Under Armour: Higher Prices And E-Commerce Could Benefit The Stock (NYSE:UAA)

FG Trade/E+ via Getty Images

Under Armour, Inc. (NYSE:UAA) recently saw an impressive increase in the number of upward EPS revisions right after the company noted changes in the Board of Directors. I do believe that the company could announce new changes as soon as new directors occupy their new seats. I also think that an ongoing increase in the average selling prices of apparel, footwear, and accessories, current successful strategies about direct-to-consumer channels, and e-commerce could bring new net sales growth in the future. There are obvious risks from emerging tariffs or supply chain issues, however I believe that UA does trade undervalued.

Under Armour: EPS Expectations Increased Substantially, And Geographic Diversification

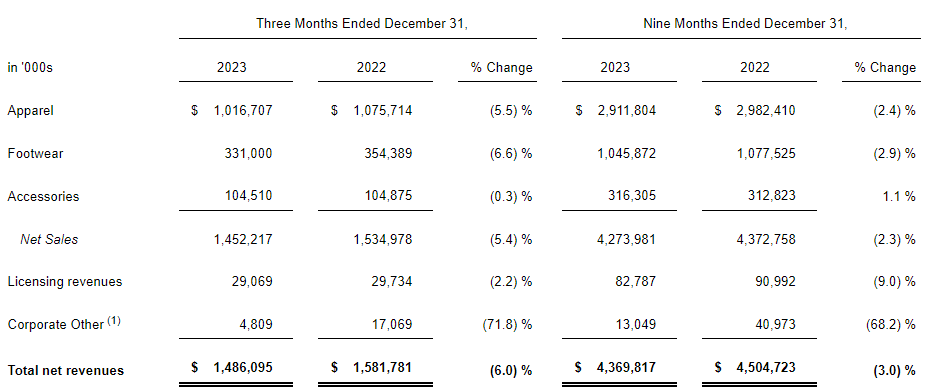

Under Armor is a designer of footwear and accessories primarily for sports activities. Most revenue comes from the sale of apparel, but footwear and accessories are also relevant sources of revenue. The following is a table obtained from a recent quarterly press release.

Source: Earnings Press Release

The long-term growth map involves the scale of the marketing of its products at an organic and inorganic level through advertising campaigns and the purchase of sponsorship spaces in the range of top athletes.

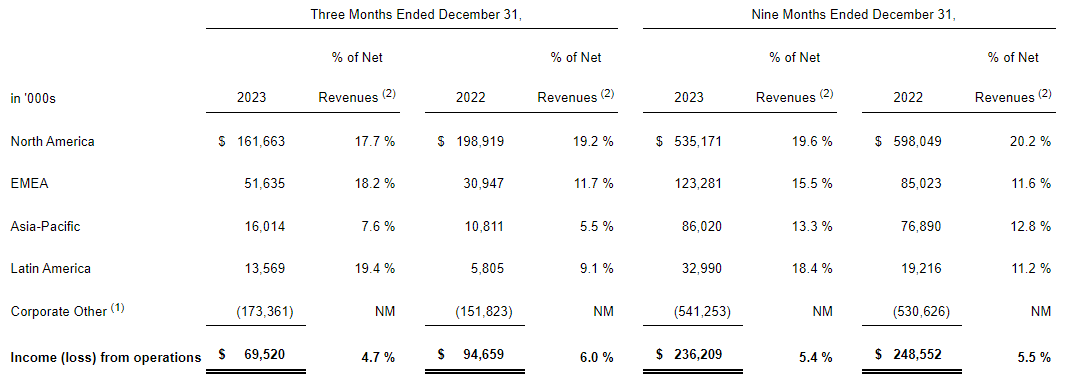

The company divides its activity according to the geographical area where it is carried out. Therefore, there are four segments, each corresponding to the territories named above. The segment that operates within the United States is the one that generates the highest profit margin for the company. This segment operates its in-person stores, where they offer direct sales to the public. The operation of the other three segments is similar, and they are responsible only for retail and wholesale distribution in addition to sales generated through e-commerce.

The net sales appear significantly diversified, which would most likely reduce net sales volatility in the coming years. Taking into account the North American domestic market alone, the company generated a total net revenue of more than $535 million in the nine months ended 2023, to which is added what came from the distribution forces in Asia, Europe, the Middle East, and Latin America.

Source: Earnings Press Release

The company maintains another separate segment for corporate affairs and the management of its digital platforms, mainly the application to monitor the fitness activities of its clients.

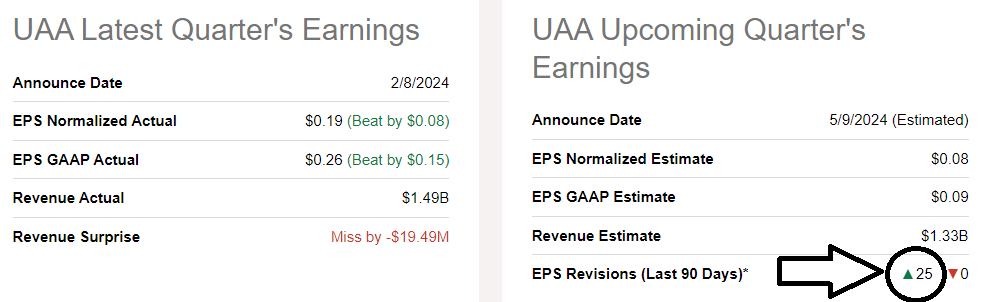

Given the most recent decrease in the stock price and recent earnings, I believe that it is a great moment for reviewing the company’s financial statements. In the last quarter, the company noted better-than-expected EPS GAAP figures. Overall, I believe that the most relevant is the new EPS revisions offered by other analysts. According to Seeking Alpha data, in the last 90 days, 25 analysts increased their future EPS expectations.

Source: Seeking Alpha

Although the company has demonstrated growth values throughout 2023, it closed the last quarter of this year with negative percentages in terms of sales in general throughout its segments. The outlook for 2024 includes a small decline in net sales of -2% or -4%, however, gross margin is expected to increase, and 2024 operating income could reach $287 million. In addition, capex could be close to $210 million and $230 million. I did include some of these figures in my DCF models, so I invite readers to have a look at them.

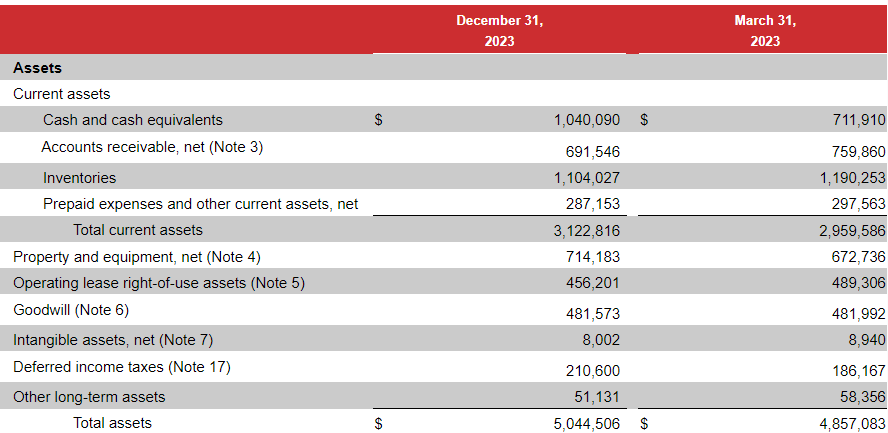

Balance Sheet

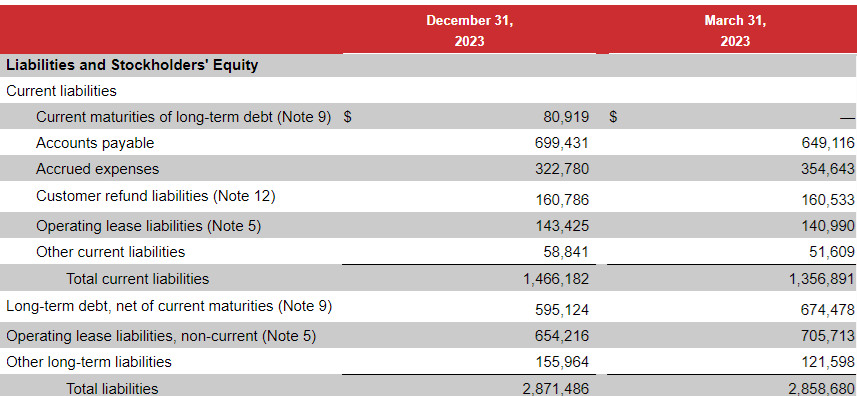

In the last quarter, Under Armour reported a significant amount of cash in hand, equal to close to $1.04 billion, which was significantly higher than that in March 2023. The company’s current ratio is also larger than 1x, and the balance sheet appears quite solid with an asset/liability ratio of close to 2x.

Source: Earnings Press Release

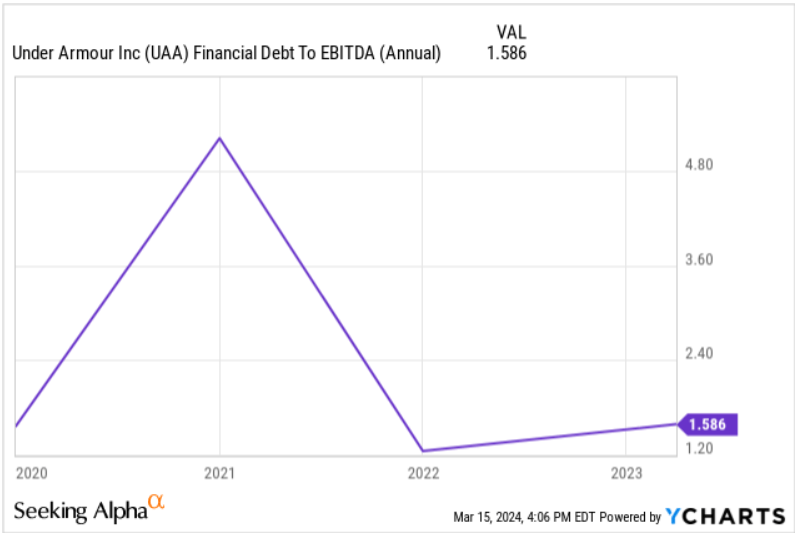

The total amount of debt and short-term debt are not small. I believe that most investors will most likely be following new debt figures. In this regard, I do appreciate quite a bit that the debt/EBITDA ratio declined significantly as compared to the figure reported in 2021. I believe that a further decrease in the leverage reported may bring better EV/FCF valuations.

Source: Ycharts Source: Earnings Press Release

Ongoing Decrease In The Total Amount Of Shares

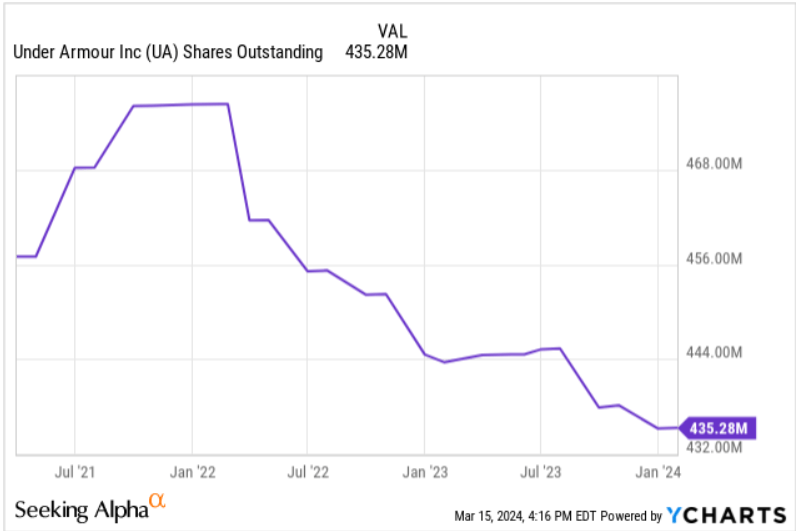

I believe that the recent share count decrease could be appreciated by market participants. From a total share count of close to 468 million in January 2022, the current figure is not far from 436 million. I think that new decreases in the share count could enhance the fair price obtained by analysts running DCF models.

Source: Ycharts

With regard to the different types of shares, I appreciate quite a bit that Under Armour launched an accelerated share repurchase transaction, which lowered the total number of Class C shares. I believe that a further reduction in the number of Class B and Class C shares could lead to stock demand from market participants.

As of January 31, 2024, there were 188,802,043 shares of Class A Common Stock, 34,450,000 shares of Class B Convertible Common Stock, and 212,029,068 shares of Class C Common Stock outstanding. Source: 10-Q.

During the three months ended December 31, 2023, the Company entered into a supplemental confirmation of an accelerated share repurchase transaction. As a result, $23.5 million was recorded to retained earnings to reflect the difference between the market price of the Class C Common Stock repurchased and its par value. Source: 10-Q.

Recent Changes In The Board Of Directors Could Bring New Changes In The Organization

I think that the new changes executed in the Board, including the change of the CEO and the appointment of Dr. Mohamed A. El-Erian as non-executive Chair of the Board, could bring beneficial changes to the organization. The new CEO is actually the founder of Under Armour. He knows the organization well and its needs. I was very surprised by the reaction of the market. Dr. Mohamed A. El-Erian is also an experienced professional, who could bring significant attention from investors.

Plank founded Under Armour in 1996, and since then, he has been the driving force behind its innovative products and brand. Source: Press Release.

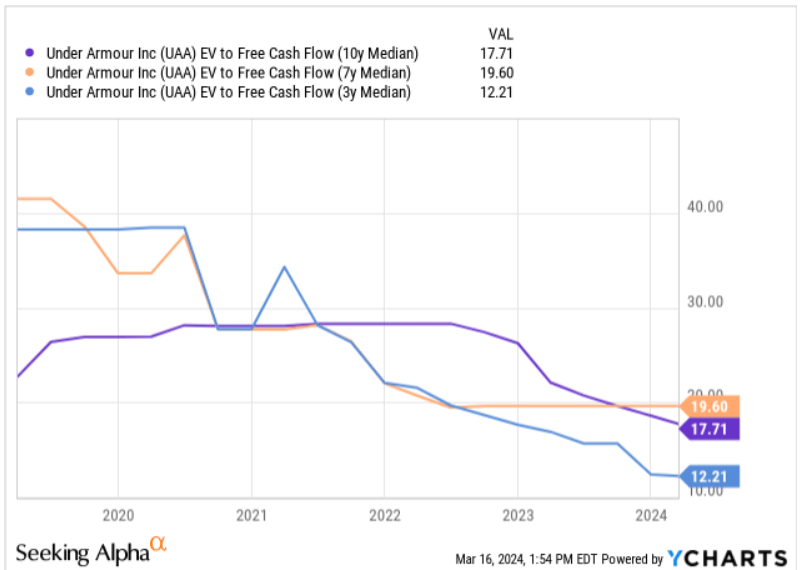

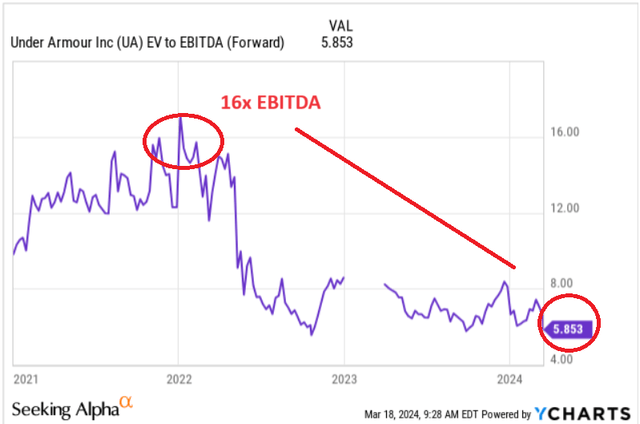

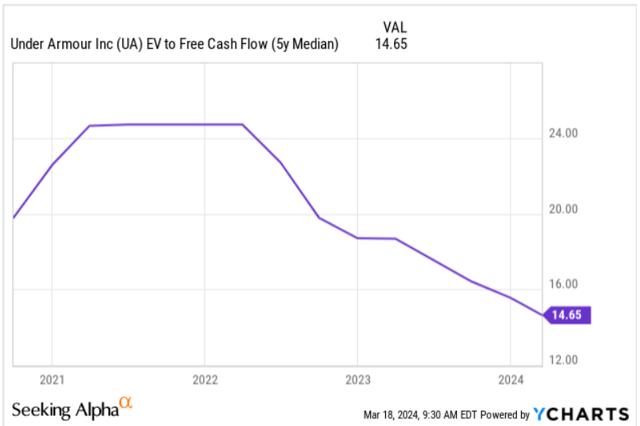

I believe that the market reacted with significant pessimism about the new changes. Recently, the stock price declined. In my view, given the current stock price and the current valuation, I think that the market overreacted. UA’s EV/FCF is significantly lower than what shareholders saw in 2020.

Source: Ycharts

Higher Average Selling Prices Could Bring Net Sales Growth

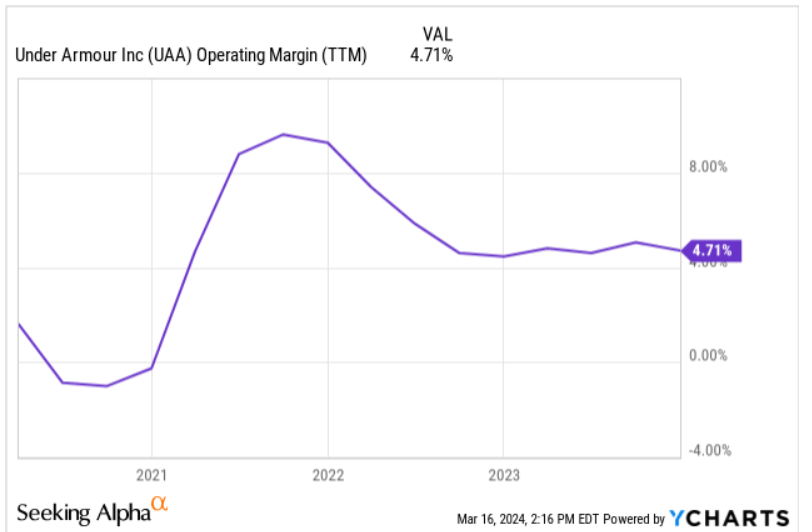

I think that recent quarterly increases in average selling prices in apparel, footwear, and accessories are an optimistic sign. If these increases continue in 2024 and 2025, and the company sells more units, net sales may trend up north. I also believe that further selection of a favorable channel and regional mix as we saw in 2023 could also bring operating margin increases. I would also like to remember that from 2021 to 2023, Under Armour did report increases in operating margin, which even reached more than 8% in 2022. With this in mind, I do not know if the recent EV/FCF declines are justified.

Source: Ycharts

Successful Direct-to-consumer Channel, And E-commerce Sales

I also believe that the recent successful strategies with regard to direct-to-consumer channels and e-commerce could bring new satisfactory news soon. In the nine months ended December 2023, teams in the EMEA region, Asia-Pacific region, and Latin America reported net sales increased thanks to these strategies.

This was primarily driven by an increase in our direct-to-consumer channel, partially offset by a decrease in our wholesale channel. Within our direct-to-consumer channel, net revenues increased in both owned and operated retail stores and e-commerce sales. Source: 10-Q

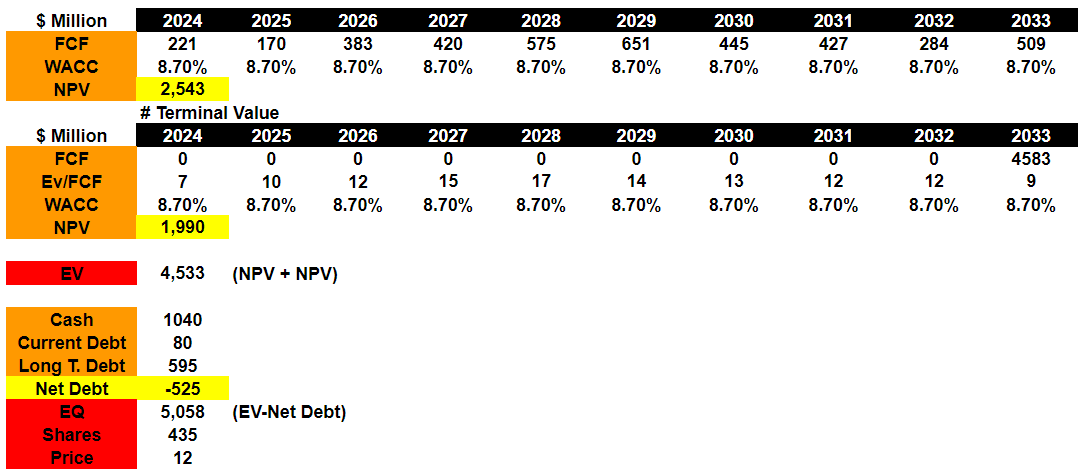

Under My Base Case Scenario, The Company Is Worth $12 Per Share

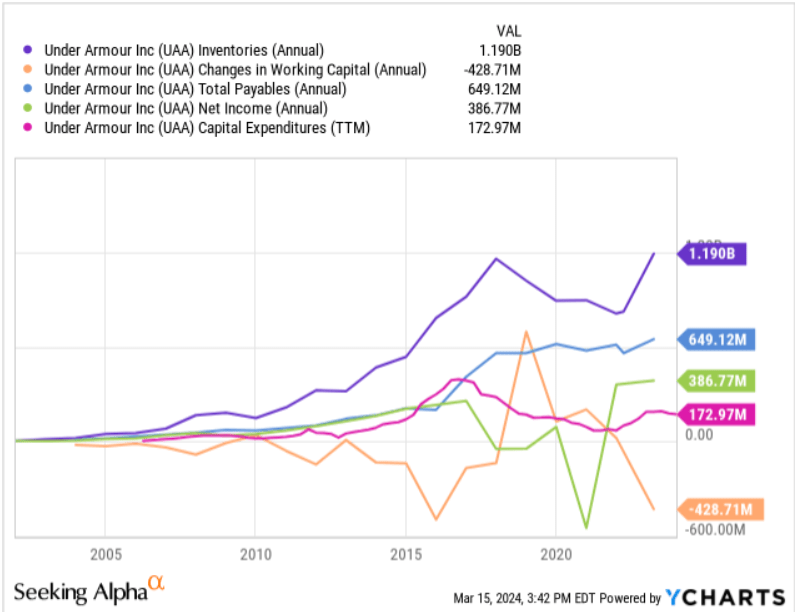

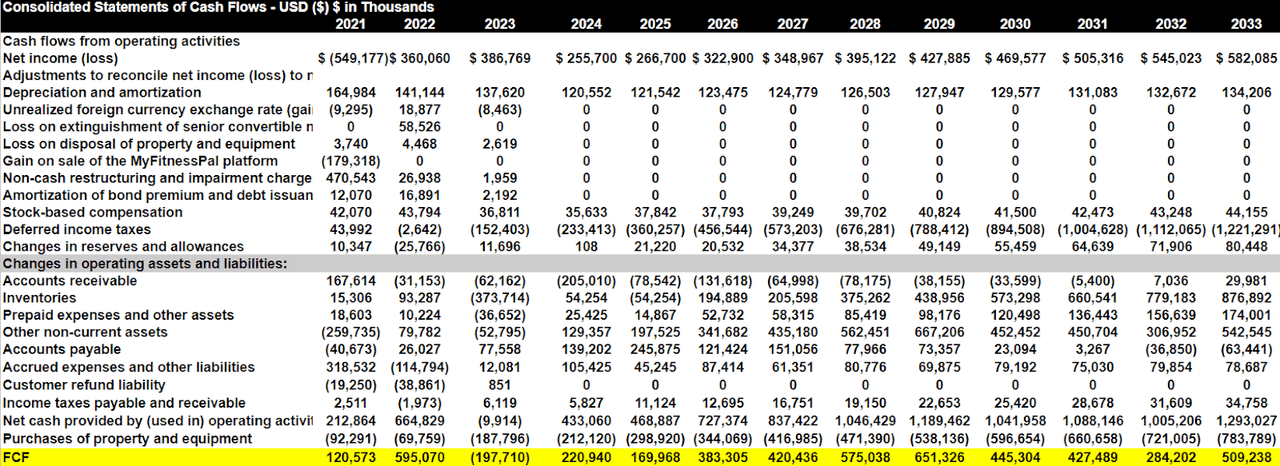

Under my base case scenario, I included the previous assumptions and other figures obtained from previous cash flow statements. In order to understand my assumptions well, I believe that investors may carefully review previous capex figures, changes in accounts payables, net income growth, and changes in working capital. I do believe that my figures are very conservative.

Source: Ycharts

I included a 2033 net income of about $582 million, with depreciation and amortization close to $134 million. In addition, I did not take into account unrealized foreign currency exchange rate gains, losses on extinguishment of senior convertible notes, losses on disposal of property and equipment, or gains on sale of business like the MyFitnessPal platform. I do not think that these events are part of the day-to-day business of Under Armour.

I also included a 2033 stock-based compensation of about $44 million, 2033 deferred income taxes worth -$1222 million, changes in reserves and allowances of about $80 million, and accounts receivable of close to $29 million.

Besides, taking into account changes in inventories of $876 million, prepaid expenses and other assets worth $174 million, and other non-current assets of $542 million, I also assumed 2033 changes in accounts payable of -$64 million.

In addition, taking into account 2033 income taxes payable and receivable worth $34 million, I obtained a 2033 CFO of $1293 million. Finally, with 2033 purchases of property and equipment of close to -$784 million, 2033 FCF would be $509 million.

Source: My Expectations

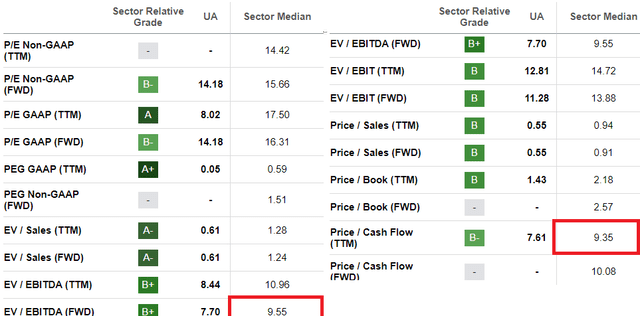

With the previous assumptions, I also took into account a WACC of 8.7% and terminal EV/FCF of 9x, which implied a total valuation including net debt of $4.53 billion. Under this case scenario, I used a WACC in line with the results obtained by other investment analysts. The sector median price/cash flow stands at 9.3x, and the sector median Ev/EBITDA is close to 9.5x. I think that my exit multiple EV/FCF of close to 9x appears conservative. The fair price would not be far from $12 per share. Under this case scenario, I expect the stock valuation to increase from $7 per share to about $12.

Source: Seeking Alpha Source: My Expectations

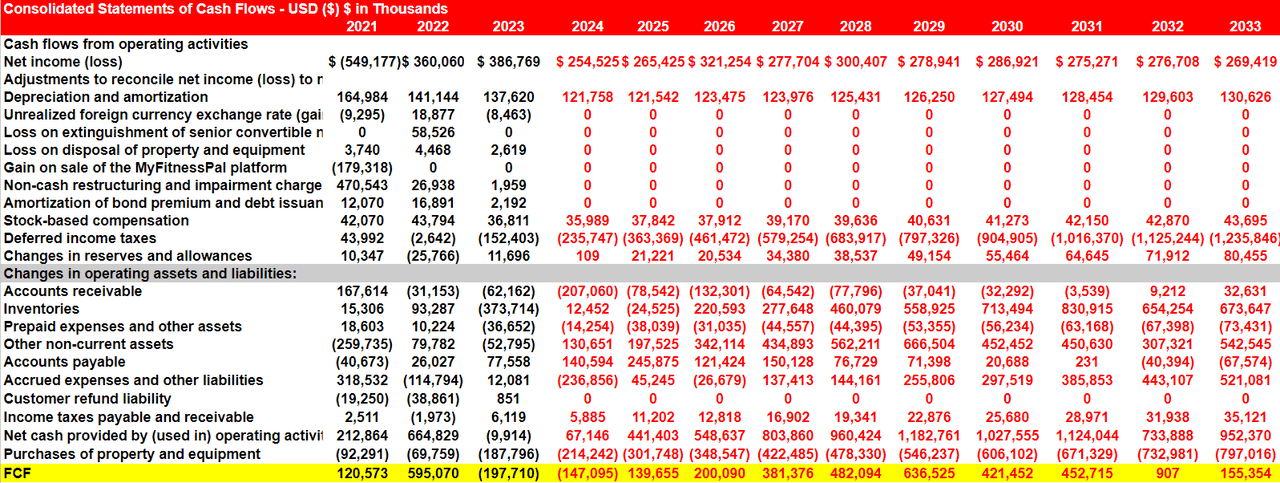

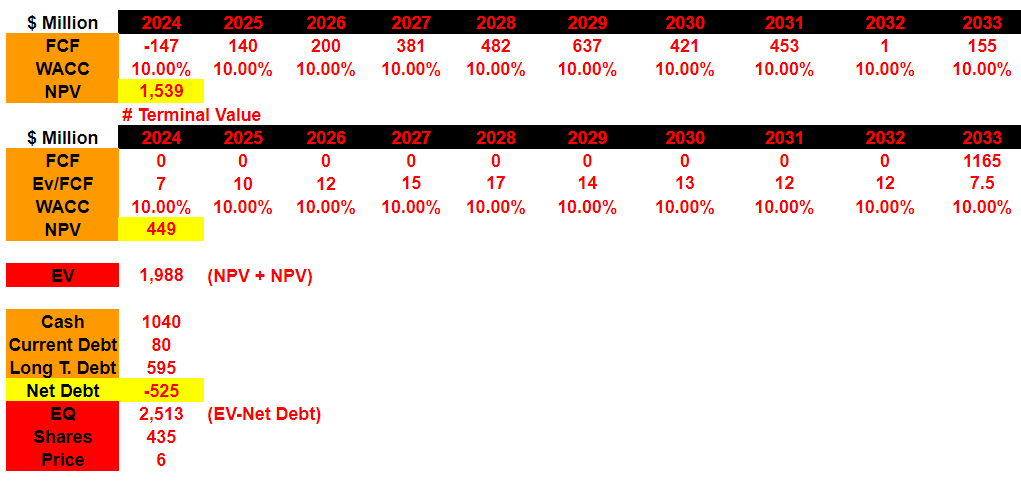

Under My Bearish Case Scenario, The Company Is Worth $6 Per Share

My bearish case scenario includes lower net income growth than in the base case scenario, and many other figures also lead to lower FCF growth. I also tried to avoid non-recurring items like losses on disposal of property and equipment or losses on extinguishment of senior convertible notes, which were set to zero in my DCF model.

My assumptions included a 2033 net income of about $269 million, which is a bit lower than that in the previous case scenario. Besides, I also assumed a 2033 D&A of $130 million and a 2033 stock-based compensation of close to $43 million.

Besides, I included the following changes in operating assets and liabilities. With changes in accounts receivable of close to $32 million, changes in inventories of about $673 million, and prepaid expenses and other assets worth -$74 million, I also assumed changes in accounts payable of -$68 million.

In addition, taking into account income taxes payable and receivable worth $35 million and 2033 CFO of $952 million, I also assumed purchases of property and equipment of -$798 million and 2033 FCF of $155 million.

Source: My Expectations

Under this case scenario, I included a WACC of 10%, which is in line with the assumptions of other analysts out there, along with an EV/2033 FCF of 7.5x, which implied a total valuation without debt of $2.5 billion. Finally, the implied stock price would be $6 per share. In the past, the company traded at 16x EBITDA, and the 5-year median Ev/FCF stood at around 24x and 14x. I think that my exit multiple EV/2033 FCF of 7.5x appears conservative.

Source: Seeking Alpha Source: Seeking Alpha Source: My Expectations

Competitors

The market for the sale of footwear and accessories for sports activity is combined between small new participants that are dedicated to a particular niche in the market and large traditional brands such as Nike, Puma, Adidas, and Reebok among others. In many cases, these large companies, in addition to being the main competitors, maintain the same manufacturing capabilities or share similar technologies with Under Armour. In addition to being essential to keep up with the fashion trends and demands of the markets, brand recognition and advertising campaigns play an important role in following all types of plans to generate belonging among consumers.

Risks

In addition to the risks inherent to high competition in the markets and regulatory frameworks for the export and import of products, in my view, it must be taken into account that the company is exposed to the volatility of fuel prices given the remoteness of its centers from distribution to the manufacturing facilities in which the products are developed. Likewise, any interruption in trade routes as well as an increase in geopolitical tensions in certain regions could translate into complications in the supply chain and price increases due to their remediation.

The company does not have its own manufacturing capabilities and outsources this part of the process, although it does market and distribute the products in the international market and domestically through its stores and direct-to-consumer electronic commerce channels. International sales occur through independent channels to which the company supplies wholesale distribution. Lack of manufacturing may not be appreciated by investors. They may believe that Under Armour may obtain less FCF margin than other competitors, which manufacture their own products.

The great concentration of these outsourced manufacturers, complications in a particular region, and changes in exchange rates for foreign trade could translate into an increase in the company’s general costs, violating the plan, which is part of its 2024 objectives.

According to the last 10-K, the production of the products sold by the company is concentrated by almost 40% in Southeast Asian countries, such as Cambodia or Vietnam. In this sense, in my view, it can be said that this production is concentrated since 10 of the 33 manufacturers associated with the company mean 60% of sales from its accessories and appearance product lines. A note was issued to market participants by professional investors about how Under Armour could suffer under Republican policy. If tariffs come back, I believe that the FCF margin may decline a bit.

Conclusion

Under Armour is currently trading at undervalued price levels, and appears to be making some changes, including the change of the CEO and changes in the Board. I expect new changes in the organization as soon as new leaders take their seats. In addition, I believe that further increases in the average selling prices of apparel, footwear, and accessories, successful strategies in direct-to-consumer channels, and e-commerce could bring soon net sales growth. Finally, I think that the recent decrease in the total amount of shares and perhaps new decreases could lead to higher stock price marks. Yes, there are risks out there from potential failed relationships with manufacturers, supply chain issues, or changes in tariffs. However, Under Armour does look quite cheap at its current price.