Tracking William Nygren’s Harris Associates Portfolio – Third Quarter 2023 Update (MUTF:OAKMX)

William_Potter

This article is part of a series providing ongoing analysis of quarterly changes to the Harris Associates 13F stock portfolio. This is based on Harris Associates’ Regulatory Form 13F filed on November 14, 2023. william Nygren’s 13F portfolio value decreased from $56.6 billion to $51.39 billion this quarter. The portfolio is diversified with the latest 13F report showing approximately 200 positions. There are 61 securities that are fairly large (each more than ~0.5% of the portfolio) and are the focus of this article. The five largest holdings are Alphabet, Charter Communications, Capital One Financial, Intercontinental Exchange, and Fiserv. Adds up to 21% of your portfolio. visit us Tracking William Nygren’s Harris Associates Portfolio Through the series, their investment philosophy and our last update About fund movements during the second quarter of 2023

harris Associates currently manages approximately $100 billion. Their flagship mutual fund is the Oakmark Fund (MUTF:OAKMX) was founded in 1991 and is Oakmark International (MUTF:Oarix) was introduced in 1992. Both funds have generated significant alpha over their lives. OAKMX delivered an annualized return of 12.40% compared to 9.96% for the S&P 500 Index, and 8.40% annualized return for OAKIX compared to 5.67% for MSCI World ex-US. index. The group’s other mutual funds are Oakmark Select (Oak LX), Oakmark Assets and Income (Oak BX), Oakmark Global (OAKGX), Oakmark Global Select (OAKWX) and Oakmark International Small Cap (oakx).

Note: Oakmark International Fund’s top holdings are not included in the 13F report because they are not 13F securities. The positions include Lloyds Banking Group (LYG), BNP Paribas (OTCQX:BNPQF), Mercedes-Benz Group (DDAIF), Intesa Sanpaolo (OTCPK:ISNPY), Bayer (OTCPK:BAYRY), Fresenius (OTCPK:FSNUY), and Continental ( OTCPK :CTTAF), Kering (OTCPK:PPRUF), and Prudential (PUK).

New Stakes:

Cisco Systems (CSCO): A 1.14% stake in CSCO’s portfolio was set at prices between ~$50 and ~$57 this quarter. The stock is currently trading near the bottom of that range at $50.09.

Increase your stake:

Capital One Financial (COF): COF is a large (top 3) 3.67% of portfolio holdings built over the past four quarters at prices between ~$85 and ~$122, and is currently above that range at ~$130. There was a further increase of about 2% this quarter.

Intercontinental Exchange (ICE): COF is a large (top 5) 3.32% of portfolio holdings built over the past four quarters at prices between ~$85 and ~$122, and is currently at ~$126. This quarter saw another ~7% increase.

IQVIA Holdings (IQV): A ~3% stake in IQV was built this quarter at prices between ~$197 and ~$232. The current stock price is ~$229.

CNH Industries (CNHI): CNHI is a 2.92% of the portfolio position purchased in the fourth quarter of 2020 at prices between $7.75 and $13. In the five quarters through Q1 2022, ~55% of sales occurred at prices between ~$11 and ~$17. The stake increased by ~20% last quarter at prices between ~$12.80 and ~$14.60. There was a further increase of about 9% this quarter. The stock is currently trading at $11.98.

Note: They control about 8% of the business.

American International Group (AIG): The 2.70% AIG position saw a ~45% stake increase last quarter at prices between ~$50 and ~$57. The stock is currently trading well above that range of $66.93. There was a slight ~2% increase this quarter.

CBRE Group (CBRE): 2.20% CBRE shares increased by ~20% during the first half of 2022 at prices between ~$70 and ~$109. The second half of 2022 saw similar price increases, ranging from ~$67.50 to ~$88. The stock is currently trading at $91.95. There was a slight increase in the last two quarters.

Willis Towers Watson (WTW): 1.71% WTW shares increased ~20% this quarter at prices between ~$196 and ~$234. The current stock price is ~$240.

Warner Bros. Discovery (WBD): WBD is 1.57% of the portfolio position purchased in Q3 2022 at prices between ~$11.30 and ~$17.50, with the stock currently trading at $11.27, just below this range. The stake also increased by about 10% in the fourth quarter of 2022. There was a slight trimming in the first quarter of 2023 and an increase of about 7% in the last quarter. Prices between $10.66 and $14.47 also increased by about 16% this quarter.

Ally Financial (ALLY), Altria Group (MO), American Express (AXP), Bank of New York Mellon (BK), Citigroup Inc. (C), Corebridge Financial (CRBG), Danaher Corp (DHR), Goldman Sachs (GS ) ), Global Payments (GPN), Interpublic Group (IPG), Kroger Co. (KR), Liberty Broadband (LBDK), Open Text Corp (OTEX), and Truist Financial (TFC): These small (less than ~1.5% of the portfolio each) holdings increased during the quarter.

Stake reduction:

Alphabet Inc. (GOOG): GOOG is currently the largest 13F position at 6.48% of the portfolio. The majority of the shares were purchased in 2014 at prices ranging from ~$26 to ~$30. The stakes also increased by ~20% over the next year at prices ranging from ~$25 to ~$38. In the two years ending in Q4 2020, ~28% of sales occurred at prices between ~$53 and ~$91. This was followed by ~26% selling last quarter at prices between ~$104 and ~$128. There was a ~12% decrease in prices between ~$117 and ~$139 this quarter. The stock is currently trading at ~$143.

Charter Communications (CHTR): CHTR accounts for a large (top 3) 4.48% of portfolio holdings. It was founded in 2015 when approximately 2 million shares were purchased at prices ranging from ~$150 to ~$190. Recent activities include: In the first half of 2021, the stake increased by ~20% at prices between ~$597 and ~$722. This was followed by a ~30% increase in Q1 2022 with prices ranging from ~$545 to ~$648. Last quarter also saw a ~25% increase in prices between ~$320 and ~$367. The stock is currently trading at ~$382. There was a small trimming of ~3% this quarter.

Fiserv Inc. (FI): FI is a large (top 5) 3.29% of portfolio positions built primarily in 2021 at prices between ~$96 and ~$111. Over the past five quarters, ~40% of sales have occurred at prices between ~$89 and ~$126. The stock is currently trading at ~$134. There was also a slight trimming of ~3% this quarter.

KKR & Company (KKR): KKR represents a 3.23% stake in the portfolio, up ~115% during the fourth quarter of 2022 at prices between ~$43 and ~$57.50. The stock is currently trading at $81.92. Last quarter saw an increase in shares of about 9%, while this quarter saw similar trimming.

ConocoPhillips (COP): COP is a 3.15% stake in the portfolio, built primarily over the last two quarters at prices between ~$94 and ~$125. Shares were down 10% this quarter, with prices ranging from ~$99 to ~$123. The stock is currently trading at ~$118.

Bank of America (BAC): BAC had a very small position in the first 13F filing in 1999. It became an important part of the portfolio in 2011. Over the period from 2012 to 2015, the stake was built from 9.8 million to 138 million shares at prices ranging from ~$6 to ~$18. . Recent activities include: The third quarter of 2022 saw sales of around 15%, followed by a slight correction in the following quarters. Q1 2023 saw an increase of ~20%, with prices ranging from ~$27 to ~$37. The current stock price is $33.43 and the stake is 2.79% of the portfolio. Last quarter there was a ~6% increase, while this quarter there was a slight decrease of ~2%.

Amazon.com (AMZN): 2.61% of the portfolio AMZN shares were built at prices between ~$85 and ~$170 over 5 quarters through Q1 2023. Last quarter, a third sold for prices ranging from ~$98 to ~$130. This quarter, prices were reduced by another third, ranging from ~$126 to ~$145. The stock is currently trading at ~$153.

General Motors (GM): GM accounts for 2.28% of the portfolio position. These are very long-term interests. The original site was small in 2007 and sold the following year. In 2013, a huge stake worth about $70 million was established at prices ranging from $27 to $41. Position size peaked at 81 million shares in 2015. The stake was sold up to 25% in the period 2016-2019 at prices ranging from $28 to $46. It then declined ~45% over five quarters through Q2 2021, with prices ranging from ~$18 to ~$64. Q1 2022 saw the stake increase by ~25% at prices between ~$40 and ~$66. The stock is currently trading at $36.02. There was a trimming of about 8% this quarter.

Charles Schwab (SCHW): ~2% SCHW stake built in the first half of 2023 at prices between ~$47 and ~$86. The current stock price is $68.58. There was some minor trimming this quarter.

EOG Resources (EOG): The ~2% EOG position has increased ~45% over the past two quarters at prices between ~$101 and ~$136. The stock is currently trading at ~$122. There was a trimming of about 8% this quarter.

Wells Fargo (WFC): 1.90% WFC stake increased by ~45% during Q3 2022 at prices between ~$39 and ~$46. The current price is $49.18. Last quarter it was up about 6%, while this quarter it’s down slightly.

Salesforce.com (CRM): CRM increased by about two-thirds to a 1.85% stake during the fourth quarter of 2022 at prices between ~$128 and ~$191. Last quarter there was a ~35% sale at prices between ~$189 and ~$223. Current price is ~$266. There was also a trimming of ~7% this quarter.

Oracle (ORCL): 1.73% ORCL position increased by ~90% during Q4 2022 at prices between ~$61 and ~$84. Last quarter there was a ~37% sale at prices between ~$93 and ~$127. This was followed by a further ~30% cut this quarter, with prices ranging from ~$104 to ~$126. The stock is currently trading at ~$106.

APA Corporation (APA), BorgWarner (BWA), BlackRock Inc. (BLK), Carlisle Companies (CSL), Comcast Corp (CMCSA), Equifax (EFX), First Citizens BancShares (FCNCA), Fortune Brands (FBIN), Hilton Worldwide (HLT), HCA Healthcare (HCA), Liberty Global (LBTYK), Lithia Motors (LAD), Masco Corp (MAS), Moody’s Corp (MCO), Meta Platforms (META), Parker-Hannifin (PH), Pinterest (PINS) ) ), PulteGroup (PHM), Reinsurance Group of America (RGA), Ryanair Holdings (RYAAY), State Street Corp (STT), TE Connectivity (TEL), THOR Industries (THO), Visa Inc. (V), and Workday; Co., Ltd. (WDAY): These small (less than ~1.5% of each portfolio) holdings declined during the quarter.

Note: Although the position size is very small compared to the overall portfolio value, it holds significant ownership stakes in APA Corporation, Liberty Global, and Reinsurance Group of America.

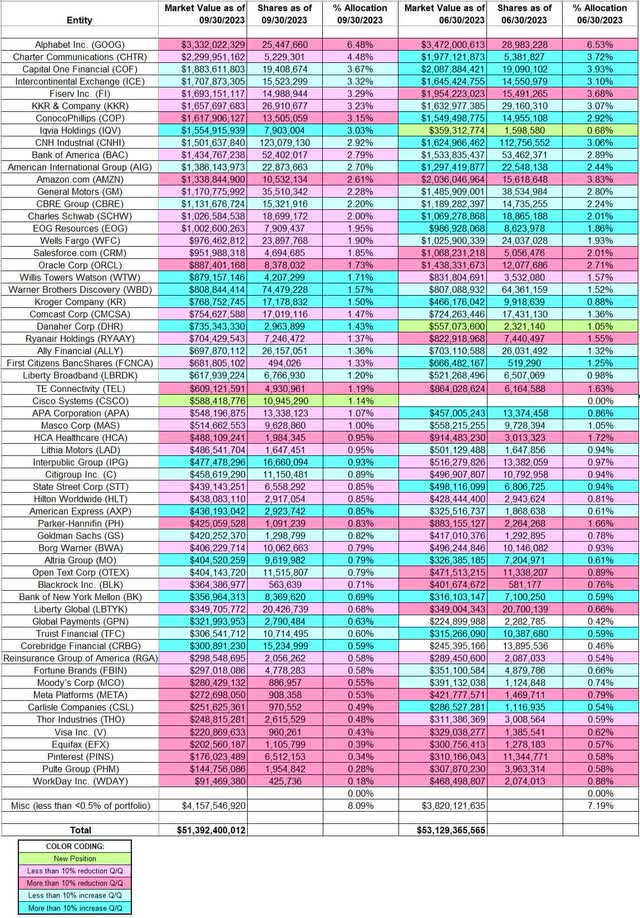

Below is a spreadsheet showing changes in William Nygren’s Harris Associates 13F portfolio holdings as of the third quarter of 2023.

William Nygren – Oakmark – Harris Associates Portfolio – Q3 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Harris Associates’ 13F filings for Q2 2023 and Q3 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.