Top Cryptocurrency Earners Today, May 4th – Bitcoin Gold, The Graph, Bitcoin SV

join us telegram A channel to stay up to date on breaking news coverage

Bitcoin rose about 7% to $62,937 on Friday, helped by smaller-than-expected U.S. employment growth. This sparked optimism about interest rate cuts and increased the attractiveness of speculative assets such as cryptocurrency. The surge made up for earlier losses caused by concerns about Federal Reserve policy tightening and falling demand. Bitcoin ETF.

However, despite this price increase, traders are still cautious as Bitcoin price has fallen compared to its March highs. This response signals deeper concerns about global macroeconomic risks that the Fed or traditional investors may not be fully aware of.

Biggest Cryptocurrency Earners Today – Top List

After the Bitcoin price surge yesterday, Captain Coin maintains its upward trajectory today.. Bitcoin, at $63,163, boasts an incredible 6.15% surge over the past 24 hours, pushing its market capitalization to an impressive $1.24 trillion. This bullish momentum also applies to other tokens in the cryptocurrency market. Bitcoin Gold, The Graph, Nervos Network, and Bitcoin SV are featured. top winner Today demonstrates widespread momentum advancing digital assets. Let’s take a closer look at this coin and find a profitable investment opportunity.

One. Bitcoin Gold (BTG)

Bitcoin Gold is a user-friendly Bitcoin alternative that aims to combine Bitcoin’s security and innovation opportunities. Unlike Bitcoin, BTG avoids direct competition and focuses on expanding the possibilities for DeFi and DApp developers. BTG’s unique approach lies in its compatibility with the Bitcoin blockchain while leveraging its unique resources. This is a coin with a similar implementation to Bitcoin, but with a wider scope for experimentation and development.

We differentiate ourselves through a new approach to blockchain development and applications. BTG, a hard fork of Bitcoin, seeks to solve Bitcoin’s scalability problems by introducing the Equihash PoW algorithm, which favors GPU mining. This innovative solution improves mining accessibility and decentralization, aligning with BTG’s commitment to open source governance. Additionally, early adoption by institutional and corporate investors highlights its potential as an alternative investment option in the cryptocurrency market.

A few days after Bitcoin’s halving, BTG’s halving reached block 840,000.

The block reward is now 3.125BTG.

Wait a minute, didn’t Bitcoin’s 2020 halving come *after* BTG’s 2020 halving? Why not now? Don’t they both come every 210,000 blocks? (1/2)

— Bitcoin Gold (BTG) (@bitcoingold) April 25, 2024

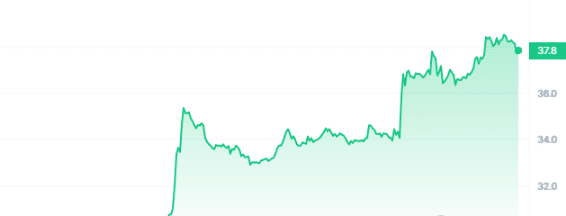

The price of BTG surged a whopping 27.92% in the last 24 hours to $37.52. With a market share of 0.03%, the price has risen 170% over the past year. It remains in a solid position, trading at $24.16, 55.87% above its 200-day SMA. The 14-day RSI was neutral at 57.26, but 11 of the last 30 trading days were positive. With a 30-day volatility of 17%, BTG offers moderate price movement. However, despite its market capitalization of $659.57 million, it is having difficulty trading large volumes due to low liquidity, with a volume-to-market ratio of 0.0085.

2. Graph (GRT)

The Graph is an indexing protocol that supports applications in both DeFi and Web3 ecosystems. This allows the creation of open APIs called subgraphs, enabling accessible data querying using GraphQL for Ethereum and IPFS networks. It aims to democratize access to decentralized public infrastructure with over 3,000 subgraphs deployed by developers for a variety of DApps such as Uniswap and Synthetix.

In recent news, The Graph introduces the Sunrise Upgrade Program, which allows users to freely access information from any source. This program provides community members with the opportunity to earn GRT tokens and supports the decentralized data phase of the network. Activities range from content creation to technical contributions, fostering community engagement and ecosystem growth.

Data democratization. Revolutionizing Web 3. Earn GRT 🌅

The Graph Foundation has just launched its 4 million GRT Sunrise upgrade program. It’s about empowering everyone on the internet to transform how the world accesses data.

Participate and complete a variety of fun on-chain and off-chain missions… pic.twitter.com/J7QP6zTLAu

— Graph (@graphprotocol) May 2, 2024

In light of these developments, GRT’s performance indicators show promising signs. With a current price of $0.279304 and a surge of 10.08% in the last 24 hours, GRT continues its upward trend. Trading at $0.117455, 137.80% above its 200-day SMA, GRT reflects investor confidence. Despite a neutral 14-day RSI of 42.34, it has recorded 14 green candle days in the last 30 days, indicating market stability. Additionally, GRT boasts high liquidity with a trading volume to market capitalization ratio of 0.0658, ensuring ample trading opportunities.

three. SEAL

New Zealand Introducing a digital seal character immersed in cryptocurrency trading on the Solana Network. This comedic figure resonates with modern cryptocurrency investors and embodies their motivations and subcultures. Reflecting strong interest from early investors, the pre-sale raised over $180,000 in just a few days.

Sealana’s pre-sale model simplifies investing by allowing users to send SOL to a specified wallet address. For each SOL contribution, investors receive 6,900 SEAL tokens. This streamlined approach fueled the initial momentum of pre-sales, quickly attracting significant investment. However, Sealana does not have a predetermined hard cap, which creates uncertainty about future token supply. A fixed conversion rate ensures scarcity, but the open nature of the pre-sale means the final token supply depends entirely on investor demand.

Moreover, the integration of Sealana and Solana offers several strategic advantages. Gain a competitive advantage by taking advantage of Solana’s fast performance, minimal transaction fees, and thriving ecosystem. also, New Zealandis an SPL token that leverages Solana’s scalability and active developer community. This distinguishes it from meme coins, which solve congestion problems in layer 1 networks such as Ethereum.

Visit Sealana Presale

4. Nervos Network (CKB)

The Nervos network is an open-source public blockchain ecosystem with a unique dual-layer architecture. The base layer, Common Knowledge Base, handles the consensus mechanism and smart asset storage. The compute layer complements this, processing real-time transactions and reflecting the network’s commitment to innovation. It also improves accessibility within the Nervos ecosystem by facilitating programming tasks.

Nervos Network Security is a PoW-based Nakamoto consensus mechanism that ensures the integrity of decentralized applications (dApps) and digital assets. The network doesn’t stop there. We are also subject to regular third-party audits by CertiK. We also engage with the community through hackathons that offer prizes to identify and address potential security vulnerabilities. This helps foster collaboration and continuous improvement.

🔥This year, CKB is on fire as innovators find ways to use CKB as Bitcoin Layer 2!🧠

Check out the first article in “The Definitive Guide to Bitcoin Layer 2”. @Liquid_BTC @rootstock_io , @stack & RGB (@lnp_bp)!👇https://t.co/op4IKmiFGX pic.twitter.com/MJM2oZQOVr

— Nervos Foundation (@RunningCKB) April 29, 2024

CKB is currently priced at $0.018848 and has seen significant growth with an impressive 18.76% surge in the last 24 hours. The price has soared 415% over the past year, demonstrating strong investor interest in the project. Nervos Network is trading 156.18% well above its 200-day SMA of $0.007369, showing potential for further growth. Although the 14-day RSI remains at a neutral level of 48.15, 40% of the last 30 trading days have seen a positive trend. With high liquidity and a market cap ratio of 0.2923, Nervous Network offers investors ample trading opportunities.

5. Bitcoin SV (BSV)

Bitcoin SV emerged in 2018 following a hard fork of the Bitcoin Cash (BCH) blockchain. It aimed to realize the original vision laid out by Satoshi Nakamoto. It provides scalability and stability, closely adheres to the Bitcoin protocol, and strives to enable advanced blockchain applications.

BSV differentiates itself by maintaining loyalty to the original Bitcoin protocol. Emphasizes scalability for efficient electronic cash payments and distributed data applications. Bitcoin SV, with its unlimited block size, is claimed to outperform traditional payment processing capabilities at lower costs. These gainers are attractive to both consumers and enterprise users. Additionally, the network is secured with a proof-of-work consensus mechanism to ensure transaction integrity and immutability.

Dive into the world of the BSV blockchain alert system through this informative video! Check out the video now and read about the BSV Alert System here: https://t.co/n1jkHFazal #BSV #blockchain #Warning system #BSVAAssociation

— BSV Blockchain (@BSVBlockchain) May 3, 2024

Analysis of performance indicators shows that BSV has seen a notable surge of 10.92% in the last 24 hours, reflecting positive market sentiment. There is a neutral 14-day RSI at 39.21, indicating a potential sideways move. However, the coin has seen a 98% increase in price over the past year. Trading above its 200-day SMA of $41.50 and with low volatility of 18%, BSV shows stability. Bitcoin SV, with its high liquidity, provides investors with a strong trading environment. The volume-to-market capitalization ratio of 0.0681 further enhances its appeal, providing an opportunity for those seeking long-term growth.

Learn more

SMOG – Meme Coin with Rewards

- Airdrop Season 1 Live Starts

- Earn XP to Win $1 Million in Stake

- Cointelegraph Special

- Staking Rewards – 42% APY

- 10% OTC discount – smogtoken.com

join us telegram A channel to stay up to date on breaking news coverage