U.S. inflation eases, consumer cooling increases the likelihood of a rate cut

JL Gutierrez

By James Knightley

Inflation easing to a “low” 0.1%

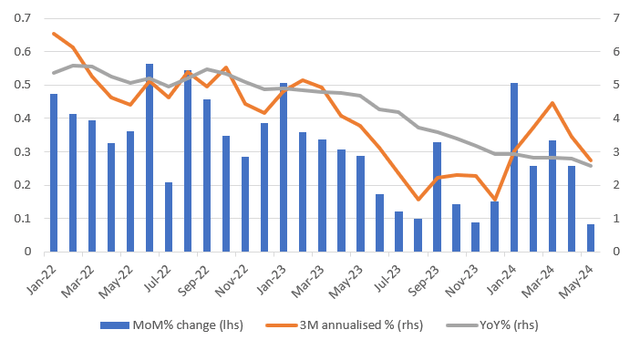

The May Personal Income and Expenditures report provided some encouragement that inflationary pressures are easing once again after being too severe for the first three months. That year, the core personal consumer expenditures deflator, a broader measure of inflation pressure than the CPI that the Fed focuses on, came in at 0.1% MoM/2.6% YoY. This was expected after reading the components of the CPI and PPI reports in detail, but it was a relief after so many surprising gains this year. The headline number (including food and energy) came in at 0.0% MoM/2.6% YoY, as expected.

Looking at the unrounded figures, the monthly change in core inflation is actually a “low” 0.1%, which equates to 0.083% to three decimal places. However, April saw a slight upward revision from 0.249% to 0.259%, which is a very small rounded 0.3% compared to the previous month. It’s a bit disappointing. But it does help the argument that inflation is doing better overall, which could open the door to rate cuts later this year.

Core PCE Deflator

Source: Macrobond, ING

Consumer Cooldown Continues

Household income was stronger than expected, up 0.5% MoM in nominal terms and up 0.5% in real household disposable income. Spending also recovered, up 0.3% MoM in real terms after a 0.1% drop in April and a downward revision to the first quarter figure. Nevertheless, the trend appears to be slowing. Consumer spending is expected to grow 3.2% in real terms annually in the second half of 2023, but assuming spending grows 0.2% MoM in real terms in June, annual consumer spending growth in the first half of 2024 would be just 1.5%. Thus, both inflation and spending suggest that tight monetary policy is cooling the economy and limiting price increases.

Fed doesn’t want unnecessary recession – cuts interest rates starting in September

The Fed sees monetary policy as being limited to 5.25-5.50% in an environment where they see the neutral rate at around 2.8%. The Fed doesn’t want to cause a recession, and I think if the data suggest they might start to make monetary policy a little less restrictive, they’ll take that opportunity, maybe as early as September. I think the Fed needs to know three things before officials feel comfortable taking that step.

- More evidence that inflationary pressures are easing. A further succession of core inflation below 0.2% month-on-month would be a necessary but not sufficient factor leading to a rate cut.

- More evidence of labor market slack. The unemployment rate rose from 3.4% to 4.0%. If it were to go well above 4%, as evidence of falling wages mounts, that would also change the argument for a rate cut. Jobless claims data and the Weak Business Survey suggest that the job market is weakening.

- Ease consumer spending. This was the main growth engine in the US, but as noted, growth was cut in half between the second half of 2023 and the first half of 2024. The Fed needs to see if this trend continues through the third quarter. Weak growth in real household disposable income, the depletion of millions of households’ accumulated savings during the pandemic, and rising loan delinquencies suggest that financial stress is real for many low-income households and will indeed persist.

If all three of these are met, I believe the Fed will look to shift monetary policy from “restrictive” to “slightly less restrictive,” perhaps by cutting rates by 25 basis points at the September, November, and December FOMC meetings.

Content Disclaimer: This publication has been prepared by ING for informational purposes only, regardless of the specific user’s means, financial situation or investment objectives. This information does not constitute an investment recommendation, nor is it an offer or solicitation to buy or sell any financial product, investment, legal or tax advice. Read more

original post

Editor’s note: The summary bullets in this article were selected by Seeking Alpha editors.