Veeva Systems: Price Still Attractive Given Growth Expectations (NYSE:VEEV)

sanjeri/E+ via Getty Images

investment thesis

Viva Systems Co., Ltd. (New York Stock Exchange: VEEV) helps streamline processes, improve collaboration, and ensure compliance with industry regulations.

The business is well established and is once again showing attractive growth. Moreover, I insist on paying 32 times as much. Veeva’s future non-GAAP operating profit pricing is attractive.

Simply put, with more than 10% of its market capitalization comprised of cash and no debt, we believe Veeva’s $231 per share over the next 12 months will look like a bargain. Here’s why:

A quick summary

Last January I wrote an optimistic article.

The stock is flawless. First of all, there’s an important question about sustainable future earnings growth rates.

Additionally, Veeva’s non-GAAP operating margins have contracted over the past three quarters.

Notwithstanding these considerations, I declare that Investors will likely look back at $175 per share as an attractive entry point over the next 12 months (but only in hindsight).

Author’s work on VEEV

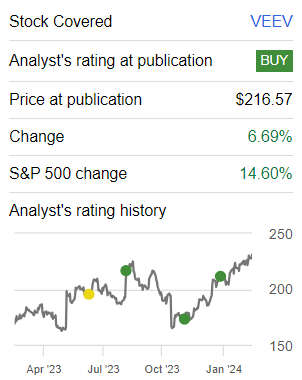

In retrospect, I was right to go from neutral to bullish on VEEV. But the timing was not good. Additionally, since I’ve been bullish on this stock, it’s up 7% compared to the S&P 500 (SP500), which is up 15%. For my part, it’s been a significant underperformance.

This reminds us that it is important to be patient and stick to your original views, even if it sometimes takes time for others to accept them. This is why I remain bullish on Veeva stock.

Why Viva? Why now?

Veeva provides cloud-based software solutions specifically tailored for the life sciences industry. These platforms help pharmaceutical and healthcare companies manage critical aspects of their business, including drug development and regulatory compliance.

Veeva’s fourth quarter fiscal 2024 results exceeded guidance with total revenue of $631 million, reflecting a resilient trajectory amid prevailing macroeconomic challenges. Of particular note is Veeva’s continued growth in its Development Cloud, which serves as a pivotal technology foundation for drug development. With its comprehensive suite of connected applications and growing customer base, Veeva is positioned to capitalize on the increasing complexity of clinical trials.

Additionally, Veeva’s focus on clinical operations and data management highlights Veeva’s commitment to increasing clinical trial efficiency while reducing costs. The significant adoption of Veeva solutions by leading biopharmaceutical companies, along with the expansion of regulatory and quality services, highlights Veeva’s evolving role as a leader in the life sciences software market.

Additionally, with the introduction of Veeva Data Cloud’s Compass Suite, Veeva is working to transform the commercial data market by providing an innovative alternative to incumbents such as IQVIA (IQV).

But Veeva also faces headwinds. One notable challenge is converting large customers to Vault CRM. Veeva’s efforts to facilitate this transition emphasize its commitment to customer satisfaction, but the process involves significant investments in migration efforts, potentially impacting profitability.

With this background in mind, let us now discuss the basics.

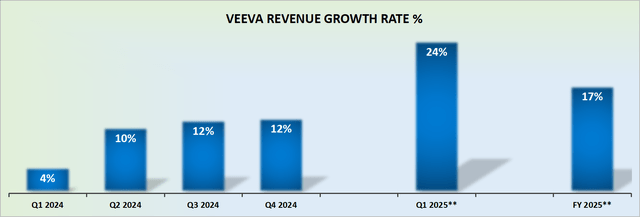

Sales growth is expected to achieve a CAGR of 17%.

VEEV Revenue Growth Rate

For the current year, Veeva’s fiscal 2025 revenue is expected to grow at a compound annual growth rate (CAGR) of 17%. Given that we are still early in the year, there may not be room for another 100 basis points of growth at some point.

However, to avoid mistakes on my part, I assumed that a CAGR of 17% would be sufficient. Needless to say, these growth rates are high due to unusually low revenue growth in fiscal 2024, considering the contract adjustments that have occurred.

As a result, the big question is what kind of growth rate investors should expect in fiscal 2026. As Veeva’s operations return to normal?

I think Veeva’s valuation today is attractive if investors can achieve a CAGR of 12% or more at the top end. And that’s where we’re headed next.

VEEV Stock Valuation – 32x Non-GAAP Operating Income

Veeva’s guidance showed non-GAAP operating income of $1.1 billion, up more than 30% from $843 million a year earlier.

Naturally, investors shouldn’t expect Veeva’s bottom-line profitability to continue to outpace top-line growth at such a rapid pace in the future.

That said, we believe there is room for Veeva to increase its non-GAAP operating income by approximately 25% year-over-year in fiscal 2026 (next year) as Veeva continues to expand and become more efficient.

On the other hand, this would result in Veeva’s non-GAAP operating margin of 43%, which we believe should be close to fully leveraging all the efficiencies and profitability of this business.

Taking all of this into account, we think paying 32 times non-GAAP operating income is reasonable. This is the price of a large, well-established and growing life sciences platform.

conclusion

I believe Veeva Systems is an attractive investment because of its role in streamlining processes and ensuring regulatory compliance within the life sciences industry.

Despite concerns about sustainable revenue growth, Veeva’s fourth quarter fiscal 2024 results exceeded expectations, reflecting resilience amid macroeconomic challenges.

With a focus on Development Cloud and the introduction of Veeva Data Cloud’s Compass Suite, Veeva is poised for continued growth.

Therefore, Veeva’s projected revenue growth rate and non-GAAP operating profit valuation of 32x represent an attractive investment opportunity.