TLTW ETF: Not the Right Way to Trade Long-Term Interest Rates or Volatility (BATS:TLTW)

Madmaxer/iStock via Getty Images

proposition

The ETF market has boomed over the past few years, especially with the advent of Rule 18F-4, which went into effect in 2020.

On October 28, 2020, the Securities and Exchange Commission announced enhanced regulations. Framework for the use of derivatives by registered investment companies, including mutual funds (excluding money market funds), exchange-traded funds (ETFs), closed-end funds, and business development companies with derivatives exposure exceeding 10% of net assets. The proposed rules and rule changes would establish a modern, comprehensive approach to regulating these funds’ use of derivatives that meets investor protection concerns and takes into account decades of evolution.

Simply put, the rule change has made it possible to implement many complex investment strategies within an ETF wrapper, paving the way for many new products to hit the market.

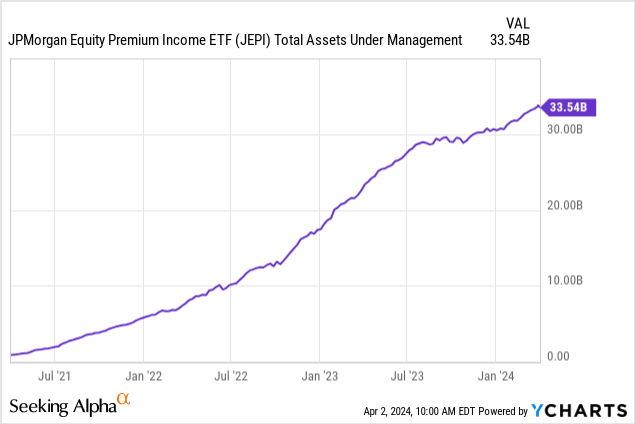

one Among the products that have experienced explosive growth over the past few years, collation funds are a representative example. JPMorgan Equity Premium Income ETF (often) is experiencing explosive growth.

In the chart above, you can see how the fund’s assets under management have grown from a few billion dollars in 2021 to more than $33 billion today.

iShares 20+ Year Treasury Buy-Write Strategy ETF (Bat:TLTW) comes from the same school of thought, but this fund covers the fixed income market rather than stocks. More specifically, the ETF writes a cover call for the iShares 20+ Year Treasury Bond ETF (TLT), which is a long-term Treasury bond fund and represents 20-year interest rates.

We covered this name here six months ago, where we explained our views on the fund mechanism and the name, taking into account the macro interest rate situation.

In light of the sharp rise in long-term interest rates over the past few days, we will revisit TLTW to see if the TLT move has been cushioned and highlight to investors why we do not believe this product is an appropriate trading method. We apply a 20-year interest rate and offer customized strategies.

Funding Structure – Coverage Currency Layering for TLT

This fund has a very simple structure. You buy TLT and then layer currencies against it.

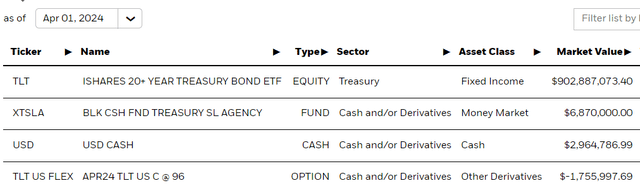

Assets held (fund website)

As can be seen in the table above, the composition consists of cash, TLT, and the April 1996 strike call. The fund offers one-month calls with a 2% out-of-the-money feature.

The iShares 20+ Year Treasury Bond Buy-Write Strategy ETF seeks to track the investment results of an index that reflects a strategy of generating income by holding the iShares 20+ Year Treasury Bond ETF while simultaneously writing (selling) one-month covered call options. do.

As an investor, can you easily replicate this strategy? totally. Now let’s see if this makes sense from a macro and financial engineering perspective.

Covered calls work best when volatility is high.

In terms of covered calls, options-based strategies work best when volatility is high. The primary pricing factor for options is the implied volatility factor. When implied volatility is low, option premiums are also low. Conversely, when implied volatility is high, investors receive significant rewards. TLT’s implied volatility is very low.

IV (Market Chameleon)

Currently, the one-month implied volatility for TLT’s at-the-money options is just 13%, which is very low implied volatility from an option premium perspective. In order for the calculations for the cover call strategy to make sense, investors should see implied volatility levels, ideally in the 20s.

The 1 month 2% OTM strategy did not work.

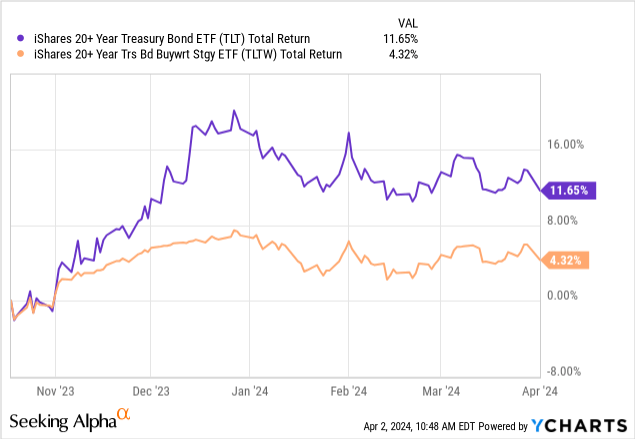

Since the last article came out and rates peaked, TLTW has trailed TLT by a large margin.

The above graph is prepared from a total return perspective, so it also includes the fund’s high dividend yield.

However, high dividend yields are a mirage and are correlated with continually falling prices. The correct way to look at TLTW is from a total return perspective benchmarked to TLT.

As long-term interest rates decline in 2024, TLT has performed well because it is an unrestricted expression of long-term interest rates. With a 2% OTM call, TLTW will be hampered in a declining interest rate environment. This trend is expected to continue in 2024/2025.

A better way to write a cover call in TLT

We believe we better serve retail investors by taking a tailored approach in TLT and long-term interest rate trading. Instead of leveraging TLTW, which represents a systematic strategy, investors can tailor their positioning based on their short-term perspective and level of volatility.

TLT has experienced a fierce rally through 2024, with markets anticipating Fed cuts in March 2024 and seven of them expected to be priced in. This caused TLT to rally close to $100 per share. This extreme view should be traded via a covered call because the fund is near the top of its short-term range and $100 represents long-term support/resistance.

Today’s markets are the exact opposite of what happened in late 2023. Market participants are now tapering off the number of rate cuts from the Fed, with some talking about a 5% long-term rate cut. We went from one extreme to the other. We don’t think the Fed will raise rates again this year, and we think it will cut rates regardless of its inflation target. We are preparing for an environment in which inflation continues to rise while the national debt problem forces the Federal Reserve to lower interest rates.

Currently, investors should buy TLT rather than cap the upside through a 2% money call. Because we’re testing the bottom of the range again. If TLT rises toward $100 again, investors can construct a custom tenor on a money call that could limit the upside while smoothing out the potential downside.

Ultimately, long-term interest rates should be traded based on the availability of economic data and extreme market outlooks rather than systematic one-month strategies based on low levels of volatility.

conclusion

As long-term interest rates fell below their October 2023 highs, TLT outperformed TLTW by a factor of three. TLTW will be constrained going forward by low implied volatility, low interest rate macros and a systematic one-month roll strategy. This fund is a poor way to trade long-term interest rates and volatility, and retail investors are best advised to engage in direct covered call sales given TLT’s extreme moves and views on Fed cuts. We experienced such a move in late 2023 when high delta covered currencies had to be sold, but today we are on the other side of the spectrum. We are now trading at the bottom of the TLT range again, and investors should take open-ended positions directly rather than utilize TLTW.