Trinseo PLC Stock: Not a Winner Again This Year (NYSE:TSE)

ipopba/iStock via Getty Images

Investment summary

Trinseo PLC’s stock performance (New York Stock Exchange: TSE) has been solid, down more than 63% over the past 12 months. I think the main reason for this has to do with poor people Not only are interest rates high, but the business’s growth prospects are unpredictable at a time when the company is incurring significant losses. Net income over the last 12 months was negative $800 million. With a market capitalization of less than $300 million, you have to wonder how long TSE will be able to stay in business if things continue the way they are.

The company had less than $300 million in cash last quarter, and we believe there could be significant dilution for shareholders in the medium term. I covered TSE on July 18th, early 2023. Be accurate. My rating at the time was a sell and I don’t think anything has changed in my view of the business. I think there are still some glaring issues that need to be addressed to get a better rating. I think there will be significant value in owning small-cap stocks in 2024, but like large-cap stocks, these will need to be very selective. Even though TSE is a small cap, I don’t think it will be a winner and I will stick with my initial sell rating here.

company division

TSE is a leading specialty materials solutions provider with a global presence covering the United States, Europe, Asia Pacific and other international markets. The company’s operations are comprised of six separate segments: Engineering Materials, Latex Binders, Basic Plastics, Polystyrene, Feedstocks and Americas Styrenics.

Within the engineering materials sector, TSE specializes in providing a wide range of advanced materials solutions. This includes hard thermoplastic compounds and mixtures as well as soft thermoplastic formulations. This segment also includes continuous casting, cell casting and extruded PMMA sheet production. These diverse products are suitable for a variety of industries and applications and demonstrate TSE’s commitment to providing innovative and customized material solutions to meet customers’ changing needs.

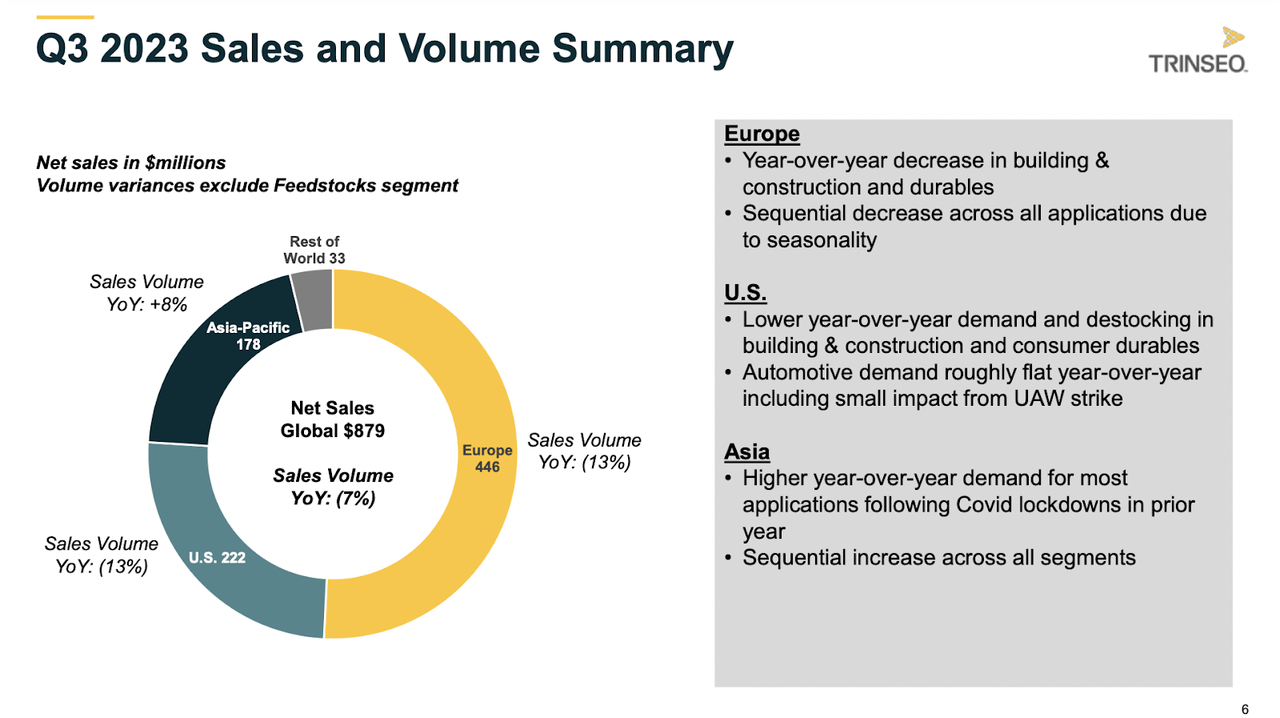

sales rate (Investor presentation)

Because it is a global company, it experiences a certain degree of risk associated with regions such as China, which appears to be cracking down on foreign investment causing companies to look elsewhere. China is a very attractive market for TSE, but we believe it could be beneficial for TSE to change tack and focus more on India. The country is growing and is expected to become one of the fastest growing economies over the next decade.

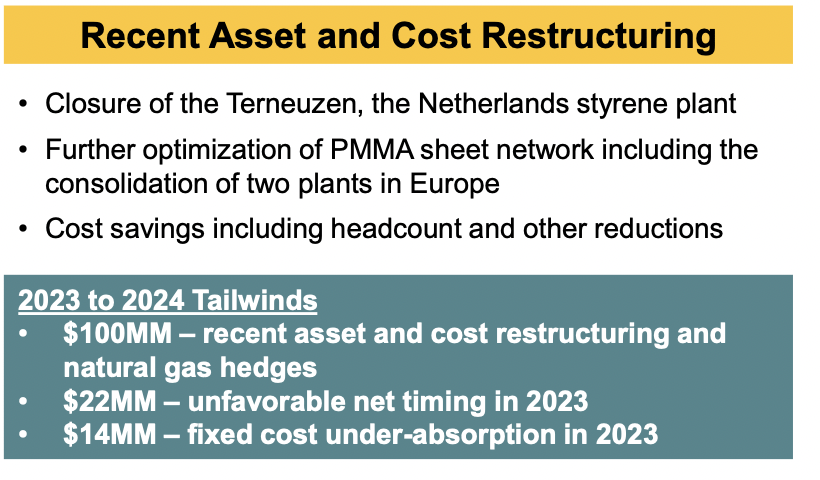

Previous company (Investor presentation)

The company hopes that through some asset and cost restructuring, it will be able to improve its operations and, consequently, its profits. In the presentation of their last earnings report, they stated that some tailwinds for the business are natural gas hedging and absorption of some fixed costs. It remains to be seen how this will be implemented and whether it will help the bottom line, but management’s proactive moves are at least a good sign.

Revenue Highlights

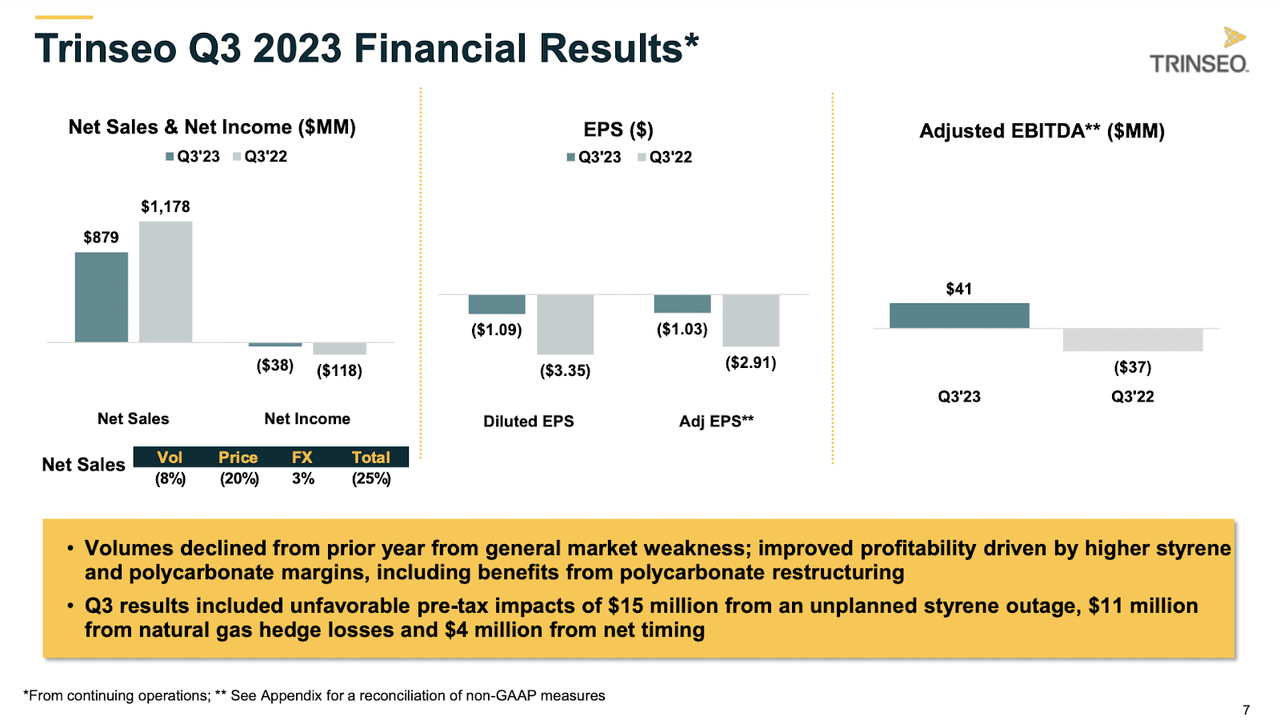

quarterly performance (Investor presentation)

Let’s take a look at the company’s last earnings report and how they performed. Sales decreased significantly compared to the previous year. This quarter, it fell from $1.1 billion to $879 million. We believe this decline, which has been the theme for most of 2023 for the TSE, is a key factor in the share price decline. However, a few important things to point out are the EPS improvement over last year. EPS was negative $3.35, but is now negative $1.09. There aren’t many estimates for EPS, but we expect TSE to return to positive earnings in 2026, with EPS of $2.6. This results in a FWD p/e of 3.2. While this is a significant factor compared to the sector median of 16.6, there are some very good reasons why TSE is currently undervalued, as we will discuss in the risk section of the article.

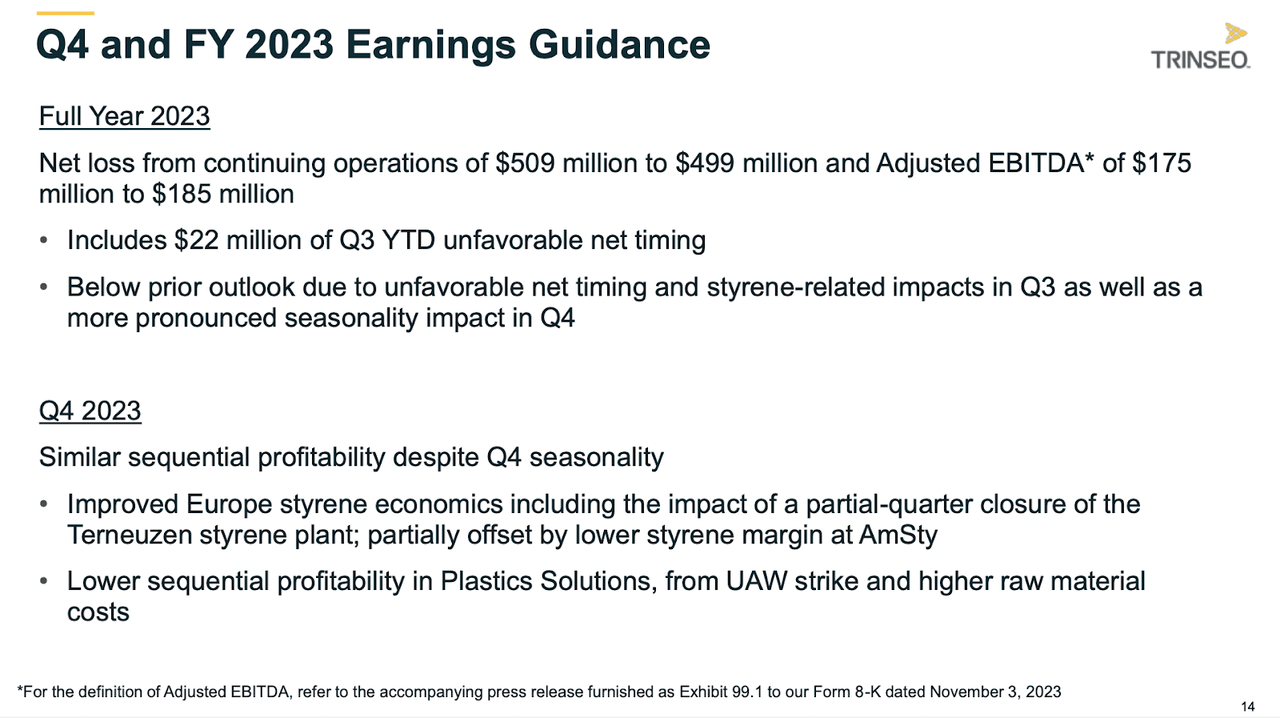

2023 Guidelines (Look for alpha)

The outlook provided does not necessarily assure investors that better times are ahead. The company noted a pronounced seasonal impact in the fourth quarter, which it believes is likely to result in continued negative returns. Total net loss for 2023 is expected to be between $509 million and $499 million. We believe there is potential for upside in the stock in the near term, driven by lower seasonal impact in the fourth quarter of 2023. If this has a positive impact on earnings and TSE records positive results, I think we’ll be in for a strong showing. There have been short-term upticks, as the company experienced in mid-2023, which was briefly mentioned on CNBC.

danger

A notable challenge for TSEs lies in the complex regulatory environment in which they operate. Like any other company, TSE is subject to a regulatory framework and non-compliance or breach of regulations can result in serious consequences. The company is grappling with a variety of regulatory issues that require careful consideration. This is not the first time the TSE has run into trouble with regulators. In late 2022, the company was fined for some negligence related to styrene purchases. Europe is a big market and TSE’s clash with the European Commission is by no means an optimistic sign or tailwind.

One of the major regulatory issues facing TSEs is class action lawsuits that cast a shadow on their public image. These legal issues attracted negative attention in the media and potentially affected the perception of the company among investors. The fallout from the lawsuit could be a contributing factor to the decline in TSE’s share price over the past 12 months as investors assess the risks involved. The lawsuit was filed in mid-2023 and seeks to recover losses caused by the company’s misunderstanding and failure to disclose significant aspects of its operations. Because of this, some investors were misled and lost money. I think this lawsuit is more of a strike on TSE’s reputation and is now a bit of a hot potato that I don’t see any reason why anyone would want to get involved. The reputation has been damaged and I think it will remain so for a long time.

margin level (Look for alpha)

In addition to the lawsuits against the company, I believe there are also many issues related to the company’s margins. There wasn’t enough effort to increase margins and generate consistently positive margins. The margin shortfall appears to have been caused by high interest rates, with TSE costs in the region now reaching $157 million. However, over the last 12 months, the company also incurred $943 million in initial item costs, which weighed heavily on its bottom line. Without it, the results would have been positive. However, until future reports provide a clear black and white view, the poor sentiment on TSE margins is likely to remain. Ultimately, we incurred income tax expense of $142 million over the past 12 months.

final words

I have previously covered TSE and my view of the business at the time was very poor as it was struggling with positive earnings and cash hemorrhaging. This has not changed since then and there has not been enough improvement in management to raise the previous rating. I have laid out a few issues that TSE needs to watch out for before taking an optimistic stance. Until then I stick with my Sell rating on TSE.