Ethereum

The inflow of Binance increases the fear of whale exit, and the ETH conflict collides at $ 2,499.

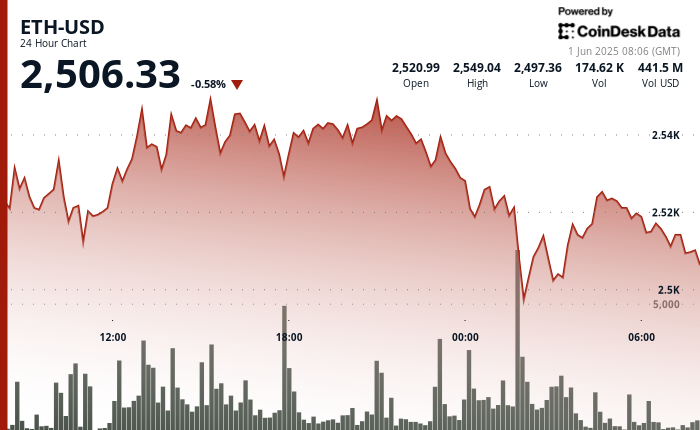

Ether Leeum (ETH) is falling to less than $ 2,500 due to the rapid increase in sales volume and wider risk emotions in the face of a downturn updated in late transactions. Global trade tensions and renewed US tariff risks have triggered dangerous off flow, and digital assets are increasingly reflecting the traditional market for designated academic uncertainty.

Onchain data showed significant inflation for binary on centralized exchanges, especially 385,000 ETH. ETH has been slowly recovered for about $ 2,506, but market observers are closely seeing whether buyers can defend this level or other legs.

Technical analysis highlights

- ETH was traded within the range of $ 48.61 (1.95%) from $ 2,551.09 to $ 2,499.09.

- Price behavior formed a strong rise channel before it collapsed at the last time.

- Heavy sales appeared near $ 2,550, and profits were accelerated with a rapid reversal.

- ETH fell from $ 2,521.35 to $ 2,499.09 between 01:53 and 01:54 and exceeded 48,000 ETH for 2 minutes.

- The amount was soon normalized and the price was slightly recovered and integrated 2,504 ~ $ 2,508 bands.

- The $ 2,500 level is currently in mid -support, but momentum remains weak as a sign of distribution in the volume pattern.

External reference