These ETF strategies have been very successful in 2023. What one analyst expects will happen to these ETF strategies next year.

hello! This week, I’m MarketWatch reporter Isabel Wang introducing ETF Wrap. In this week’s issue, we look at the ETF strategies that have exploded in popularity in 2023 and whether they can continue to gain momentum in the year ahead.

Please send your tips or feedback to isabel.wang@marketwatch.com or christine.idzelis@marketwatch.com. You can also follow me on @Isabelxwang And find Christine @CIdzelis.

Click here to sign up for the weekly ETF Wrap.

U.S. exchange-traded funds had a strong 2023, growing assets to $8.1 trillion as of Dec. 27, with net inflows of about $580 billion, according to FactSet data.

ETF that tracks the large-cap benchmark S&P 500 Index

,

The investment, up 24.6% this year, had the strongest net inflows in 2023 among the roughly 700 funds MarketWatch tracks, according to FactSet data.

SPDR S&P 500 ETF Trust

,

The Vanguard S&P 500 ETF, the world’s largest and oldest ETF with $493 billion in assets under management, has seen its largest net inflows so far this year, with more than $47 billion.

$41 billion iShares Core S&P 500 ETF

It hit $36 billion during the same period, according to FactSet data.

Looking at the performance at the beginning of the year, technology-related stock funds showed a remarkable turnaround in 2023 after experiencing a turbulent bear market the previous year. Some ETFs that track the tech-heavy Nasdaq 100 index

Semiconductor stocks are also expected to end 2023 with an increase of more than 50%, thanks to the rise of the ‘Magnificent Seven’ stocks.

Fidelity Blue Chip Growth ETF

It rose 58.7% in 2023, making it the top fund in the U.S. excluding ETNs and leveraged products, according to FactSet data. WisdomTree America Quality Growth Fund

While up 56.2% this year, Invesco QQQ Trust Series I

In 2023, it rose by 55.6%. The profits of all these funds are Apple Inc. This was fueled by a massive rally in large technology stocks such as AAPL.

and Nvidia Corp. NVDA,

They have surged 49% and 239%, respectively, this year, according to FactSet data.

Will these ETF strategies continue to be successful in 2024? Will others emerge to make bigger gains next year? Here’s how one CFRA ETF analyst sees things going in the new year.

Technology-led growth ETFs will continue to stand out in 2024

The recent strong performance of technology and growth-led ETFs is likely to continue in 2024, even with higher volatility, according to Aniket Ullal, senior vice president and head of ETF data and analytics at CFRA.

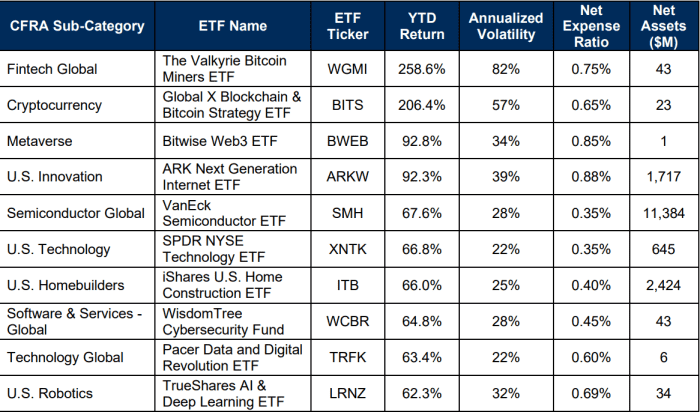

The table below summarizes the best-performing ETF subcategories in 2023, excluding leveraged and inverse ETFs. The best ETF sectors include technology and growth-related themes such as fintech, cryptocurrencies, semiconductors, software, and metaverse. “It is very likely that these themes will continue to have a strong year in 2024,” Ullal said.

Source: CFRA ETF Database, data as of December 18, 2023

One concern for investors is whether ETFs tied to the technology sector can continue to rise in 2024. However, CFRA analysts believe that some of the largest technology companies have strong balance sheets and cash flows, which should make them “safe havens” with a “growth tilt.” ” next year.

“Despite the recent AI-driven rise, the technology sector is still growing in many areas, and ETFs like the Technology Select Sector SPDR Fund

There are no frothy multiples yet,” Ullal said in a note to clients on Friday.

see: Will ‘The Magnificent Seven’ be strong again? What to expect from tech stocks in 2024.

Meanwhile, massive amounts of cash stored in U.S. money market funds could keep the bull market rally going next year.

As of Dec. 20, $5.9 trillion remained in U.S. money market funds, according to data compiled by the Investment Company Institute. However, given the stock market rally in 2023 and the “potential transition” to interest rate cuts by the Federal Reserve next year, Ullal and his team believe investors may want to move their funds out of cash-like instruments and back into 60/40 portfolios. I witness it happening. He wrote that he would increase his stock exposure next year.

Continued growth of options-based ETFs

ETFs that use options-based strategies, such as covered call ETFs or fixed outcome ETFs, have exploded in popularity in 2023. Ullal said these ETFs have “long-term staying power” to maintain investor interest in the future.

In particular, the $31 billion JPMorgan Equity Premium Income ETF, the largest covered call ETF in the United States.

,

It has seen net inflows of $13 billion so far this year and is among the top five funds raising the most capital in 2023, according to FactSet data.

Cover call ETF or option income ETF is a fund that generates profits by collecting insurance premiums using an options strategy called cover call writing. In a covered call transaction, an investor sells a call option on an asset he or she owns. This gives the option buyer the right, but not the obligation, to purchase the asset at a specified “strike” price on or before a specific exercise date. date.

If the asset’s price falls and the “strike” price is not reached before the expiration date, the call option expires with the buyer walking away, but the investor still gets to keep the premium as the payout.

This is why cover call strategies typically work well in sideways or choppy market environments. That’s because investors are compensated by giving up the upside of stocks with higher option premiums.

Additional information about covered call ETFs: These types of ETFs are designed to hedge against volatility and help investors weather stormy stock markets.

Ullal said the growing popularity of options-based ETFs can be attributed to the success of JEPI and the ETF company’s continued expansion of its range of covered call and buffer ETFs in 2023. Even though these strategies tend to underperform in rapidly rising stock markets.

“Flows will probably be more moderate (in 2024) than we’ve seen so far, but I don’t think the flows will be negative or that this category will disappear,” Ullal said in a follow-up interview with MarketWatch. thursday. “What’s happening now is that there are investors who are willing to sacrifice or sacrifice some (stock) performance for income or downside protection.”

Against this backdrop, Ullal sees options-based ETF strategies continuing to grow in 2024, but these strategies will be put to the test if the current bull market trend continues.

See also: An ETF that won’t fall? These new ‘buffer’ funds are designed to provide 100% protection against stock market losses.

Emerging markets ETF without China drag

According to Ullal, ETF investors may want to “decouple” their emerging market exposure by reconsidering China-related assets in their ETF portfolios.

Having high exposure to China in emerging market holdings has been challenging for ETF investors in 2023. China has significantly underperformed other emerging markets this year due to a slower-than-expected post-pandemic economic recovery, weakness in the country’s real estate sector and geopolitical factors. Ullal said there were tensions with the United States.

China exposure to two of the most popular emerging markets ETFs: Vanguard FTSE Emerging Markets ETF.

iShares Core MSCI Emerging Markets ETF

,

31% and 24.4%, respectively, according to FactSet data. Accordingly, VWO rose 8.3% this year, and IEMG rose 10.7% in 2023.

Meanwhile, SPDR S&P China ETF

It’s down 12.8% year to date, according to FactSet data. However, the iShares MSCI Emerging Markets ex China ETF

,

Companies with no China exposure rose 18.9% over the same period.

One option for investors is to adjust their exposure by combining a China-focused ETF with a non-China emerging markets ETF such as EMXC, Ullal said.

Alternatively, investors can use country-specific ETFs to structure the emerging markets sleeve of their portfolios or use active ETFs such as the KraneShares Dynamic Emerging Markets Strategy ETF.

,

He added that the fund’s China exposure is dynamically adjusted based on fundamentals, valuation and technical signals.

Growing Demand and Competition in the Active Bond ETF Category

The U.S. bond ETF sector is dominated by funds that passively track Treasury bonds, such as the 10-year Treasury note.

,

Yields have been falling as recent discussions about the Fed’s interest rate path and a possible shift to lower rates continue to take center stage through 2024.

But MarketWatch reported an increase in demand for active bond ETFs last week, and Vanguard launched two new active bond funds earlier this month. John Croke, head of active bond product management at Vanguard, told MarketWatch that appetite for active bond ETFs among the company’s clients has grown significantly over the past two years.

Meanwhile, the companies that dominate the index and active bond ETF categories are different, Ullal noted. In the index bond ETF category, Vanguard competes with traditional competitors BlackRock and State Street, while in the active bond ETF category, where it is expanding its presence, Vanguard competes with managers such as JPMorgan, First Trust, and PIMCO.

“This competition will put pressure on existing players, but it will be good for investors and will be an important trend to watch in the coming year,” Ullal said.

As usual, let’s take a look at the best- and worst-performing ETFs from last week through Wednesday, according to FactSet data.

good…

| top performer | %Performance |

|

AdvisorShares Pure U.S. Cannabis ETF |

12.7 |

|

Innovative data sharing ETF expansion |

10.5 |

|

SPDR S&P Biotech ETF |

9.9 |

|

ARK Genome Revolution ETF |

8.3 |

|

ARK Innovation ETF |

6.4 |

|

Source: FactSet data as of Wednesday, December 27. Start date December 21st. Excluding ETNs and leveraged products. Includes over $500 million in NYSE, Nasdaq and Cboe traded ETFs. |

|

… And the bad thing

| low performer | %Performance |

|

iMGP DBi Managed Futures Strategy ETF |

-2.9 |

|

Vanguard Total International Bond ETF |

-2.2 |

|

iShares 20+ Year Treasury BuyWrite Strategy ETF |

-2.1 |

|

VanEck BDC Income ETF |

-1.2 |

|

Vanguard Short-Term Inflation Protected Securities ETF |

-1.2 |

|

Source: FactSet data |

|

New ETF

-

According to the fund investment prospectus submitted to the Securities and Exchange Commission, TCW Group has applied to convert TCW Artificial Intelligence Stock Fund TGFTX to TCW Artificial Intelligence ETF, and is seeking to convert TCW New America Premier Stock Fund TGUSX to TCW Compounders ETF. They say there is. On Tuesday.