Top Cryptocurrency Companies with the Most Revenue

Key Takeaways:

- Cryptocurrency revenue comes from fees paid by tokens or blockchain users. This provides cryptocurrency companies with the critical capital they need to innovate and expand.

- Cryptocurrency revenue represents a key indicator that provides insight into the health of cryptocurrency companies. If revenue is growing slowly, it can also provide insight into the company’s challenges.

- The top three most profitable cryptocurrency projects are Ethereum, Tron, and Maker DAO.

Intelligent cryptocurrency investors ask a simple question: Is this cryptocurrency company making money??

In the words of Jerry Maguire, show me the money.

Revenue, fees, market cap, and daily active users (DAU) are our most important metrics. This is to determine the flow of money.

We are focusing on the best cryptocurrency companies with the most revenue in this feature.

We’ve unpacked the highest-grossing projects and explained them in one easy-to-understand chart.

revenue definition

Because cryptocurrencies are new and evolving, there are many different definitions of “yield,” but we use the standard developed by Token Terminal.

In cryptocurrency, “revenue” reflects the cryptocurrency company’s total fees that go back into the protocol. This revenue is typically earned through transaction fees, such as:

- network fee: Users pay these transaction fees to block miners or validators from approving transactions.

- transaction fee: Users pay DEX transaction fees to swap tokens on platforms such as Uniswap.

- loan fee: Borrowers pay users through decentralized finance (DeFi) lending platforms such as Aave and Compound.

- casting fee: NFT uses mining fees to create new NFTs.

Some fees are paid to users or network participants, but cryptocurrency companies save some for supporting organizations, project development, or innovation. The fees saved by the company are defined as ‘profit’.

Relationship between revenue and project success

Revenues and fees can indicate the success and long-term sustainability of a cryptocurrency project. Higher revenue figures usually indicate significant demand for the project and demonstrate real utility. Blockchain projects that generate significant revenue are more likely to survive competition in the long term.

Top Blockchains by Revenue

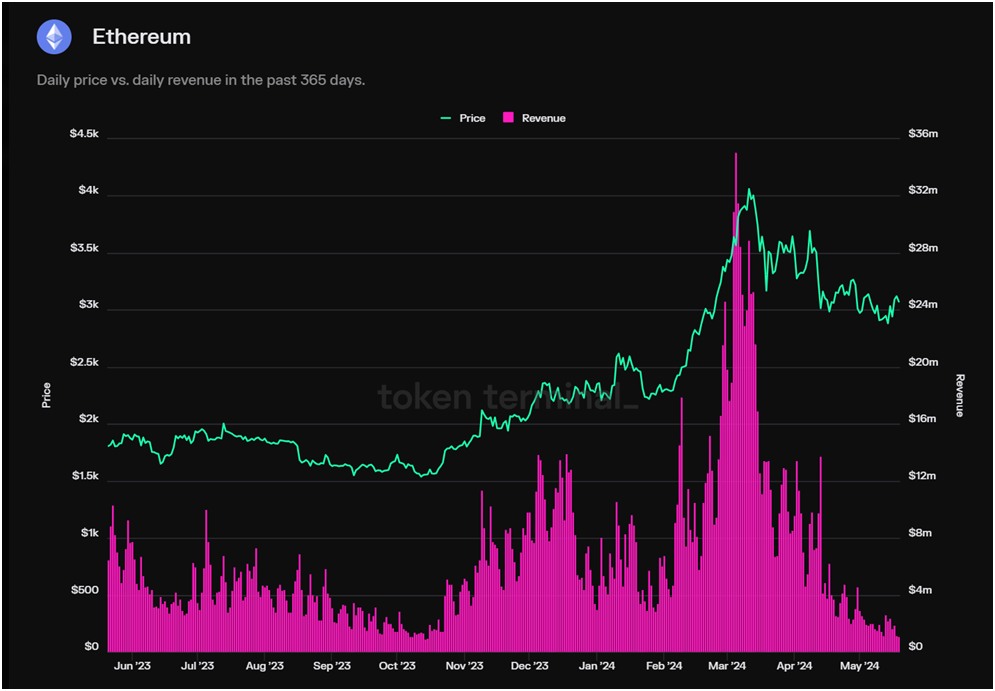

Ethereum

revenue source: Ethereum’s profits come from network fees, also called gas fees. These fees arise from Layer-2 solutions built on Ethereum. These additional costs can be significant.

In 2021, the Ethereum blockchain adopted the EIP 1559 upgrade, changing the way fees are calculated and processed. The new fee system uses block-based and sender-specified maximum fees instead of gas price auctions.

Ethereum’s daily revenue peaked at over $35 million in March 2024, driven by increased DeFi and NFT activity in the first quarter of this year. The meme coin hype stimulated the number of transactions, which also contributed to revenue growth.

Revenue dynamics share a direct relationship with Ethereum price and market capitalization.

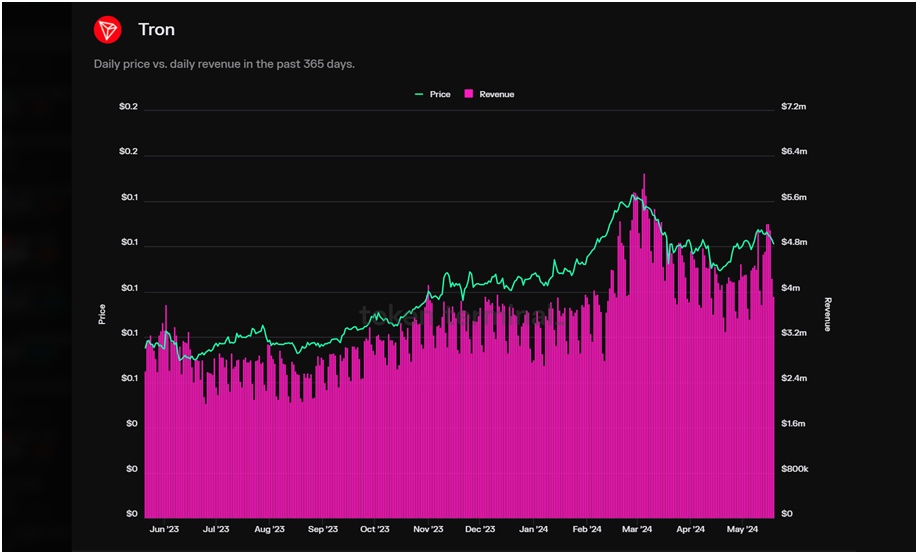

tron

revenue source: Tron makes money by charging fees on TRX transactions. This fee is burned to promote token deflation.

Tron is an Ethereum alternative that is more focused on Asian markets. It was launched in 2017 by Justin Sun, an extravagant cryptocurrency entrepreneur who reportedly paid $4.5 million for a charity dinner with Warren Buffett.

Tron, which uses a more efficient but centralized Delegated Proof of Stake (DPoS) consensus algorithm, is currently the 14th largest blockchain network in the world.

With over $9 billion in TVL, Tron is the second-largest DeFi player after Ethereum. However, it has an isolated ecosystem, with nearly $7 billion worth of TVL coming from JustLend, a lending protocol.

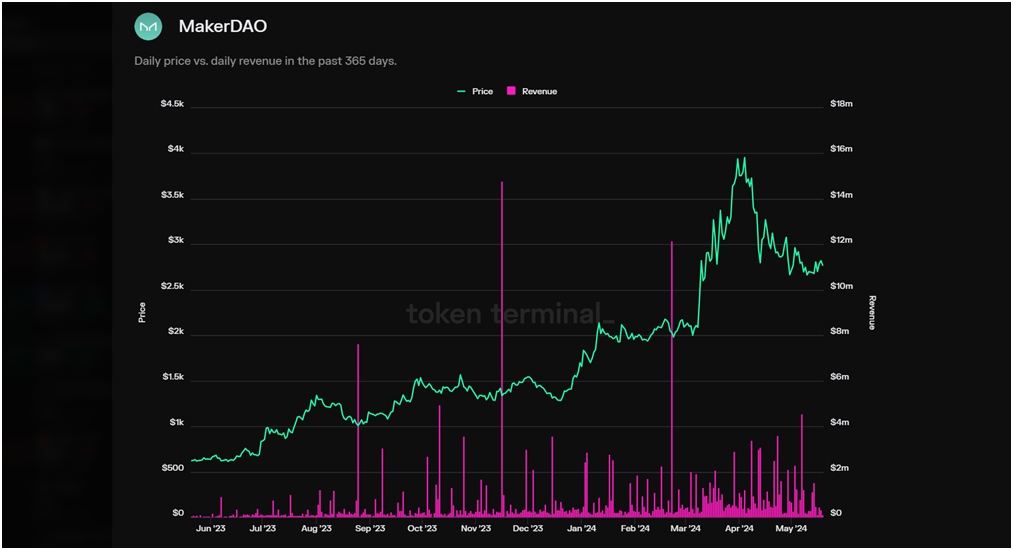

MakerDAO

revenue source: The platform generates revenue from interest paid by borrowers, liquidated collateral, and fees paid to maintain the DAI peg.

Maker is one of TVL’s largest DeFi apps, holding over $9 billion in cryptocurrencies in smart contracts.

The Ethereum-based protocol acts as a lending platform and currency system, issuing a USD-backed stablecoin called DAI.

Maker’s daily revenue fluctuates below $1 million, sometimes spiking to over $1 million and even over $10 million. This indicator shows a low correlation with the token price. However, this chart clearly shows the connection between Ethereum and Maker DAO revenue streams. This is likely because Maker is built on Ethereum. Maker DAO’s due diligence will almost certainly include research and analysis of ETH.

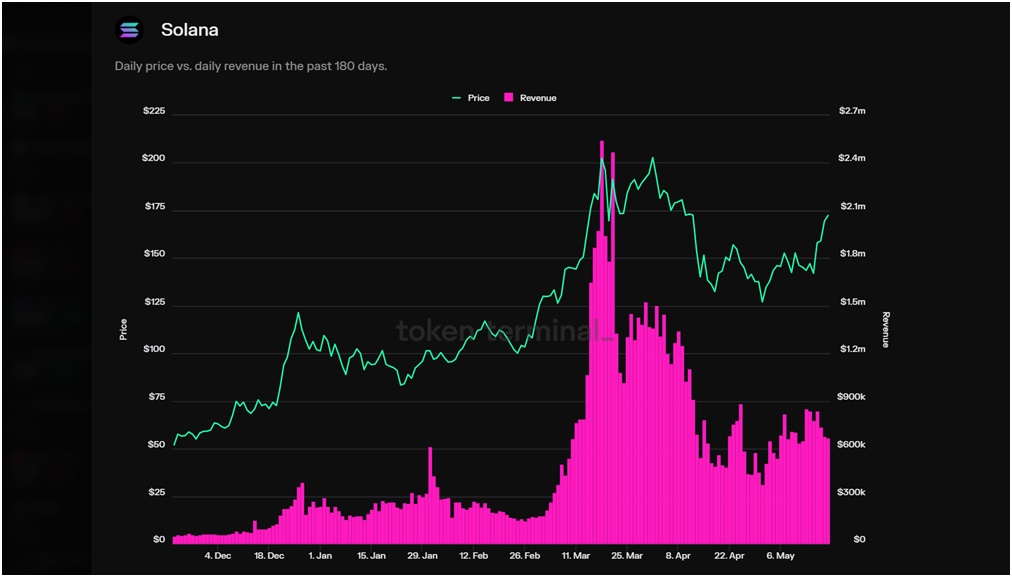

Solana

revenue source: The network uses a fee system in which 50% of the total fee is delivered to the validator and 50% is burned. Revenue peaked at more than $2.5 million in March, according to Token Terminal.

Since early 2023, Solana has been the fastest-growing blockchain network, at times surpassing Ethereum in several aspects such as NFT trading volume and DAU. It also has a vibrant DeFi ecosystem, attracting approximately $5 billion in TVL.

Solana has more daily active users and trading volume than Ethereum, allowing for higher returns. However, since it charges much lower fees than Ethereum, this must be made up for by trading volume (i.e. more users trading more frequently on Solana).

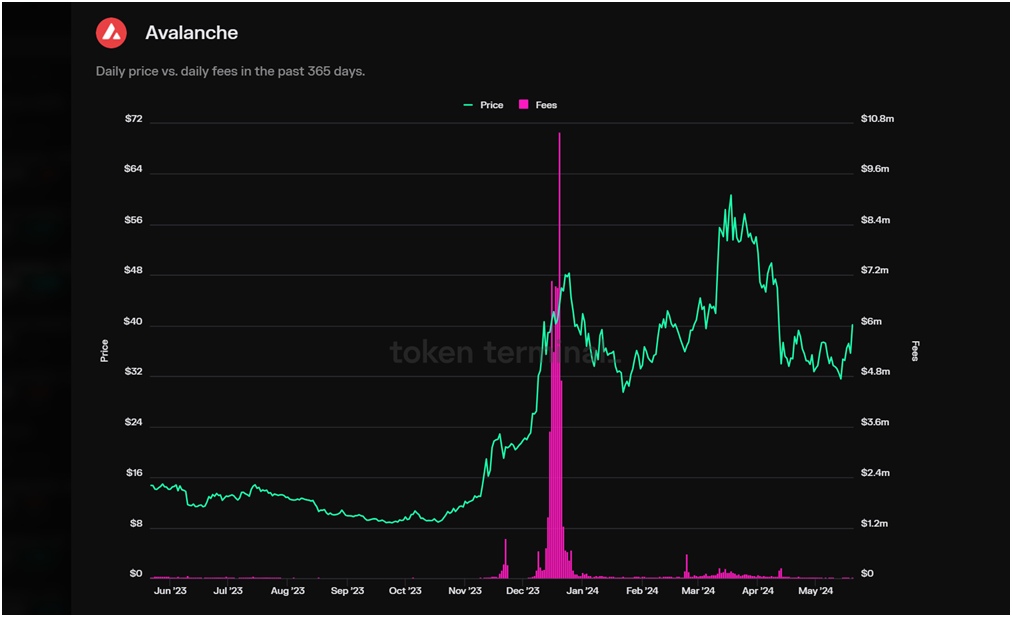

avalanche

revenue source: Avalanche is supported by transaction fees paid in AVAX, which are burned after the transaction.

Avalanche is a layer 1 blockchain focused on efficiency and interoperability. It shares similarities with Ethereum by leveraging the Solidity programming language to allow developers to build apps that are compatible with both networks.

The Avalanche’s top position in terms of revenue is largely due to a surge in transaction fees in late 2023. In December, network fees soared to $53 million. This is more than 25 times more than the sales recorded last April. If December were left out of the window, the Avalanche’s ranking would be much lower due to their monthly fee of less than $3 million.

The surge in trading fees was driven by demand for inscription-based NFTs as part of a social experiment introduced by the Trader Joe’s app.

Subsequent revisions to trading fees did not affect AVAX prices.

Investor Implications

Evaluating cryptocurrency projects through key metrics such as DAU, revenue/fees, market capitalization, etc. can provide insight into the health and long-term sustainability of the project.

High-yield projects like Ethereum and Solana demonstrate strong demand and utility, suggesting long-term resilience and growth potential.

To learn more about these metrics, take a look at our detailed pages on DAU, Revenue, Daily Active Developers, and Market Capitalization. Understanding these factors is important to make informed investment decisions in the speculative cryptocurrency market.

Subscribe to the Bitcoin Market Journal for more blockchain projects with growth potential.