Top Cryptocurrency Earners Today June 1 – Livepeer, GMX, Synthetix, Helium

join us telegram A channel to stay up to date on breaking news coverage

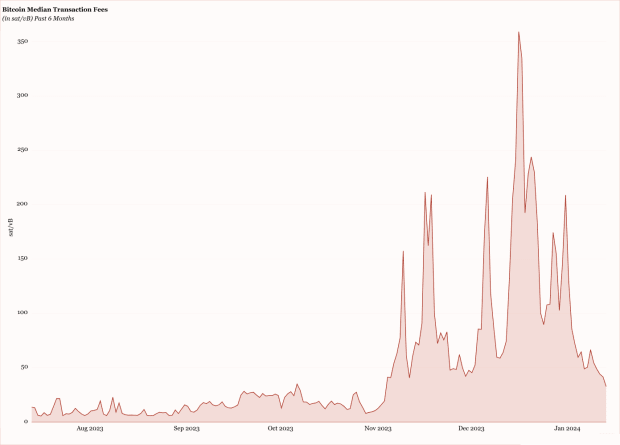

The day after the U.S. Memorial Day holiday, Bitcoin was trading close to $68,000. But by Friday morning, it had fallen near the state’s low, hitting $67,300. This is a 2% decrease from previous levels. Bitcoin rose 11% in May, but lagged the CoinDesk 20’s 20% surge.

However, as of today, June 1st, the price of Bitcoin is $67,614, down -1.03% in the last 24 hours. This brings Bitcoin’s market capitalization to $1.33 trillion, with BTC currently holding 52.39% market dominance. Market observers are closely monitoring macroeconomic developments for potential catalysts, with next week’s economic report expected to influence Bitcoin’s trajectory.

Biggest Cryptocurrency Earners Today – Top List

Despite recent Bitcoin price fluctuations, the market is showing notable gains today. top riser – Livepeer, GMX, Synthetix and Helium lead the way, each offering unique solutions in their segments. Livepeer’s price surged 8.69% to $22.93, while GMX rose 4.83% to $39.31. Synthetix rose 3.90% to $2.91, while Helium rose 4.48% to $4.12. These projects are gaining attention, so let’s closely analyze their performance to identify potential opportunities.

One. Live Peer (LPT)

Livepeer is the pioneer of the first fully decentralized live video streaming network protocol. We aim to provide an efficient blockchain-based alternative to centralized broadcast solutions. Creators can submit their work to the platform, then reformat and distribute their content to users and streaming platforms. Users can benefit from pay-as-you-go content, auto-expanding social video, uncensored journalism, and video-enabled DApps.

LPT coins hold value as incentives and payment options within the network. Ensures cost-effectiveness, reliability and security. LPT coin holders can stake their coins to become delegators who earn a small fee without having to deal with transcoding.

People on the network, called orchestrators, also use computer resources to process transcoding and earn cryptocurrency rewards. They contribute to mining, which is essential for creating new blocks. Staking increases security by earning new coins and incentivizing orchestrators to follow network rules. Built on top of Ethereum, Livepeer uses a delegated proof-of-stake (DPoS) consensus mechanism. This avoids the high energy costs of proof-of-work systems like Bitcoin.

The launch of the Livepeer AI subnet is a significant milestone toward Livepeer’s vision of infinitely expanding the distributed video computing market on an open, permissionless network.

Let’s take a look at the roadmap for AI video computing on the Livepeer network.

— Livepeer (@Livepeer) May 29, 2024

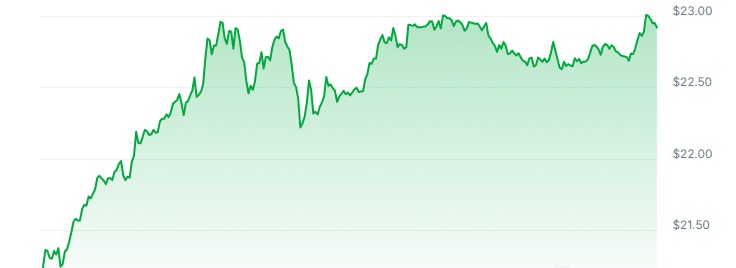

The current price of LPT is $22.93 and is up 8.69% in the last 24 hours. Over the past year, its price has surged 350%, outperforming 80% of the top 100 cryptocurrency assets. It is trading 270.99% above its 200-day SMA of $6.19. The 14-day RSI is 44.63, indicating a neutral position. The price has seen positive gains in 16 of the last 30 days, with volatility of 17%. Liquidity is high with a market capitalization of $744.98M and a 24-hour trading volume of $117.47M.

2. GMX (GMX)

GMX is a fast-growing branch and permanent DEX of Arbitrum and Avalanche. Arbitrum secures transactions over the Ethereum network, while Avalanche uses a unique consensus mechanism to process transactions simultaneously. Therefore, GMX supports low trading fees and no price impact trading. Traders can use up to 50x leverage on the platform, similar to many CEXs.

GMX maximizes capital efficiency with a unique model. Unlike most DEXs that utilize multiple single asset pools, GMX utilizes a single multi-asset pool, GLP. This pool contains several large tokens and stablecoins. Trading takes place through an innovative AMM model and GLP generates revenue for liquidity providers.

GMX has two tokens: GLP and GMX. GLP provides liquidity and reflects the value of all GMX assets. GMX serves as a utility and governance token. ABDK Consulting audits the GMX contract and has an active bug bounty on Immunefi.

Everyone pay attention #DeFi Builder:

GMX announces the launch of the second phase of the GMX Grants Program following the success of the first phase and the recent approval of the GMX STIP-Bridge proposal by the Arbitrum DAO.

For the Wave 2 grant, GMX will allocate approximately 600,000 ARB. pic.twitter.com/xMYhvbdsra

— GMX 🫐 (@GMX_IO) May 31, 2024

The current price of GMX is $39.31. It is up 4.83% in the last 24 hours. Over the past 7 and 30 days, prices have risen 17.1% and 63.1%, respectively. However, it is down -28% over the past year and is trading -17.82% below its 200-day SMA of $47.83.

The 14-day RSI is 43.83, indicating a neutral stance. GMX has recorded 14 green days out of the last 30 days, resulting in a positive response of 47%. The 30-day volatility is 11%, indicating relative stability. GMX is highly liquid with a trading volume to market capitalization ratio of 0.2342.

three. Winner AI (WAI)

Winner AI It captured the attention of investors with impressive pre-sale performance, raising over $3.7 million. This meme coin sets itself apart through its AI-powered trading bot designed to optimize cryptocurrency trading opportunities. These bots are designed to continuously monitor markets, process data, and provide predictive insights. Therefore, this improves trading efficiency by providing traders with important entry and exit points. This, combined with commission-free token swaps and robust staking protocols, sets WienerAI apart in the crowded cryptocurrency market.

3 million raised!

As the number of holders increases, expectations for the launch and AI trading bot launch also grow!!

🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭🤖🌭 pic.twitter.com/Y19TEbKwjc

— WienerAI (@WienerDogAI) May 26, 2024

The project’s token economics model is strategically designed to foster long-term engagement and community growth. Of the total 69 billion WAI supply, 30% will be allocated to pre-sale, 20% to staking rewards, and 20% to airdrops and giveaways. The remaining tokens support liquidity and marketing activities, ensuring a balanced approach to immediate and future needs.

The development team’s roadmap includes a smart contract audit and a global marketing campaign. They are also planning to list on a major exchange, indicating a well-planned strategy for continued growth. Undoubtedly, the pre-sale is generating quite a buzz and has already surpassed a significant milestone. each $ water The current token price is $0.000713. Now is the perfect time to invest as an early stage investor and reap significant returns.

Visit Wienerai Presale

4. Synthetix (SNX)

Synthetix is an Ethereum-based decentralized protocol that creates synthetic representations of assets as tokens and tracks their value at a 1:1 ratio. Backing these assets with SNX as collateral enables access to a variety of assets such as cryptocurrencies, commodities, and fiat. SNX powers the Synthetix network, providing deep liquidity and low fees for decentralized liquidity provisioning. Facilitates transactions across protocols such as Kwenta, Lyra, Polynomial, and 1inch & Curve.

Through autonomous trading and a staking pool that compensates SNX holders for trading fees, Synthetix ensures smooth trading while reducing the need for intermediaries. The platform utilizes smart contract oracles to ensure precise price accuracy, increase user trust, and alleviate liquidity issues. Additionally, moving to the Optimistic Ethereum mainnet will improve scalability and reduce gas costs, making the platform more secure and efficient.

🔥 Weekly Burn Fee Updates 🔥

Synthetix distribution from May 22nd to May 29th @optimism and @Base Total Burn:

– $299,990sUSD

– 8,187 $SNXThese fees are burned through weekly debt distribution and the SNX buyback and burn process to stakers and $SNX holder. pic.twitter.com/5Z3oHDSO8W

— Synthetix ⚔️ (@synthetix_io) May 31, 2024

The price of SNX is $2.91, up 3.90% in the last 24 hours and up 23% over the past year. Synthetix is currently trading -13.67% below its 200-day SMA of $3.37, but there is still potential for growth. With a 14-day RSI of 42.82, the coin indicates a neutral stance, but its recent performance boasts 14 green days out of the last 30 days, representing a positivity rate of 47%. Moreover, stability prevails with a 30-day volatility of 6%. Synthetix is showing high liquidity, boasting a market capitalization of $333.74 million and a 24-hour trading volume of $47.41 million.

5. Helium (HNT)

Helium is a decentralized wireless network that connects IoT devices through Helium hotspots. Initially a traditional business, Helium shifted to cryptocurrency to create a decentralized public network. Helium, widely known as the “People’s Network,” provides scalable and affordable wireless infrastructure. Each hotspot covers an area 200 times larger than traditional WiFi, and there are more than 500,000 hotspots in operation worldwide.

Built on the ERC-20 standard, Helium’s HNT token is a tradable asset critical to network security and governance. By staking 10,000 HNT, holders can run a validator node and earn rewards. This process secures the network and allows participants to influence the future of Helium. It uses a proof-of-coverage consensus mechanism supported by the HoneyBadger BFT protocol to ensure reliable communication. The network’s wallets also use asymmetric keys to protect users’ private keys.

🎉IoTNet is Helium’s decentralized network that is modernizing water utility systems and transforming water management by leveraging real-time insights and sustainable solutions.

In Bulgaria, IoTNet achieved cost savings by migrating more than 14,000 sensors to upgrade water supply systems.

— Helium🎈 (@helium) May 29, 2024

The current value of HNT is $4.12, up 4.48% in the last 24 hours and up 195% year-on-year. It is also 83.01% above its 200-day SMA of $2.25, and its 14-day RSI is 74.77, indicating that it is currently overbought. However, in the last 30 days there have been 13 green days, and the 30-day volatility remains at 10%. It also reflects low levels of liquidity, as indicated by the market capitalization-to-volume ratio of 0.0090. The data suggests a notable price increase for HNT. Investors should exercise caution.

Learn more

PlayDoge (PLAY) – Latest ICO on BNB Chain

- 2D Virtual Doji Pet

- Play to get Meme Coin Fusion

- Staking and in-game token rewards

- SolidProof Thanks – playdoge.io

join us telegram A channel to stay up to date on breaking news coverage