The reasons why Bitcoin and Ethereum prices plummeted are as follows.

The cryptocurrency market has been hit by another wave. selling pressure As Bitcoin and Ethereum prices plummet Widespread fear and uncertainty. The recession sparked new fears as spot Bitcoin ETFs lost more than $536 million in one day. Extended bearish phase. Analysts are calling this correction “Bloody Friday.” This is a less serious but still serious reflection of last week’s brutal sell-off that swept billions of dollars from the market and sent BTC and ETH tumbling lower.

Related Reading

ETF outflow causes Bitcoin and Ethereum price collapse

The recent plunge in Bitcoin and Ethereum prices has recently been a large-scale Outflow from U.S. Spot Bitcoin ETF. X Social Media Cryptocurrency Analyst Jana explanation This is one of the bloodiest weekly downturns of the quarter. bitcoin tumbling Ethereum is down 13.3% in 7 days and 17.8% over the past month. At press time, Bitcoin is trading just above $106,940, while Ethereum is hovering around $3,870, and both are experiencing steep retracements from recent highs.

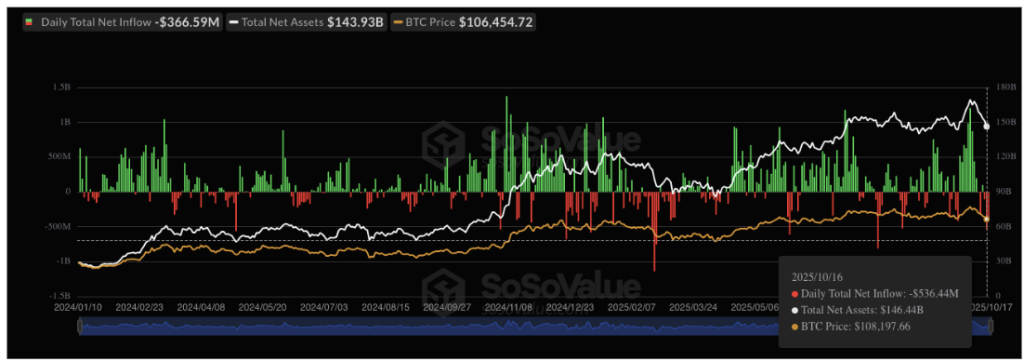

Data from SoSoValue show On Thursday, October 16, daily net outflows from the Spot Bitcoin ETF reached $536.4 million, marking the largest daily negative flow since August 1, when $812 million exited the market. out 12 US Bitcoin ETFsThere were eight registered major outflows, leading to outflows of $275.15 million. ARKB of Ark&21SharesThis was followed by $132 million from Fidelity’s FBTC. Funds managed by other major firms, notably Grayscale, BlackRock, Bitwise, VanEck, and Valkyrie, also reported significant withdrawals.

These ongoing outflows have now gone on for three days in a row, with a major outflow of $366.5 million just one day earlier on October 17th. that Continued negative ETF flow This highlights waning investor confidence and suggests the broader market downturn could continue in the near term. combined with $19 billion liquidation event Last Friday, increased ETF outflows could put more selling pressure on an already weak market.

Experts warn of deeper market pain ahead

Many experts believe that the cryptocurrency market is still There is more room for decline. Data from Polymarket, one of the world’s largest forecasting platforms, show 52% of participants expect Bitcoin to fall below $100,000 before the end of October. Veteran economist and Bitcoin critic Peter Schiff also said: warned With Bitcoin and Ethereum facing another major decline, the next few months could be disastrous for the industry, with widespread bankruptcies, defaults and layoffs predicted.

Meanwhile, technical analysts are pointing to the following signs: Deeper Weaknesses in Ethereum’s Structure. According to Crypto Damus, Ethereum has broken key weekly support and is showing a bearish setup on the charts. that says MACD is set to “red cross” soon, leaving room for a significant selloff.

Other analysts, such as Marzell, echoed There are similar concerns that Ethereum is now getting closer to a “crash zone.” However, he also highlighted the $3,690-$3,750 range as a near-term demand area where buyers could step back in and trigger the next round of upside.

Related Reading

Featured image from Unsplash, chart from TradingView