United Bankshares: Progress (NASDAQ:UBSI)

luminola

Over the past year, I have been taking an in-depth look at the financial sector, specifically focusing on commercial community banks. One of the biggest companies I get to analyze is a company called: United Bankshares (NASDAQ:UBSI). With a market capitalization of $4.63 billion at the time of this writing, the company isn’t exactly a giant in the banking sector. But it is by no means small. In an article I wrote in August 2023, I acknowledged that stock prices had not recovered most of the decline they suffered during the banking crisis earlier that year. But after digging deeper I realized that the stock was trading at a fairly high multiple. This leads me to rate the business a ‘Hold’ to reflect my view that the stock is unlikely to outperform the broader market in the near future.

Since then, things have gone fairly smoothly for the institution. Management reduced debt and continued to increase deposits. The company’s earnings have suffered to some extent, but the overall underlying picture shows improvement from quarter to quarter and year to year. To reward this continued fundamental growth, the market has driven up the stock price, giving shareholders a 21% upside. This is higher than the 15.7% increase seen by the S&P over the same period. Clearly, my calls for business have been wrong so far. But again, if you look closely, there’s no reason to be optimistic about future market-beating performance. Compared to similar companies, the stock price appears to be evaluated somewhat fairly. And in absolute terms, there are definitely reasons not to like the company. Because of this, I have decided to maintain a ‘Hold’ rating on the company.

I don’t spend money on this

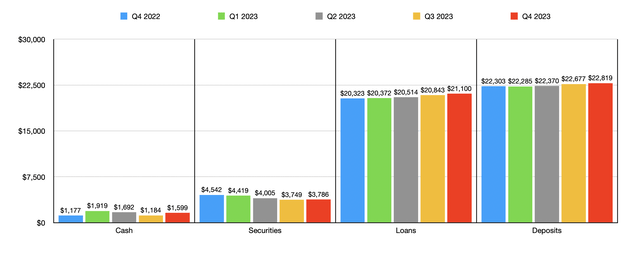

When it comes to United Bankshares, the best place to start is probably with its balance sheet data. A huge liability of any bank would be deposits on its books. Debt is usually something you don’t want to see, but growing deposits indicate that the institution itself is growing, which means the company has additional capital available to grow and generate interest income. By the end of 2023, total deposits had reached $22.82 billion. This is an increase from the $22.37 billion the company had during the second quarter of 2023, the most recently updated data available at the time I wrote my previous article. This amount is higher than the book value of $22.3 billion at the end of 2022. It is nice to see deposits increasing. Another good thing is that uninsured deposit exposure has decreased from 30% when I last wrote about the company to 28% today. As a rule of thumb, I like to see numbers below 30%. The lower the number, the better the situation. So this is great.

Author – SEC EDGAR Data

There were other areas of the institution’s growth as well. Moving to the asset side of the balance sheet, we have just under $21.1 billion in loans. This is up from the $20.51 billion the company had at the end of last year’s second quarter and compares well with the $20.32 billion the bank had at the end of 2022. This does not mean that everything has increased. This window of time. For example, the value of available-for-sale securities decreased from $4.01 billion in the second quarter of last year and $4.54 billion at the end of 2022 to $3.79 billion currently. There is a bit of a mix of cash. As of the end of the most recent quarter, the total amount was $1.6 billion. This is down from $1.69 billion two quarters ago but up from $1.18 billion reported at the end of 2022.

Author – SEC EDGAR Data

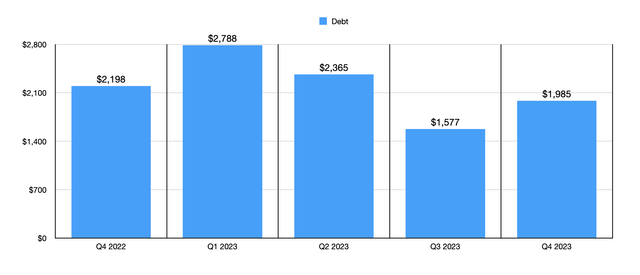

Another important metric to keep an eye on is debt. When a company takes on debt and uses its capital in that way, it can increase its cash, marketable securities, and loans. During the most feared period of the financial crisis, almost all financial institutions I analyzed at the time reduced their borrowing capacity to increase liquidity. Higher interest rates have significantly increased the institution’s total interest expense. But that was a price we thought they were willing to pay to keep cash on the books. Total debt at the end of 2022 was just under $2.2 billion. When I first wrote about the company, this figure had grown to $2.37 billion. But since then we have seen a decline. Although it is not as low as the debt of $1.58 billion at the end of the third quarter, it recorded debt of $1.99 billion at the end of last year.

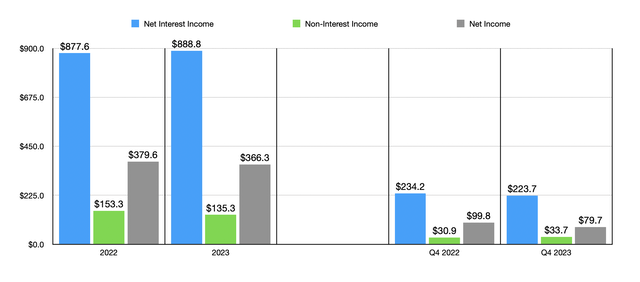

Agencies Mike’s overall growth gave the impression that the bank was growing from an income statement perspective as well. But this is not exactly true. From 2022 to 2023, net interest income increased slightly from $877.6 million to $888.8 million. This was due to a slight improvement in net interest margin from 3.50% to 3.56% and a very slight increase in average asset value. However, as the chart below shows, net interest income in the fourth quarter of 2023 was slightly lower than the same time a year ago. This was primarily a result of a decrease in net interest margin from 3.87% to 3.55%. The decline in average return on assets seems to be one of the reasons.

Author – SEC EDGAR Data

Of course, there are other things we need to pay attention to as well. The company’s biggest weakness was non-interest income. This decreased from $153.3 million in 2022 to $135.3 million in 2023. This despite a slight improvement in the fourth quarter of last year compared to the last quarter a year ago. Much of this pain was caused by the weakening housing market, which reduced revenue from mortgage banking activities from $42.7 million to $26.6 million. This was instrumental in slightly lowering net income for the year from $379.6 million to $366.3 million, with much of that decline occurring in the final quarter.

Author – SEC EDGAR Data

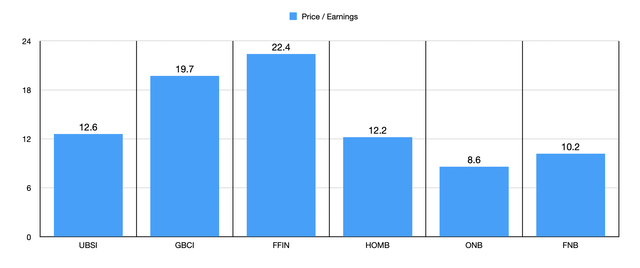

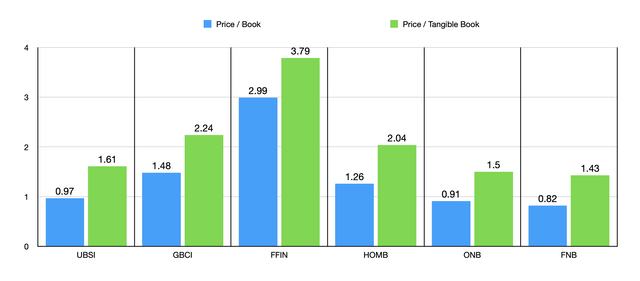

Despite the recession, the company is still generating plenty of profits. But this doesn’t make it an attractive investment. As you can see in the chart above, I used price-to-earnings multiples to compare United Bankshares to five similar companies. In this case, three out of five companies ended up being cheaper than that. I’d also like to note that the institution’s multiple of 12.6 is considerably higher than what I look for in this space. I’m generally not that interested unless a bank trades in multiples of 10 or less. Meanwhile, the chart below compares United Bankshares to the same five companies using both price-to-book and price-to-book approaches. In both cases, two out of five companies ended up cheaper than that.

Author – SEC EDGAR Data

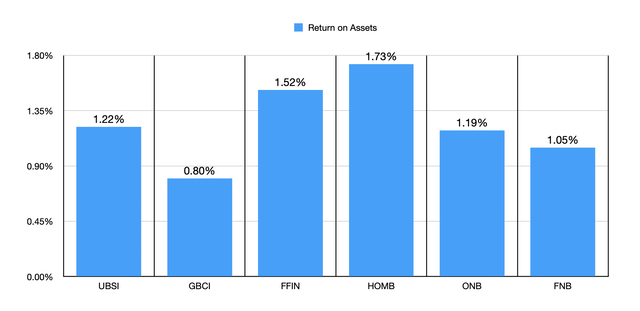

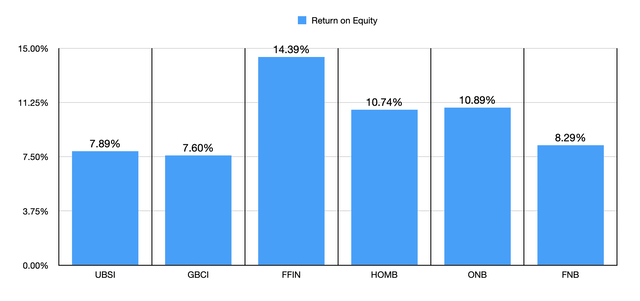

We must also pay attention to the quality of the assets we are dealing with. That’s why we decided to look at return on assets for United Bankshares as well as the same five comparable companies in the first chart below. In this case, the stock price of three of the five companies was lower than that of United Bankshares. You can also check the return on equity for each institution in the chart below. This is one area where United Bankshares thrives. Only one in five scored lower than that.

Author – SEC EDGAR Data Author – SEC EDGAR Data

takeout

From everything I can tell, United Bankshares remains a solid company and will likely perform well for itself and its investors in the coming years. But every investor is different, so I only prioritize the best opportunities. Stock prices are absolutely expensive compared to profits. And other than the return on equity, there’s nothing that sets it apart in any particular way from other companies I’ve compared it to. Taking these facts into account, we have decided to maintain a ‘Hold’ rating for now.