Vertex: Positive Growth Outlook with Margins at Inflection Point (NASDAQ:VERX)

Galeanu Mihaly

outline

My recommendation for Vertex (NASDAQ:VERX) is rated a Buy as operating indicators continue to point to positive growth going forward. In particular, I was impressed with VERX’s ability to cross-sell and increase revenue per customer. Current weak macro environment. Another notable thing is VERX’s margin outlook. I became more positive after management provided FY24 guidance suggesting an incremental adjusted EBITDA margin of 36%. For reference, I Previously rated We placed a Buy rating on VERX because we expect strong price growth and migration of ECC customers to support growth in the near term and that this growth will help maintain premium valuation multiples.

Latest results and updates

VERX reported total 4Q23 revenue of $154.9 million, an 18.1% y/y growth that exceeded consensus expectations of $146.4 million. growth is Driven by both subscription and service revenue, subscription revenue hit $130.7 million and service revenue hit $24.4 million. In terms of profitability, adjusted EBITDA was $32 million, again beating consensus expectations of $28.7 million, and adjusted net income was $21 million, beating consensus. VERX ended FY23 with total revenue growth exceeding my expectations (16.4% vs. 15%). This makes us even more positive about the business and this optimism is further supported by fundamental operating indicators.

Looking at P&L, Annual Recurring Revenue (ARR) growth was even stronger at 18.9%, accelerating from 17.8% in 3Q23, indicating demand trends remain robust despite the prevailing macro conditions. If VERX can accelerate ARR even under these circumstances, consider the possibilities when the macro situation turns around. An even more positive indicator of stronger demand is that average ARR per customer (ARRPC) growth actually accelerated from 16% in 3Q23 to 18% in 4Q23, reaching ~$119,000. This marks the fifth time VERX has held ARRPC. Over $100,000. This suggests that either VERX is very good at cross-selling its products, or that customers are finding a lot of value in VERX products and want to adopt more. Either way, this is great for business and we expect it to support future growth. From an organic growth (i.e. volume) perspective, VERX continued to add customers, increasing total customer count from 4,303 in Q3 ’23 to 4,310, and importantly, net dollar retention rate (NDRR) actually increased by 200 bps. It solidifies the notion that VERX is seeing very positive traction in driving ARRPC forward. Since 25% of the NDRR improvement comes from organic price increases, this is also a strong indicator that demand health remains strong (sales volume rising despite price increases in a weak macro climate).

One concern I had was that if Pagero were acquired by Thomson Reuters, Pagero might end its relationship with VERX (VERX wanted to acquire Pagero, but pulled out when they outbid the others). Pagero believes that electronic invoicing is a very important part of the overall VERX product because it is a feature that VERX does not have. Aims for managed global tax compliance. Fortunately, during the call, management noted that the multi-year partnership agreement with Pagero announced in October 2023 is still in effect. To be honest, I’m not entirely sad how this turns out (despite my positive opinion), since VERX doesn’t have to spend $555 million to acquire Pagero, but can still leverage Pagero’s products.

Despite FY24, we believe business momentum will continue as FY24 guidance shows accelerated subscription revenue growth. For reference, total revenue is expected to be between $650 million and $660 million, which would imply growth of about 14.5% at the midpoint, and management emphasized expectations for mid-single-digit services (assuming 5%) revenue growth. . If you do the math, subscription revenue is expected to grow by 16.2%, an acceleration from 15.7% in FY23. The better news is that growth will come at very strong incremental margins. FY24 adjusted EBITDA margin was guided in the range of $130 million to $135 million, implying a margin of ~20.2%, up 190 basis points from FY23. If you do an incremental adjusted EBITDA margin analysis over the last few years, this guide implies an incremental margin of 38% (y/y), so that’s huge. This is higher than the recent high of 27% seen in FY20. FY23 suggests that VERX could see a strong inflection point (i.e., fixed costs are largely covered).

Valuation and Risk

Author’s evaluation model

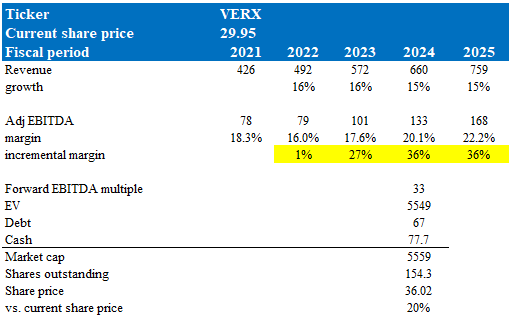

According to my model, the value of VERX increased 20% to $36 in FY24.

This price target is based on a growth forecast of 15% over the next two years in FY24 and FY25, using FY24 guidance and extrapolating that momentum into FY25. I note that my growth expectations have been adjusted lower to reflect the guidance, but I still think there is potential for outperformance as subscription revenue is expected to grow up to 16% (accelerating) and become a larger portion. Business growth should begin to reflect subscription revenue growth. I also incorporated adj. As margins have become an increasingly important part of our business, I have incorporated EBITDA performance into my models to further increase business value. Using management’s FY24 EBITDA guidance as a starting point, we estimated the same incremental margin ahead of FY25, which equates to a margin of 22.2%, or EBITDA of $168 million ($133 million adjusted EBITDA in FY24 and $168 million adjusted EBITDA in FY25). It’s possible. In terms of multiples, VERX is trading at a historical average multiple of 32x forward EBITDA. Although the outlook is positive, we refrain from taking an aggressive stance on assuming upward revisions to the multiple.

danger

The downside risk is with Pagero. Despite its multi-year relationship with Pagero, management indicated delays in implementing electronic invoicing regulations in key markets. Assuming these delays take longer than expected (since Pagero is not incentivized to prioritize its work through these provisions compared to VERX), growth could be delayed.

summary

To summarize this post, the recommendation for VERX is a buy rating. Last quarter’s performance really supported my bullish view of the business, with both revenue and adjusted EBITDA exceeding consensus expectations and underlying operating metrics (strong ARR and ARRPC growth) indicating healthy demand despite macro headwinds. Regarding the Pagero acquisition, although it didn’t happen, we liked the fact that our multi-year partnership with Pagero guaranteed access to their electronic invoicing capabilities. What’s noteworthy going forward is that FY24 guidance suggests accelerated subscription revenue growth and significant margin improvement.