The Hoax of Modern Finance – Part 7: The Illusion of Forecasting | Dancing with the Trend

Note to the reader: This is the seventh in a series of articles I’m publishing here taken from my book, “Investing with the Trend.” Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of facts. The world of finance is full of such tendencies, and here, you’ll see some examples. Please keep in mind that not all of these examples are totally misleading — they are sometimes valid — but have too many holes in them to be worthwhile as investment concepts. And not all are directly related to investing and finance. Enjoy! – Greg

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.” — Lao Tzu

So that there can be no confusion, I want to state my honest heartfelt opinion on forecasting: I adamantly believe there is no one who knows what the market will do tomorrow, next week, next month, next year, or at any time in the future—period.

Hindsight is a wonderful tool to use in order to know why something might have occurred in the past, but rarely is the cause known during the event itself. The prediction business is gigantic. William Sherden, in The Fortune Sellers, claimed that in 1998 the prediction business accounted for $200 billion worth of mostly erroneous predictions. Can you imagine with the growth of the Internet and globalization, what that industry is today? Frightening! As Oaktree Capital Management’s Howard Marks says, “You cannot predict, but you can prepare.”

Dean Williams, then-senior vice president of Batterymarch Financial Management, gave a keynote speech at the Financial Analysts Federation Seminar in August 1981, where he made some almost prophetic comments about investing that are as true today as they were then. He spoke about the relationship between physics and investing, but I have previously discussed that subject. Another comment was, “One of the most consuming uses of our time, in fact, has been accumulating information to help us make forecasts of all those things we think we have to predict. Where’s the evidence that it works? I’ve been looking for it. Really! Here are my conclusions: Confidence in a forecast rises with the amount of information that goes into it. But the accuracy of the forecast stays the same.” Later on, he added, “It’s that you can be a successful investor without being a perpetual forecaster. Not only that, I can tell you from personal experience that one of the most liberating experiences you can have is to be asked to go over your firm’s economic outlook and say, ‘We don’t have one.'” He goes on to talk about using simple approaches versus complex ones, delving into the fact that they also must be consistent approaches. This is a must-read; you can find it from an Internet search on Dean Williams Batterymarch.

Sherden states that the title “second oldest profession” usually goes to lawyers and consultants, but prognosticators are the rightful owners. Early records from 5,000 years ago show that forecasting was practiced in the ancient world in the form of divination, the art of telling the future by seeing patterns and clues in everything from animal entrails to celestial patterns. As Isaac Asimov wrote in Future Days, such was the eagerness of people to believe these augers that they had great power and could usually count on being well supported by a grateful, or fearful, public. I’m not so sure most of this isn’t applicable to today. Sherden did much research into the numbers of people directly involved in forecasting—and this data was from 1998. They are staggering and growing. And let’s not forget that one of the largest-selling newspapers in the country is the National Enquirer. Below are some of the findings on forecasting from Sherden’s book.

- No better than guessing.

- No long-term accuracy.

- Cannot predict turning points.

- No leading forecasters.

- No forecaster was better with specific statistics.

- No one ideology was better.

- Consensus forecasts do not improve accuracy.

- Psychological bias distorts forecasters.

- Increased sophistication does not improve accuracy.

- No improvement over the years.

A weather forecaster will have an exceptional record if he says simply that tomorrow will be just like today. If I were a weather forecaster, I would tend to err on the side of bad weather instead of good weather. Then, if you are wrong, most will not notice. It is when you forecast good weather, and it is not, that they will notice. Most market prognosticators tend to have a bullish or a bearish bias in their forecasts. Bullish forecasts are generally well-accepted, especially by the Wall Street community, and bearish forecasting is a giant business because it infringes on investors’ fears.

“Given the difficulties forecasting the future, it is very useful to simply know the present.” — Unknown

Barry Ritholtz (The Big Picture blog) recently pointed out how ridiculous the forecasting business has become. In particular, the end-of-the-year forecasts for the next year or the best stocks to own. Here is an example from the August 14, 2000, issue of Fortune magazine by David Rynecki on “10 Stocks to Last the Decade.”

August 14, 2000

- Nokia (NOK: $54)

- Nortel Networks (NT: $77)

- Enron (ENE: $73)

- Oracle (ORCL: $74)

- Broadcom (BRCM: $237)

- Viacom (VIA: $69)

- Univision (UVN: $113)

- Charles Schwab (SCH: $36)

- Morgan Stanley Dean Witter (MWD: $89)

- Genentech (DNA: $150)

Closing Prices December 19, 2012

- Nokia (NOK: $4.22)

- Nortel Networks ($0)

- Enron ($0)

- Oracle (ORCL: $34.22)

- Broadcom (BRCM: $33.28)

- Viacom (VIA: $54.17)

- Univision ($?)

- Charles Schwab (SCH: $14.61)

- Morgan Stanley Dean Witter (MWD: $14.20)

- Genentech (Takeover at $95 share)

Ritholtz goes on to say, “The portfolio managed to lose 74.31 percent, with three bankruptcies, one bailout, and not a single winner in the bunch. Even the Roche Holdings takeover of Genentech was for 37 percent below the suggested purchase price. Had you merely bought the S&P 500 Index ETF (SPY), you would have seen a gain of over 23 percent.”

On March 11, 2008, CNBC’s Mad Money host, Jim Cramer, emphatically said it was foolish to move money out of Bear Stearns. He claimed that Bear Stearns was just fine. He was totally wrong. A week later, JPMorgan agrees on March 16 to buy Bear for $236 million, or $2 a share, representing just over 1 percent of the firm’s value at its record high close just 14 months earlier. The deal essentially marked the end of Bear’s 85-year run as an independent securities firm. On Monday, March 17, Bear shares closed at $4.81 on optimism another buyer may emerge. The average target price: $2. Don’t confuse advice from someone in the entertainment business with advice from someone who manages money. In fact, don’t pay attention to anyone’s predictions. No one knows the future!

The Reign of Error

In 1987, a book was written entitled The Great Depression of 1990, by Dr. Ravi Batra, an SMU professor of economics. Sadly, I bought and read that book. Batra was claimed as one of the great theorists in the world and ranked third in a group of 46 superstars selected from all economists in American and Canadian universities by the learned journal Economic Inquiry (October 1978). The foreword was written by world-renowned economist Lester Thurow, who said The Great Depression of 1990 is crucial reading for everyone who hopes to survive and prosper in the coming economic upheaval. The title for one chapter was “The Great Depression of 1990–96.” Not only did he pronounce the beginning of it, he also proclaimed to know the end.

The 1990s saw the largest bull market in history, with the Dow Industrials rising from 2,700 to over 11,000 during the decade of the 1990s. By the end of the decade, we were flooded with books about the never-ending bull market, such as Dow 40,000 by Elias, Dow 36,000 by Glassman and Hassett, and Dow 100,000 by Kadlec. From 2000 until early 2003, we witnessed a bear market that removed most of the gains of the previous 10 years, with the Dow Industrials back down to about 7,350.

“We are making forecasts with bad numbers, but bad numbers are all we have.” — Michael Penjer

These forecasts were dead wrong; however, I ‘m sure the authors sold a lot of books. The bad news in the stock market did not end after the bear market from 2000 to 2003; by March 2009, the Dow Industrials was below the level of the previous bear by another 8 percent. Agencies whose duty is to make forecasts were almost universally wrong during the 2006 to 2007 period, with forecasts of the economy, the markets, and the world outlook all positive; even the ones that weren’t quite as rosy were only modestly so. The business magazines were the same. How many forecasts do you find yourself reading and listening to? Did you ever research to see if any of them ever turned out to be correct? Or even close?

Finance is not the same as physics, in that no mathematical model can fully capture the large number of always changing economic factors that cause big market moves—the financial meltdown of 2008 is an example. Emanuel Derman says, “In physics, you’re playing against God; in finance, you’re playing against people.” The parallelism between physics and finance has gained support from author Nassim Taleb, who says, “It doesn’t meet the very simple rule of demarcation between science and hogwash.” Whether invoking the physicist Richard Feyman or the late Fischer Black, the use of mathematical models to value securities is an exercise in estimation. Derman further states, “You need to think about how to account for the mismatch between models and the real world.”

“Science is a great many things, but in the end they all return to this: Science is the acceptance of what works and the rejection of what doesn’t. That needs more courage that we might think.” — Jacob Bronoski

Long Term Capital Management (LTCM) was started by John Meriwether, who had a great following along with Myron Scholes and Robert Merton, two famous economists. Together, they grew LTCM into assets of more than $130 billion, using a model they claimed would achieve exceptional returns without the usual risk. That alone should have been all the warning anyone needed. In 1997, their model did not do well, and by mid-1998 they had lost all of it; they had borrowed more than a trillion dollars to make investments. The story ended in September 1998, when the New York Federal Reserve Bank led a group of organizations to step in and bail them out; shortly thereafter, there was no more LTCM. Academics with sophisticated models are a dangerous lot. And here’s the best part—just before the demise, Scholes and Merton won the Nobel Prize for economics for their efforts in financial risk control.

LTCM was not alone; stories of hundreds of funds have gone out of business after short periods of exceptional success. Rogue trades were rampant. Remember Nick Lesson of Barings Bank? How about Jerome Kerviel of Societe Generale, or a host of large banks during the period? The list is long and growing. Enron, WorldCom, and Global Crossing were just a few large companies that went bankrupt, taking their employees’ pensions and investments with them. I don’t recall anyone ever anticipating any of these failures; forecasters never do.

After the inflationary decade of the 1970s, the price of gold was soaring. In the early 1980s, forecasts of gold reaching unbelievable heights were everywhere. They were supported with the facts that gold’s fixed value was released in 1971 and it was free to trade, and trade it did. The Hunt Brothers had bought a large portion of the silver market. No forecaster saw anything but higher prices. I recall buying three 100-ounce bars and wishing I had more money to buy more. You will see in Chapter 11 on drawdowns that gold plummeted in 1981, and it took more than 25 years to get back to its peak. And by 2013, the forecasts of gold going to the moon were everywhere.

At what point will we start to believe that forecasting is a hoax? This book is about the stock market, where the forecasting business is huge. I can tell you this: stock market forecasters are no different than economic forecasters. The ones who get lucky with a forecast are the ones who have yet to be wrong. I think the worst of them are the ones I call outliers (not to be confused with outlaws); these are the ones who, through some stroke of luck, make a forecast about something big and it turns out to actually happen. However, it is rarely in the exact manner of the forecast, but that is soon forgotten as he or she is paraded through the financial media as the guru of the year. They start newsletters, hold conferences, and embark on periods of more and more forecasts because they are now experts. Yet, most rarely make another correct forecast. John Kenneth Galbraith said: “When it comes to the stock market, there are two kinds of investors: those who do not know where it is going, and those who do not know that they do not know where it is going.”

An Investment Professional’s Dilemma

When speaking to investment advisors, I often remind them that they must deal with two realities:

- Your clients expect you to have answers.

- The market is unpredictable.

Once you have your clients believing #2, then the questions for #1 will be easier to answer. Most advisors, and especially their clients, get caught up in the moment and are easily swayed into believing that some expert actually knows the future. Or that they focus on the recent past and extrapolate that ad infinitum.

“Mind you, you should take economic forecasts—even my own—with a big grain of salt.” John Kenneth Galbraith may have been more right than econometricians like to think when he said that “The only function of economic forecasting is to make astrology look respectable.”

Nobel Prize-winning economist Kenneth Arrow has his own perspective on forecasting. During World War II, he served as a weather officer in the U.S. Army Air Corps, working with individuals who were charged with the particularly difficult task of producing month-ahead weather forecasts. As Arrow and his team reviewed these predictions, they confirmed statistically what you and I might just as easily have guessed: The Corps’ weather forecasts were no more accurate than random rolls of a die. Understandably, the forecasters asked to be relieved of this seemingly futile duty. Arrow’s recollection of his superiors’ response was priceless: “The commanding general is well aware that the forecasts are no good. However, he needs them for planning purposes.” (Peter Bernstein, Against the Gods)

“You don’t need a weatherman to know which way the wind blows.” — Bob Dylan

The book Dance with Chance by Spyros Makridakis (an author who wrote a wonderful business-forecasting book a couple of decades ago) gives a short story about Karl Popper. Popper was a philosopher of science born in Austria. In the 1930s, he leveled a charge against Sigmund Freud, whose psychoanalytical theories had gained widespread acceptance. Popper pointed out that real scientists start with conjectures, which they then try to refute—as well as seeking evidence to support them. Only by failing to disprove their hypotheses, can they prove they were correct. Meanwhile pseudoscientists, as Popper called them, only look for events that prove their theories correct. Theories like this are little more than untested assertions. That’s not to say the assertions can’t eventually turn out to be right, but we can only reach this conclusion once someone has tested them.

“Forecasting the future is much more difficult than forecasting the past.” — Unknown

Forecasting the future of monetary, economic, financial, or political possibilities has a serious flaw in that regardless of if your forecast is close to being correct, or even if it is spot on, the assumption about how the market will react is where the big problem lies. There is a flawed belief that positive events from political, economic, and monetary news will reflect positively on the markets. Conversely, negative news events will reflect negatively on the markets. This simply is not true. You can see that there is hardly any usable correlation to these events and the markets; earnings announcements are a perfect example. How many times have they been positive and the stock market did not react accordingly? The gap between a good economic or monetary forecast and the reality of what the market does is huge.

“There is always a reason for a stock acting the way it does. But also remember that chances are you will not become acquainted with that reason until sometime in the future, when it is too late to act on it profitably.” — Jesse Livermore

The following (slightly modified) comes from Gary Anderson, who wrote the must-read book entitled The Janus Factor. The link between fundamentals and price is elastic, and rarely still. At times, good earnings reports cause the price of a stock to rise, while at other times traders use positive earnings news to sell the same stock. Will a global crisis increase the value of the dollar or send it lower? The linkage between change in the world and change in the market is often ambiguous and sometimes just plain mysterious. In most cases, human beings are clever enough to create plausible stories to account for the market’s response to events, but too often only with the aid of hindsight. There is a constant shift in the fundamental reasoning used to support decisions to buy and sell. The financial media is constantly justifying each move in the market with whatever recent event they can find that supports that move. Fundamental conventions supporting buy/sell decisions can vary from period to period and have no place in rational investing.

We can draw a useful distinction between reasons and causes. Earnings do not cause prices to move, nor do research reports, news bulletins, talking heads, dividends, stock splits, the economy, peace, or war. These factors may be reasons motivating traders to buy and sell, but the direct cause of a stock’s price movement is the buying and selling activity of traders and investors. We focus on causes, not reasons—on what traders do, not why. This is accomplished by measuring price and price derivatives (breadth, relative strength) of price movement.

Gurus/Experts

What would we do without all the experts, gurus, pontificators, purveyors of gloom and doom, and, of course, the perma-bulls and perma-bears?

First of all, a giant industry would be gone, an industry that generates billions of dollars in the USA alone. I’m not going to spend a great deal of time on this, because the website of CXO Advisory Group LLC, CXOadvisory.com , does all the heavy lifting. They have an entire section devoted to GURUS. Here are the two questions they ask at the beginning of that section: “Can experts, whether self-proclaimed or endorsed by others (publications), provide reliable stock market timing guidance? Do some experts clearly show better intuition about overall market direction than others?” They address these questions with a logical and transparent process. After following more than 60 experts and thousands of observations, near the end of the Guru section, they conclude: “The overall accuracy of the group, based on both raw forecast count and on the average of forecaster accuracies (weighting each individual equally) is 47 percent. In summary, stock market experts as a group do not reliably outguess the market. Some experts, though, may be better than others.” Hmmm! It seems like a coin toss, on average, would do better.

Additionally, CXOadvisory.com reviews numerous academic papers, and then does its own backup analysis to determine if the paper’s author and they agree. An excellent piece, when reviewing Charles Manski’s July 2010 paper entitled “Policy Analysis with Incredible Certitude,” categorizes incredible analytical practices and underlying certitude. These four are:

- Conventional certitudes (conventional wisdom)—Predictions (indicators) that experts generally accept as accurate, but are not necessarily accurate.

- Dueling certitudes—Two contradictory predictions that competing experts present as exact, with no expression of uncertainty (leading to conflicting strong investment strategy recommendations).

- Conflating science and advocacy—Developing arguments (assumptions) that support an investment strategy rather than an investment strategy that supports evidence-based arguments, while portraying the deliberative process as scientific.

- Wishful extrapolation—Drawing a conclusion about some future situation based on historical tendencies and untenable assumptions (ignoring differences between the historical and future situations, and emphasizing in-sample over out-of-sample testing).

If you have ever watched television, read a newsletter, or attended a seminar, I’m sure the above sounds familiar. People who appear as experts generally aren’t any better than the masses; however, when they are wrong, they are rarely held accountable, and never admit it (generally). They will respond that their timing was just off or some catastrophic event caught them off guard, or worse—wrong for the right reasons.

There is a book by Philip Tetlock, Expert Political Judgement: How Good Is It? How Can We Know?, that deals with the business of prediction. Tetlock claims that the better-known and more frequently quoted they are, the less reliable their guesses about the future are likely to be. The accuracy of their predictions actually has an inverse relationship to his or her self-confidence, renown, and depth of knowledge. Listen to experts at your own risk.

Larry Williams was an active and renowned trader before I even began to show interest in the markets. There is one significant point that Larry has made consistently that needs to be repeated here. If you are going to be mentored by someone, if you are going to read someone’s book on trading/investing, if you are going to sign up for a course of instruction from someone, please make sure they are qualified to teach the subject. This does not always translate into how they trade or invest. Like Larry says in his Trading Lesson 16, Kareem Abdul-Jabbar tried coaching and was a disaster at it; Mark Spitz’s swimming coach could not swim. However, the bottom line is that the best teachers are probably the ones who actually trade and invest, as they have firsthand experience to the nuances of the skill. This argument is not unlike the one between the ivory tower academics and those involved in the real world applying their craft every day. While they may have considerable talent to offer, your chances are probably better with a real practitioner.

Masking an Intellectual Void

My formal education was in aerospace engineering. My education in “The World of Finance” came and continues to come from people in the investment industry I have grown to respect. I hate to list some as fear of leaving someone out, but Ed Easterling, John Hussman, and James Montier are certainly at the top of the list. Are these professionals always correct? Of course not, but they usually admit it and they write in such a manner that they know the uncertainty is always there and yet present valid arguments on a wide range of topics and concepts. The rest of the learning comes for reading literally hundreds and hundreds of white papers in finance and economics. This process caused my concern at the insane use of advanced mathematics, usually in the form of partial differential equations, to supposedly assist in making the point that the paper was addressing. I cannot tell you how many times I thought that most of the math was unnecessary and more often than not the paper would have stood alone without the math. In many instances I think there is an attempt by most to overly complicate their work with mathematics with the belief that it brings credibility to their work. Another reason, and one I certainly cannot prove, is that they also know that most people who read their paper, other than their peers, will not grasp the math and just assume it is valid and necessary.

The senior special writer, Carl Bialik, of The Wall Street Journal, who writes a section called “The Numbers Guy”, is one of my favorite reads. As I was wrapping up research for this book and thinking that I had included enough opinions about things without substantial evidence, I was delighted to find support from Carl for this section on “Masking an Intellectual Void.” On January 4, 2013, he wrote two articles entitled, “Don’t Let Math Pull the Wool Over Your Eyes,” and “Awed by Equations.” Those articles referenced two papers that gave support to my belief in the overuse of mathematics, and how readers of white papers generally were impressed with what they actually did not understand. Research was conducted using only the abstracts of two papers, one without math, and one with math; the catch being that the one with math was bogus, totally unrelated to the paper. Yet the highest percentage of participants who gave the highest rating to the abstract with added math, based on the participants’ educational degree, was as follows:

Math, Science, Technology 46 percent

Humanities, Social Science 62 percent

Medicine 64 percent

Other 73 percent

I think this shows that those who had a high probability of not understanding the math gave the paper with the bogus math a higher rating, while those who possibly did understand the math did not.

This is just my lame attempt at humor. The financial academics have almost universally used partial differential equations in their white papers; I think, more often than not just to hide an intellectual void. Many times, the difficult math is not necessary, but by including it, they know most will never be able to question their work. Sad, indeed! Incidentally, the equation can be simplified to 1 + 1 = 2.

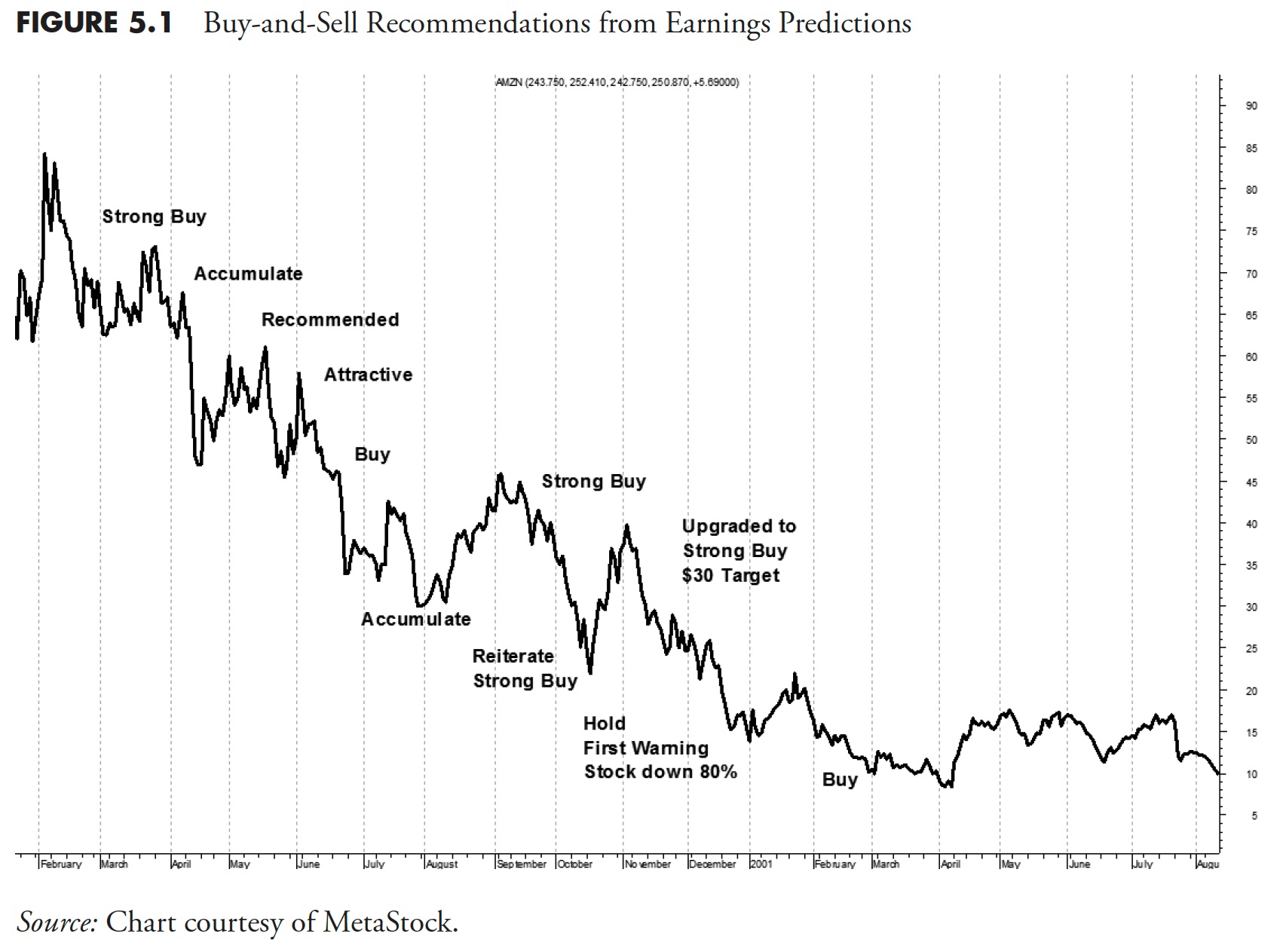

Earnings Season

For decades, I have watched the parade of earnings announcements and how the media hangs on each one as if it actually had some value other than filling dead air. Figure 5.1 shows the stock price of Amazon back in the 2000-2001 bear market. The annotations are from actual earnings forecasts from analysts. If you yell “buy” all the way down, the odds are good that you will eventually be correct. Hopefully, you will still have some money.

“In our view, security analysts as a whole cannot estimate the future earnings pattern of one or more growth stocks with sufficient accuracy to provide a firm basis for valuation in the majority of cases.” — Benjamin Graham

It seems that the media is so focused on earnings reports that they forget to report the actual earnings. Instead, their focus is on where the earnings came in relative to the analysts’ estimate. After beating up on experts, it is hard to imagine that someone would actually make an investment decision based on an analyst’s (expert) guess as to what earnings should be. These analysts are constantly wined and dined by the companies they analyze, so, in general, I think they are biased, and almost always to the upside. In fact, I think most are really just trend followers, in that they are always forecasting better earnings as markets rise and, once a market rolls over and begins to decline, they eventually begin to forecast lower earnings.

Figure 5.1

Figure 5.1

When asked what investors’ greatest problems are, the late Peter Bernstein said, “Extrapolation! They believe the recent past is how the future will be.”

Are Financial Advisors Worth 1% of AUM (Assets Under Management)?

“People who need advice are least likely to take it.” — Unknown

Many asset managers hold entirely too many stocks and have become closet benchmark trackers. If they beat their benchmark, they call it alpha, and when they do not beat their benchmark, they call it tracking error. If your investment manager rebalances your portfolio periodically based on a few questions that he required you to answer when setting up the account, here are some things to think about. Usually, the risk tolerance and objective questionnaire is much more involved, but here are two questions typically asked:

- What percentage of current income will you need when you retire?

- On a scale from 1 to 7, what is your risk tolerance?

Do you honestly believe a person knows the answers to those questions? No way! They will try to answer based on what the advisor has told or suggested to them. The law requires this type of action for advisors, so pick an advisor you think will actually meet your needs and, if you are unsure, can point you in the right direction.

Economists Are Good at Predicting the Market

“The economy depends about as much on economists as the weather does on weather forecasters.” — Jean Paul Kauffman

Just to put this into perspective, the stock market is a component of the index of leading indicators. If the stock market is a good leading indicator of the economy, why ask an economist what the market is going to do? Yet they are paraded daily across the financial media, making forecasts about the markets, political policy, fiscal policy, monetary events, and, yes, occasionally about the economy. When they are correct, they won’t let you forget it; when they are wrong, no one remembers. Many economists are good when dealing with the economy, but rarely are they good when they stray into other areas.

News Is Noise

Here is a humorous attempt to portray some of the daily noise often referred to as news. On Wall Street today, news of lower interest rates sent the stock market up, but then the expectation that these rates would be inflationary sent the market down, until the realization that lower rates might stimulate the sluggish economy pushed the market up, before it ultimately went down on fears that an overheated economy would lead to once again an imposition of higher interest rates.

Rolf Dobelli, writing for The Guardian, on April 12, 2013, in an article entitled “News is bad for you—and giving up reading it will make you happier,” listed these problems with news:

- News misleads.

- News is irrelevant.

- News has no explanatory power.

- News is toxic to your body.

- News increases cognitive errors.

- News inhibits thinking.

- News works like a drug.

- News wastes time.

- News makes us passive.

- News kills creativity.

He claims he has gone without news for four years and says it isn’t easy, but it’s worth it. Since he wrote for a news organization, I would imagine he is also looking for work.

“If you can distinguish between good advice and bad advice, then you don’t need advice.” — VanRoy’s Second Law

When asked at seminars what is the single most important concept to understand when investing, I respond simply that it is to know thyself. The human mind is a horrible investor, and the use of heuristics does not help. The next chapter deals with human behavior as it relates to the market.

Thanks for reading this far. I intend to publish one article in this series every week. Can’t wait? The book is for sale here.