Traders liquidate more than $250 million as Bitcoin price falls

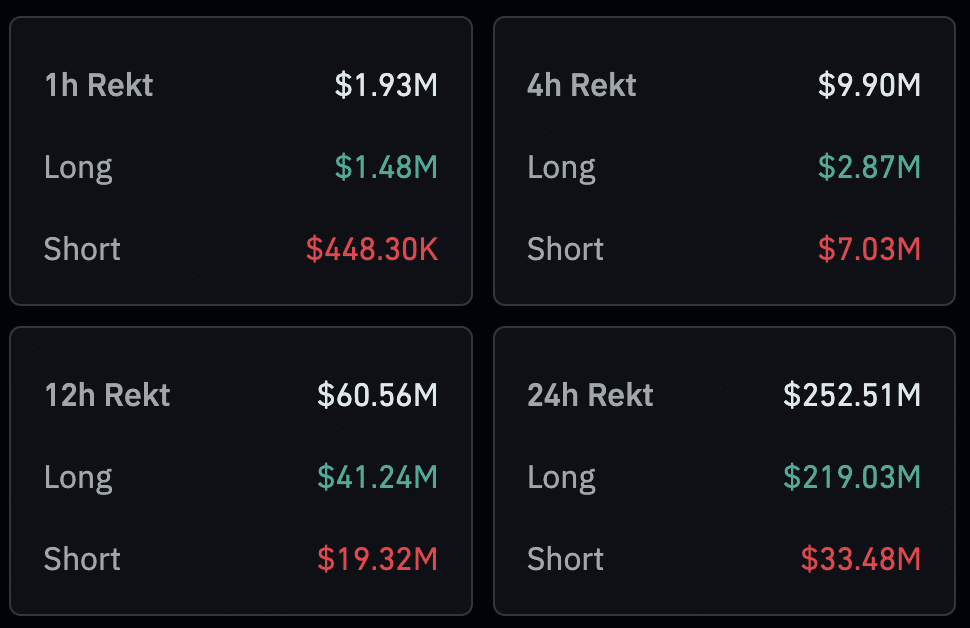

In the last 24 hours, the total liquidation volume in the cryptocurrency market exceeded $250 million.

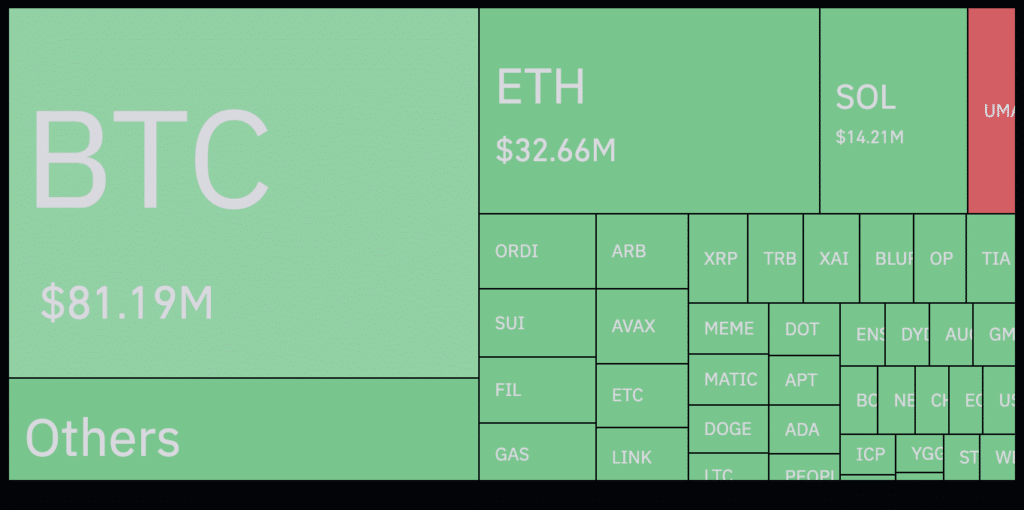

According to Coinglass, the current liquidation volume stands at $252.5 million. Most forced closed positions were in Bitcoin (BTC) and Ethereum (ETH).

Previously, the price of Bitcoin fell below $41,000 and traders suffered losses of $81.1 million. Market participants who opened long positions in Ethereum also suffered significant losses. The second-largest cryptocurrency has a market capitalization of $2,400, causing $32 million in losses for traders.

Over 90% of liquidations were distributed between OKX, Bybit, Huobi, and Binance. Binance has executed its most important orders. The exchange closed buying BTCUSDT at $7.31 million.

At the time of writing, the price of the largest cryptocurrency was $41,200. According to Coinglass data, over the past few hours, traders have opened more long positions than short positions, indicating market participants’ confidence in further growth of BTC.

Cryptocurrency enthusiasts and market watchers were weighed down by asset manager Grayscale’s brisk BTC selling. Grayscale’s Bitcoin Trust (GBTC) previously experienced significant outflows totaling $594 million due to the current downturn in the cryptocurrency market. At the same time, Grayscale moved 9,840 BTC worth $418 million to Coinbase Prime, bringing total volume since January 12 to 41,478 BTC.

Source: https://crypto.news/traders-liquidate-over-250m-amid-bitcoin-price-decline/