VFQY: High-quality ETF with strong value and small-cap tilt.

bearded dave

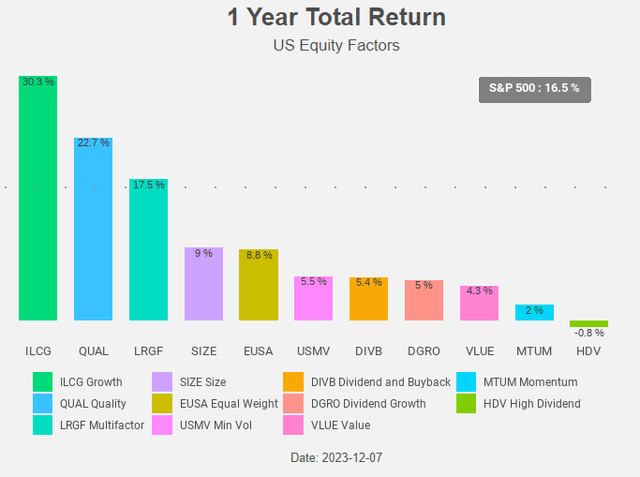

Blue-chip stocks are shining amid an economic slowdown that could lead to a recession. Blue chip stocks have strong balance sheets and have a low risk of default. This is a valuable feature when the economy is slowing. In such economic circumstances The Federal Reserve typically stops raising interest rates, and blue chip stocks have historically performed well in this interest rate environment. Quality, along with growth, are the best performing asset factors.

Value and small-cap stocks perform less well because they are hampered by rising interest rates.

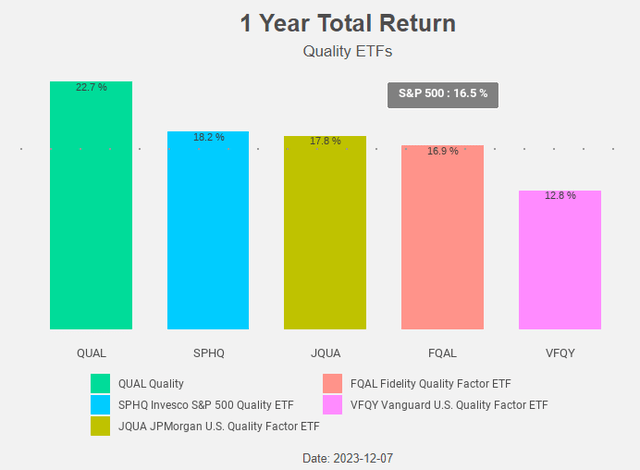

Figure 1: Total Return Chart (Radar Insights)

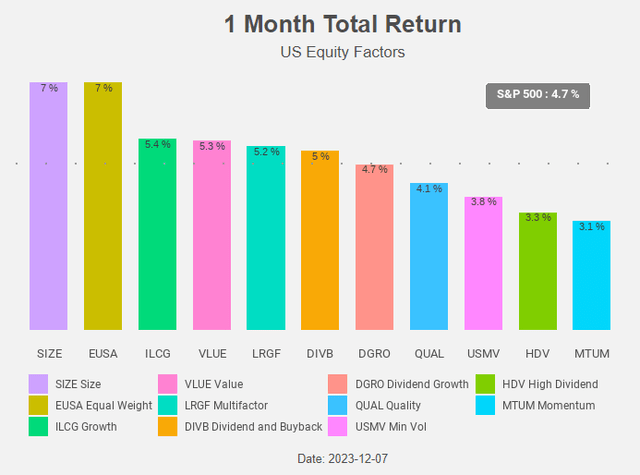

The recent decline in interest rates is a tailwind for value and small-cap stocks. Vanguard US Quality Factor ETF (bat:VFQY) is a high-quality ETF with high value and a small-cap bias. This slope may be an interesting feature that favors VFQY over other qualities. ETF.

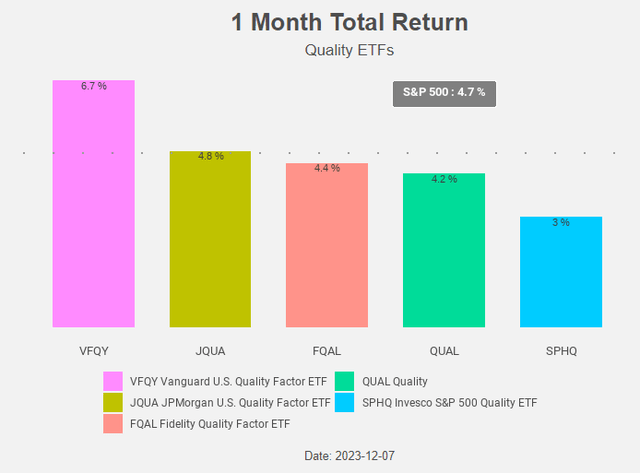

Figure 2: Total Return Chart (Radar Insights)

The best-performing quality ETFs over the past 12 months have been the iShares MSCI USA Quality Factor ETF (QUAL) and the more defensive JPMorgan US Quality Factor ETF (JQUA). Additionally, the Wahed FTSE USA Shariah ETF (HLAL) is also performing well (see more details here and here).

The only quality ETF that doesn’t outperform the S&P 500 is VFQY.

Figure 3: Total Return Chart (Radar Insights)

However, over the past month, VFQY has been the best-performing quality ETF thanks to its value and small-cap bias.

Figure 4: Total Return Chart (Radar Insights)

Will this trend continue?

Vanguard U.S. Quality Index ETF

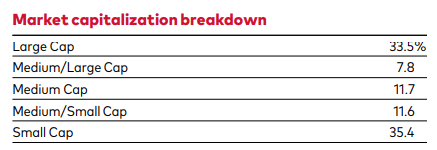

The Vanguard US Quality Factor ETF measures the performance of the top 3,000 companies (representing approximately 98% of the investable U.S. stock market) by benchmarking the Russell 3000 Index. This gives VFQY a small cap tilt.

Figure 5: Market capitalization analysis (Vanguard)

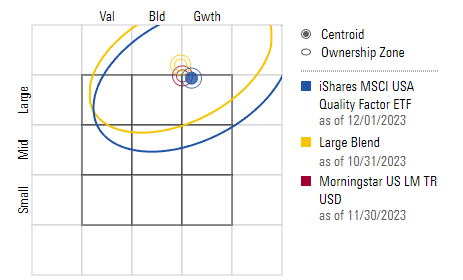

The iShares MSCI USA Quality Factor ETF is benchmarked against the MSCI USA Sector Neutral Quality Index and does not bet on any sector compared to the S&P 500 and can be classified as large-cap growth.

Figure 6: Style box QUAL (Morningstar)

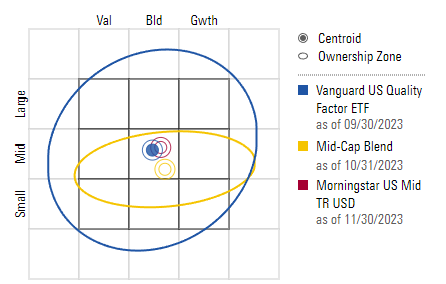

The small-cap and value tilt moves VFQY away from large-cap growth and toward a more balanced profile for both value/growth and size.

Figure 7: Stylebox VFQY (Morningstar)

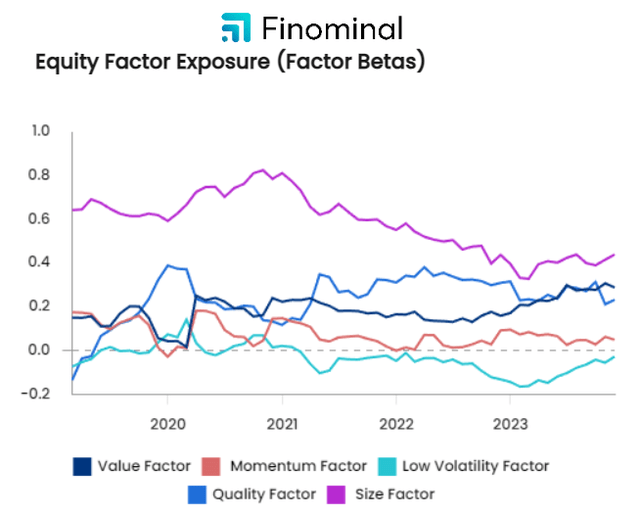

Looking at VFQY’s equity factor exposure, we see that the factor betas for size and value are currently much higher than the quality factor betas.

Figure 8: Factor beta VFQY (final)

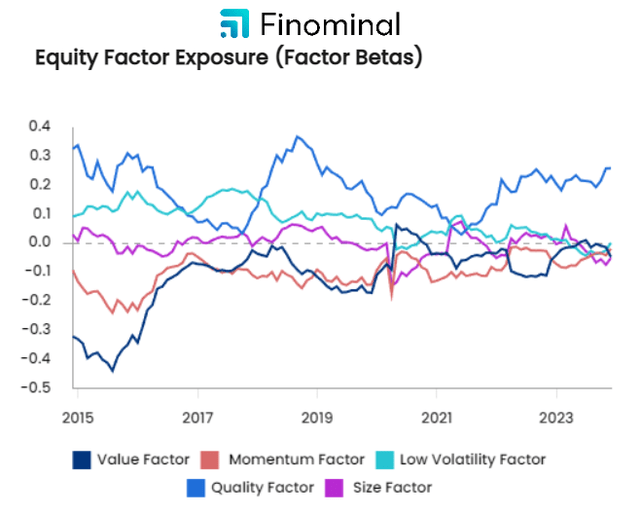

QUAL, on the other hand, is a pure quality ETF with factor betas close to zero for value, size, low volatility, and momentum.

Figure 9: Factor Beta QUAL (Final)

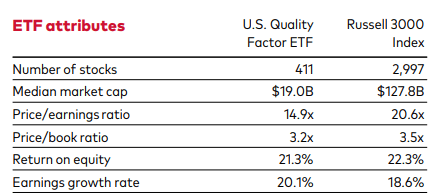

The higher weighting of value and size gives VFQY a cheap valuation with a P/E below 15!

Figure 10: ETF properties (Vanguard)

We were honestly a little surprised to see that VFQY’s return on equity was lower than the Russel 3000. VFQY uses a rules-based quantitative model that explicitly focuses on return on equity. Other measures they use include total profitability, change in net operating assets, and leverage.

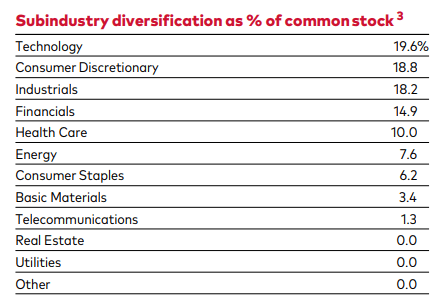

A rule-based portfolio construction model creates portfolios in which technology is the largest sector.

Figure 11: Top Segment (Vanguard)

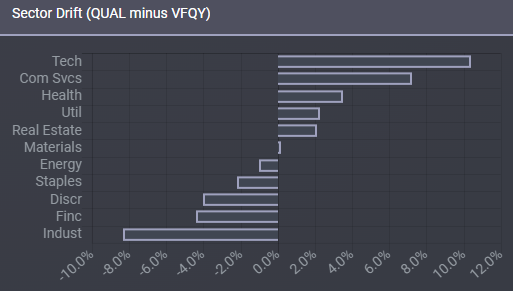

However, compared to QUAL, VFQY is underweight technology and communications services and overweight industrials, financials and consumer discretionary.

Figure 12: Sector Drift (ETFresearch.com)

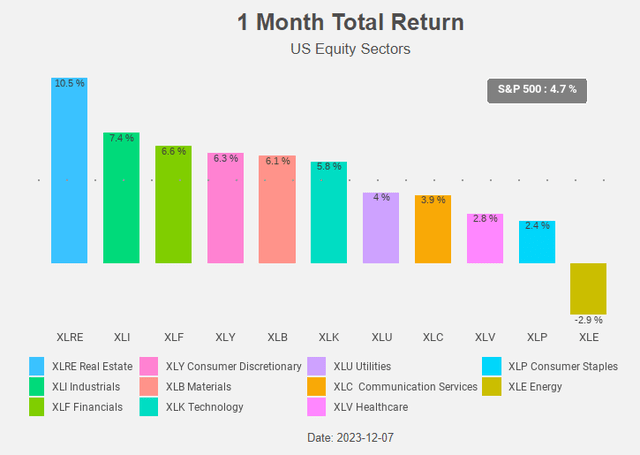

These overweight sectors have been among the best performing sectors (along with real estate) over the past month.

Figure 13: Total Return Chart (Radar Insights)

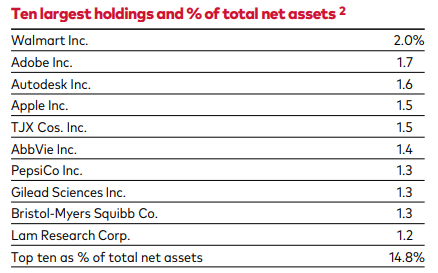

VFQY is more diversified than QUAL, with nearly 40% invested in its top 10 holdings. For VFQY this is less than 15%.

Figure 14: Top 10 Holdings (Vanguard)

VFQY’s value and small-cap tilt may be interesting characteristics that favor VFQY over other high-quality ETFs.

Small cap and value stocks

First, let’s look at the outlook for small-cap stocks.

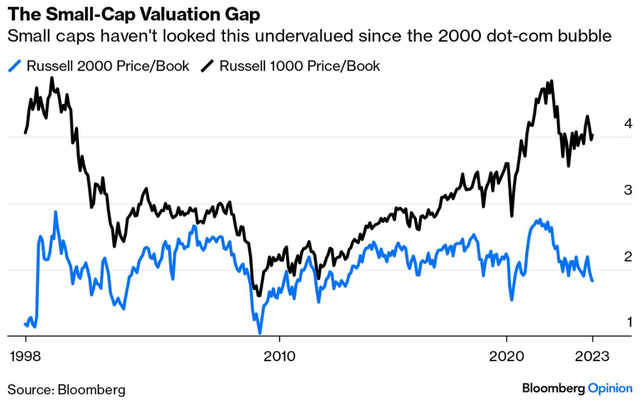

Small-cap stocks underperform because they tend to have weaker balance sheets, with more floating-rate debt and therefore higher interest costs. If the Federal Reserve begins to cut interest rates, this will be a strong tailwind for small-cap stocks. This would also be beneficial for small-cap stocks if they can avoid a recession and have a soft landing. We’ve already seen the impact of lower long-term interest rates on small-cap performance last month. And the little hats are also very affordable. This could be another tailwind going forward.

Figure 15: Small Cap Valuation Gap (Bloomberg)

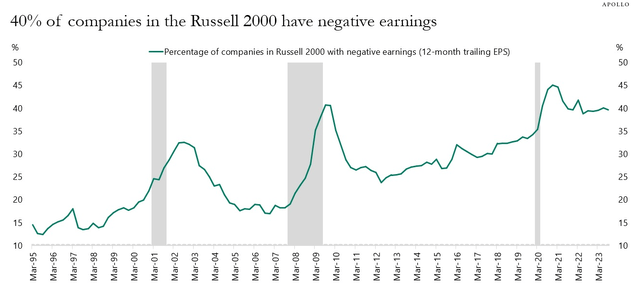

Hamilton Lane’s research discusses the impact of loss-making companies on valuations. This effect is stronger for small-cap stocks. This is because there are more companies that make losses among small-cap stocks.

Figure 16: Percentage of Companies Incurring Losses Russell 200 Index (Apollo)

Excluding loss-making companies, the remaining small-cap stocks (such as the Russell 200 Index) are significantly cheaper than the indices that contain them. This is important to VFQY because it uses (total) profitability and return on equity as metrics to select high quality stocks.

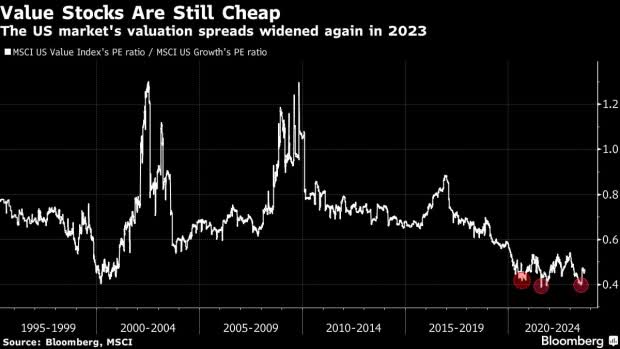

Like small-cap stocks, value stocks are clearly underperforming growth stocks.

Figure 17: Value-to-Growth Performance (Bloomberg)

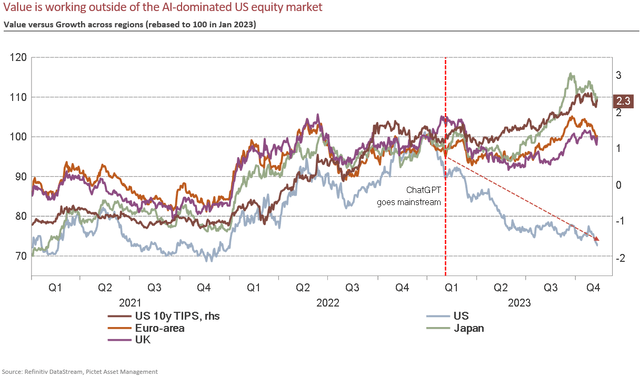

Value is performing better outside the U.S., where the impact of the AI boom has been less overt. The Magnificent 7 is a truly American story.

Figure 18: Value Performance (Pictet)

Like small-cap value stocks, value stocks are certainly cheaper than growth stocks.

Figure 19: Value vs. Growth Valuation Spread (Bloomberg)

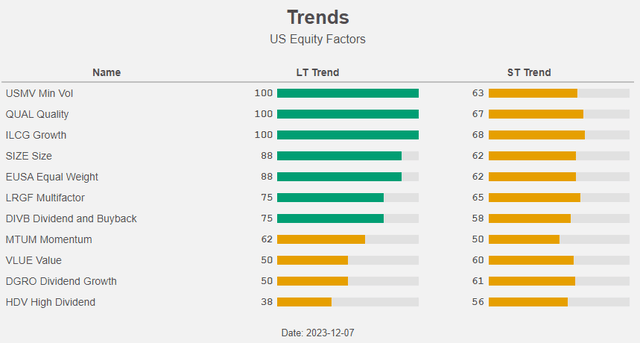

Quality maintains a strong long-term upward trend. Although Value is not in a clear upward trend (yet?), the situation for Value and Size is improving.

Figure 20: Trends (Radar Insights)

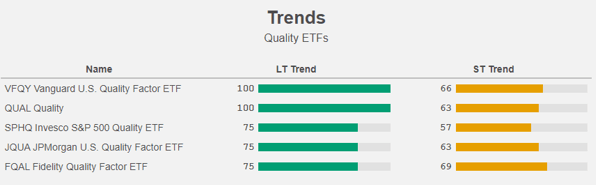

All quality ETFs have the highest scores on QUAL and VFQY, indicating a long-term upward trend.

Figure 21: Trends (Radar Insights)

conclusion

We don’t know if we are already in a recession, but we do know that the Federal Reserve is slowing the economy by raising interest rates. Quality tends to perform better when the Fed ends raising interest rates and the economy is slowing or entering a recession.

It looks like the Fed has actually finished raising interest rates. Long-term interest rates are falling, which supports value and small-cap stocks. This is a tailwind for VFQY. We remain positive on high quality stocks in general and QUAL in particular. However, VFQY is a great way to complement and diversify your high-quality stock allocation.