Treasury FRN: It’s not just an interest rate hedge.

Ralph Hahn

Kevin Flanagan

This year marks the 10th anniversary of the issuance of U.S. Treasury (UST) floating rate bonds (FRNS). In January 2014, the country’s debt managers auctioned off the first installment of these new securities, and over the years, UST FRN has grown to a following: It is an important part of the Treasury’s regular funding schedule. But what is more relevant is that they have become an essential aspect of investors’ bond portfolios. Typically, FRNs of all kinds are considered tactical interest rate “plays,” but when it comes to Treasury floaters, investors are discovering that FRNs also offer strategic solutions beyond simple interest rate hedging strategies.

There is no doubt that UST FRN has served as a powerful investment strategy to help us weather the Federal Reserve’s recent historic rate hike cycle and the resulting surge in Treasury yields. Over the past two years. In fact, it could be argued that with so many different asset classes in the negative column during this period of interest rate increases, it sometimes seemed like investors had nowhere to hide but UST FRN.

To view the most recent month-end and standard performance and to download the fund’s prospectus, click here.

To capitalize on the opportunities Treasury FRNs can offer investors, we also launched the WisdomTree Floating Rate Treasury Fund (USFR) in early 2014. In other words, USFR also celebrates its 10th anniversary this year. Investors quickly became drawn to the benefits of this strategy as the Federal Reserve tightened monetary policy, but it is becoming increasingly clear that this approach is also a solution worth considering in the current and future interest rate environment.

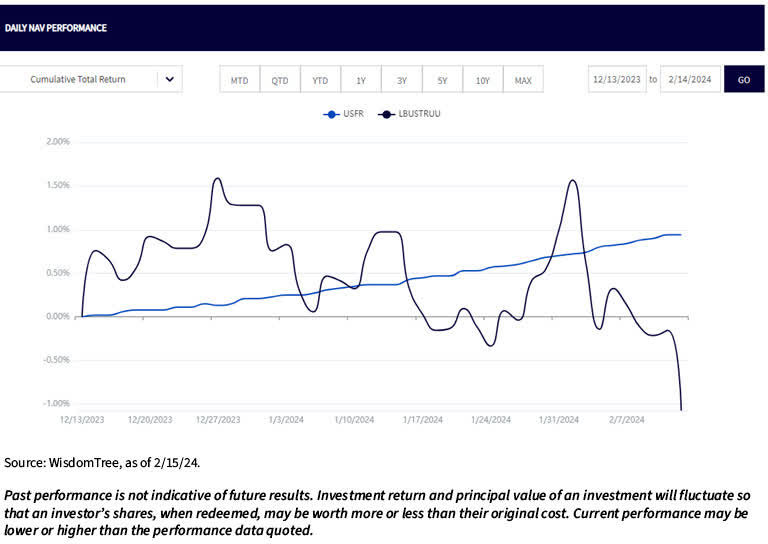

With the shift from Fed rate hikes to the prospect of Fed rate cuts now in full swing, investors are taking a first-hand look at how Treasury FRNs have performed compared to the broader bond market. The “real” turning point occurred at the December FOMC meeting when Chairman Powell outlined the Fed’s thought process with a dot plot, predicting three rate cuts this year.

Over these two months, it was interesting to see how USFR performed compared to its benchmark, the Bloomberg US Aggregate Total Return Index, better known as the Agg. As highlighted in the graph above, Agg has experienced some significant volatility as optimistic expectations about the timing and size of a potential rate cut have fluctuated. It’s not that a rate cut has been ruled out, it’s just that the Fed has failed to validate the initial enthusiasm of the broader market with labor market and inflation data. In fact, current interest rate cut expectations in the money and bond markets have decreased from 6 levels to around 4 levels, or closer to what the Fed expects. Meanwhile, USFR has experienced a steady upward trend and, at the time of this writing, has posted a positive total return of just under +1.0% compared to a decline of just over -1.0% for the Agg.

Another important thing to consider is the difference in returns between the two. USFR’s average yield to maturity is 5.49%, or about 60 basis points (bps) higher than Agg. Additionally, USFR has a period of 1 week while Agg has a period of 6.25 years, so the period profiles are significantly different. In other words, the Treasury FRN strategy is delivering noticeably more returns without the additional duration of Agg and higher volatility.

And don’t forget that the yield curve is still inverted. Therefore, UST Floating Rate Notes (FRNS) are, in many cases, the highest-yielding Treasury bonds by a wide margin. Therefore, even if the Fed cuts interest rates by 100 basis points in 2024, UST FRN yields will likely still be close to or above current fixed-coupon Treasury yields.

conclusion

In my opinion, investors should consider using USFR as a strategic lynch pin when positioning bond portfolios. USFR is a “check-in” feature for various interest rate forecasts.

IMPORTANT RISKS ASSOCIATED WITH THIS DOCUMENT

There are risks associated with investing, including the possible loss of principal. Floating rate securities may be less sensitive to interest rate changes than fixed rate securities, but they may decline in value. Fixed income securities generally decline in value as interest rates rise. The value of an investment in the Fund may change rapidly and without notice due to default by the issuer or counterparty and changes in the credit ratings of the Fund’s portfolio investments. The Fund’s investment strategy may allow the Fund to make higher capital gains distributions than other ETFs. Please read the fund prospectus for specific details regarding the fund’s risk profile.

Kevin Flanagan, Head of Fixed Income Strategy

As a member of WisdomTree’s Investment Strategy Group, Kevin serves as Head of Fixed Income Strategies. In this role, he contributes to the asset allocation team, writes fixed income-related content, travels with the sales team, conducts meetings with clients, and provides expertise on WisdomTree’s existing and future bond ETFs. Kevin also works closely with the Fixed Income team. Prior to joining WisdomTree, Kevin spent 30 years at Morgan Stanley where he served as Managing Director of Wealth Management and Chief Fixed Income Strategist. He was responsible for making tactical and strategic recommendations and created asset allocation models for fixed income. He has been a contributor to Morgan Stanley Wealth Management’s Global Investment Committee, a lead author for Morgan Stanley Wealth Management’s monthly and weekly fixed income publications, and worked with the firm’s Research and Consulting Group divisions to build ETF and fund manager asset allocation models. Kevin holds an MBA from Pace University’s Lubin School of Business and a Bachelor’s degree in Finance from Fairfield University.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.