The inside scoop on the $500 million interstate flight.

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has seen significant exodus from centralized exchanges in recent weeks. Data shows a growing preference for holding assets outside of trading platforms.

At the time of this writing, ETH is trading at $2,289, down 0.7% over the past 24 hours, but up 1.6% over the past week, according to data from Coingecko.

Ethereum outflow amounted to $1.2 billion.

Last week, $500 million worth of ETH left exchanges, bringing total outflows to $1.2 billion in January, according to blockchain analytics firm IntoTheBlock. This represents a significant change compared to previous months and raises questions about the motivation behind this trend.

500 million dollars $ETH Withdrawals from CEX this week bring total outflows to more than $1.2 billion last month. pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

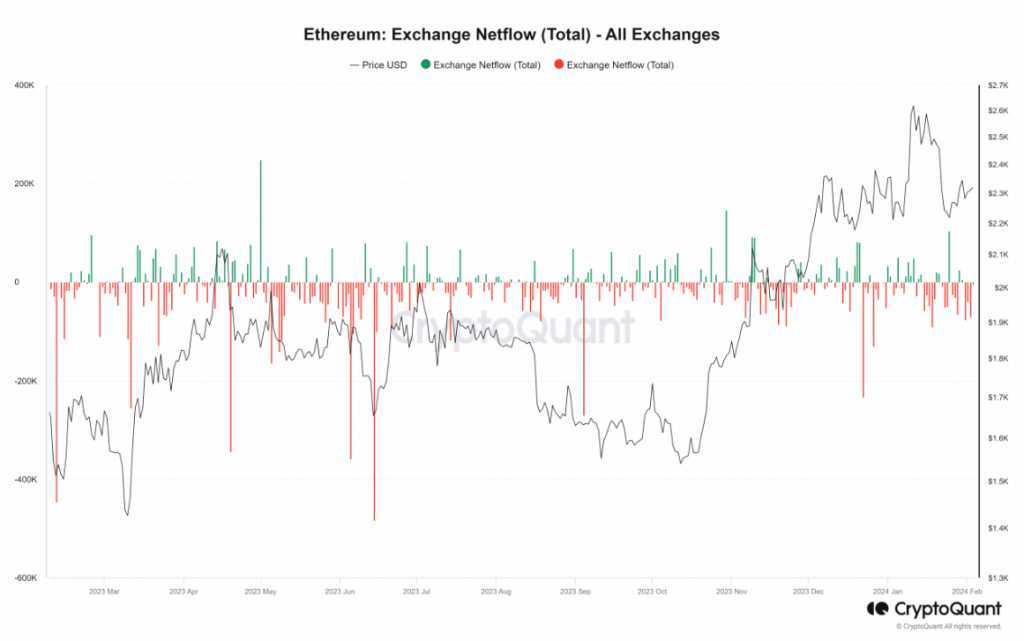

CryptoQuant data paints a clearer picture, showing the dominant outflow pattern since early January. The chart shows exchange holdings continuing to decline, with the last inflow recorded on January 30th. As of this writing, outflows continue unabated, with over 3,000 ETH leaving exchanges every hour.

However, the impact on overall exchange supply is not completely uniform. The total amount of ETH held on exchanges first increased in January, reaching approximately 10.7 million by mid-month, but then decreased to 10.3 million on January 28. Supply has resumed its upward trend, with current supply standing at approximately 10.6 million units.

Binance ETH Exodus: Investor’s Strategic Move

Interestingly, ETH historical balances on Binance, the world’s largest cryptocurrency exchange, tell a different story. Despite an overall increase in exchange holdings, Binance has seen ETH balances continue to decline throughout January. From its peak of over 3.9 million ETH on January 23, the balance has decreased to approximately 3.7 million ETH. This indicates that users are actively withdrawing Ethereum from the platform.

Ethereum currently trading at $2,288.5 on the daily chart: TradingView.com

The exact reasons for this trend remain unclear, but several possible interpretations emerge.

- Increase investor confidence: Moving ETH off exchanges could potentially signal a growing sentiment among investors to hold the asset long-term, driven by confidence in its future potential. Additionally, some investors may choose to transfer ETH to DeFi platforms for staking or monetization opportunities.

- Market uncertainty: Recent outflows may reflect broader concerns about market volatility or potential regulatory changes, which could lead investors to look for safer ways to store their holdings.

- Dynamics by Binance: Binance’s decline may be due to factors specific to the exchange, such as user preference for alternative platforms, trading fees, or policy changes.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.