Verizon Stock: Earnings, Subscriber Growth, Media Loss, And Revenue Declines (NYSE:VZ)

Bloomberg/Bloomberg via Getty Images

Investment Thesis

Verizon (NYSE:VZ) has had a tough FY23 and Q4 as the telecommunications giant has struggled to turn subscriber growth into revenue or income expansion.

A softening consumer has resulted in wireless equipment revenues falling YoY all the while service revenues remain essentially flatline.

The closing of the AOL and Yahoo divestitures should allow Verizon to focus more on their core telecommunications business which hopefully will yield margin expansion in the coming years.

Nevertheless, the recent rally in shares since late 2023 has left Verizon shares trading at around a 22% undervaluation given a base-case earnings scenario for 2024.

Given that the firm is only expecting around 2% revenue growth in the coming year, I find the current undervaluation to provide an insufficient margin of safety should a recessionary outlook manifest for the year.

From my previous Strong Buy recommendation, shares have appreciated a great 29% compared to the S&P 500’s change of only 14.5%.

Therefore, I downgrade my rating for Verizon to a Hold at the present time.

Company Background

Verizon is an American telecommunications company that offers a wide range of network connectivity products to both consumer-grade and enterprise-level customers alike. The firm has grown to become the world’s largest provider of wireless, fiber optics, and global information network services.

The firm’s primary business relies on the provision of wireless network services through cell phones and network contracts. Verizon also operates a smaller fixed-line business that provides broadband to around 10 million customers.

Verizon operates within the highly competitive and increasingly consolidated telecommunications business and is by far the largest player in the industry.

While key rivals AT&T (T) and T-Mobile (TMUS) are much smaller than Verizon, a mostly rational pricing model has emerged between players with little price competition occurring between firms.

Earnings Analysis – Q4 & Full Year 2023

I conducted an in-depth analysis of Verizon’s economic moat and financial profile just a few months ago in late 2023.

I highly recommend reading this article to gain a deeper understanding of how Verizon generates its profits and to better understand the firm as an investment opportunity.

In this update, I’d like to break down the firm’s recent Q4 and full-year 2023 results which generated a mixed bag of data for investors to consider.

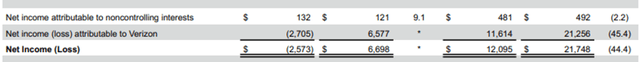

Verizon reported a net loss of $2.6 billion in Q4 2023, compared to a net income of $6.7 billion in Q4 2022.

This was mainly due to a $7.8 billion non-cash impairment charge related to its media business (AOL, which notably included Yahoo), which was sold to Apollo Global Management in July 2023.

I continue to view the divesture of the firm’s Media business as a positive and believe the refocusing on their core operations should allow Verizon to hopefully increase efficiency resulting in expanding margins and net incomes.

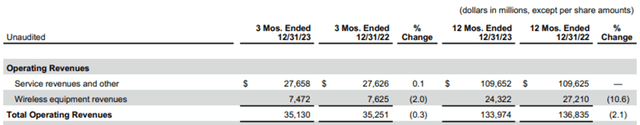

Total revenues for Q4 were essentially flatline YoY at $35.1B due to no real growth in the firm’s service revenues or wireless equipment revenues.

VZ FY23 Q4 Financial Statements

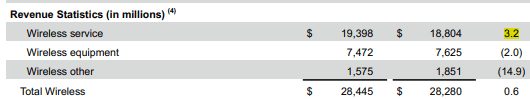

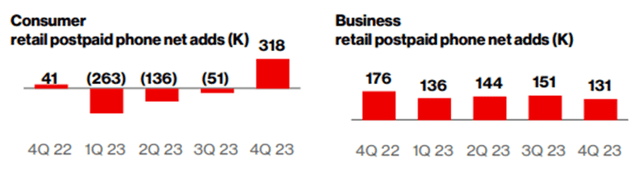

The firm’s wireless service revenue grew by 3.2% year over year to $19.4 billion in Q4 2023, driven by strong customer growth and demand for its 5G network. The company added 449,000 postpaid phone net additions across its Consumer and Business segments, up from 217,000 in Q4 2022.

However, this solid growth in wireless service revenue was offset by weak wireless Other sales and a slight decline in wireless equipment revenues.

VZ FY23 Q4 Presentation

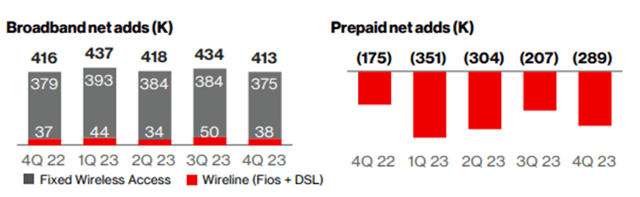

The company also added 413,000 total broadband net additions in Q4 2023, the fifth consecutive quarter that Verizon reported more than 400,000 broadband net additions. This included 375,000 fixed wireless net additions and 55,000 Fios Internet net additions.

VZ FY23 Q4 Presentation

The company’s total broadband subscriber base reached 10.7 million as of the end of Q4 2023.

While such robust subscriber growth suggests Verizon continues to be a highly competitive player within the industry, I am a little disappointed at the firm’s inability to transform these operational gains into real quantitative revenue or income growth.

VZ FY23 Q4 Financial Statements

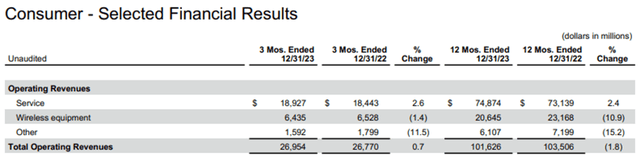

Verizon’s Consumer segment reported a revenue of $27 billion in Q4 2023, a decrease of 0.7% YoY. This came primarily on the heels of weak demand for wireless handsets and flatline service revenues.

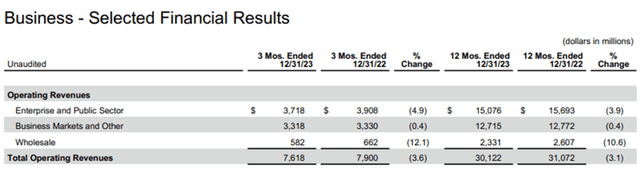

VZ FY23 Q4 Financial Statements

The firm’s Business segment reported a revenue of $7.6 billion in Q4 2023, a decrease of 3.6% YoY. This was slightly offset by a 1.9% reduction in operating expenses but left operating income down 24.3% YoY at just $443 million.

These results left Verizon’s total operating margin for Q4 2023 at 14.8%, down from 16.8% in Q4 2022.

The Consumer segment’s operating margin was 25.9%, down from 27.4% in Q4 2022. The Business segment’s operating margin was 7.3%, down from 8.7% in Q4 2022.

The margin declines were mainly due to higher wireless network costs and increased investments in 5G deployment and customer acquisition.

The higher customer acquisition costs illustrate just how sensitive product pricing is within the wireless and broadband industry with Verizon essentially being unable to differentiate their services tangibly from the competition.

VZ FY23 Q4 Financial Statements

Considering the firm’s full year 2023, revenue totaled $134 billion, down 2.1% YoY. This was once again mainly due to the impact of the media divestiture and lower wireless equipment revenue, partially offset by higher wireless service revenue and broadband revenue.

The softening demand for wireless handsets has continued to hurt the firm’s overall topline growth.

While I do believe a more growth-oriented business environment may help reignite growth in this segment, the current struggles illustrate how exposed Verizon is to competition within this key business unit.

Verizon’s full-year 2023 total service revenue was $109.7 billion, representing no change YoY. The company added 1.8 million total wireless postpaid net additions, up 26% year over year. The company’s total wireless postpaid phone net additions were 1.1 million, up 18.4% year over year

Full-year 2023 total broadband net additions were up 21.4% YoY to 1.6 million. This included 1.4 million fixed wireless net additions, up 31.3% YoY, and 0.3 million Fios Internet net additions, up 1.1% YoY.

VZ FY23 Q4 Financial Statements

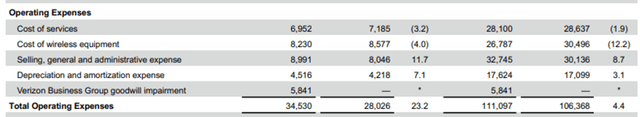

Unfortunately, a significant 4.4% increase in operating expenses particularly due to a goodwill impairment left operating income down 25% for the full year at just $22.9B.

VZ FY23 Q4 Financial Statements

Total 2023 net income attributable to Verizon fell accordingly to just $11.6 billion, down 45% year over year.

Overall, it is clear that Verizon delivered a very mixed bag of results to round off their FY23.

While the growth in total wireless and broadband subscribers was great to see, the firm struggled to grow margins as the highly inflationary and higher interest-rate environment limited the firm’s ability to expand profitability.

This was further hampered by the firm’s overall decrease in full-year revenues and the one-off charges related to the sale of the Media business.

While I still see Verizon as one of the better wireless and broadband operators considering the likes of AT&T and T-Mobile, it is undeniable that 2023 has been a pretty lackluster year for the firm.

Valuation – Q4 & Full Year 2023

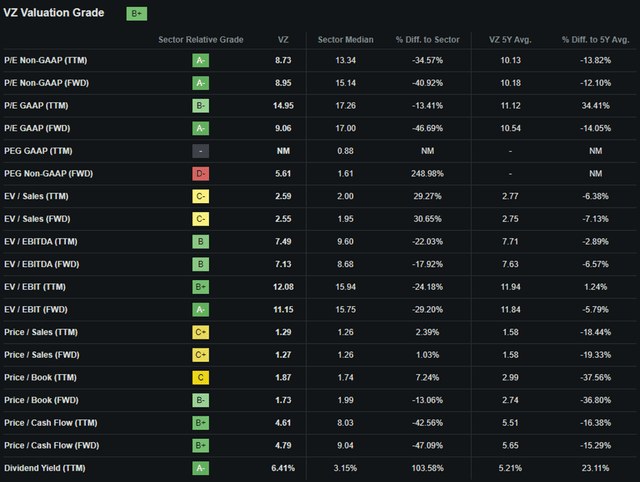

Seeking Alpha | VZ | Valuation

Seeking Alpha’s Quant assigns Verizon with a “B+” Valuation rating. I believe this letter grade is a reasonably accurate representation of the value present within the firm’s stock at present time.

Verizon currently trades with a P/E GAAP TTM ratio of 14.95x which represents a 34% increase relative to their running 5Y average.

However, I believe this massively elevated P/E ratio relative to their historic values is unrepresentative given the net loss in Q4 and the impact of one-off items on their most recent 2023 results.

Verizon also has a P/CF ratio TTM of just 4.61x and an EV/Sales TTM of 2.59x. Both of these ratios are 17% and 7% below the firm’s running 5Y average respectively.

I like how cheap the stock appears relative to their cash flow as it illustrates how markets are discounting the underlying cash generation abilities of Verizon.

Furthermore, the low 4.61x ratio also illustrates that very little growth has been baked into the stock’s price.

Finally, I just want to highlight Verizon’s Price/Sales TTM ratio of just 1.29x. This perfectly supports my thesis that investors are pricing in little to no growth in Verizon’s earnings in the coming years.

Seeking Alpha | VZ | 5Y Advanced Chart

The last FIVE years have seen VZ stock generate abysmal returns for shareholders. The wireless providers stock has been massively outperformed by the popular S&P 500 tracking index fund SPY (SPY) to the tune of 100%.

Volatility for the stock has however been very low with a beta of just 0.40x. This however is little consolation given the continuous drop-off in share prices over the last five years.

Seeking Alpha | VZ | 3M Advanced Chart

Over the last three months, Verizon shares have seen a truly massive rally relative to the stock’s usual volatility with shares rising almost 13% as a result of the almost stock market-wide bull run that began in late 2023.

While I do believe the stock was significantly undervalued prior to this run, little tangible catalyst appears to have started the rally at least with regards to Verizon’s underlying business operations or earnings releases.

The Value Corner

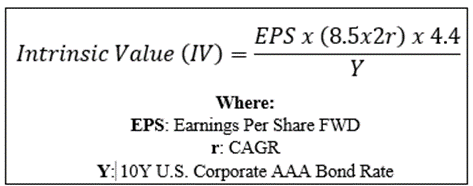

By utilizing the Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Let’s start with a base-case valuation using Verizon’s current share price of $40.61, a conservative 2024 EPS estimate of $4.59, a realistic “r” value of 0.02 (2%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.87x, I derive a base-case IV of $52.00.

This represents a substantial 22% undervaluation in shares at present time.

When using a near zero growth CAGR value for r of 0.01 (1%) to reflect a worst-case scenario where a recessionary environment causes Verizon to see no real revenue and margin growth, shares are valued at $43.50 representing a 7% undervaluation in shares.

This bear-case scenario perfectly illustrates how essentially no growth is factored into the current share price for Verizon even after the massive rally that started in late 2023.

In the short term (3-12 months), I find it difficult to predict a direction for the stock given their exposure to a highly sensitive consumer discretionary spending environment and the overall competition present in the wireless market.

Given that Verizon will struggle to tangibly differentiate its products from those offered by competitors apart from competing on price, I see little tangible upside in 2024 for the stock.

In the long-term (2-10 years), I believe Verizon is now better placed to expand its total subscriber volumes and operate a more lean and profitable business thanks to the divestiture of the media business.

Verizon’s Risk Profile

Verizon faces some risk from the one-off costs associated with the removal of 1960s lead-sheathed cables along with political agendas pressuring broadband pricing models.

The use of lead-sheathed copper cables in telecommunications infrastructure during the 1960s has led to a large number of companies facing contamination risks arising from their broadband networks in particular.

Verizon has around 540,000 miles of copper cable with around 15% of that mileage consisting of lead-sheathed cables. This means Verizon could potentially only have to recover approximately 81,000 miles of lead-contaminated cabling.

While this number is still huge, it pales in comparison to the 200,000 miles of network cable AT&T has that present a contamination risk.

From an ESG perspective, Verizon also faces some political pressure with increasingly loud demands for affordable high-speed internet to be made available to the masses.

The Biden administration has declared that broadband service is no longer a luxury but a necessity. This could see Verizon facing price ceilings for their services which may erode margins significantly.

Should such policies spread to wireless network coverage, Verizon could see its largest business segment suffering from contracting margins and falling revenues.

Nevertheless, I believe the lack of substantial environmental, societal, or governance concerns makes Verizon a great pick for a more ESG-conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research if these matters are of concern to you.

Summary

Verizon continues to generate some pretty mixed fiscal earnings with the latest Q4 results being no exception.

While total subscriber volumes for their wireless and broadband solutions continue to grow, the firm has been unable to generate real topline revenue growth with operational efficiency down YoY due to increased expenses.

While the one-off costs that impacted Q4 income, in particular, were regrettable, I believe the divestiture of the media businesses will allow Verizon to focus more on its core operations and increase the efficiency of its consumer and business segments.

Current valuations remain attractive with a base-case scenario still suggesting an undervaluation of around 22% may be present in shares.

Nevertheless, I believe a weak consumer in 2024 and a post-rally selloff may limit the total amount of upside present in Verizon stock at present time and therefore downgrade the company to a Hold rating.

Given the firm’s lackluster growth prospects and historic underperformance, I would ideally like to see an undervaluation of around 30% as a minimum before starting a new position in the stock.