VGT ETF: Buying at Record Values Is the Matter (NYSEARCA:VGT)

Richard Drury

Vanguard Information Technology ETF (NYSEARCA: VGT) has fallen more than 7% over the past three weeks, which is equivalent to about 10 years of the ETF’s dividend yield. VGT has delivered poor cash returns since its peak in 2021. A half-year period of zero excess returns, including a median decline of 38%. The failure of the surge in investor sentiment surrounding the AI boom to deliver meaningful risk-adjusted returns reflects extreme valuations that dampen income and create asymmetric downside risks, especially relative to high cash rates. With interest rate cut expectations receding and the upward trend ending, another large decline is expected.

VGT ETF

The Vanguard Information Technology ETF seeks to track the investment performance of the MSCI US Investable Market Information Technology 25/50 Index, an index of large-, mid-, and large-cap stocks. Small U.S. companies in the information technology sector classified according to the Global Industry Classification Standard (GICS). VGT is the largest ETF targeting the IT sector specifically and offers a low expense ratio of 0.1%. Three stocks, led by Microsoft, account for 45% of the index.MSFT), apologize (AAPL) and NVIDIA (nvidia), the weights are 18%, 15%, and 12%.

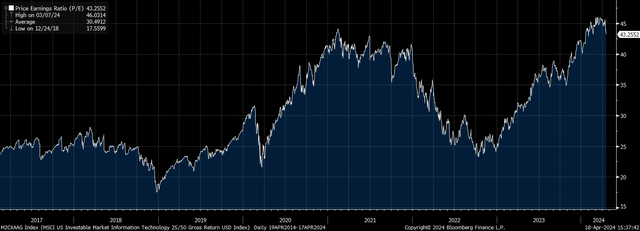

Apple’s decline and Nvidia’s rise have pushed PE multiples to new highs.

The Fund will invest no more than 25% of its assets in any one security and at least 50% of its assets in securities each representing no more than 5% of the Fund’s assets. Each 25/50 index is a float-adjusted market capitalization weighted index that is rebalanced quarterly. Since our previous article on VGT in June last year, the composition of the index has changed dramatically. Most notably, Apple’s market share fell by about 8 percentage points due to Nvidia’s rise. Apple’s cheaper valuation compared to Nvidia has had the effect of increasing the PE ratio of the VGT underlying index from 35x in June last year to 43x today.

VGT Lagging PE Ratio (Bloomberg)

The ETF’s weakness over the past three weeks, from its March high of just 0.7% dividend yield, has wiped out the equivalent of 10 years of dividend income and brought VGT’s return-to-cashback ratio below its 2021 high. For assets that declined 38% over this period, this is poor performance and comes despite widespread optimism surrounding AI-related revenue growth. This highlights the risk of investing in stocks with extremely long duration due to extremely expensive valuations.

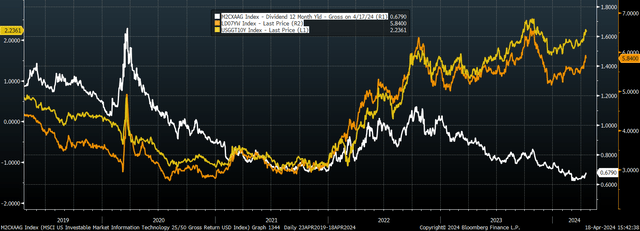

Rising yield pressures suggest that another major correction should be expected.

If an investor demands a 10% annual total return from technology stocks, in line with the long-term return of the S&P 500, this means the dividend must be increased indefinitely to 10-0.7=9.3%. Even with a perpetual growth rate of 9.0%, the ETF’s fair value would decline by 30%, and with a growth rate of 8.0%, its fair value would be 65% lower than its current level. Of course, fair value is very sensitive to the required rate of return, and it could be argued that the relative safety of stocks included in an index due to their exclusivity means that investors will demand a lower rate of return. But with long-term investment grade bonds currently yielding nearly 6%, it is difficult to imagine investors demanding long-term returns of less than a few percentage points.

Current market conditions are reminiscent of previous periods when investors suddenly demanded much higher return prospects, leading to sharp selling. As you can see in the chart below, VGT has been sensitive to sharp rises in real Treasury yields and credit spreads in recent years, both of which have begun to trend upward as expectations of Federal Reserve easing have waned.

VGT dividend yield, US 10-year TIP yield and long-term corporate bond yield (Bloomberg)

The breakdown of the uptrend from the October 2023 low has shifted the technical outlook significantly, with the focus now on the pivot area of $466 below the February 21 low. Keep in mind that another peak-to-trough decline of 38% would take VGT down to $334, and if this looks aggressive, the dividend yield would rise to around 1%. This is still 1.2pp lower than UST’s actual return compared to 10. -Annual average of more than 0.8pp.

VGT ETF price (Bloomberg)

New AI optimism poses upside risks, but downside asymmetries dominate.

While we believe the risk-reward outlook currently facing VGT is worse than any market in the world, there are still potential catalysts that could push the ETF higher. Both MSFT and AAPL are scheduled to report earnings over the next few weeks, and positive surprises could reignite investor sentiment around AI-driven growth potential. Another rally in Nvidia stock, which has been a key driver for VGT in recent months, cannot be ruled out. That said, given current valuations, rising bond yields, and weakening price action, we see a lower path of least resistance for ETFs.