USOI: Crude Oil Stock Covered Calls Provide Attractive Entry for 4 Reasons (NASDAQ:USOI)

Torsten Asmus

Credit Suisse X-Links Crude Oil Stock Covered Call ETN (NASDAQ:USOI) is a unique product for investors looking to speculate on crude oil prices. This is done by buying nearby futures and selling covered. Call as described below.

The Credit Suisse Nasdaq WTI Crude Oil FLOWSTM 106 Index (the “Index”) implements a “covered call” investment strategy by maintaining a notional long position in Reference Oil Shares while selling notional call options on that position on a monthly basis. I’m going to do it. It is about 6% out of the money (i.e. 106% of the strike price). The notional net premium (if any) received on call sales is paid as a distribution at the end of each month. The index’s strategy is designed to generate monthly cash flow in exchange for giving up gains above the 106% strike price. Index strategies do not provide protection against losses due to declines. The value of the reference oil stock in excess of the notional call premium received, if applicable.

Source: USOI

The “yields” on these products tend to be high, but whether they generate total revenue depends on many other factors. Fees are modest at 0.85% per annum and investors should remember that since this is an ETN, there is some credit risk from the issuer. The notes were originally guaranteed by Credit Suisse and are now the responsibility of UBS (UBS). So, let’s leave the fund basics aside and look at what really determines whether you can make money in this fund. This is a macro. We found four reasons to be a bit optimistic about this macro perspective.

1) strip

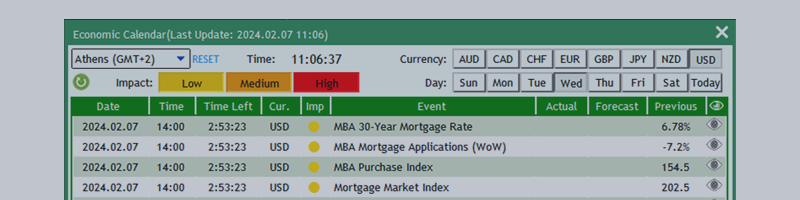

Unlike buying stocks, commodity futures constantly have to fight “rolls.” This rollover involves selling this month and buying next month or the month after (depending on the ETF or ETN rules). This causes problems when there is contango. For those unfamiliar, contango is a condition in which months further out are significantly more expensive than the month currently expiring. What you do is buy high, sell low, and repeat. Currently the strip is flat. You can see that there is very little difference between February 2024 and September 2024.

CME Group

LoL seems to be less of a problem. Current global inventory conditions mean that contango, if it occurs, will not be steep. This creates a situation where owning this product is not a money-losing setup, at least not immediately. This is reason number one.

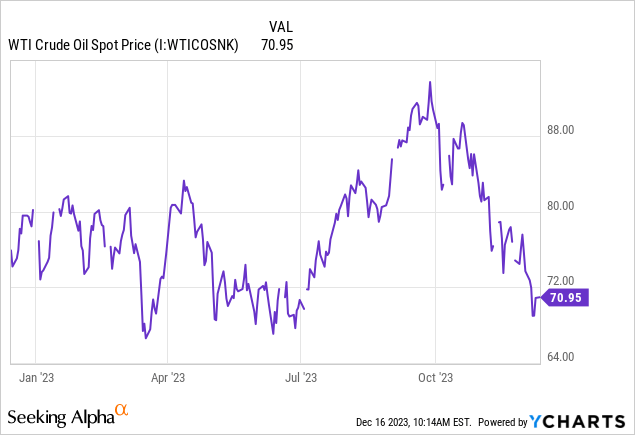

2) Cleaning with oil

It seems like yesterday that crude oil prices rebounded to $90 due to geopolitical tensions. That disappeared and commodity prices fell to $70 a barrel.

Typically, you only want to speculate on the buy side of commodities after a drop, regardless of any guaranteed call protection. Well, now we have one and it dramatically improves your odds of success.

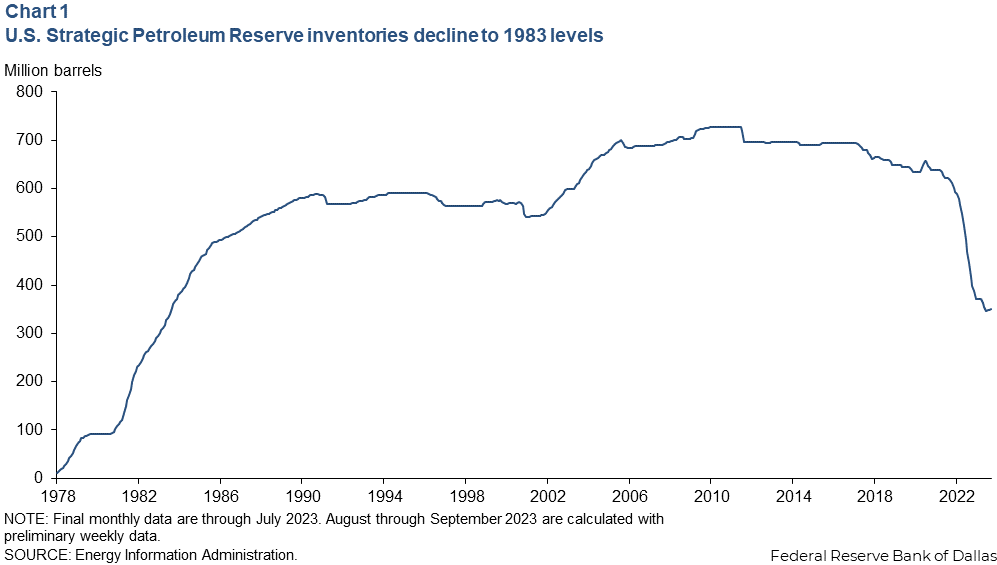

3) SPR recharge

One of the biggest news stories of 2022 was the depletion of the Strategic Petroleum Reserve. Although these leaks were heavily criticized, they prevented a major surge in oil prices.

EIA

It turns out the Biden administration contains some good oil traders, and now they’re looking to buy low what they sold high.

The Department of Energy’s Strategic Petroleum Reserve Project Management Office (SPRPMO), located at 900 Commerce Road, East, New Orleans, Louisiana, is required to purchase up to 3 million barrels of sour crude oil produced in the United States. This oil is for delivery in March 2024. You are invited to submit a proposal. You should make proposals addressing this requirement based on the information provided in the attached Request for Proposals (RFP), 89243524RCR000011. Proposal submissions will only be accepted by email. Instructions for preparing proposals are described in Part IV, Section L of the RFP and must be received by 11:00 a.m. Central Time (CT) on December 18, 2023. Offer valid until 4pm. CT, December 28, 2023. The Government may finalize the grant at any time before the offer expires under paragraph B.5. To participate in a federal procurement, potential proposers must be registered and have an active account in the award management system.

Source: Department of Energy

We think this is a progressive move and as oil prices go lower, buying will become more aggressive. This is likely to create a solid bottom near $65 per barrel, if not higher, over the next six months. So now your chances of making money are significantly higher.

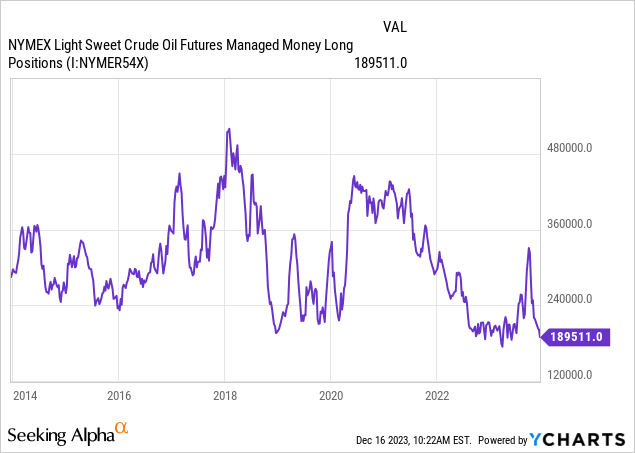

Managed Money Laundering

The final reason here is that the money management that chased higher geopolitical tensions has been abandoned and our sentiments have weakened there too. You can see the long positions below, which are below the depth of COVID-19.

verdict

Covered call ETNs are not for everyone, but based on the assets in these ETNs, I think a lot of people enjoy speculating on them. Calls involving crude losses, strip setups, and SPR purchases offer very good risk-reward setups. You also want to guess when crude oil gets hated, and at least the managed money long positions support this. We rate it a Buy and expect investors to see annualized returns of 20% (10% total) over the next six months. The real risk here is that crude oil is reflecting the wheels falling off of the global economy. But so far, other signs do not point in that direction. Even in this case, SPR fillers should limit the disadvantages.

Please note that this is not financial advice. It may look and sound like it, but surprisingly, it isn’t so. Investors should conduct their own due diligence and consult with professionals who are aware of their objectives and constraints.