The path of inflation will drive the stock market next year. Here’s a playbook.

New data released from the UK on Wednesday morning showed prices falling more than expected. This is further evidence that a downward trend in inflation is underway globally.

With the S&P 500 poised to thrive in 2023, the key question now is how much inflation will last and for how long.

A 24% surge.

Analysts at 22V Research, led by Dennis DeBusschere, have compiled a playbook for how the market will react. They note that the Fed expects core PCE (3.5% year-over-year as of October, new data released Friday) to decline to 2.4% by the end of 2024.

In the first scenario, growth remains above the 2% trend, wages take longer to clear inflation, and the core PCE is slightly above 2.4% but not above 2.75%.

In that setup, the Fed would still cut interest rates, but probably not by three or four times. But 22V says: That would make it more difficult to short or favor deep cyclical stocks such as energy, materials and industrials, they say, as well as sell the U.S. dollar or invest in falling U.S. Treasury yields.

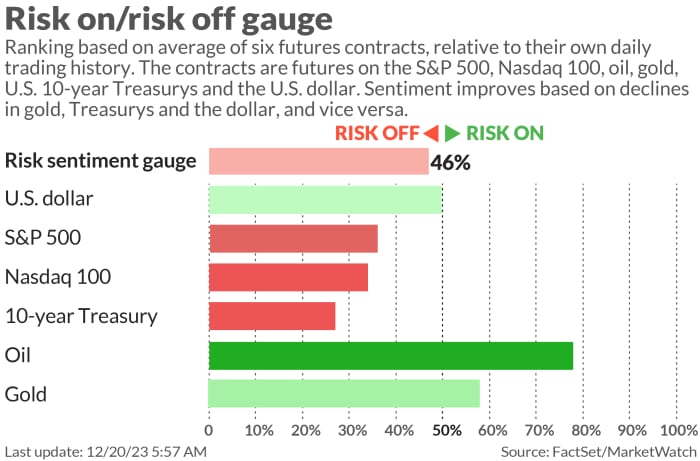

In the second scenario, we see core inflation tracking above 3%. — Treasury yields and US dollar

They predict it will move higher and risk aversion factors will benefit.

In the third scenario, inflation would head to 2.4% before the end of 2024. This means the Fed will cut interest rates four to five times, increasing downside risks to the dollar and Treasury yields and further easing of financial conditions.

“Assuming core PCE falls below 2.4% with no increase in unemployment, stocks do very well,” they say.

But 22V’s broader message is that laggards, like small-cap stocks, need to continue to catch up.

“By the end of the year we are not worried about a sharp decline, but the VIX

Below 13, with credit spreads in the 18th %tile (very narrow), price/earnings (S&P) above 19.5x, and investor sentiment (AAII) in the 98th percentile, the scope for further upside for the S&P is narrowing. Internal circulation remains a better way to achieve profits by the end of the year,” DeBusschere and team said.

read: This is a good time to invest in bond funds. A manager has an edge over his biggest competitor.

market

Stock Futures ES00

YM00

NQ00

It’s drifting south along with bond yields.

UK Yields Fall and Track

This comes after inflation in the country fell sharper than expected. Pound GBPUSD

It’s taking a toll on me. Brent crude oil BRN00

It’s back above $80 a barrel as traders monitor the Red Sea turmoil.

|

Key Asset Performance |

last |

5d |

1m |

YTD |

1 year |

|

S&P 500 |

4,768.37 |

2.68% |

5.07% |

24.19% |

24.77% |

|

Nasdaq Composite |

15,003.22 |

3.23% |

5.66% |

43.35% |

42.25% |

|

10 years treasury |

3.911 |

-11.43 |

-50.14 |

3.11 |

23.75 |

|

gold |

2,053.40 |

0.50% |

3.11% |

12.20% |

12.57% |

|

Oil |

74.43 |

6.53% |

-3.11% |

-7.55% |

-5.09% |

|

Data: MarketWatch. Changes in Treasury yields are expressed in basis points. |

|||||

buzz

fedex stock FDX

The package delivery giant is on the decline after lowering its full-year sales forecast amid concerns about slowing demand for holiday deliveries.

General Mills Stock GIS

The loss in sales has lowered the outlook for the consumer food company.

Tesla TSLA

He reportedly told some employees that he would not be granting performance stock awards this year.

read: Investors who fueled the year-end stock market rally say, “‘The Magnificent 7’ will continue into 2024.”

alibaba baby

CEO Eddie Wu will take charge of the China Internet group’s e-commerce business.

NYSE discontinues Farfetch stock FTCH.

About liquidation warning.

U.S. third-quarter current account data is scheduled to be released at 8:30 a.m., while existing home sales and consumer confidence are expected at 10 a.m.

The Colorado Supreme Court banned former President Donald Trump from voting in the state’s presidential primary, citing the insurrection clause. Trump’s lawyers said they would appeal.

best of the web

Hedge fund traders investing heavily in bonds

Red Sea shipping attack could undermine financial markets’ main theme for the new year

Cubicles are making a comeback.

Chart

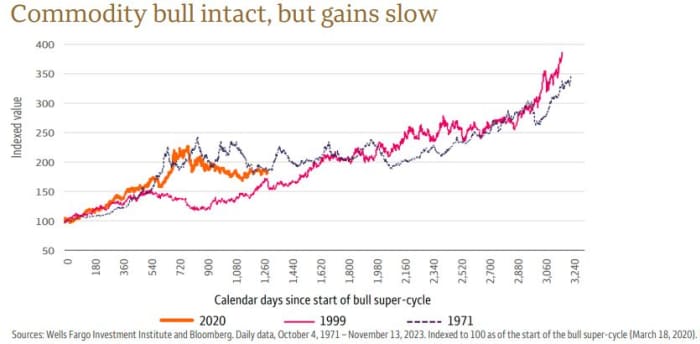

Three years later, the commodities bull supercycle appears to be slowing, with commodity prices hitting 10-year highs. But John LaForge, director of global real estate strategy at Wells Fargo Investment Institute, said investors shouldn’t give up on the asset class.

He provides the chart below.

“These long cycles have typically experienced periods of consolidation as sustained price increases add supply or slow demand, often leading to a reaffirmation of a bullish super cycle,” LaForge tells clients. Every downturn is a buying opportunity, and while he likes energy and precious metals, he suggests investors should stay diversified and not just stick to one sector.

best price

The most searched stock market stocks on MarketWatch as of 6 a.m. are:

random read

Women receive potatoes as a bonus and are taxed on them.

Microsculpter’s nativity scene has eyelashes.

What You Need to Know starts early and is updated until the opening bell rings, but if you sign up here you’ll get it delivered to your email box just once. The email version will be sent around 7:30 a.m. ET.