Trump Media and Technology Stocks: No Fundamentals Here (NASDAQ:DJT)

U.Ozel.Images/iStock Unpublished via Getty Images

introduction

Trump Media and Technology Group (NASDAQ:DJT) It has seen a big move YTD and is currently up 163%. I wanted to check the company’s financials, but the price movement has nothing to do with fundamentals or anything. It has to do with Mr. Trump and his ardent followers. Although the play here is high risk, high reward, I think the odds of making money with this play are unfavorable for a rational investor. The exorbitant fees make short selling undesirable, and the market will certainly remain irrational longer than fees alone can keep these stocks solvent. In my opinion, the company is not worth investing in.

Finance very briefly

So let’s get into it, shall we? DJT had approximately $270 million in cash and equivalents, including restricted cash, as of the first quarter of 2024. That’s quite a bit of extra cash. Previous quarter. This increase is a result of the business combination and the issuance of TMTG convertible bonds. I don’t have any debt, so at least I have that. Usually, people think that a position like this is good if the company is doing well, but that may not be the case for DJT.

While the company’s revenue fell 31% year-over-year, platform operating costs soared. In the most recent quarter alone, the company lost $327.6 million, or -$3.61 per share. Most of the increase in expenses is due to increased share-based compensation. For other companies, such as those with a small market capitalization and rapid growth, excessive SBC may be fine. But DJT is an $8 billion company with less than $800,000 in revenue. I had to double-check that I was reading my quarterly statements correctly because it was hard to believe that the company was bringing in any income. eight hundred thousand dollars At the same time being evaluated based on profit 8 billion dollars.

Some might argue that such losses are expected because the company is investing for the long term. Again, there may be debate about this, but the clock is ticking because the returns are so small.

There’s nothing more to say about finances that hasn’t been covered before. The huge difference between top-of-the-line and cost is shocking to say the least. DJT’s $270 million cash cushion will last a little longer if the company’s cash burn remains around $9 million a quarter. Hopefully it turns positive so it can last longer, but we’ll have to see how it all plays out over the next few quarters.

How are you making money?

DJT’s business model relies solely on the social media platform “Truth Social”. Like all other social media platforms, DJT’s main and only source of revenue is displaying advertisements to users of the platform. So, you would think that if this kind of revenue was related to users, it would be very easy to track it, right? In reality, that’s not the case. The company does not believe in “traditional KPIs” such as average revenue per user (or ARPU), price, ad impressions, or subscriptions. We don’t see daily active users or monthly active users on the platform like every other social media platform and that’s because the company “We focused on developing Truth Social by enhancing its functionality and user interface.” And now the company “Evaluate the most relevant, reliable and relevant key operating metrics to align with your evolving business model.”

Anyway, let’s say these metrics aren’t “right” for your company’s vision and business model. Let’s say enhancing features and improving the user interface is a good idea. So why are profits declining? In my view, even if the platform is strengthened for user convenience, it will not be enough to secure a large base, and without a user base, no advertisers will want to use the platform.

Additionally, if the common metrics are incorrect, how should a potential investor evaluate a company if there are no indicators to determine how well the company is performing? Revenue alone may not be enough.

platform

I don’t know how many of you have tried to join the platform, but I recently joined to see what it looks like. I barely registered because I had to check a box to allow the platform to send me updates on my phone number. After hitting the “next” button for longer than I care to admit, I realized that checking the box was essential. Now that we were done, it was time to check out some tweets in the Discover tab since we had skipped who to follow. Because the user base is low, there are very few new posts. I can see how people could end up thinking it’s corny since it’s basically a one-sided private group chat. It was a somewhat smoother experience than anything I’ve attempted. But I deleted my account within hours.

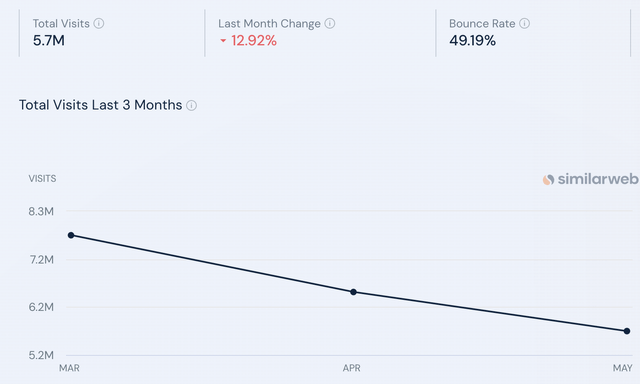

There is a website where you can check some statistics regarding some of the metrics of the platform and in the image below you can see that the platform has lost 13% of its monthly traffic and has been steadily declining since March.

similar web

Now let’s compare the platform with its stiff competition. We can clearly see a huge difference in engagement. It goes without saying that companies essentially don’t make money on their platforms. There isn’t enough traffic and the traffic coming through it isn’t suitable for many advertisers. Speaking of advertisers, many of the ads I saw were for Trump products.

similar web

Basics don’t matter

This company is similar to GameStop (GME). Despite the company’s poor performance, it has a huge following of people who started out as die-hard fans of the company. DJT is supported by Trump fans who will not sell their stock for any reason. Price movements are not driven by the company’s fundamentals. This appears to be trading based on emotion, and many day traders try to capture companies with high volume and momentum so they can ride the wave, whether up or down.

Should I participate?

I try to stay away from companies that don’t seem to follow those basics. The daily price fluctuations are so large that you could be left holding the bag for a while until another emotionally charged rally occurs, such as the outcome of the first presidential debate or hearing. For DJT, much of the move will depend on how the election goes or what happens to Trump after the hearing scheduled for July 11.Day. Before that, there will be the first presidential debate on June 27th.DaySo, expect some volatility in the stock accordingly.

You might think this stock should crash, but it’s just a matter of when. Yes? Why not make it shorter? Yeah, but that’s a big deal. The amount of shares you can short a company’s stock is very limited, and shorting 100 shares of DJT would cost up to $30,000 per year in interest alone. It’s not worth it. The commission for short selling it is over 600%. So, if you already own some stocks and want to offer those stocks to short sellers, you may have some interest in the stocks, but that defeats the purpose of holding them and wanting the stock price to rise instead of supporting them. Short seller.

In summary, how you play this or any other meme stock is up to you. It’s a high-risk, high-reward situation for DJT, and we’re not willing to take any chances here, especially if more dilution is on the way. According to its latest S-1 filing, the company is registering the issuance of up to 21.49 million shares of common stock, which may consist of common stock upon exercise of various warrants such as placement warrants and post-IPO convertible notes. With the resale of shares held by “selling security holders” (paraphrase). It is not yet fully approved and is subject to change.

Unless it surprises us next quarter, I don’t see how the company can survive on what is essentially very little revenue. The cash position will likely remain for some time if it continues to burn at a similar rate to recent quarters. Trump is the company’s largest shareholder and the other directors are currently under a lock-up period so they can’t sell their shares, but who knows what will happen after that? There is too much risk involved and fundamentally the company is not performing well. You could catch a nice swing over the next month or two and see that the stock is primed to go either way right now. I think it was too quiet. I am not participating in this right now.