US Sector Relevance to China

vans photos

Fei Wang

Chinese investors tend to place a high emphasis on domestic stocks. Incorporating U.S. stocks can help Chinese investors diversify their strategies and mitigate home country bias. For example, the S&P 500® may be associated with exposure and sensitivity to: US economy. Additionally, market participants looking to offset a domestic equity bias or express a tactical view may consider the potential application of the S&P 500 Sector Index.

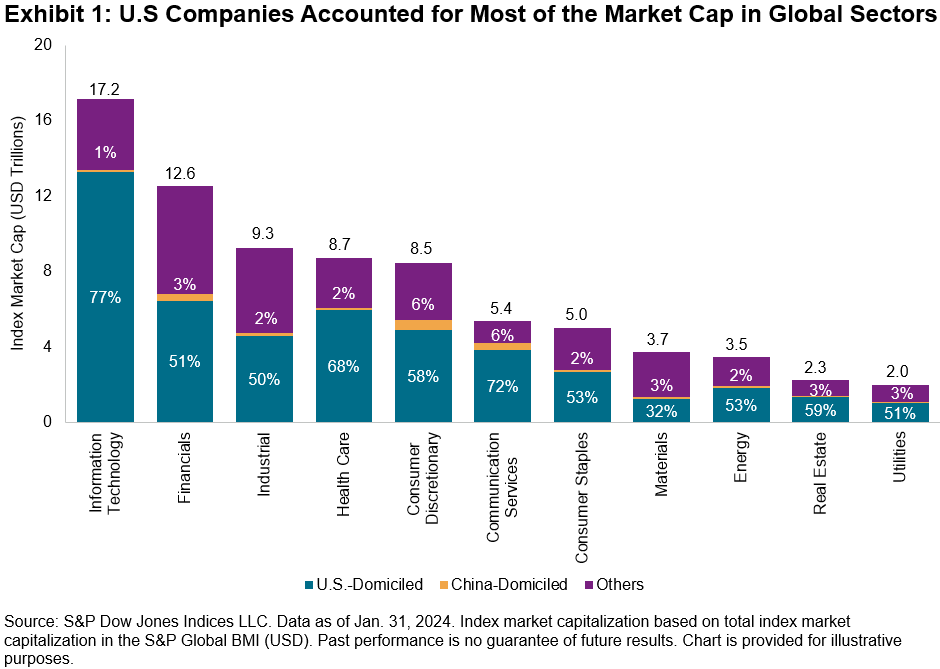

The representation of U.S. stocks in global stock markets highlights the importance of the U.S. perspective when expressing views on various sectors. Figure 1 shows the percentage of each GICS® sector represented by companies domiciled around the world. In particular, American companies accounted for most of the market capitalization in 10 of 11 global industries.

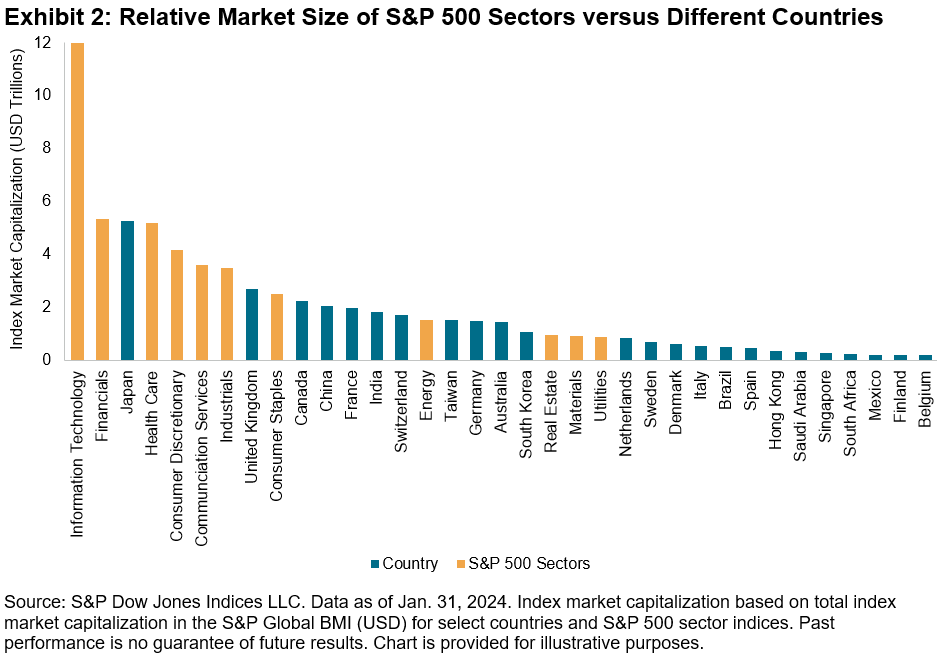

Moreover, the breadth and depth of the U.S. stock market S&P 500 sectors are similar in size to many countries. For example, as of January 31, 2024, the market capitalization of S&P 500 information technology ($12 trillion) was second only to the overall U.S. market by S&P Global BMI ($50 trillion). S&P 500 Financials and S&P 500 Health Care are similar in size to the Japanese market. U.S. Sectors The size of the sector makes it difficult to express a view through a sector lens due to market size or Capacity scaling distribution – Historically, it is about expressing views through a national lens.

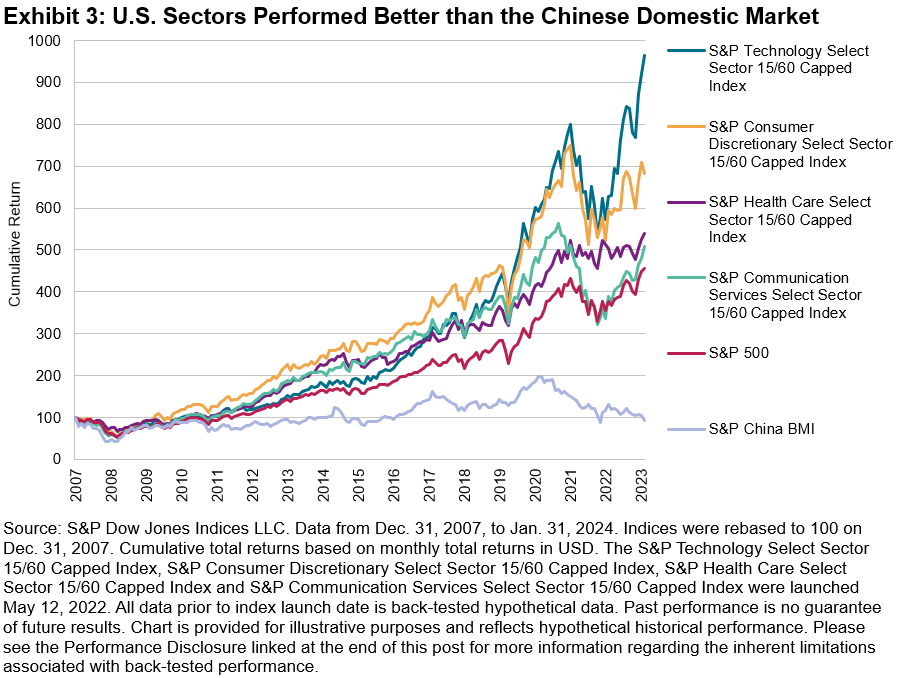

The S&P Select Sector 15/60 Capped Index measures the performance of S&P 500 companies across 11 GICS sectors while using a capping mechanism to limit the weight of the largest companies in the index. These U.S. sector indices can help Chinese investors diversify their strategies, especially when domestic markets are underperforming.

In recent years, China has been facing a variety of internal and external difficulties, with a slower-than-expected recovery from the COVID-19 crisis. However, during the same period, some sectors in the United States showed remarkable resilience and achieved significant gains. For example, the S&P Communication Services Select Sector 15/60 Capped Index, which had a larger decline than the S&P China BMI in 2022 (-34% vs. -22%, respectively), bounced back with a 42% return in 2023. S&P China BMI fell another 10%.

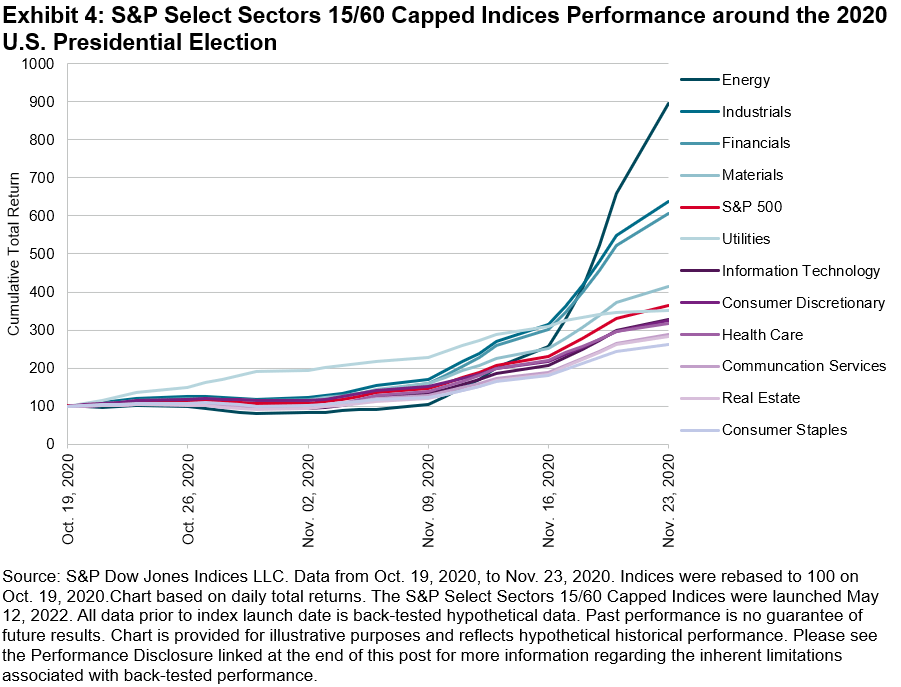

Historical evidence highlights the potential value of using sectors to express views on U.S. presidential elections, as investors often consider the expected impact of a candidate’s policies on various market segments. The 2016 election saw significant differences between the best and worst performing sectors, highlighting the potential value of expressing views through a sectoral perspective. More recently, sector performance pre- and post-2020 elections has been influenced by a number of dynamics, including the surge in oil prices, which helped boost the performance of energy companies (see Figure 4).

A new presidential election is underway ahead of the end of 2024. Given the prevailing global and US circumstances, Chinese investors may still leverage the US sector to convey their views on the potential impact of the election.

Overall, the U.S. sector represents an important market segment and may present opportunities that Chinese investors, regardless of global equity exposure or tactical strategy, may not want to overlook. The upcoming presidential election adds an additional dimension to the strategic considerations of Chinese investors by providing a platform for investors to express their views on U.S. issues.

expose: Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material was reproduced with the prior written consent of S&P DJI. For more information about S&P DJI, visit: S&P Dow Jones Indices. For full terms and conditions and disclosures, please visit: www.spdji.com/terms-of-use.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.