The return of the meme stock craze: Is it time to shift your investment focus? | chart watcher

key

gist

- Wednesday’s broad stock market rally shows investors are still willing to take chances in the stock market.

- Despite the stock market rebound, the Telecommunication Services and Technology sector was the worst performer in the S&P 500 on Wednesday.

- Gold prices are falling after several years of sideways movement.

Some unusual activity was noticed in the stock market today. It is interesting to note that while stock market indexes rose, with the S&P 500 hitting an all-time high and the Dow Jones Industrial Average posting its third straight day of declines, the Communication Services and Technology sector was the worst performer among the S&P 500 sectors. It was awesome.

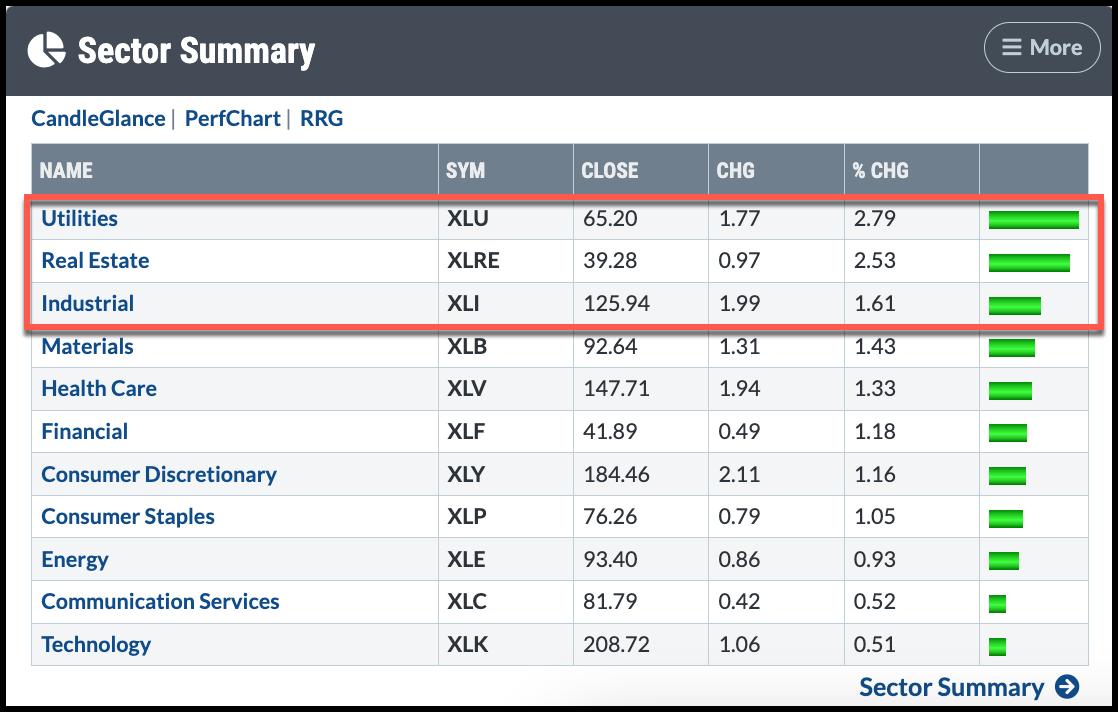

The sector summary below shows that all 11 S&P 500 sectors were in the green at the close on Wednesday. However, utilities, real estate and industrials were the top three sectors. One day doesn’t create a trend. But if this continues, it means investors are becoming more familiar with the overall market and are not afraid to diversify their investments across different asset classes.

Chart 1. Sector summary for Wednesday, March 27th. All S&P 500 sectors were positive, but the Communication Services and Technology sectors fell to the bottom.Chart source: StockCharts.com. For educational purposes.

widespread gathering

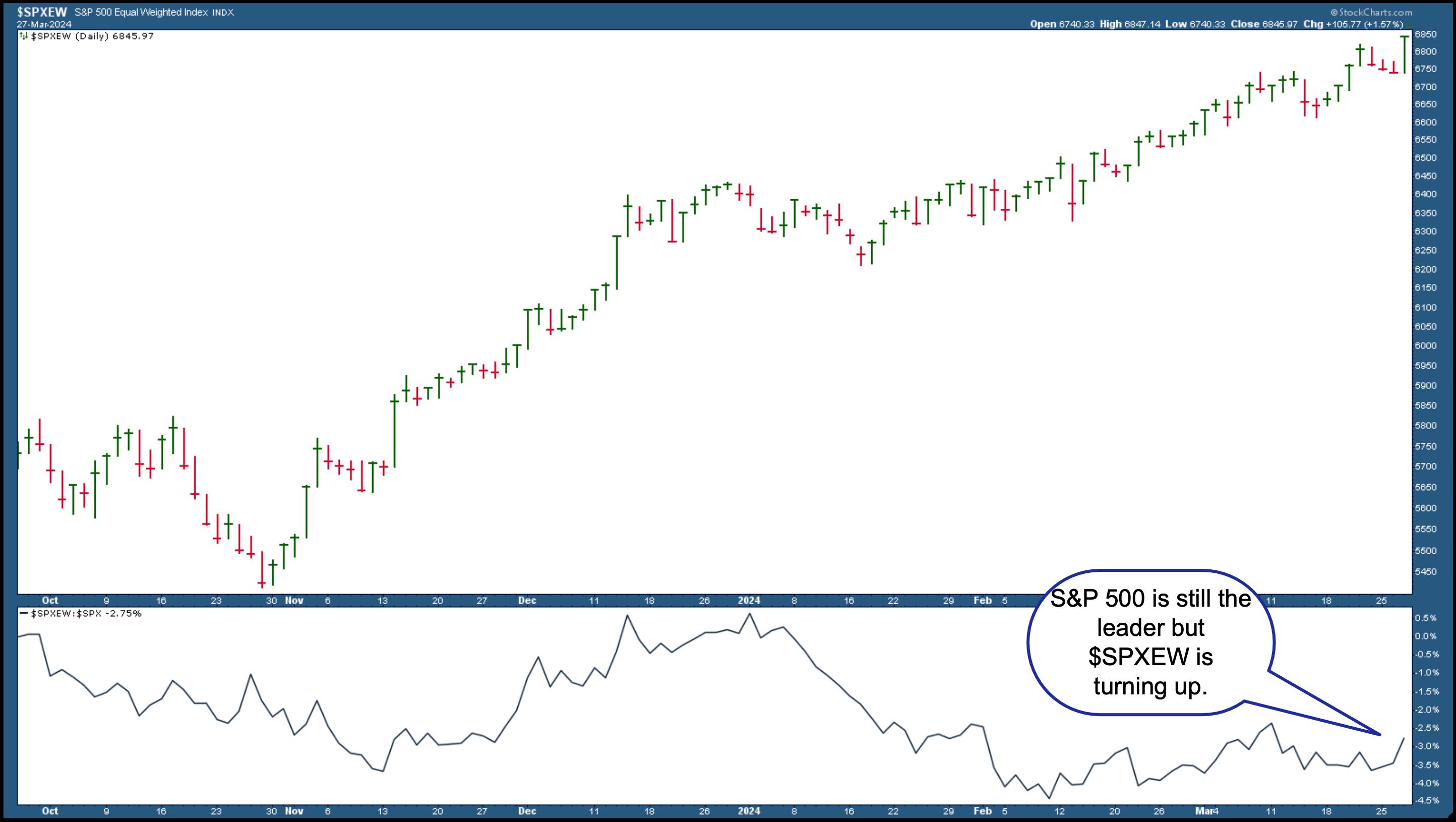

If I run the following: New all-time record Scan, one of these scans StockCharts Sample Scan Library, there were more than 40 stocks and exchange-traded funds representing a variety of sectors and market capitalizations. The S&P 500 Equal Weighted Index ($SPXEW) closed higher (see chart below), confirming that Wednesday’s rally was broad-based.

Chart 2. The S&P 500 Equal Weight Index closed higher.

Keep an eye on this chart to see if $SPXEW continues its upward trend. When comparing $SPXEW’s performance to the S&P 500 ($SPXEW:$SPX) shown in the bottom panel, it is clear that $SPXEW is starting to rise, although it still significantly underperforms the S&P 500. . If it continues in that direction, investor participation in the market may increase.

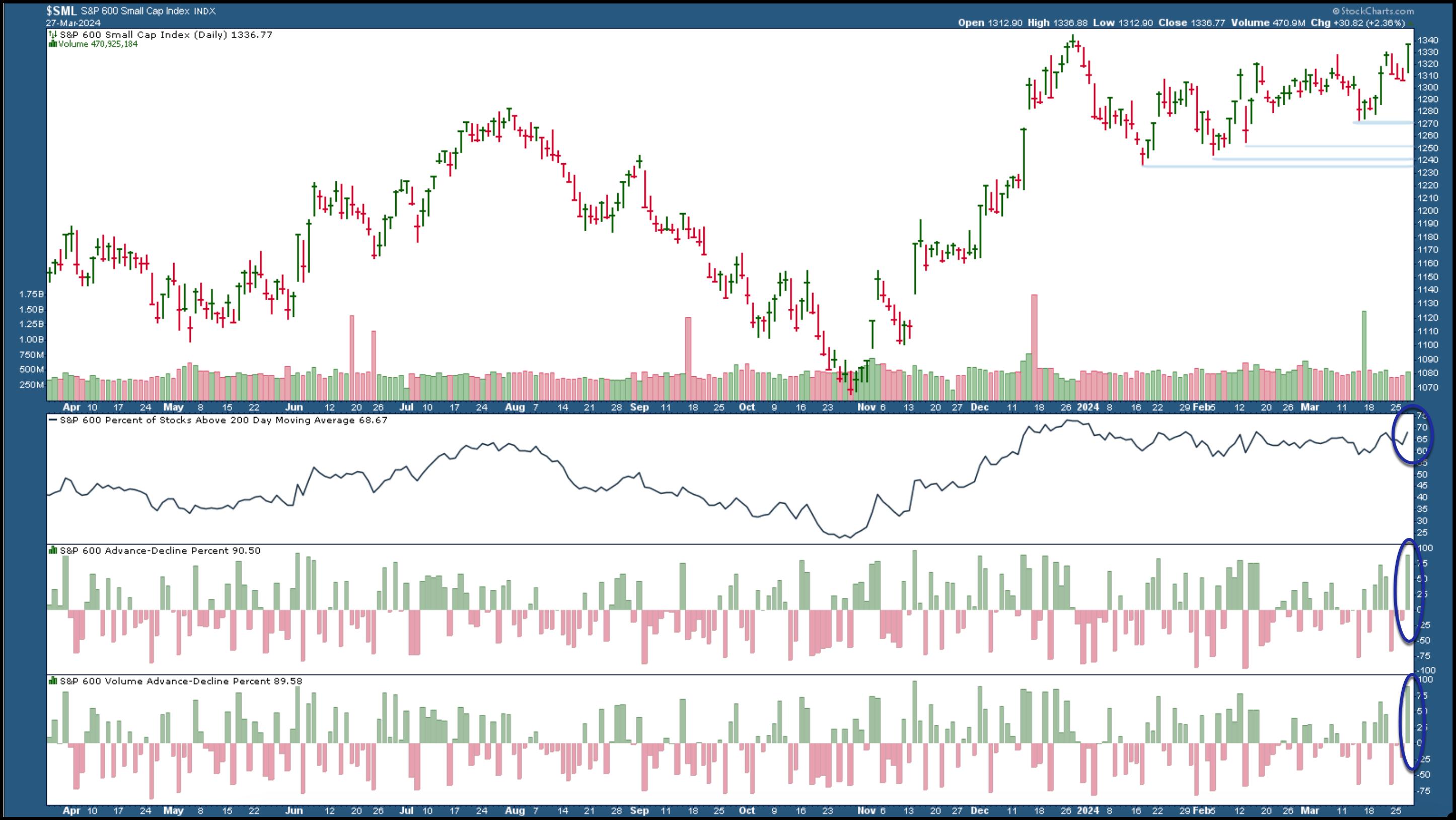

There was also a wide range of small and medium-cap stocks. The S&P 600 Small Cap Index ($SML) closed higher, showing strong market breadth (see chart below).

Chart 3. S&P 600 small-cap index closes higher. A break above the December 2023 high could be a sign of further strength for small-cap stocks. The small-cap market is also solid.Chart source: StockCharts.com. For educational purposes.

The percentage of S&P 600 stocks trading above their 200-day moving average is nearly 70%, with gains far outweighing declines. If you load a chart of the S&P 400 Mid-Cap Index ($MID), you can see that it has hit an all-time high with a similar market margin to $SML.

gold soars

Another area you shouldn’t ignore is gold. The price of gold plummeted. The gold futures monthly chart below ($GOLD) shows that gold prices have broken out of their trading range and are currently above $2212 per ounce.

Chart 4. Gold price surge. This may be a short-term rise, but if there is momentum, gold prices could rise much higher. Chart source: StockCharts.com. For educational purposes.

Gold continues to hit new highs, which is interesting because investors typically turn to gold as a hedge. But why hedge when inflation is cooling? It’s hard to say. Perhaps gold traders felt left behind and thought it was time to get noticed. So, it may be a short-term rally, but if momentum remains, you can take advantage of the rally by investing in an ETF such as GLD.

meme stock craze

Gold traders aren’t the only ones feeling left out. Some elements of meme stock mania show their presence in the stock market. Two stocks that have garnered significant investor interest after several days of trading are Reddit (RDDT) and Truth Social (DJT).

Is this a sign that investors are satisfied with the current state of the stock market and are looking to make quick profits? As investors become more complacent, we are likely to see more investor participation. However, this type of manic behavior can also mean that the market has peaked. That doesn’t mean the stock market will crash. But this means that when there is a change in investor sentiment, it is time to put up your antennae.

conclusion

The broad market rally is encouraging, but that should not lead to complacency. Trade using risk management strategies and monitor different sectors and asset classes closely. Looking at the big picture of the stock market helps you navigate the stock market strategically to see increased returns on your investments.

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use these ideas and strategies without first evaluating your personal and financial situation or consulting with a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as editor-in-chief of Stocks and Commodities Technical Analysis magazine for over 15 years. Learn more