money service business.

- Violates the International Emergency Economic Powers Act (IEEPA) by evading sanctions.

CZ pleaded guilty to money laundering charges, and Binance agreed to pay a $4.3 billion settlement with the U.S. Treasury and FinCEN, the largest fine against a cryptocurrency company in history. Treasury Secretary Janet L. Yellen said:

“Today’s historic penalties and oversight to ensure compliance with U.S. laws and regulations mark a milestone for the virtual currency industry. “Every institution, wherever it is located, that wants to benefit from the American financial system must follow the rules that keep us all safe from terrorists, foreign enemies, and criminals or face the consequences.”

As a result, Binance had to leave the US market, and CZ resigned as CEO. The company then appointed the relatively unknown Richard Teng as its new CEO.

Who is Richard Teng?

Richard Teng, a Singapore native, has more than 30 years of financial services and regulatory experience, which may bode well for the company’s new chapter, which is expected to be defined by compliance.

Born in 1971, Teng is a distinguished graduate of Nanyang Technological University and the University of Western Australia, where he earned a bachelor’s degree in accounting and a master’s degree in applied finance.

He began his career at PricewaterhouseCoopers and then joined the Monetary Authority of Singapore (MAS) in 1997, where he contributed significantly to the development of Singapore’s financial sector. He later served as Chief Regulatory Officer of the Singapore Exchange (SGX), where he played a key role in policy formulation and compliance.

In 2015, he became head of the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Markets (ADGM), one of the first regulators to develop a cryptocurrency framework.

Teng was appointed CEO of Binance Singapore in August 2021. In May 2023, he was promoted to regional head for Asia, Europe and MENA.

Teng’s extensive regulatory experience positions him as an excellent candidate to help the company address its regulatory challenges. CZ praised the new CEO as “a leader with the best qualifications.” Nonetheless, Teng took over management of Binance during a difficult time for the company.

While some investors are concerned about the void left by CZ’s departure, Teng was quick to reassure the cryptocurrency community that the platform will continue to be user-centric, with a focus on fund security and ease of use.

The CEO expressed the company’s commitment to compliance globally. He acknowledged Binance’s current regulatory hurdles and expressed readiness to bring in new team members with regulatory experience to work with regulators across jurisdictions to ensure compliance and meet global standards.

Binance remains the world’s largest cryptocurrency exchange. Teng can be the “indoor adult” the company needs to maintain its leadership position by securing strategic partnerships and productive relationships with regulators.

New Binance: Finance and Compliance

Binance is not a public company. They do not share details about their profits and other finances. Nonetheless, the company releases an annual report that includes several key indicators.

In its latest version, Binance claims to have added 40 million users in 2023, bringing it to 170 million users, a 30% increase. The emergency SAFU (Secure Assets for Users) fund is valued at $1.2 billion.

According to the proof-of-holdings report, the company claims that the cryptocurrency assets held by Binance fully cover users’ net balances.

Throughout 2023, the Company continued to engage with regulators around the world and meet standards for each jurisdiction in which it operates. Binance currently holds licenses, registrations, and approvals in 18 jurisdictions around the world, including Japan, Australia, France, Italy, Spain, and Mexico.

In 2023, the company invested more than $210 million in its compliance programs, a 35% increase from the previous year. Additionally, Binance processed 58,000 law enforcement requests compared to 50,000 in 2022.

Coinbase is coming to Binance

The biggest winner from the Binance incident is Coinbase, the largest cryptocurrency exchange in the U.S., which has the opportunity to expand globally rather than undercut Binance.

Ironically, this is the second time Binance has “assisted” Coinbase. In 2022, CZ toppled FTX, the second-largest cryptocurrency exchange operator at the time, due to a long-standing rivalry between the companies.

Later, when Binance pleaded guilty to the DoJ charges, Coinbase CEO Brian Armstrong took to X (formerly Twitter) to emphasize that the company took a long-term view and invested heavily to ensure compliance. that said:

“Today’s news highlights that taking the hard way was the right decision. “Now we have the opportunity to start a new chapter in this industry.”

Coinbase’s stock price soared following the news, rising 100% in a matter of weeks to its highest level in about 18 months.

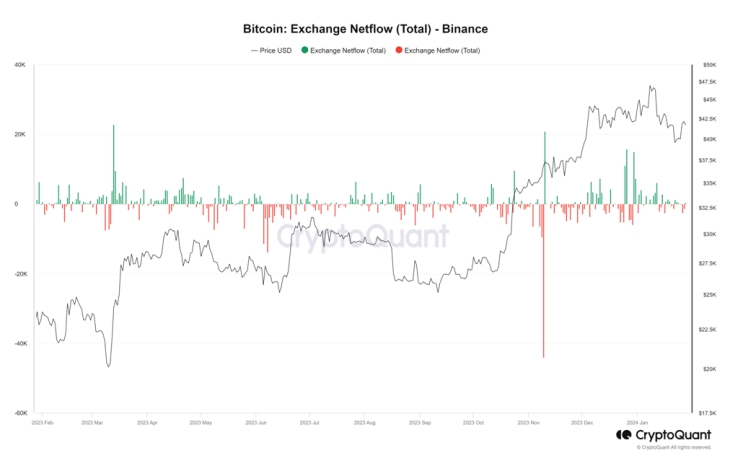

Meanwhile, in late November 2023, Binance recorded its largest ever outflow, with approximately $1 billion worth of cryptocurrency leaving the exchange. Nonetheless, this was not a mass exodus and Binance still appears to have plenty of liquidity.

future

Teng faces serious challenges as the company prioritizes transparency and compliance across multiple jurisdictions.

Binance hasn’t even resolved all of its issues in the U.S., as it’s still engaged in an ongoing legal battle with the SEC coming up in 2024.

The company must respond to accusations of listing tokens that the SEC considers unregistered securities, artificially inflating trading volumes, failing to limit U.S. users, misleading investors about market surveillance, and misappropriating user funds.

Companies are also facing challenges in Europe as the MiCA framework goes into effect in 2024.

Binance had to abandon its registration with the Cyprus regulator and failed to obtain a license in the Netherlands. The company also withdrew its applications for regulatory approval in countries such as Germany and Austria.

Going forward, Binance will focus on the Asian and MENA markets where it has a stronger presence. It remains to be seen whether the exchange will maintain its market share in the US and Europe.

Investor Implications

Binance is at an inflection point. Just as Uber traded Khosrowshahi for Kalanick, the company also traded Teng for CZ. Our hope is that, like Khosrowshahi, Teng can be the adult in the room.

Teng has extensive regulatory experience, a global perspective and a collaborative approach, with a focus on user security and compliance. He’s also been with the company for many years, so he potentially has the knowledge and relationships needed to run the company well.

However, he has a limited public profile, especially compared to the Twitter-friendly CZ. He is not proven in crisis management at CZ level. And compliance can come at the expense of innovation. If you are too careful, Binance may lose its lead.

We argued that the company’s settlement with the DoJ was the best $4.3 billion they could spend because CZ is not in jail and Binance continues to operate. The SEC case is still looming, but the settlement resolves a vexing problem for the United States.

For long-term BNB investors, Binance remains a dominant force in the cryptocurrency space.

However, Binance is losing market share. Their dominance had begun to decline even before the DoJ agreement.

Will Richard Teng, the adult in the room, be enough to overcome the regulatory hurdles to steer Binance and regain its lost dominance, or will Coinbase and other compliant players capitalize on its mistakes?

Only time will tell, but next year promises to be a pivotal year for the cryptocurrency giant. In the meantime, we are holding BNB.