US government continues seizing Bitcoin and controls nearly 1% of circulating supply

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

The U.S. federal government has once again added to its sizable Bitcoin stockpile, with the seizure transferring $922 million worth of Bitcoin from wallets linked to Bitfinex hackers.

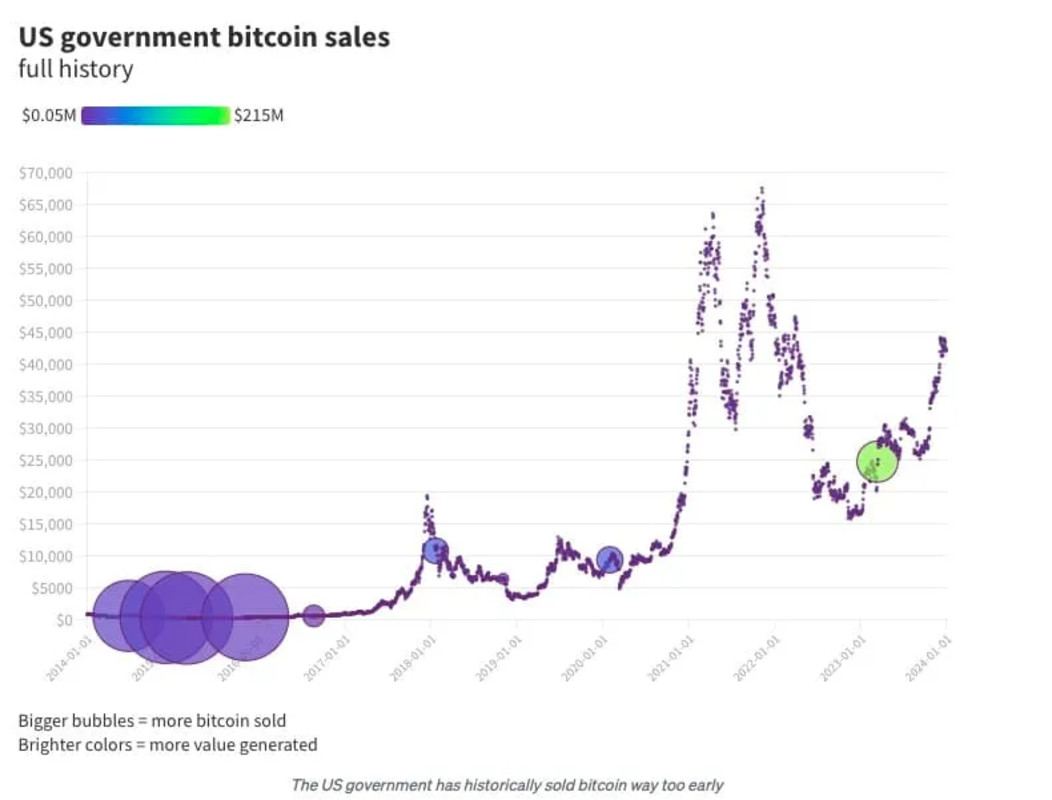

Through a series of various seizures and other asset forfeitures, the U.S. federal government has undoubtedly amassed and holds enough Bitcoin to be considered one of the biggest whales. In the early days of Bitcoin, the community’s overwhelming spirit of cryptocurrency anarchism led to a series of extralegal business ventures, most famously the Silk Road. The industry’s era of overt illegalism is almost completely over, but the success of these early ventures has amassed huge amounts of Bitcoin. This was accumulated by the U.S. government over time.

Silk Road alone has been at the center of several large-scale seizures by law enforcement, and the actual safes on site were far from the only source. Over the past few years, we’ve seen several instances of various hackers hijacking the Silk Road, seizing their assets and adding them to the federal government’s massive stockpile. Hundreds of millions of Bitcoins from these sources have already been sold through government auctions or other means, but billions still remain. Law enforcement appears to be in no hurry to wash their hands of these assets.

On February 29, inventories increased once again when the government moved more than 15,000 bitcoins from the wallets of two Bitfinex hackers. Hackers Ilya Lichtenstein and Heather “Razzlekhan” Morgan recently testified about the 2016 Bitfinex hack. The hack resulted in the theft of nearly 120,000 bitcoins, making it one of the most profitable heists in history. As one of the longest-running exchanges in the entire cryptocurrency ecosystem, Bitfinex remains a standout, but their operations still bear the scars of a theft of this scale. First of all, US citizens are completely banned from accessing the platform along with citizens of several other countries. Perhaps this is why the Justice Department has refused to say whether the government plans to reimburse Bitfinex’s 2016 customers who actually had their money stolen.

Whatever the government’s plans for this money, seizures like this have once again highlighted the enormity of the federal government’s Bitcoin reserves. Thankfully, government transactions for these assets are all a matter of public record, and Bitcoin transactions themselves are all fully transparent on the blockchain. For this reason, analysts are confident in the claim that the United States holds 200,000 Bitcoins worth about $12.1 billion. This makes it one of the largest whales, with only Binance and Satoshi holding more volume. In fact, the government currently holds almost 1% of all Bitcoin in circulation. Despite claims that prosecutors are not interested in maximizing profits when disposing of these assets, it is undeniable that the government has significant influence over the entire space.

These seizures are particularly interesting due to recent comments from exiled whistleblower Edward Snowden. In particular, considering the global acceptance of Bitcoin in regulatory and traditional finance, Snowden said, “This year it will be revealed that central governments have been purchasing Bitcoin, a modern alternative to fiat gold, without disclosing that fact.” “It will happen,” he predicted. After all, if Bitcoin is digital gold, it makes sense that powerful countries would want to increase their reserves. This strategy famously worked for Salvadoran President Nayib Bukele, who welcomed the new bull market by declaring that Salvador’s Bitcoin investment had increased 40% since his initial purchase. Of course, he doesn’t plan on selling it.

In any case, Snowden’s comments seem particularly relevant given that the United States has never actually purchased any of the Bitcoin it currently holds. Although the government has a theoretical responsibility to divest these assets, the pace is still slow and it would be very simple for Congress to stop the sale of these assets in the meantime. All it takes is a hope that policy will change, and true Bitcoin reserves could emerge overnight. This is the crux of Snowden’s specific prediction that the government will acquire Bitcoin in secret and that the government has sufficient deniability. We have no reserves. We reserve these assets to sell later. There’s nothing suspicious about it!

If a government actually wanted to secretly acquire large amounts of Bitcoin, it would face numerous transparency issues due to the trustless nature of the Bitcoin blockchain. The anonymous ‘Mr. 100” made headlines during the month of February, earning 100 BTC per day, reaching the status of the 15th largest whale. Speculation has already begun that the central government is the culprit, as chain analysts try to determine the identity of the buyer. Based on timing of purchase and many other factors, buyers are likely to be located in Asia, particularly the Middle East. Qatar, the United Arab Emirates and Saudi Arabia are all strong candidates to become the coin’s rightful owners.

This means that if the government wants to increase its Bitcoin reserves, it may be easier to seize the asset outright than to purchase it at a fair price. After all, why not save money if your transactions are recorded on the blockchain? The UK appears to be well-positioned to increase its stockpile in this way, as is the US, which seized $1.77 billion in January. Not only have these Bitcoins been confiscated from foreigners who are currently on the run with no way to recover their funds, but the UK government has since passed legislation strengthening its powers to seize or freeze cryptocurrency assets. It won’t take much time to start accumulating a treasure trove that is noteworthy in itself.

At this point, the days when Bitcoin’s core community took a rebellious attitude toward law enforcement are a long time ago. People can commit crimes around Bitcoin just like any other currency, but the fact of the matter is that Bitcoin is becoming increasingly legitimate to governments around the world. US regulators have approved a Bitcoin ETF, and other countries are falling like dominoes to approve it themselves. Eventually, it will become essential for a strong government to remain on par with its competitors and maintain its own Bitcoin reserves. After all, the United States has significant influence and controls nearly 1% of the large industry. Will we be the only country with this influence? It may be difficult for any country to secretly build up these reserves, but the race is nonetheless on. No matter who wins, ultimately first place is Bitcoin.