Trading system using RC Soldiers and Crows indicator – Trading Strategy – February 23, 2024

In this blog post, I will present three effective and good strategies that you can add to your portfolio using the RC Soldiers and Crows indicator.

//——

summary:

- 1 Strategy (confirming trend with moving average crossover setup)

- 2 Strategy (confirmation signal of breakout system)

- 3 Strategy (Swing Trading on Higher Timeframes with Internal Moving Average Filter)

//——

#1 Strategy (Trend Confirmation of Moving Average Crossover Setup)

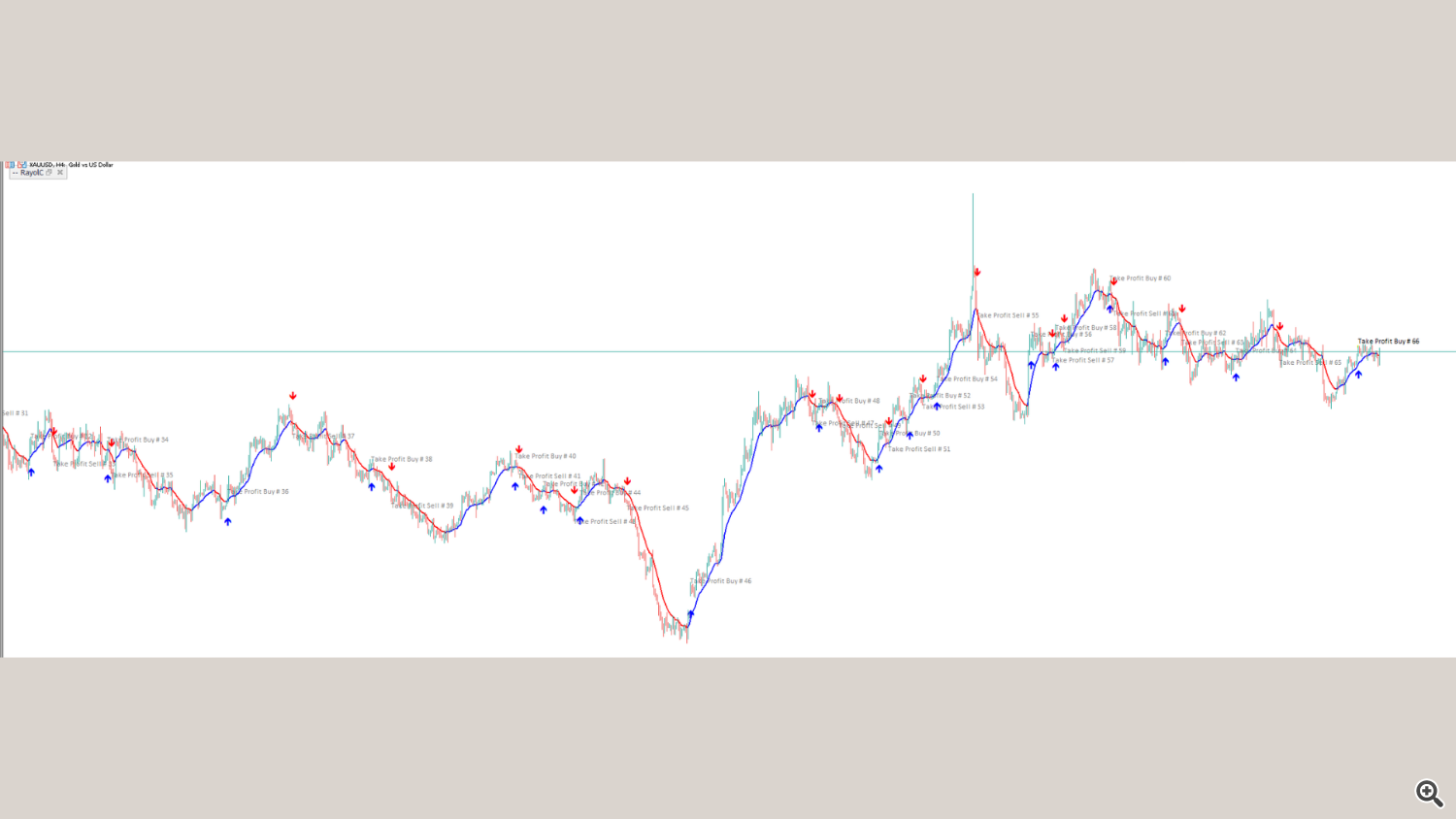

– First, choose a highly volatile asset to negotiate, for example XAUUSD.

– Go to shorter time periods like M5.

– Add a fast exponential moving average of 50 periods to the chart, then another slow exponential moving average of 200 periods. (image below)

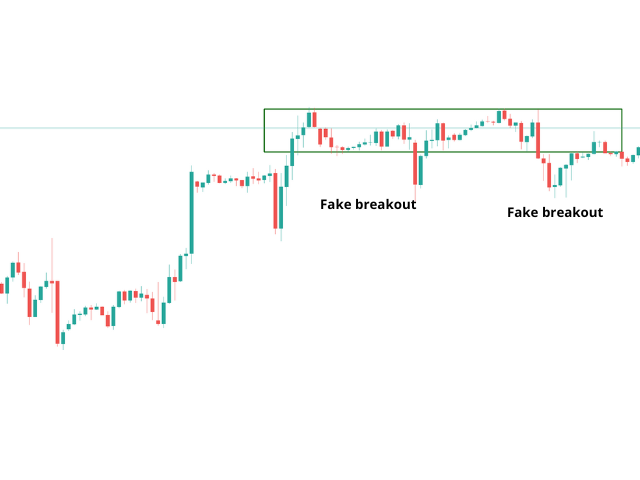

– As you know, using a simple “moving average crossover” system can harm a trader’s account by providing a lot of fake signals that can lead to failed trades. (image below)

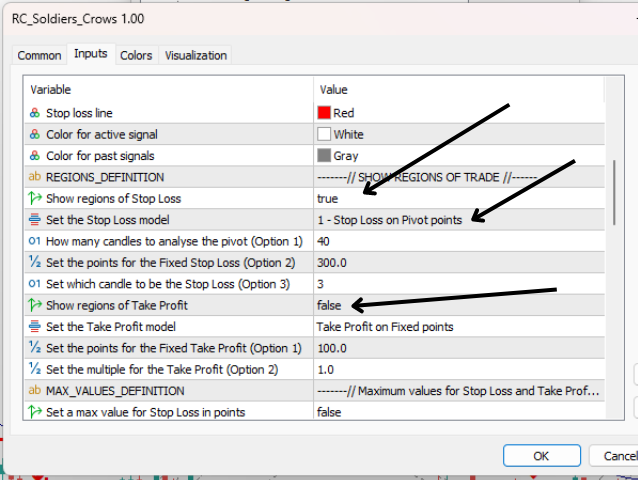

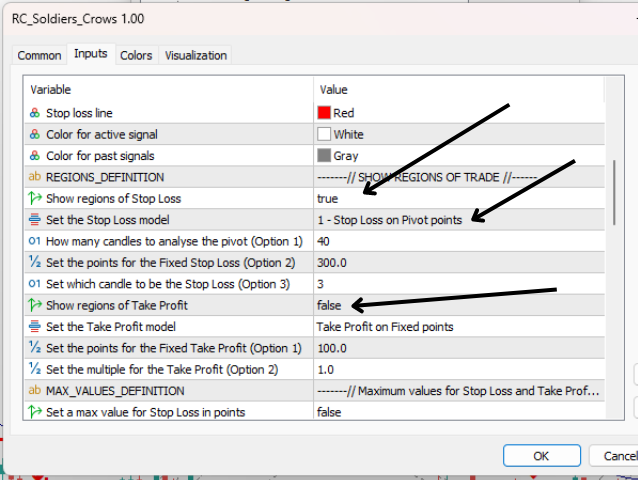

– Now let us see how RC Soldiers and Crow indicator can provide powerful insights and good entries to filter out bad signals from moving average crossovers. First, add the indicator to the active chart, then in the “Show trading areas” section, set “Show stop loss areas” to true and set “Stop loss model” to “1 – Stop loss at pivot point”. Finally, set the “Show Take Profit Area” option to false. Click OK. (image below)

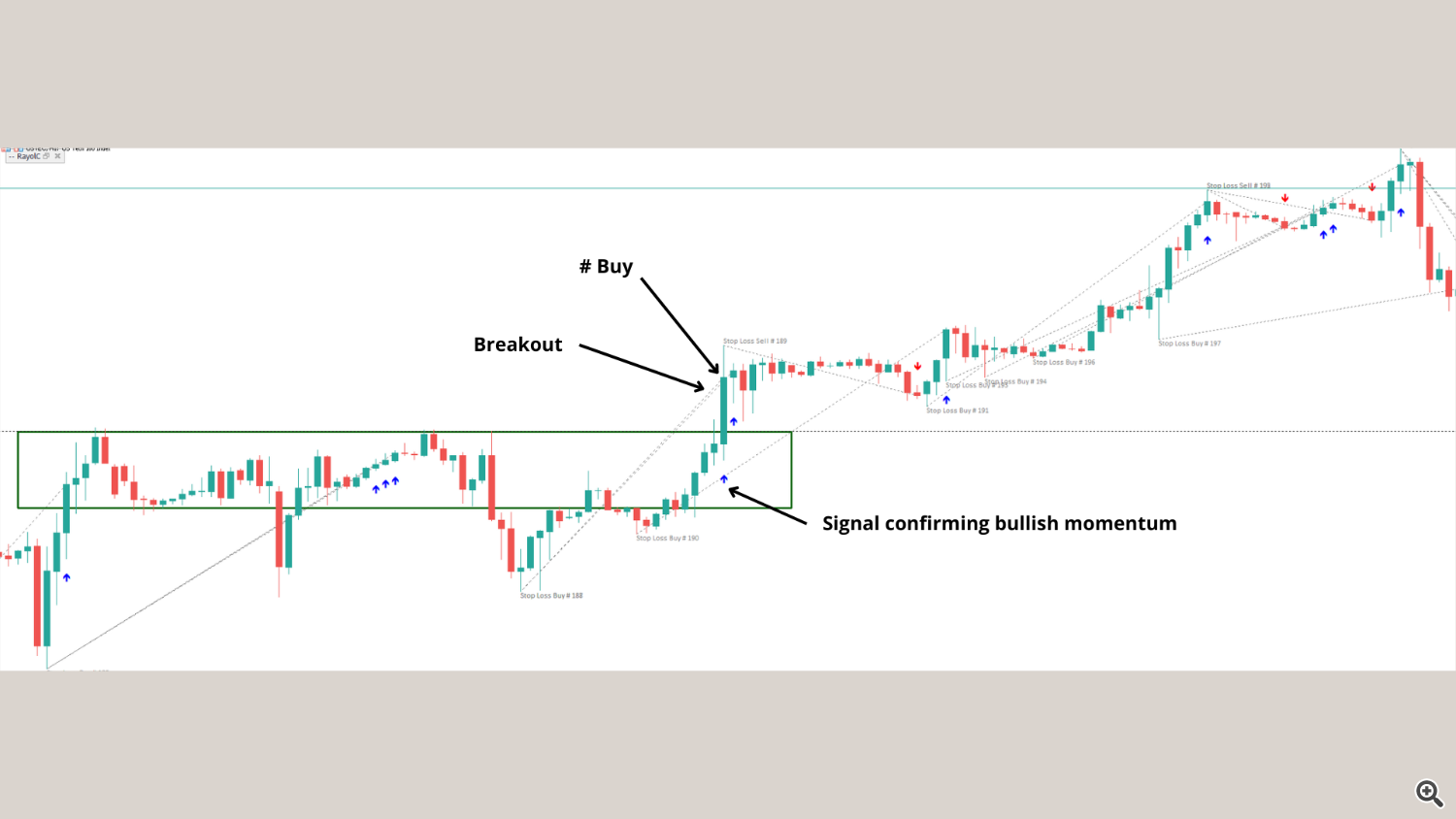

– Long positions must now be opened only in the following cases: The indicator provides a buy signal after an upward crossover and notice how the indicator provides a good stop loss price based on the recent pivot level. Same logic for short positions. (image below)

– Notice in the larger image how a stop loss was set at the pivot level and then a buy (two blue dots on the chart) covered past losses and provided a nice profit, although some of the sells ended in losses. merchant. (image below)

In a nutshell, this first trading system is as follows:

1. Wait for the intersection between the two averages defined above.

2. After that, the indicator gives a signal after this crossing and opens a position in the direction of the trend, which is indicated by the intersection of the faster average with respect to the slower average. For example, if a fast EMA crosses a slow EMA from bottom to top, you would wait for a buy signal from the indicator.

3. Set a stop loss on the pivot point for higher win rates.

//——

#2 Strategy (As a confirmation signal for the breakout system)

– First, look at the current main trend, draw a sideways channel, and look for a breakout in that direction. (image below)

– You will find that just trading with the main trend will help you avoid getting into bad short-term trades. Anyway, let’s look at that “integrated channel” from an expanded perspective. (image below)

– Now let’s see how the RC Soldiers and Crow indicator can provide powerful insights and good entry points to filter out bad signals found in breakout systems and show price momentum after breakouts to confirm actual breakout occurrence.

– First add indicators to the active chart and then “SHOW REGIONS OF”

In the “TRADE” section, set “Show Stop Loss Area” to true, set “Stop Loss Model” to “1 – Stop Loss at Pivot Point” and finally set “Show Take Profit Area” option to false. Press OK. (Image below)

– You can now see how useful the indicator is by showing a signal after a breakout has occurred. (image below)

In a nutshell, this second trading system is as follows:

1. Find key trends and draw integrated channels where breakouts are expected.

2. Add an indicator to the chart, wait for the corresponding signal from the indicator after a breakout occurs in the direction of the main trend, and open a position.

3. Set a stop loss on the pivot point for higher win rates.

//——

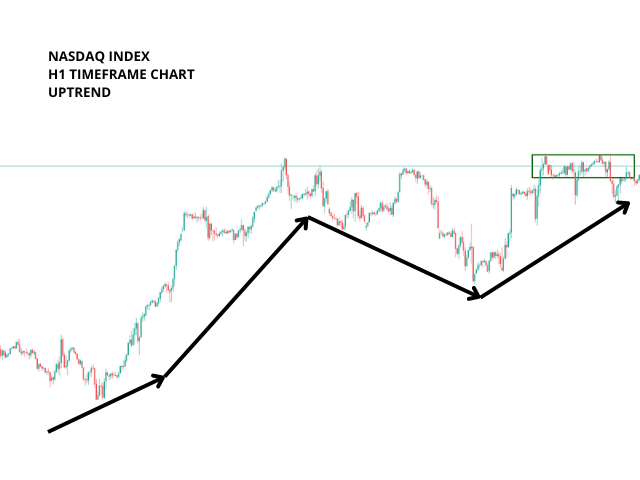

#3 Strategy (Swing trading on higher time frames using an internal moving average filter)

– First, bUsing this setup in the direction of the larger trend and opening orders only in that direction will give you the best results, especially on high time period charts and assets with a clearly defined fundamental bias, such as the SP500, Nasdaq Index or Gold. Same as H4 and above.

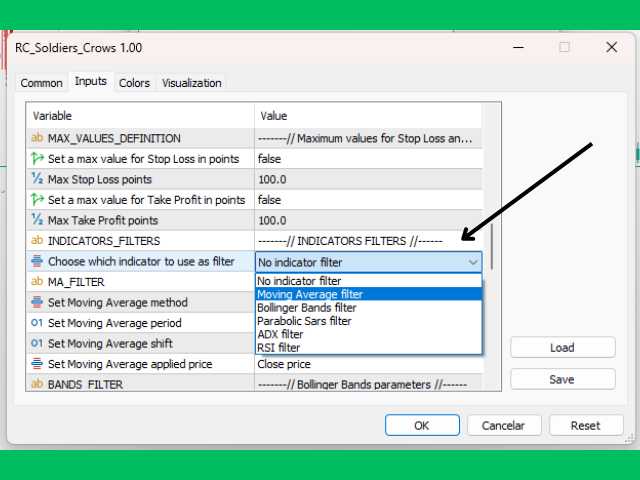

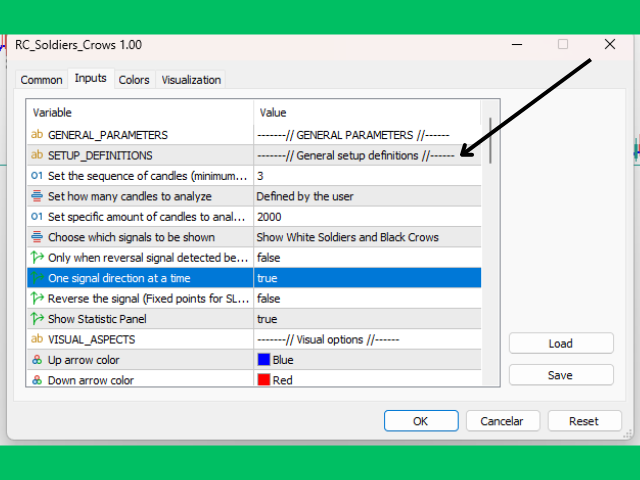

– Now let’s add indicators to the chart. Use the moving average filter in the indicator itself. Then also enable the “One signal direction at a time” option. (image below)

//—-

– Open a buy position when the indicator signals and close it only when a new sell signal appears, or vice versa. (image below)