Thermo Fisher Scientific: Normalization Confirmed (NYSE:TMO)

jetcityimages

investment thesis

preview

We initially partnered with Thermo Fisher Scientific (New York Stock Exchange: TMO) in the article “Thermo Fisher Scientific: From a pandemic boom to a more sustainable growth path” from March of this year. Our paper is based on the company’s current trajectory from boom to normal. It was caused by an epidemic. Given the expected gradual decline in profits, we identified high debt and low cash reserves as factors to consider. Afterwards, the company’s stock price fell by 20%, but later rebounded. It is currently about 8% lower than in March.

update

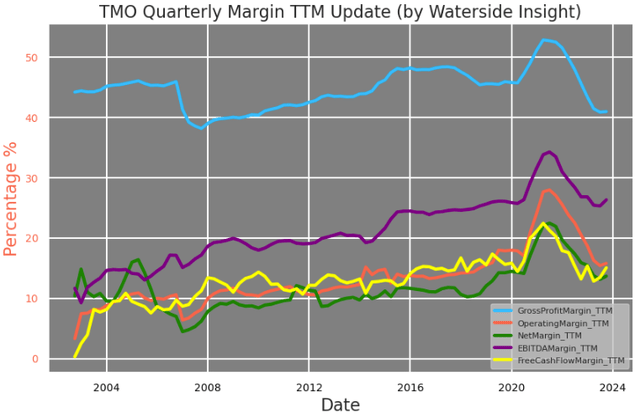

Thermo Fisher’s revenue is still at an all-time high, but margins are mostly back to pre-pandemic levels, the company said. This confirmed that we are on the path to more sustainable growth normalizing from the previous pandemic boom.

Thermo Fisher: Quarterly Margin Update (Calculated and tabulated by Waterside Insight using company data)

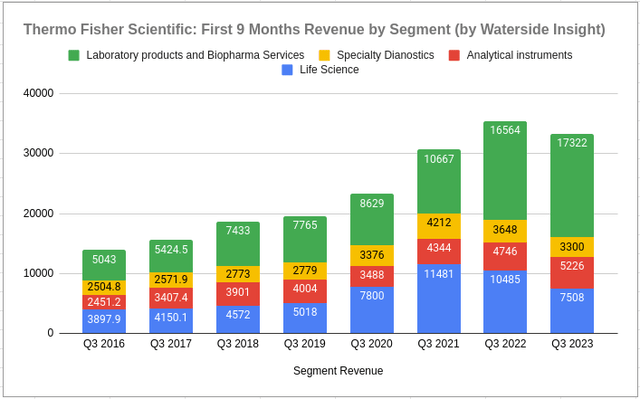

We previously expected the company to address its high debt levels and develop new growth patterns in the post-pandemic world. In the updated chart below, the largest revenue slowdown can be seen in the Life Science Solutions (LSS) sector. Gains in the Laboratory and Biopharmaceuticals (LPBS) and Analytical Instruments (AI) sectors are showing continued strength. Both have continued to expand since 2020.

Thermo Fisher: Segment Revenue for First 9 Months (Calculated and tabulated by Waterside Insight using company data)

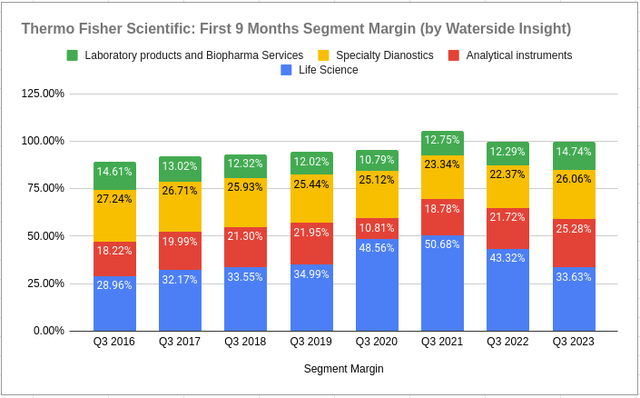

From the perspective of each division’s margins, most of them were maintained compared to the same period last year, except for Life Science Solutions (LSS). But margins were falling back to 2019 levels. Margins in the other three segments all showed steady growth compared to before the pandemic.

Thermo Fisher: First 9 Months Segment Margin (Calculated and tabulated by Waterside Insight using company data)

The LSS segment is very important to Thermo Fisher and the company has been taking steps to strengthen its competitive position. We are expanding our strategic partnership with Flagship Pioneering to form new platform companies in the life sciences sector, but we are not stopping there. We are in the process of acquiring Olink, a leading provider of next-generation proteomics solutions, for $3.1 billion. Olink will become part of the Life Sciences Solutions segment. According to the acquisition announcement, Olink is expected to achieve revenue of $200 million in 2024 and grow by mid-teens per year. It is also expected to generate $125 million in revenue by year five. So, assuming 15% annual growth, revenue by year 5 would be $350 million, giving Olink an expected net profit margin of 35.73%. This is roughly equivalent to the current margins of the LLS segment, but the potential of proteomics has a much larger impact for Thermo Fisher. Modern biopharmaceutical research combines proteomics approaches with genomics and bioinformatics to provide a deeper understanding of biological systems informing disease changes. It is highly complementary to TF’s existing mass spectrometry platforms and applications.

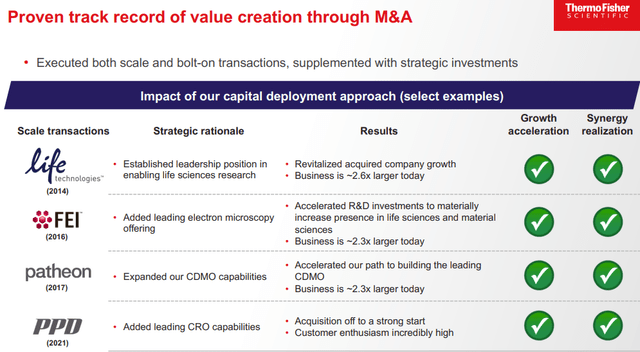

Thermo Fisher has a proven track record of successful M&A. Acquisitions more than doubled in the five years before the pandemic. Later, in 2021, it acquired PPD for its Laboratory Products and Services segment, which strengthened the drug development process and later renamed this segment to Laboratory Products and Biopharmaceuticals. The LPBS division saw a 45% increase in sales in the year following this acquisition. Additionally, to strengthen its Specialty Diagnostics segment by the end of 2022, the acquisition of Binding Site Group, which focuses on early diagnosis and monitoring through routine testing of patient care, is expected to add $0.07 in EPS for the year. Since then, SD segment sales have remained flat for the first nine months, but margins have increased by 16.5%. Acquisitions have always been an integrated part of Thermo Fisher’s growth strategy, but investors should also pay attention to goodwill, which accounts for about $45 billion, or 47% of assets, up from 42% before the pandemic. From this perspective, next year’s deals may be smaller until faster asset growth allows it to accumulate more cash.

Thermo Fisher: M&A record (Company announcement)

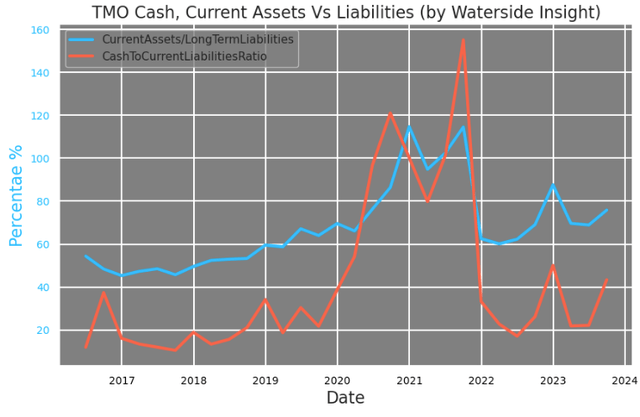

Thermo Fisher has also made some progress on its debt issue, another aspect where we had previously wanted to see improvement. In the first nine months of this year, we repaid 5% of our debt, or $2 billion, up from $375 million in the same period last year, and even after repayments, our total debt rose 2.3% this year. It paid out about $1.9 billion in commercial paper this year, but is currently in the process of issuing an additional $2.5 billion in notes. Cash and cash equivalents account for about 40% of current liabilities, up from a low of 20% at the start of the year. The Olink acquisition will require approximately $143 million in cash, which is expected to fall back to 20-30%. Assets currently account for about 80% of long-term liabilities, slightly higher than before the pandemic. Leverage for liquidity is within standard ranges, but there is limited room to go higher. It is expected that debt will continue to be reduced to a level similar to this year for at least the next three years.

Thermo Fisher: Current Assets and Liabilities (Calculated and tabulated by Waterside Insight using company data)

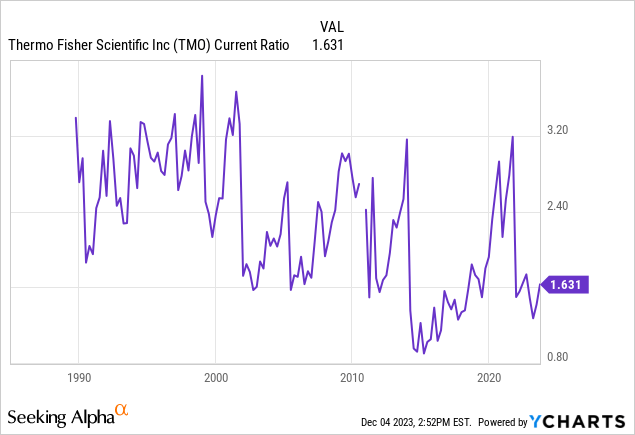

The company’s current ratio has improved slightly to over 1.5x, compared to an average of about 2x over the past 20 years. Thermo Fisher also authorized $4 billion in stock buybacks in November, replacing $1 billion previously authorized. So far in the first nine months, it has generated $3 billion in common stock purchases and $387 million in dividend payments. But I think the buybacks could be smaller next year.

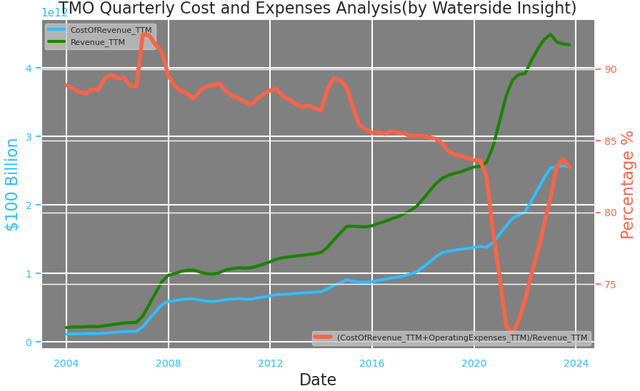

To reduce costs and improve efficiency, Thermo Fisher implements the PPI system, which stands for Practical Process Improvement (PPI) business system. Under this system, the company deploys global sourcing initiatives, workforce reductions, facility consolidation, and low-cost local manufacturing strategies to control costs and expenditures. These systems have helped us effectively navigate the supply chain constraints of the past two years. Costs and costs are now back to 2020 levels. With more acquisitions made over the past three years, including the ongoing Olink acquisition, there is room for PPI systems to operate with further consolidation and reduced headcount. The same goes for maintaining margins.

Thermo Fisher: Costs and Fees (Calculated and tabulated by Waterside Insight using company data)

Overall, we are making progress in areas of concern at Thermo Fisher and our expectations of normalization have largely been realized over the past six months. In its search for long-term growth drivers, the company has made one large acquisition per year of targets that best complement its current portfolio. However, if acquisitions are made, the pace or scale may ease next year. It might not be a bad idea to pause and consolidate your current holdings.

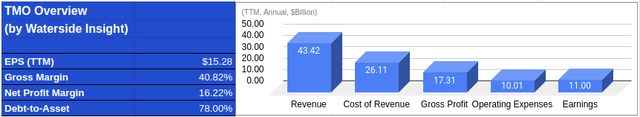

Financial Overview and Assessment

Thermo Fisher: Financial Overview (Calculated and tabulated by Waterside Insight using company data)

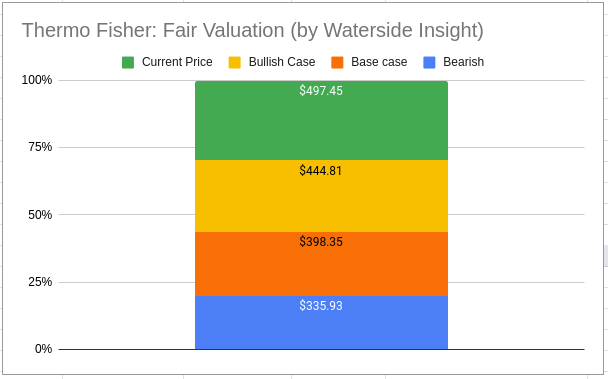

Since the beginning of the year, Thermo Fisher has significantly reduced CapEx from more than $500 million per quarter to about $300 million now. This brings CapEx back to 2020 levels. We initially expected free cash flow to decline by approximately 15% this year, but this decline has now put us on track to decline by only 5% year-over-year. It is difficult to reduce CapEx any further here. Therefore, from our perspective, we still expect a slowdown in free cash flow in 2024 if net income does not improve. And the increase in debt levels has led to the WACC being increased to 8.4% from the previous 6.77% to account for the higher interest rate environment. The updated fair value assessment has been revised with current prices above our bullish case.

Thermo Fisher: Fair Valuation (Calculated and tabulated by Waterside Insight using company data)

conclusion

Amid normalization following the pandemic-induced boom, Thermo Fisher continued to make progress on several fronts to sustain long-term growth, reduce debt, and strengthen cash reserves. However, this effort will not be a one-off and should continue over the next few quarters, with more consolidation likely to occur. Rising prices since the end of October have pushed the stock above its revised fair value. Although we are optimistic about long-term growth, we recommend selling based on the ample premium inherent.