Three broad indicators that confirm a bullish market trend | a cautious investor

There is no denying the strength of the major averages marking their April lows. The S&P 500 ended the week within a rounding error of its previous all-time high of 5250. What will it take for SPX and NDX to hit new all-time highs in May?

Today, we will analyze the three market breadth indicators we are observing to determine the possibility of further rise in the stock index. We’re also looking at the same three charts to look for warning signs of trend exhaustion! First, let’s measure how many stocks are above key moving averages.

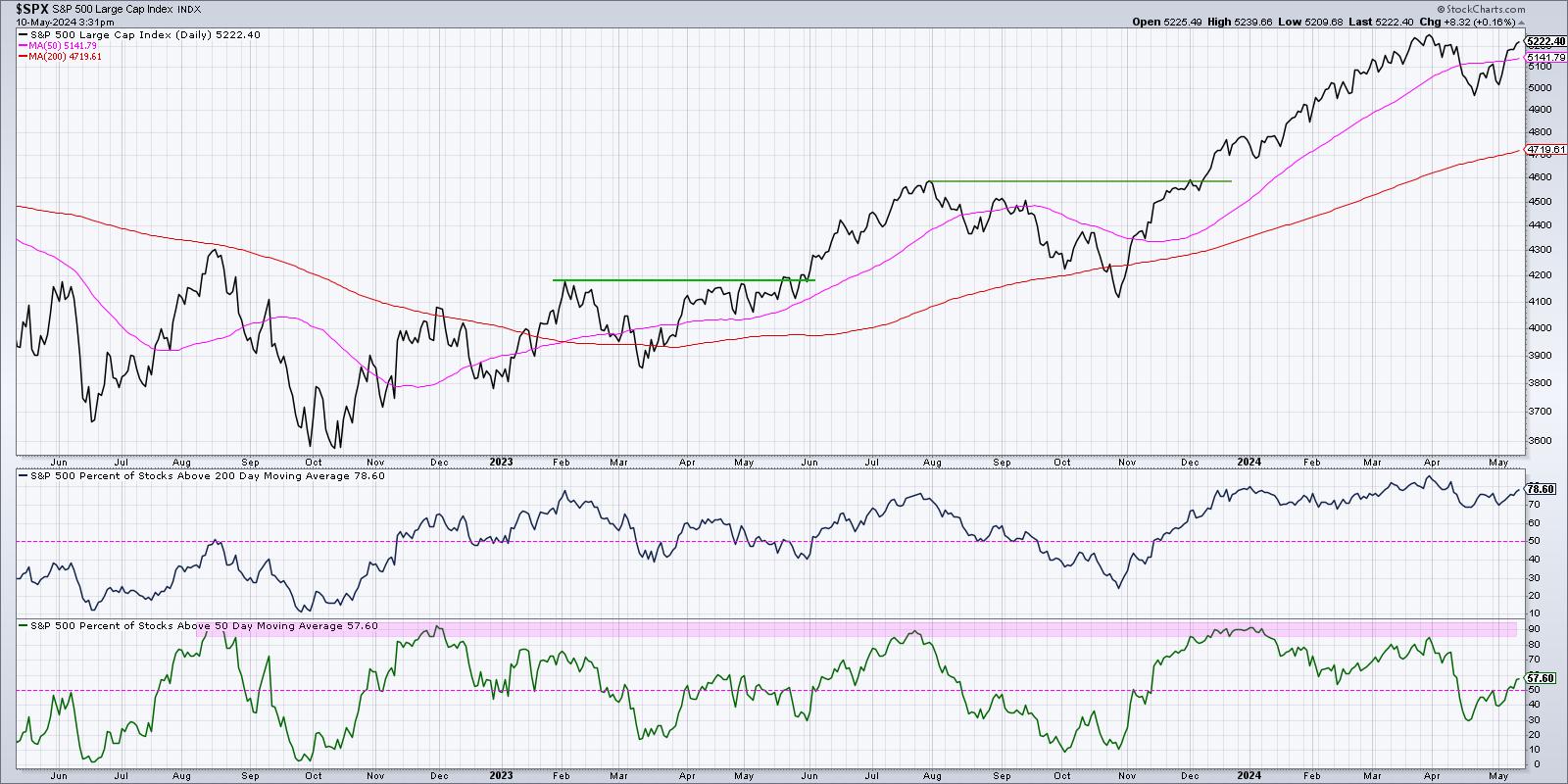

Percentage of stocks exceeding their 50-day and 200-day moving averages

One of my favorite breadth indicators shows how the members of a particular index are trading relative to their 50-day and 200-day moving averages. During an uptrend phase, stocks tend to move higher than two upward moving averages. This simple comparison of numerous names allows us to determine whether the market movement is a narrower or broader progression.

The bottom panel shows that at the end of 2023, approximately 90% of S&P 500 members are trading above their 200-day moving average. At the market’s lowest point in mid-April, this figure fell to around 30%. This means that about 60% of S&P 500 members will be above their 50-day moving average in early 2024. Talk about a broad market decline!

Since the April low, this indicator has bounced back more than 50%, reaching nearly 60% this week. I have observed that values above 50% are generally bullish. This means that most SPX members are in a short-term uptrend. Therefore, as long as this indicator remains above 50%, conditions are quite constructive. Regarding the red flags on this chart, I find that when the indicator reaches around 85-90%, it is usually near a market high. Therefore, this indicator currently suggests strength in the market.

New 52-week highs and lows

Now that we’ve decided on a broad rally from the April lows, what about leadership names? Are any stocks already hitting 52-week highs?

As you can see in the bottom panel, when the S&P 500 fell to around 4950 in mid-April, S&P 500 members had very few 52-week highs (green) or 52-week lows (red). Most stocks hit 52-week highs in the first quarter, and most are still well above their October 2023 lows. However, over the next three weeks, we see the 52-week high increasing more and more.

So even though the S&P 500 itself has yet to hit a new 52-week high, there are some early leadership names that are already hitting 52-week highs. A healthy upward trend is usually indicated by an extension of a new 52-week high. So going forward, the more green this chart has, the better.

What raises a red flag in this second chart? Basically, the evaporation of a new 52-week high would tell us that the nascent leadership stock is no longer on the upswing, and perhaps we are in a new down phase.

Nasdaq 100 Bullish Percentage Index

The Bullish Percent Index is a market breadth indicator constructed by analyzing point-and-figure charts for a specific universe (in this case, Nasdaq 100 members). What percentage of those stocks most recently gave a buy signal on our own point-and-figure chart?

The top panel shows the Nasdaq 100 Bullish Percent Index, which is getting very close to the 50% level. I have found that when an indicator falls below 30% and then bounces back above 50%, this often acts as a strong buy signal and suggests further upside is possible. This can be seen in the most recent signals from January 2023 and November 2023.

Therefore, if this indicator crosses 50% in May, it means that the current uptrend phase has just begun. If the indicator fails to break above 50%, this could indicate that this group of major growth stocks, which includes almost all Magnificent 7 stocks, is not showing enough upward momentum to confirm an upward trend.

Do you think the S&P 500 will hit a new all-time high above 5250 in May 2024? Please watch the video below and leave a comment!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more