The new year begins with a blow to the leadership sphere | MEM edge

Growth stocks came under selling pressure last week, with the Nasdaq falling more than 3% with most Magnificent Seven names plunging. They weren’t the only stocks to fall in 2023, as semiconductor and software stocks also underperformed. The technology sector, on the other hand, was the worst performer of the week, falling 4.2%.

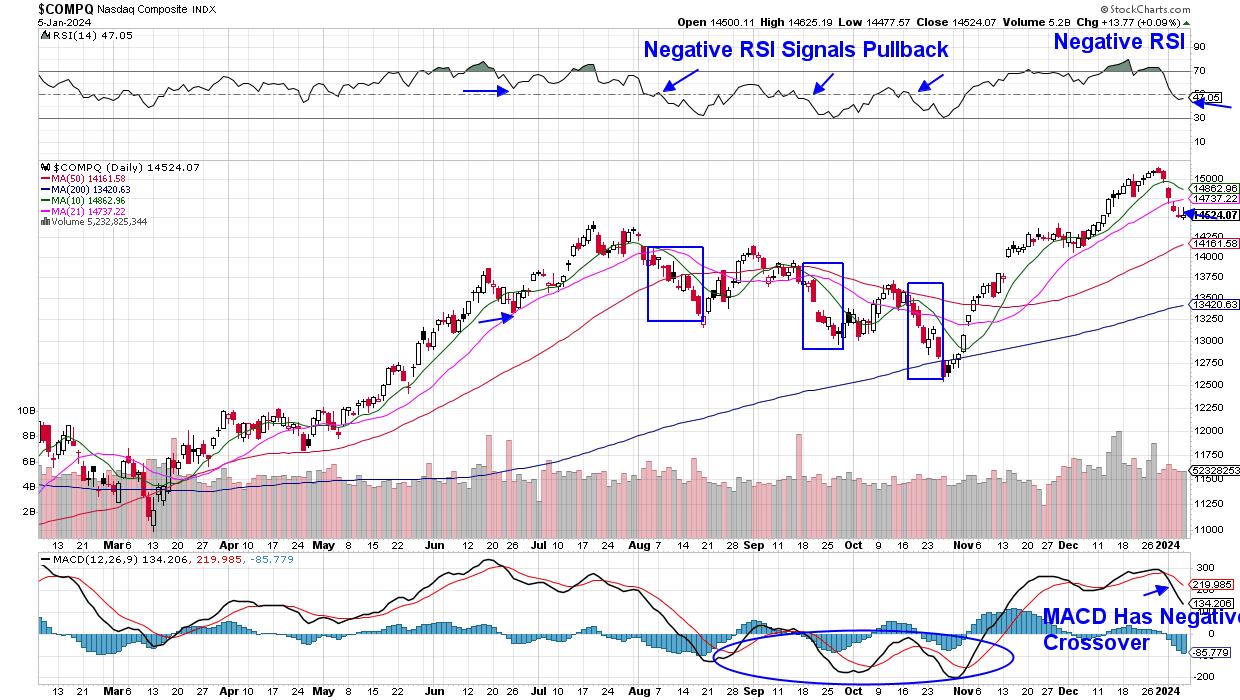

As you can see in the chart below, Nasdaq recorded a negative RSI on the daily chart last week, which, as highlighted, happened three times last year. Additional selling occurred as the price closed below the 21-day moving average, indicated by the rectangular box.

Nasdaq Composite Index ($COMPQ) daily chart

Nasdaq Composite Index ($COMPQ) daily chart

It’s unclear how much lower the Nasdaq will go, but it will certainly be important to keep an eye on interest rates. Similar to last year’s weak period, interest rates continue to rise and the 10-year Treasury yield is now above 4%. Growth stocks are underperforming in a rising interest rate environment. You may also want to examine the characteristics of the Nasdaq’s early November lows, as the index trended upward again through the end of the year.

Also noticeable last week was a clear shift toward value stocks, led by finance and healthcare. Both companies performed well. Next week we’ll get clues about the fundamentals of finance when major bank stocks, including JP Morgan (JPM), Bank of America (BAC), and Wells Fargo (WFC) report their fourth-quarter results. Management’s guidance regarding growth prospects for the year is equally important. Each of these companies has an optimistic chart of their results.

Pullbacks can be painful, but during this bull market phase, strong areas of the market can prepare you for another rally. Subscribers to my MEM Edge report were advised to hold on to most of the growth stocks on the report’s recommended holding list when the report is published midweek on Wednesday. Sunday’s weekly report will provide further insight into industry groups and specific stocks, as well as the broader market. Use this link here and you’ll get immediate access for a very small fee as well as a 4-week trial.

happy new year!

Mary Ellen McGonagle

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the firm to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more