Today’s Top Cryptocurrency Earners March 15 – Today’s Top Cryptocurrency Earners

join us telegram A channel to stay up to date on breaking news coverage

Today’s cryptocurrency market is characterized by dynamic changes, with total trading volume surging to $614.58 billion in the last 24 hours. Despite the bullish sentiment reflected in the extreme greed score of 88 on the Fear & Greed Index, only 10% of cryptocurrencies showed gains. The majority, 90%, suffered losses, making the market more volatile. ACH had the biggest gain, with a surprising rise of 24.71%, in contrast to Bitcoin SV’s significant decline of -18.90%.

With the overall cryptocurrency market capitalization at $2.62 trillion and Bitcoin’s dominance solidified at 51.36%, investors are riding a wave of opportunity. They look for the next big move amidst the shifting tides of the digital asset space. This is where the necessity of this reading arises. top winner We help investors make informed decisions in the market.

Biggest Cryptocurrency Earners Today – Top List

Before going into details, let us understand the essence of the top companies. Solana’s impressive 6.05% surge highlights its growing momentum backed by unparalleled transaction speeds. Worldcoin’s innovative World ID system and 3.28% price increase demonstrate Worldcoin’s commitment to revolutionizing identity verification and financial access. Sei’s pioneering Parallel Stack initiative targets Ethereum’s scalability, and its modest price increase of 0.58% signals a push for blockchain innovation. The stability of UNUS SED LEO, reflected in its 0.58% surge despite low liquidity, highlights its utility within the Bitfinex ecosystem, providing exclusive benefits and enhancing value retention.

One. Solana (SUN)

Solana is a blockchain platform designed for speed and efficiency. Launched in 2020, it uses a unique combination of technologies to solve problems faced by other blockchains. Ideal for decentralized finance (DeFi) applications where fast transactions and low fees are important. The network can theoretically handle large volumes of 700,000 transactions per second, putting it ahead of most competitors.

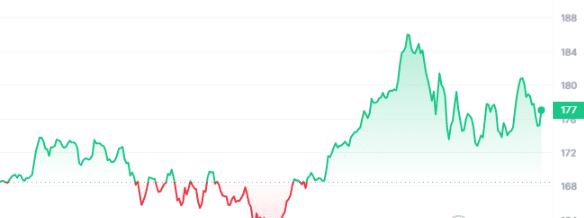

Solana (SOL) is trading at $178.87, up 6.05% in the last 24 hours. With a market dominance of 3.02%, SOL boasts a whopping 814% price increase over the past year. Solana has significantly outperformed Bitcoin (225.72%) and Ethereum (301.14%) and is currently 276.80% above its 200-day SMA of $47.08. The 14-day RSI of 57.98 suggests neutrality, while 57% of the last 30 trading days have been positive, suggesting a potential upward trend. Despite low volatility (currently 15%), Solana maintains high liquidity with a volume-to-market cap ratio of 0.2982.

Solana is gaining momentum with some exciting developments. The recent integration with Binance’s Web3 wallet allows users to manage their tokens and use applications built on Solana directly. This opens up a world of possibilities for users and simplifies their interaction with the platform.

Breaking news: @ParallelTCG We are planning to release a new AI-based game. @ParallelColony, this is Solana! 🎮🔥

AI agents will be able to make autonomous on-chain transactions in a completely new kind of survival game. See more👇 https://t.co/mFYek4oyiT

— Solana (@solana) March 15, 2024

Additionally, the launch of Solana’s BILS stablecoin demonstrates the potential of innovative financial solutions. The Israeli Shekel supports BILS and operates within a regulatory sandbox. This pilot project paves the way to explore new financial applications on the Solana blockchain. These developments highlight the growing interest in Solana.

2. World Coin (WLD)

Worldcoin, a pioneering project in the cryptocurrency space, aims to build the world’s largest identity and financial network and democratize access to ownership. At its core is the innovative World ID system, which provides individuals with a means to verify their humanity online while protecting their privacy through state-of-the-art zero-knowledge proofs.

Individuals can seamlessly participate in the protocol through the World App and Orb devices to secure a World ID through biometric authentication. This empowers users through recurring grants of WLD tokens and facilitates the creation of a widely distributed digital currency.

With a current price of $9.77 and a surge of 3.28% in 24 hours, Worldcoin maintains a market dominance of 0.06%. The 14-day relative strength index (RSI) is 58.18, indicating neutrality and a potential sideways move. Over the last 30 trading days, 63% have seen positive growth, while 30-day volatility is only 25%. With a volume to market capitalization ratio of 1.8603, Worldcoin boasts high liquidity.

Read highly specialized audit reports on Orb software conducted by security experts. @trailofbits https://t.co/jVNuG20GzM

— World Coin (@worldcoin) March 14, 2024

As a recent development, Worldcoin has undergone a comprehensive security audit and no serious flaws have been identified. The audit conducted by Trail of Bits focused on strengthening the platform’s resilience to potential hacking threats. Despite initial privacy concerns, the audit confirmed the robustness of Worldcoin’s identity verification technology, including biometric data protection. As regulatory scrutiny intensifies, Worldcoin maintains a firm commitment to compliance and addresses potential issues with determination and transparency.

three. SMOG

After debut, smog The token has captivated investors with its remarkable performance and has established itself as a standout company in the Solana ecosystem. Now that the largest airdrop in Solana history is imminent, anticipation is growing. However, passionate holders will need to participate in a staking plan to be eligible to participate in this monumental event.

Despite the recent 11% decline, analysts remain optimistic, seeing this as a temporary setback that will soon be overcome. The drop presents a golden opportunity for new investors to get involved in one of the most promising meme projects of the quarter.

Surviving hot temperatures is a skill possessed by only a few 🔥#smogOn the other hand, it excels at the very art 🎭

no fire can burn $smog #dragon! 🐲

— Smog (@SMOGToken) March 6, 2024

Not stopping at this, the team is actively pursuing multi-chain status and expanding its influence across various platforms. Plans are underway to launch on additional DEX and CEX platforms, promising further growth and exposure.

After an outstanding performance early in the week, expectations are growing that the asset’s upward trend will be revived. Powered by a growing community smog The token looks set to see continued success in the cryptocurrency space.

Visit the Smog website

4. SIX

Sei, a layer 1 blockchain, is not just a DeFi chain. A versatile platform tailored for the rapid exchange of digital assets across a variety of domains, from gaming to NFTs. While centralized exchanges solve the scaling problem, Sei solves the Exchange Trilemma head-on. It simultaneously prioritizes decentralization, scalability, and capital efficiency.

In Sei, speed is everything. Boasting an industry-leading last-last time of only 300ms, Sei provides an unparalleled trading experience. It is supported by a state-of-the-art Twin Turbo consensus mechanism and market-based parallelism. The built-in matching engine and proactive protection further enhance security and efficiency, ensuring users receive best-in-class service.

Regarding performance indicators, Sei maintains a neutral position with a 14-day RSI of 48.79, indicating a potential sideways move. Despite 43% of the last 30 trading days being positive, the 30-day volatility is only 6%, showing stability. High liquidity, with a volume to market capitalization ratio of 0.5278, highlights Sei’s robustness in the market.

NFTs are the heart and soul of all cryptocurrency ecosystems.

They are just starting Sei. https://t.co/FFqOZDXzms

— Sei 🔴💨 (@SeiNetwork) March 14, 2024

In recent news, Sei Labs introduced The Parallel Stack, a groundbreaking initiative aimed at enhancing the scalability of Ethereum. Sei Labs seeks to improve Ethereum’s transactions per second (TPS) by leveraging the power of parallel processing. The goal is to increase the current 50 TPS bottleneck to a promising 5,000 TPS. This move reflects Sei Labs’ commitment to setting new standards for blockchain performance and fostering accessibility and innovation in the blockchain space.

5. One but Leo)

UNUS SED LEO is a utility token from Bitfinex, a prominent cryptocurrency exchange recognized for its strong spot market liquidity. LEO provides exclusive benefits to users within the Bitfinex ecosystem, including reduced trading fees and discounted funding fees. It is distinct in that it is issued on the Ethereum and EOS blockchains, increasing diversity and accessibility.

Bitfinex introduced LEO in 2019 as it aimed to strengthen its funds following claims that payment processor Crypto Capital had caused it to lose $880 million in funds. In particular, Bitfinex plans to put 27% of its total consolidated profits into LEO token buybacks, eventually removing the entire supply from circulation. This transparent mechanism ensures continued support and value retention for LEO holders.

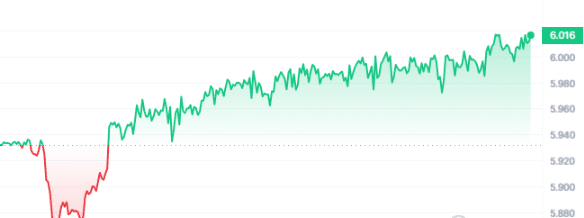

According to performance indicators, the current price of LEO is $6.01, up slightly by 0.58% in the last 24 hours. Despite being up 79% over the past year, it is trading 56.42% above its 200-day SMA, indicating stability. The 14-day RSI is 41.04, suggesting a neutral trading situation, with 73% showing positive growth over the past 30 days. However, its low liquidity, with a market capitalization-to-volume ratio of 0.0019, presents a notable challenge for potential investors and requires careful consideration.

El Salvador’s Bitcoin investment has paid off ✨

The country’s holdings are currently valued at more than $150 million, securing a profit of $50 million. This is an important milestone as the country adopts Bitcoin as its fiat currency! 🙌Details of Bitfinex Alpha: https://t.co/qD7uie37Yz pic.twitter.com/rzkJAu0f0I

— Bitfinex (@bitfinex) March 14, 2024

bitcoin It plunged to a one-week low of $66,629.96, down more than 5% from recent highs, as concerns about U.S. inflation and concerns about fewer interest rate cuts unsettled investors. This shows how big-picture economic factors affect the cryptocurrency market. The volatility increased further as MicroStrategy decided to raise money to buy Bitcoin.

Learn more

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 50% or more

join us telegram A channel to stay up to date on breaking news coverage