Veeva Systems Stock: Strong Reasons To Buy And Hold The Shares (NYSE:VEEV)

JHVEPhoto

I rate Veeva Systems (NYSE:VEEV) as a buy as the company is performing as expected while showing new milestones and demonstrating excellent management execution to keep offering new added-value software and cloud services that support the company in strengthening its competitive advantages. In my last article about Veeva in December 2023, its stock was trading at $190 per share, while now the stock price is trading at around $200 after peaking at $234 per share. I developed my bullish case, stating that there was a recovery in the perception of the macroeconomic environment, particularly speaking about a possible stop in the interest rate hikes by the Fed for 2024, and that that scenario could improve Veeva’s customer expectations in the near future, so they might be more keen to spend more on Veeva’s products. However, there is some uncertainty as it seems that the FED could decide not to reduce the interest rates for a longer period, so Veeva’s stock price is returning to attractive levels again. In this article, I will supply new information that reinforces my bullish case for Veeva as a long-term holding. In addition, I will offer my intrinsic value, considering the information about the last results of FY 2024.

Context

The revenue growth for FY 2024 was 9.7% YoY, and the EPS growth was 7.3% YoY, which exceeded analysts’ expectations by 3.2%. Revenue growth in FY 2023 and FY 2022 was 16% and 26%, respectively, so it’s clear that Veeva experienced a deceleration as a result of factors more associated with a deceleration of the demand of the healthcare industry in the last 2 years.

Veeva’s business model has demonstrated resiliency even in a hard scenario with uncertainties related to the FED’s policy and the pessimistic view of Veeva’s customers with respect to the foreseen future; nevertheless, this perception of the different players in the healthcare industry is changing gradually. Some weeks ago, Veeva stock dropped 7% in one day because its Chief Financial Officer, Brent Bowman, stepped down from his role. Apparently, Mr. Bowman gave much confidence to the market, so the fact that he is leaving concerns some investors as it’s unknown who will replace him in that critical position.

In my view, this is just noise, as the critical part of my thesis with respect to Veeva’s future is Peter Gassner being the founder, who holds an important stake in the company—51.5% of the total voting power. I talked about how important Peter Gassner is for Veeva in a previous article written in 2022; thus, he has the highest incentives to find a suitable profile for the position left by Bowman. The additional drop in the stock price apparently responds to macroeconomic uncertainties; however, the business model is strong, as I will show in the article.

R&D solutions are one of the key factors for future growth, combined with the Veeva Vault CRM migration

As we know, Veeva offers two big groups of software: i) commercial solutions, and ii) R&D solutions. I think that the most value generated is in R&D solutions, which has increased its participation in overall revenue from 43% in FY 2022 to 50% in FY 2024, adding to the fact that this is the segment with the highest growth in the last few years, with a growth of 27% in FY 2023 YoY and 14.5% in FY 2024 YoY.

I think that the R&D solutions are where Veeva can reinforce its leadership and competitive advantages over the long haul. In the last quarter of FY 2024, Veeva has won 2 new enterprises as customers from the top 20 pharmaceutical companies for its EDC software (electronic data capture) for advanced clinical studies; in the entire year, there were 8 wins for EDC.

This EDC product belongs to Veeva’s Clinical Data group of software; indeed, apart from EDC, there are other software that add value to clinical data, such as CDB (Clinical Data Base), RSTM (Randomization and Trial Supply Management), ePRO (Patient Reported Outcome), and eClinRO (Clinician Reported Outcomes). As you can imagine, if one client buys one of those products, it’s highly likely that the same client might end up buying the rest of the software to build up an ecosystem that integrates all these software that assess this critical area of interest.

On the other hand, Veeva is advancing well in its migration plans to Veeva Vault CRM, a topic well covered in my previous articles. There are already three top 20 pharmaceutical companies that have been migrated to Vault CRM, which will give Veeva the opportunity to offer a better integrated solution with sales, marketing, and medical, all in the same database. The management is now in deep conversations with the other Top 20s to keep going with the process of migration to Vault CRM.

In an article written in December 2022, I mentioned:

Veeva has a contract to use Salesforce’s platform that ends in September 2025, and a five-year winding down period during which Veeva might continue using the Salesforce platform combined with some of Veeva’s solutions to its customers. Nevertheless, during this five-year period there would be limitations on additional subscriptions Veeva can sell to its existing clients.

So, Veeva is advancing well in this process, which would enable it to not only depend on the Salesforce CRM platform from which 30% of Veeva’s total revenue is generated but also to offer new add-on products such as marketing automation and service centers to Veeva’s clients in Veeva Vault CRM.

SMB segment: a long-term opportunity, not now.

In my previous article written in September 2023, I mentioned that the SMB segment of the market was a great opportunity ahead, particularly because some analysts thought that the segment of the top 50 pharmaceutical companies was a bit saturated. However, it was not easy for Veeva to attack the SMB segment more aggressively, as those small biotech companies were experiencing difficulties given the uncertainty caused by the macroheadwinds, which were impacting the funding environment for these companies.

That was confirmed by the management in the last call for FY2024, so probably we might see a better scenario for the SMB segment when the interest rates are reduced. As Peter Gassner pointed out:

The emerging biotechs, the small center of the segment is still a tough sliding there. This year, we saw a record number of companies get acquired and go out of business. And a small number of new companies were able to get escape velocity because of the funding environment, it’s tough, and it continues to be tough. And you never know when it turns around until it turns around, all you know is that it hasn’t turned around yet.

The SMB segment represents an interesting long-term opportunity, but now the sector that is supporting Veeva’s revenue growth is that of the Top 50 pharmaceutical companies, as Veeva is tackling new areas while penetrating deeper into those areas, creating an ecosystem. One example is the Veeva Compass suit, which is a collection of software that delivers industry data to accelerate the launch of different products from pharmaceutical companies.

As such, Compass Prescriber and Compass National were launched in January 2024; both products supplement Compass Patient. These products can do things that were not possible before, offering very valuable data, so early adopters are assessing how they can use that data to their own advantage. Most of the early adopters need to build some kind of infrastructure around these new Veeva’s products, and that takes time. As such, I can imagine a gradual adoption of the innovative products that are not offered by any other competitor.

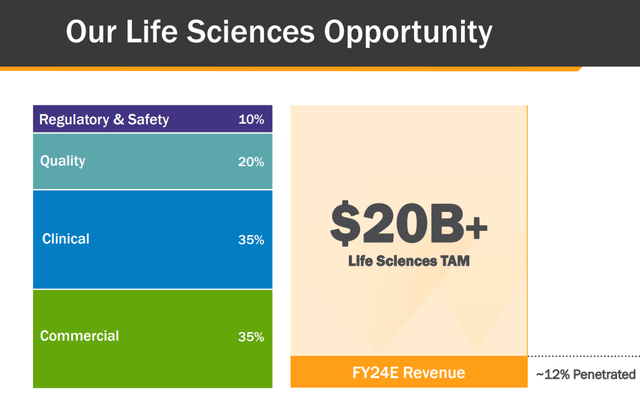

Let me remind you that Veeva has a TAM of $20 billion with only 12% penetration:

Veeva’s presentation January 2024

As Veeva keeps developing new products and software, TAM might be expanded in the next few years, just like TAM was $13 billion in 2022. That’s why I consider Veeva an excellent long-term bet.

Veeva knows how to be protected from competitors, even if they are Google and Microsoft, with their AI advances

IQVIA (IQV) is one of Veeva’s main competitors in the healthcare industry, but if you’ve read my previous articles, you will notice that I provided evidence that Veeva’s business model has a better quality than IQVIA’s, showing better financial and operating metrics associated with capital returns, better margins, and less financial leverage. All in all, Veeva is way more innovative than IQVIA, launching more innovative products at a faster pace, which contributes substantially to enjoying better financial metrics.

On the other hand, companies like Microsoft (MSFT) and Alphabet (GOOG) are leading the race for AI, but even with that advantage, both companies face “the wall of specialization” in the healthcare industry. For instance, Alphabet is trying to get into the clinical trials process while expecting that its cloud vertex AI, or Med-PaLM 2, could be useful in a way for big pharmaceutical companies.

Both products were not particularly designed for the healthcare industry; as such, pharmaceutical companies need to adapt those products to their own particular needs. While exploring Microsoft and Google’s products in the healthcare industry, I noticed that the scope to use generative AI is very limited, as neither of them is offering a wide range of products that cover several critical areas for pharmaceutical companies.

This is understandable as both companies are not specialized in this sector, so they need to offer some products that cover a limited number of areas, such as compliance, workflows, etc., where generative AI can be used effectively. On the other hand, customers need to do a lot of coding over time in order to adapt those products to their particular needs, and even when, at the beginning, that coding does not represent a real obstacle, it could represent a real headache over the long term.

Conversely, Veeva is tackling the AI challenge in a completely different way: to accumulate critical data in many critical areas over time that are not covered by competitors. The generative AI is useless without the data, and even worse, if the data is not of high quality.

In the last call for FY 2024, Peter Gassner talked about how critical the data is for AI developments and that Veeva has the upper hand:

And then as far as our rule, we’ve been doing some really heavy work over the last two years on something in our Vault platform that’s called the Direct Data API. And that’s a pretty revolutionary way of making the data come out of fault in a consistent — transactionally consistent manner much, much faster, roughly 100 times faster than it happens now. That’s going to be critical for all kinds of AI applications on the top, which we may develop, which our customers may develop, and we’re also utilizing that from some really fast system to system transfer between our different Vault family. So that’s been the biggest thing that we’ve done. We haven’t really invested heavily in large language models. So far, we just don’t see quite the application in our application areas, not to say that, that wouldn’t change in the future. I would, I guess, I would say we’re in a pretty good position because AI really — the durable thing about AI is the data sources, the data sources. The AI models will come on top, and that will be largely a tech commodity, but the control and the access to the data sources, that’s pretty important, and that’s kind of where Veeva plays.

So, we can see that Peter Gassner is taking a smart approach to focusing on the most important factor behind any AI development: the data. As Veeva is working to develop more areas deeply in three big areas, such as the development cloud, the commercial cloud, and the data cloud, the way to use generative AI is more uncertain, so Veeva is constructing data with its current products and new ones to offer a suitable platform of high-quality data that could be used in the future for more advanced generative AI models developed by customers or third parties.

As I pointed out in my previous articles, the main advantage of Veeva is that the company has the ability to launch more new products and software faster than competitors in very critical areas such as clinical data, clinical operations, regulatory, etc.; those software can be integrated to offer a way better value for customers than owning disconnected software in different areas from different providers.

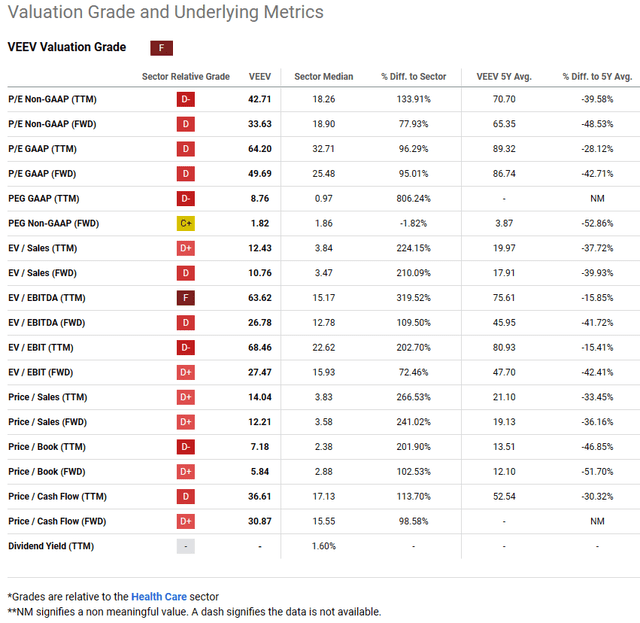

Valuation

According to Seeking Alpha, Veeva appears to be expensive in almost every metric; however, we need to consider that all these metrics are compared with companies that belong to the healthcare industry, but the great majority of them are outside the very niche segment of Veeva and they do not have the same quality, so we will need to use another method to calculate the intrinsic value of the company.

Seeking Alpha

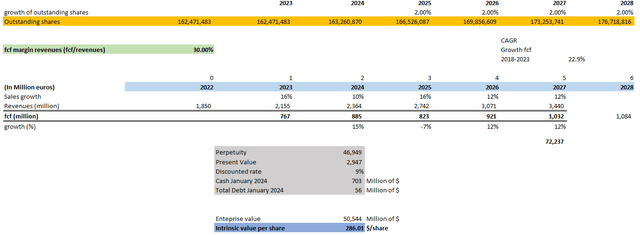

I will use the discounted cash flow (DCF) method, so I will adjust certain assumptions from my previous article:

- Outstanding shares: 163,260,870 (2% annual growth of outstanding shares due to stock-based compensations).

- FCF margins: 30% (the average of the last 6 years was 37%)

- Revenue growth: 16% for FY2025 (aligned with what the management said in the last call and confirming its target of at least $2.7 billion in revenues for 2025).

- Revenue growth for 2026 and 2027: 12% annually (consensus)

- Cash as of January 2024: $703 million.

- Debt as of January 2024: $56 million.

- Discounted rate: 9%.

- FCF growth in perpetuity: 7.5% annual (CAGR FCF growth from 2018 to 2023: 22.9%).

Author

To find the perpetuity, we used the formula:

Perpetuity = FCF 2028/(discounted rate – g).

where g = FCF growth in perpetuity, which was assumed to be 7.5% annual.

With perpetuity, we calculate the present value of all the FCFs beyond 2027. Then, we calculate the enterprise value using the following:

Enterprise Value = Present Value of FCF (from 2024 to 2027) + Perpetuity + Cash – Total Debt.

Finally, the intrinsic value is calculated by taking the enterprise value and dividing it by the outstanding number of shares; I am taking the outstanding number of shares of 2027 projected to incorporate a certain dilution. In this way, we could get $286 per share under the assumptions presented. I like to see how Veeva was able to keep its FCF margins in the last 6 years, which is one of the sources of value for Veeva’s intrinsic value. In fact, Peter Gassner made the following comment in the last call for FY 2024:

That was a concept we call lean teams. Not doing layoffs, but we want lean teams. We want the smallest teams possible with high-performance people that could perform well together. So this kind of discipline that’s why our margins are increasing. And I think you’ll see that from us increasing margins over time.

So, an explanation for these higher FCF margins not only comes from Veeva’s pricing power but also from cutting costs and avoiding repeating mistakes, which is related to the fact that the organization is structured to be more efficient.

Furthermore, the growth of FCF was 15% in FY 2024 YoY, so I am assuming that there would be a growth of FCF of around 7.5% on average for the long haul, which might push up the intrinsic value to $286 per share. One of the key assumptions is a buy-and-hold strategy while accumulating shares at current prices regardless of stock volatility in the short term.

Risk

Veeva has been in the process of litigation with IQVIA (IQV) since 2017 due to assertions of infringing intellectual property rights by Veeva. There are counterclaims and countersuits from Veeva that might significantly reduce any claim or suit from IQVIA. We’ll need to follow up on this litigation since it’s unclear when the final results will be, but we expect that whatever the result, it will not materially affect Veeva’s growth prospects.

I was reading about Veeva’s position and IQVIA’s position with respect to the lawsuit, and without getting into the details, you will notice that Veeva is taking a more open approach to this problem, offering IQVIA the possibility to get access to some of Veeva’s products since it is expected that some clients are using both brands.

In Veeva’s view, IQVIA was using anti-competitive practices that apparently were harming the industry. Conversely, IQVIA is claiming infringing intellectual property rights from Veeva while being less open to working with her. Probably, you might think that both positions are understandable, and it’s hard to determine which of them is acting in bad faith to gain a competitive advantage.

I’ve found two pieces of evidence that make me feel more confident about Veeva’s position in the lawsuit. First, the financial metrics of Veeva are way better than those of IQVIA. Specifically speaking of the FCF margins and revenue growth in the last 5 years, Veeva has achieved an average of more than 30% of FCF margins and a double-digit annual revenue growth of between 10 and 30% in the last 5 years. Adding to the fact that Veeva has very low debt levels,.

Conversely, IQVIA barely generated 10% of FCF margins and a single-digit annual revenue growth most of the last 5 years. Adding that, IQVIA needed way higher debt levels than Veeva’s, around 100x Veeva’s debt levels, taking the ratio of total debt to net income. As such, those results indicate that Veeva is growing faster over the years while offering high-quality products that reinforce its power pricing, threatening IQVIA’s market position.

Secondly, in July 2023, the Federal Trade Commission (FTC) blocked a deal that would give IQVIA a market-leading position in ads for healthcare products such as prescription drugs to doctors and other professionals. In this sense, it seems like IQVIA was trying to make desperate moves to protect its market position given Veeva’s more aggressive approach to gaining market share, which is something that I discussed in my previous article when I mentioned that Veeva is launching new high-quality products faster to the market than IQVIA, covering the main areas demanded by the top pharmaceutical companies.

The aforesaid two points give me confidence that Veeva has a more solid case to be protected from the results of that lawsuit, whose jury trial date is in 2024.

Final Thoughts

In this article, I provided more information that explains why I like Veeva’s approach to tackle new areas and organizational culture to launch more innovative products that truly add value to its customers than its main peers; the management has a very long-term vision and skin in the game. Furthermore, Veeva seems to have the right approach for future AI developments in the healthcare industry.

I think that a long-term investor can take advantage of the drop in the stock price, which seems to be more associated with factors related to macro headwinds than intrinsic factors associated with the company. My strategy is to buy excellent businesses and accumulate shares as the price keeps dropping below a certain point, and it seems that the current stock price is a good start.

Some people get confused about stocks with high multiples, and sometimes those multiples do not indicate the stock is expensive at all. The strong market position and the long-term predictability of the business model might make a stock with a high PER undervalued, taking the DCF approach, and Veeva could be one example.

In my opinion, if your strategy is to hold the stock for the long term, beyond five years, the long-term drivers will end up boosting Veeva’s market capitalization. As such, holding the stock for two or three years is not an adequate strategy, since we’re not giving the market much time to incorporate all of its long-term drivers into the stock price.

I am writing about Veeva regularly, adding more and more relevant information to each new article in order to assess the company’s performance and adjust our intrinsic value in case I see some important changes in my assumptions.