The rise of supermicrocomputers will not last forever.

DNY59

We were formerly Super Micro Computer, Inc. (NASDAQ:SMCI) in November 2023, discussed a strong generative AI investment thesis thanks to the observed correction in previously inflated P/E valuations.

The insatiable market demand was also evidenced by the strong performance of the second quarter of 2024. We upgraded our Buy ratings by forecasting and raising FY2024 revenue guidance, validated by the last quarter results of several hyperscalers and data center REITs.

In this article, we will discuss how the market has entered a new state of AI craze, with SMCI’s stock valuation and price reaching new all-time highs, giving interested investors a minimal margin of safety.

Despite its excellent growth and impressive future guidance, we’re not sure the stock deserves its excessively premium growth valuation. That’s because once the hype subsides and sales growth slows, it could lead to massive volatility.

The generative AI investment thesis is overly enthusiastic here

SMCI is now twice ahead of its Q2 2024 earnings report with revenue of $3.66 billion (+73.4% QoQ/ +103.2% YoY) and adjusted EPS of $5.59 (+62.9% QoQ/ +71.4% YoY) .

These figures indicate that the availability of generative AI chips is increasing, with leading global foundry Taiwan Semiconductor (TSM) recording increased revenue in the fourth quarter of 2023 and January 2024.

We believe much of the top tailwind is intensifying AI chip competition, with Intel (INTC) and Advanced Micro Devices (AMD) increasing their Gaudi 2/3 and MI300 pipelines, respectively, to compete with Nvidia. It is assumed that it is caused by . (NVDA) has the upper hand with the H100/H200 series.

To further fuel the AI hype, SMCI raised its FY2024 revenue guidance to $14.5 billion (+103.6% YoY) at the midpoint (+103.6% YoY) from its original guidance of $10 billion (+40.4% YoY). The first increase was revised upward to $10.5 billion (+10.5 billion dollars). 47.4% YoY).

With positive comments about “a very large and growing backlog that grew again this quarter” and expanded “inference opportunities in our general CPU customer base,” we are not surprised by management’s strategic choices to accelerate long-term growth.

For example, SMCI recently increased working capital by approximately $600 million and increased capital expenditures to $14.72 million (+459.6% QoQ/+48.8% YoY) through the most recent quarter.

This naturally results in a moderately diluted share count of 58.08M (+0.89M QoQ/ +1.94M YoY) and impacted free cash flow generation of -$609.81M (-327.6% QoQ/ -503.3% YoY).

But with an improving balance sheet of $626.44 million in net cash (+43% QoQ/ +285.9% YoY), we’re not too worried after all. Because these efforts will allow SMCI to capitalize on the ongoing AI boom with an expected $641.73. B Hardware TAM will expand at a CAGR of +33% through 2032.

At the same time, the market is already expecting NVDA to provide strong future guidance, driven by TSM’s optimistic fiscal 2024 guidance. The latter expects revenue growth of over +20%, strong growth of its industry-leading 3nm technology, and strong demand. 5nm technology.”

SMCI expects to increase monthly manufacturing capacity to 5,000 racks by June 2024 (+25% of current capacity), combined with raising annual revenue target to $25 billion (+20% from previous target of $20 billion) So, the AI revolution is still in its early stages.

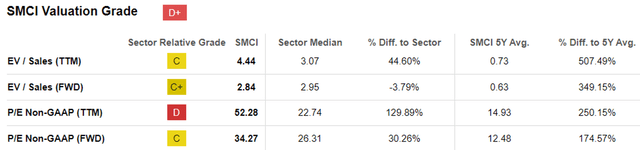

SMCI Assessment

pursue alpha

With SMCI directly benefiting from the relentless demand for complete AI server solutions, the market appears to have valued the stock at a high FWD P/E valuation of 34.27x.

This compares to server solution competitors such as 16.63x one-year average, 11.15x three-year pre-pandemic average, 8.03x Hewlett Packard Enterprise Company (HPE), and 12.95x Dell Technologies Inc. (DELL).

But here we would like to draw some cautions.

SMCI continues to deliver excellent growth while providing impressive future guidance, but it’s unclear whether its inflated premium growth valuation is warranted. That’s because once the hype wears off and sales growth slows, it can cause massive volatility.

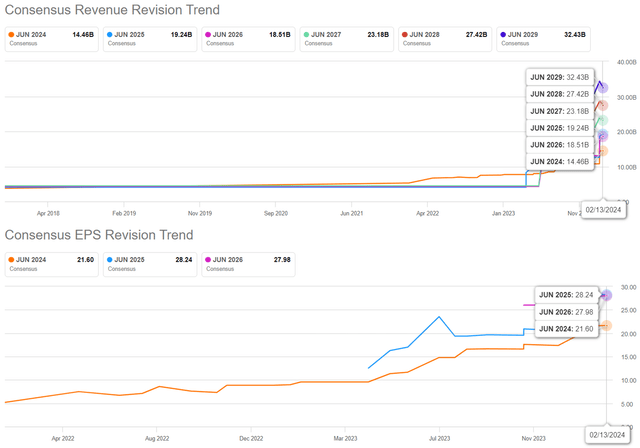

Agreed Forward Estimates

pursue alpha

For now, the consensus has slightly increased forward estimates thanks to the Q2 2024 earnings release and upward revision to 2024 revenue guidance, with SMCI expected to post an accelerated top/net revenue CAGR of +37.5%/+33.3% through 2024. It’s possible. FY2026.

This compares to original estimates of +33.2%/+30% and historical growth rates of +18.2%/+35.1% between FY2016 and FY2023, respectively.

Compared to HPE’s +2.7%/+2% and DELL’s -1.7%/+1.6% over the same period, SMCI’s projected top/net expansion is truly impressive.

But it’s unclear how long the double-digit growth will continue, with the stock’s overinflated valuation and overbought position giving interested investors minimal margin of safety.

At the same time, with many SMCI insiders also cashing in recently, we believe there could be moderate volatility over the next two weeks depending on how NVDA’s earnings release scheduled for February 21, 2024 plays out.

With the Fed signaling a pivot through the first half of 2024 and stock markets entering extreme greed territory, combined with overly elevated sentiment, we believe there could be a pullback in the near future, with SMCI’s short-term interest rate also increasing to 10.58% in 2024. Writing time.

So, is SMCI stock a buy?Sell or Hold?

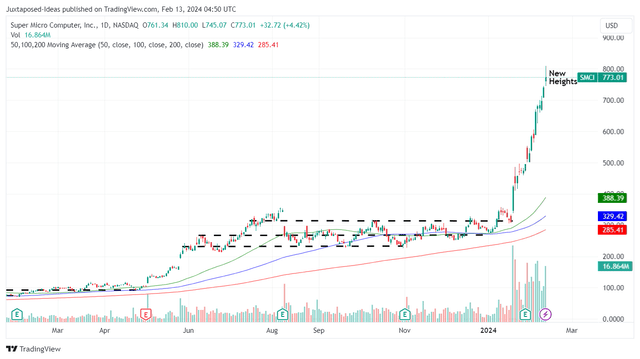

SMCI 1 year stock price

trading view

Currently, SMCI has quickly broken through its 50/100/200-day moving averages since the beginning of the year, with a notable +176.08% rally, outperforming the overall market’s YTD performance of +5.99%.

However, with the stock chart hitting a new high at $770, it appears to be trading larger than our fair value estimate of $485.20 based on LTM Adjusted EPS of $14.16 (+30.5% sequentially) and FWD P/E valuation of 34.27x. .

Based on FY2026 adjusted EPS estimates of $27.98, the stock would derive most of its upside potential to its long-term target price of $958.80, providing at least a minimal margin of safety for interested investors.

Due to the potential volatility, we prefer to cautiously downgrade our previous Buy rating to Neutral. We do not advise anyone to follow this rally as the potential correction could be very painful indeed.

Likewise, traders looking to take profits if the uptrend bends can do so too, and it remains to be seen when the current momentum will change.

“A trend is your friend until it bends.”