The most successful basic patterns are those with increasing breakouts. Here are two examples | MEM edge

Last week, the S&P 500 rose a modest 0.2%, roughly equivalent to the four-month basic breakout point of 4607. In addition to a breakout, a move above this level would push the index higher than its July high. Key areas of possible resistance. What’s notable is that longer-term base breaks often precede longer-term gains, such as in early July of this year when another four-month base break preceded a 9.6% rise in the S&P 500.

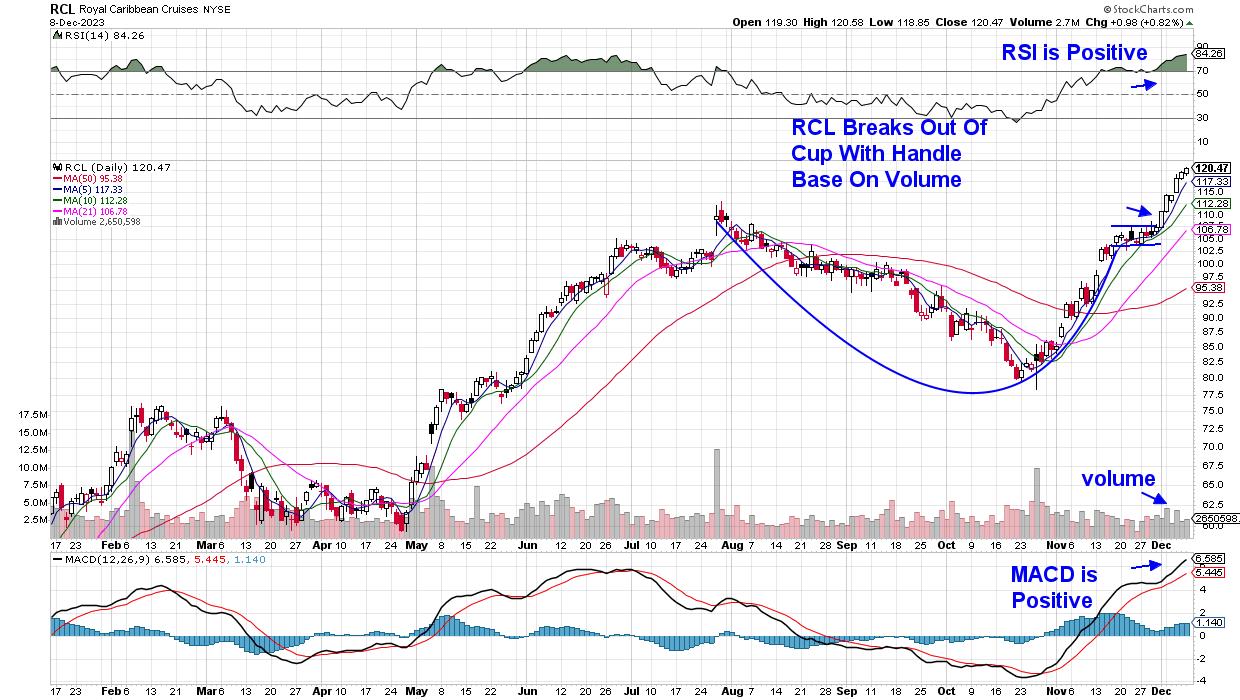

Currently, the broader market is on the rise, which makes screening for stocks coming from the base more interesting. Today we’ll focus on the recent Cup Base Breakout with Handle. Of the eight basic basic patterns, the cup with handle remains one of the most successful to this day. This chart pattern was identified by William O’Neil during decades of research that uncovered commonalities between winning stocks that outperformed the market. As you can see in the example below, other features besides the primary breakout on the chart are also present in these winners.

Royal Caribbean Cruises (RCL) daily chart

Royal Caribbean Cruises (RCL) daily chart

Royal Caribbean Cruises (RCL) announced a breakout of cup bases with handles this month amid reports of a significant increase in travel over the Thanksgiving holiday. What is noteworthy is that the right side of the RCL base has not reached its peak at the end of July. Failure to break through to previous highs is one of the keys to the base cup section. Additionally, the breakout occurred at above-average volume, indicating a build-up. The buy point is above the handle high point and is indicated by an arrow. RCL then entered an upward trend with the stock finding support at the rising 5-day moving average. Using June as a precedent, RCL has potential for further upside from here.

Daily chart of IDEXX Laboratories, Inc. (IDXX)

Daily chart of IDEXX Laboratories, Inc. (IDXX)

IDEXX Laboratories (IDXX) announced a cup-based breakout on Monday, following two Wall Street price target upgrades for the maker of diagnostic products for the veterinary market. Analysts were impressed by the growth projections presented by management at an industry conference earlier this week. On the daily chart above, the RSI is in an overbought position, while the weekly chart on IDXX has just posted a positive MACD and the RSI is below the overbought level. This can cause stocks to be strong in the short and long term.

As mentioned, a successful handle breakout combines several characteristics, such as above-average volume for the handle breakout and, ideally, is triggered by positive news regarding the company’s growth prospects. Additionally, RCL and IDXX, shown above, both reported strong earnings that beat recent estimates. Additionally, as with all base breakouts, the odds of success increase significantly if the broader market is trending upward.

These essential ingredients for a successful breakout of the cup-with-handles foundation are present in select homebuilding stocks that are currently being driven by low mortgage rates and pent-up housing demand. We highlighted two of these stocks as strong buys in our stock recommendation list in our twice-weekly MEM EDGE report. For immediate access to these and other bullish stocks, use this link here for a low-cost trial that you can stop at any time. This timely report will also inform you about changes in the current optimistic outlook for the market and the sector rotation that will take shape in the coming year.

I look forward to sharing my insights with you on a regular basis, as I have with many of my other subscribers over the years!

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the firm to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more