The Real Housewives of Cryptocurrency

Crypto comes to mind sometimes Real Housewives.

Everything is a drama. It’s a constant stream of discord, arguments, and excessive meltdowns. There is a lot of alcohol. And if nothing interesting happens, they will produce a new drama. Because we all get addicted to the dopamine rush.

As fun as it is to watch Teresa Giudice flip the tables or watch the ongoing feud between Lisa Vanderpump and Kyle Richards, most of us would agree. Stability is usually better than volatility..

Children do better when they live in safe, stable homes than when their parents are raging alcoholics.

Relationships are better when both partners know what to expect rather than when bipolar disorder develops.

The economy is better off if the value of a country’s currency is predictable rather than overly inflationary.

Cryptocurrency projects do better when token prices are stable, not just across the board. Here’s why:

Strange things about investing in tokens

As I’ve been investing in this field, I’ve only recently realized something important. Your Investments Are Displayed In the protocol’s token.

Let’s say we invest in ETH. Of course, Ethereum is like a giant computer that people pay to use. Every time you use a Dapp or purchase an NFT on the Ethereum network, you pay a fee.

Fees are not paid in dollars but in ETH.

Now, our investment philosophy is that when you buy ETH, you are also buying “stocks” in the Ethereum “company.” If you believe in the long-term future of Ethereum, buy and hold ETH like you would invest in Apple or Tesla or any other technology company.

But if you hold ETH, you own it. The network’s default currency.

This is the strange thing about cryptocurrency investing. When you purchase Apple stock, you see it in dollars. There is a stable reference. If the $APPL price goes up or down 10%, that doesn’t mean the cost of using your iPhone will suddenly go up or down 10%.

But if ETH goes up or down 10% do Network usage becomes somewhat more expensive.

Stop for a moment and think about this. i’ll wait.

Volatility harms users.

Cryptocurrency investments often use the network’s own tokens, which is why volatility is bad: Let’s take ETH as an example again.

high cost: If the price of ETH rises, network costs will become more expensive for users, hindering adoption. This is like using an ATM, which may charge you a $2 or $20 fee. And not only the cost of using Ethereum, but also All dapps built on top of it.

uncertain reward: Many DeFi protocols built on top of Ethereum offer rewards in native tokens. However, if the price of ETH falls significantly, the value of ETH also decreases. their Tokens also take users out of the protocol and dapp. (Remember Users = Value.)

Devalued Savings: Users also hold ETH as a store of value within the network (not for investing, but for actually using Ethereum computers). When the price plummets, net worth falls, weakening trust in the Ethereum network as a whole.

Volatility harms investors.

Short-term traders like volatility, but long-term investors like us do not. Here’s why:

volatility risk: It’s fun and rewarding to see the value of ETH rise 50% in a matter of weeks, but on the flip side, when that happens, investors cut their losses and sell in droves. Even if you have the courage to hold on, it is difficult to maintain your passion if 50% is lost.

market correlation: ETH tends to fluctuate with the price of Bitcoin (and the broader cryptocurrency market), so price may have nothing to do with how well Ethereum performs as a “business.” Even as users grow and adoption rates increase, volatility can paint a different picture.

future value: This is the biggest problem. The more volatile the price of ETH, the harder it is to predict potential fees, which impact everything from user growth, developer activity, and work. This is like investing in AT&T without knowing whether your phone will cost $40 per month or $400 per month.

Ethereum was used as an example here, but This principle applies to all layer 1 projects that invest in the tokens that run the network.. And this is especially true for layer 2 projects, which are currently investing in volatility on top of volatility.

I’m not saying you shouldn’t invest in these protocols. Long-term investors should seek stability.

Stability > Volatility

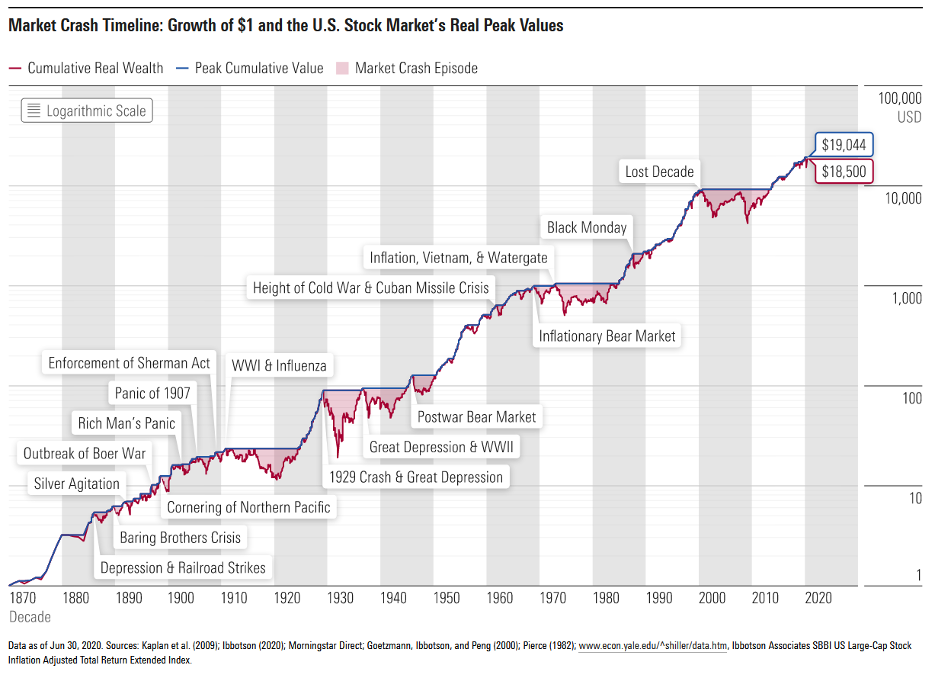

Just because stability is better than volatility does not mean that prices should never change. Ideally, we would see steady and (fairly) predictable growth, like the US stock market, with volatility easing over time.

Of course, this is ideal. Nothing in nature is completely stable. Hurricanes, floods, and fires happen. But in the long term, there is an underlying stability that allows us to predict that the seasons will change and the sun will rise again tomorrow.

Let’s celebrate that stability is what makes people trust cryptocurrencies. This is how people actually use it for something other than speculation.

It might not make great reality TV, but it would be a great investment.

Health, wealth and happiness,

John Hargrave

publisher, Bitcoin Market Journal