ThredUp Stock: More Pain Ahead, No Light at the End of the Tunnel (NASDAQ:TDUP)

Kathrin Ziegler/DigitalVision via Getty Images

Introduction and thesis

ThreadUp(NASDAQ:TDUP) is a leading online thrift store and fashion resale platform founded in 2009. It operates in the second-hand fashion marketplace, allowing consumers to buy and sell high-quality used clothing, shoes and accessories.

TDUP has achieved strong growth and brand development through innovation in the apparel industry, leveraging technology and driving traffic to its products through changes in shopping behavior. Although this improved the company’s earnings trajectory, its financial progress was disappointing.

In our view, TDUP is not an attractive business that can generate long-term returns. There are too many market players in the industry and, like the wider market industry, it is likely to normalize to a few monopolistic players (think eBay). I think TDUP’s positioning is good, but there are external factors, such as its ability to sustain marketing. It’s an expense you don’t want to gamble on. We don’t think investors are being rewarded enough for betting on TDUP being the “last one standing.”

With cash down, macroeconomic conditions straining and margin improvement limited, we suggest investors exercise restraint.

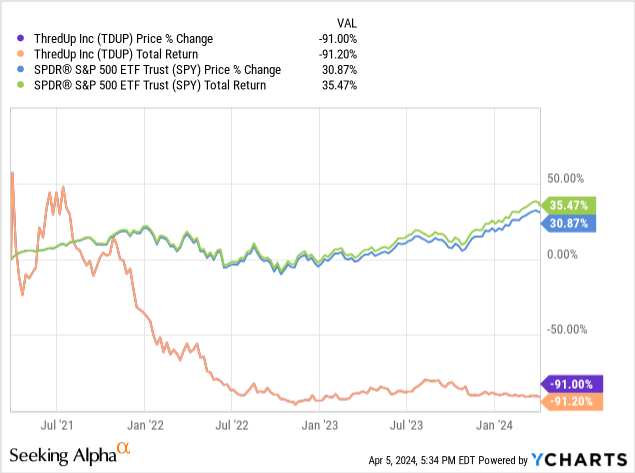

stock

TDUP’s stock price is at such a disappointing level that it has lost more than 80% of its value in a short period of time. This reflects widespread market sell-off and poor financial development, particularly in discretionary industries.

financial analysis

Capital IQ

Presented above are TDUP’s financial results.

Revenue and commercial factors

TDUP’s revenue has grown well over the past decade, reaching a compound annual growth rate (CAGR) of 20% through FY23. Despite this, profitability has not developed very positively.

business model

ThreadUp

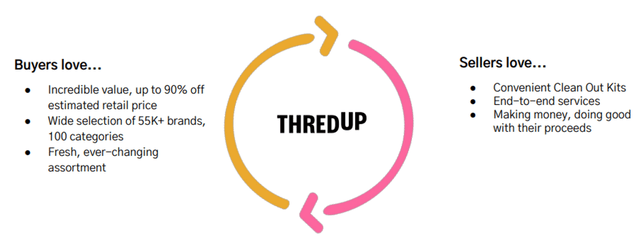

TDUP operates as an online thrift store and resale marketplace focused on buying and selling used clothing and accessories. This model responds to the needs of consumers looking for eco-friendly and affordable fashion in line with sustainability trends.

TDUP leverages data analytics to manage the selection of used items and ensures quality and style levels with dynamic pricing. This curation process involves, in part, a quality control team that evaluates and selects items based on brand, condition, and current fashion trends.

TDUP’s inventory is largely user-generated, as individuals can sell lightly used clothing and accessories on the platform. This is a very important component in the industry as success requires network effects. Consumers want to shop where they have a wide range of choices, while sellers want a marketplace where sales are made at attractive prices/times. We believe that this will be a decisive differentiator in the coming years, as none of our peers (in the fashion sector) has yet reached a monopoly position. One reason for this is the inherent environment in which many participants currently exist.

The company is expanding on a concept called “Resale-as-a-Service,” which essentially allows fashion brands and retailers to create resale marketplaces and acquire inventory from customers. The company already counts H&M ( OTCPK:HNNMY ), Tommy Hilfiger ( PVH ), and J.Crew as clients.

ThreadUp

TDUP offers a Clean Out Kit to simplify the selling process for individuals. Sellers can fill these kits with unwanted clothing, and TDUP handles the rest, including photographing the items, listing them, and shipping them. These are the little things that help companies differentiate themselves from their competitors and reduce friction, which is key in a growing industry.

We like the company’s efforts to maximize monetization and find new avenues for growth. The business stopped offering “Goody bags” a few years ago. Although it failed, innovation was necessary to succeed.

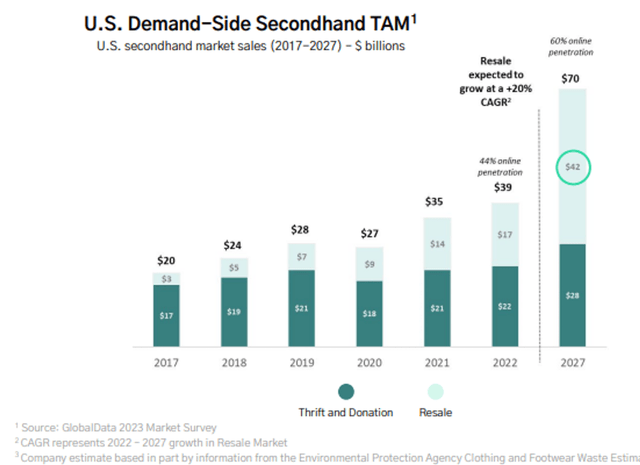

TDUP has established itself as an advocate for sustainable fashion by encouraging clothing reuse. The company emphasizes the environmental benefits of buying second-hand and contributing to the reduction of fashion waste. This is a key selling point, along with the widening wealth gap, both contributing to the continued growth of the second-hand market.

ThreadUp

finance

TDUP’s recent performance has slowed, with sales growth of (2.1)%, +4.4%, +8.2%, and +20.8% over the past four quarters. At the same time, margins also improved.

The slowdown experienced is, in our view, reflective of the broader macroeconomic environment. Consumers are experiencing skyrocketing costs of living as inflation and interest rates rise, making it difficult for wages to track proportionately. This has contributed to reducing spending for many people looking to protect their finances.

However, unlike many in the sector (such as The RealReal (REAL)), TDUP has maintained positive growth overall. This reflects the products you sell and the segments you target. The company offers both high-end and pre-owned consignment services, making it well-positioned for a resilient sector. Despite the difficult macro situation, consumers are encouraged to save while seeking discounts.

Capital IQ

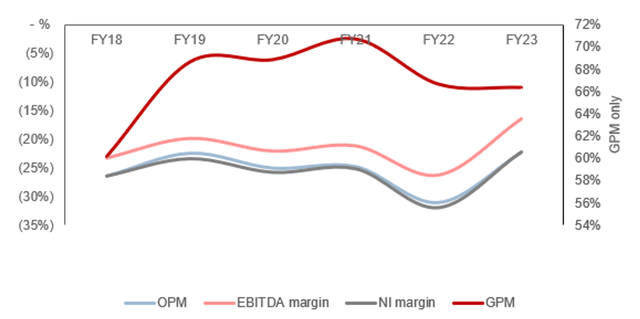

TDUP’s margin development was non-existent, with EBITDA-M improving only about 7%, but revenue nearly tripling. The reason is difficult market dynamics.

Despite the increase in volume, GPM has remained essentially flat since FY19, suggesting the business is operating close to peak unit economics. Further improvements can only be achieved by restructuring the pricing structure, which is likely to have unintended consequences.

If your GPM is ~66%, your business profitability shouldn’t be an issue, but it isn’t. The increasing competition and nature of the sector requires companies to spend significant amounts of money on marketing. TDUP currently spends 90% of its revenue on S&A, and despite this, its earnings are still slowing. The problem we see is that developing a moat is incredibly difficult. Differentiation essentially comes from having multiple buyers and sellers, creating network effects that make it an attractive market to participate in.

In reality, we are struggling to see how TDUP can be converted to profitability. With GPM being fairly rigid, significant improvements can only be made at the operational level, and we are working to ensure this without completely hindering growth and losing market share.

TDUP is currently burning cash with an FCF margin of 15% over the LTM period. This reflects the fact that the company has made a huge investment for growth, with the recent decline due to a slowdown in facility investment. FCF will remain negative due to fundamental issues of profitability.

With approximately $48 million to spend during the LTM period and a cash balance of $74 million, TDUP will need to raise debt or equity in the near future. Given that EBITDA parity is inaccessible, shareholders will likely need to fund this.

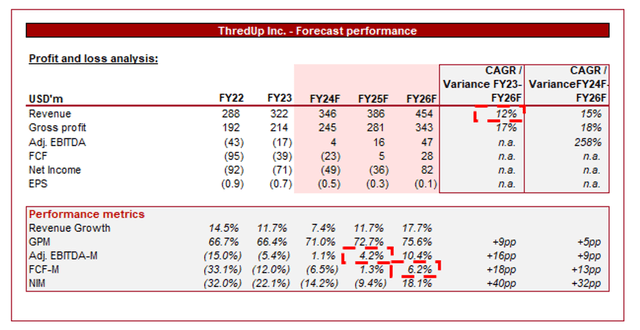

Capital IQ

Presented above is Wall Street’s consensus view for the next few years.

Analysts predict continued growth at a CAGR of 12% by FY25F. Accordingly, margins are also expected to improve sequentially and reach adj. EBITDA positive in FY24F and FCF positive in FY25F.

I rarely completely disagree with an analyst’s opinion, but right now I’m very skeptical. Driving margin improvement will require essentially halting growth spending, which will inevitably contribute to slower sales. It’s hard to see how the company can maintain levels close to double digits.

Additionally, it’s hard to see how margins could drop so dramatically, especially given the historically limited improvement since EBITDA-M was (12.2)% in the most recent quarter.

evaluation

Capital IQ

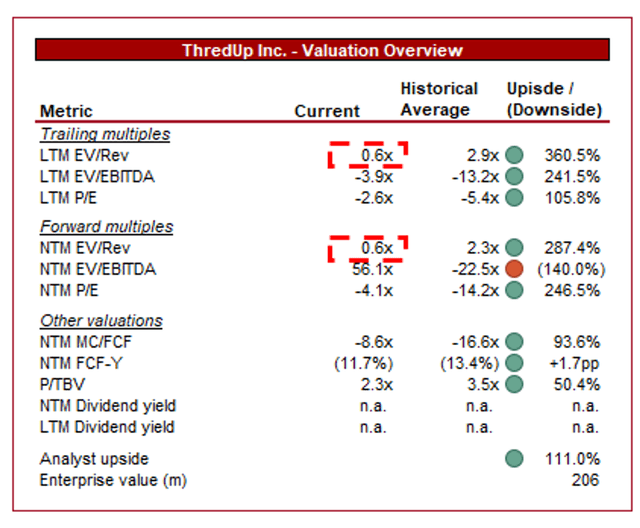

TDUP is currently trading at 0.7x LTM earnings and 0.6x NTM earnings. This is a discount to the historical average.

The discount to historical averages is undeniable, as margin improvement is limited and the growth trajectory is slowing.

Given the significant uncertainty surrounding TDUP’s ability to achieve profitability, we believe it should trade at less than 1x earnings under current circumstances. A sharp reduction in costs is expected to result in growth in ~MSD, while a more gradual reduction in costs is expected to result in an increase in ~HSD, suggesting that this multiple will see a fairly rapid contraction. For this reason, despite our negative view of the company, we do not believe it is overvalued.

The main risks of our paper

The risks of the current paper are:

- (Parent) Argument.

- (Upside) Interest in sustainable and affordable fashion is growing.

- (Upside) Expansion into new markets and strategic partnerships.

- (Disadvantage) Counterfeit scandal.

- (Disadvantage) Fierce competition does not subside.

final thoughts

TDUP has a lot of potential. The management appears to be more active than other teams we’ve looked at within this industry, and the stock trades at a greater discount. The industry is highly competitive, and we expect many of our peers (potentially TDUP) to disappear over the next decade as the sector moves toward scale and consolidation.

But with massive losses expected along with slowing growth and minimal margin improvement, there’s no reason to take the risk on the company.