Valley National Bancorp: Quality Outlook Worth Consideration (NASDAQ:VLY)

fly view production

The market capitalization at the time of this writing is $5.51 billion. Valley National Bancorp (NASDAQ:VLY) is one of the large banks that I decided to research in depth in the past. year. The agency’s revenues and profits have soared over the past few years. Looking at the 2023 fiscal year picture, there were some weaknesses. Moreover, this bank is not the cheapest prospect on the market. However, it looks strong and healthy. For value-oriented people who don’t need a deep value outlook and instead prefer high-quality operators with little risk, Valley National Bancorp certainly qualifies for consideration in my book.

A solid bank worth a look

According to the management team At Valley National Bancorp. It works like this: It is a bank holding company and financial holding company founded in 1927. Through its banking subsidiaries, the company offers a wide range of banking solutions to its customers, including players in the commercial space, private banking, retail, insurance, etc. . We also offer wealth management financial services products. Examples of services offered include, but are not limited to, deposit and loan products, commercial real estate financing, asset-based lending, small business lending, home equity loans and home equity lines of credit, and automobile financing. , and more.

The organization makes all this possible through its 230 operating branches. Of these, 55% are located in New Jersey. Another 18% are in New York, and an additional 18% are in Florida. The remaining 9% is then divided between Alabama, California, and Illinois. What this tells me is that Valley National Bancorp is exposed to every major economic center in the United States, with the exception of Connecticut and Texas. At the same time, we are also entering smaller markets such as Illinois.

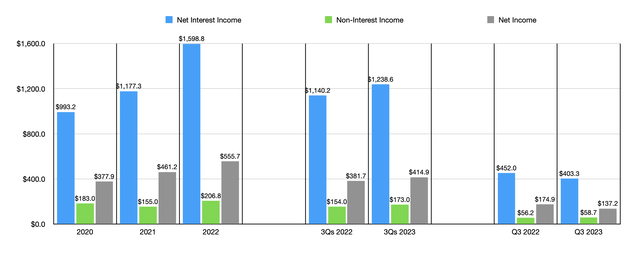

Author – SEC EDGAR Data

In recent years, Valley National Bancorp has achieved significant growth. From 2020 to 2022, the institution’s net interest income increased from $993.2 million to just under $1.6 billion. Non-interest income increased from $183 million to $206.8 million over the same period. And thanks to increases in these two metrics, net income increased from $377.9 million to $555.7 million. For fiscal year 2023, data for the first nine months shows continued growth. Net interest income was $1.24 billion, compared to $1.14 billion reported a year ago. Non-interest income increased from $154 million to $173 million. And net income increased from $381.7 million to $414.9 million.

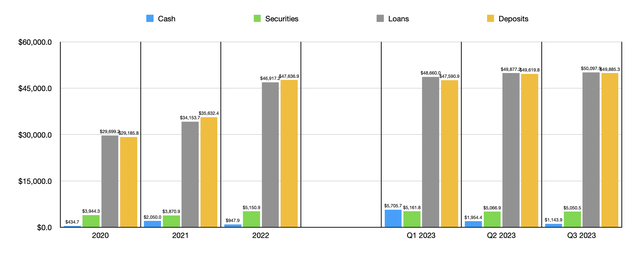

Author – SEC EDGAR Data

This increase was only possible by increasing the institution’s balance sheet. The bank’s loan value increased significantly from $29.7 billion in 2020 to $46.92 billion in 2022. Loans continued to grow throughout fiscal 2023, reaching an all-time high of $50.1 billion in the third quarter. We understand that many investors are currently concerned about their office real estate exposure. As of the end of the most recent quarter, approximately $3.2 billion, or 6.4%, of the company’s loan exposure was in office properties. Honestly, it’s not bad. Between 2020 and 2022, the value of investment securities increased from $3.94 billion to $5.15 billion. But since then, that particular asset has been stagnant. Today, that number stands at about $5.05 billion.

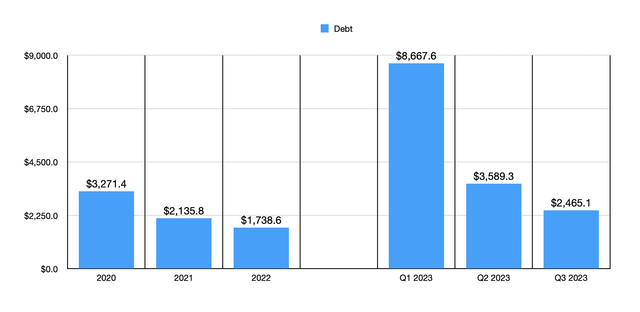

Meanwhile, cash was all over the map, as you can see in the chart above. This is likely related to management’s decision to take on additional debt. For example, from the end of last year to the end of the first quarter, the bank’s debt exploded from $1.74 billion to $8.67 billion. This increased cash from $947.9 million to $5.71 billion. This makes a lot of sense, considering that the period we are talking about involves a banking crisis that began in early 2023. Many banks do not require that money to prove that you are financially stable. Of course, the debt has been decreasing since then. As its cash decreased to $1.14 billion, its liabilities also decreased to $2.47 billion.

Author – SEC EDGAR Data

The increase in loans and investment securities was only possible due to the increase in deposits. In 2020, Valley National Bancorp had $29.19 billion in deposits on its books. By 2022, this amount has increased to $47.64 billion. There was a slight decrease in the first quarter of 2023, reaching $46 million. But it was short. As of the end of the third quarter, deposits reached an all-time high of $49.89 billion.

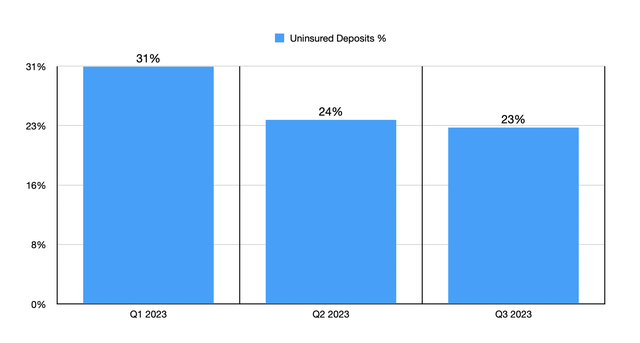

Author – SEC EDGAR Data

We were unable to find data on uninsured deposit exposure at the end of 2022. However, we understand that it has decreased from 31% of the company’s deposits from the end of the first quarter to the end of the third quarter of 2023. 23% are classified as uninsured. It would be nice if this number were lower, but I have always said that the benchmark for a healthy organ should be less than 30% exposure. So Valley National Bancorp gets a passing grade on this one.

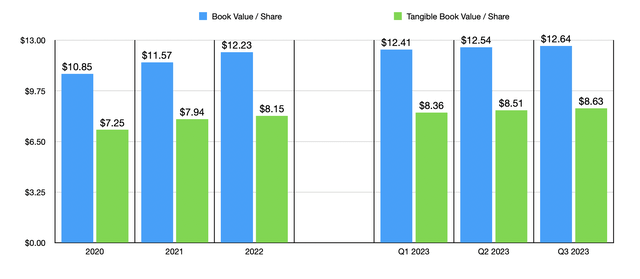

Author – SEC EDGAR Data

The final metric we’ll cover is book value per share. As you can see in the chart above, both the institution’s book value per share and its tangible book value per share have steadily increased. Even in times of crisis, the company has demonstrated its ability to grow in this respect. It’s really nice to see. Now, in terms of the company’s valuation, it is worth noting that the stock is trading at 85.9% of its book value. Meanwhile, the company is trading at a 25.8% premium to its tangible book value. I have seen some banks both trading at discounted prices over the past year. However, compared to the size of the institution and many others I have seen, this seems perfectly respectable.

Another way to value a company is in relation to its revenue. If you rely on 2022 earnings, Valley National Bancorp’s stock is trading at an earnings multiple of 9.9. Annualized fiscal 2023 financial results are expected to result in net income of approximately $604 million. This implies a slightly lower price compared to the earnings multiple of 9.1. Both are lower than the 10.4 average I’ve seen in the market. However, other banks I looked at had price-to-earnings multiples of around 6 or less and were somewhat attractive.

takeout

Based on all the data provided, we think Valley National Bancorp is a solid institution. It’s definitely not a play that can generate huge upside. But I think it could potentially deliver good market-beating returns. Uninsured deposit exposure is robust and the institution has a good track record of growth in both deposits and loans. All other profitability and balance sheet metrics also look good. Given all these factors, I have no problem rating the bank a “buy” at the moment.