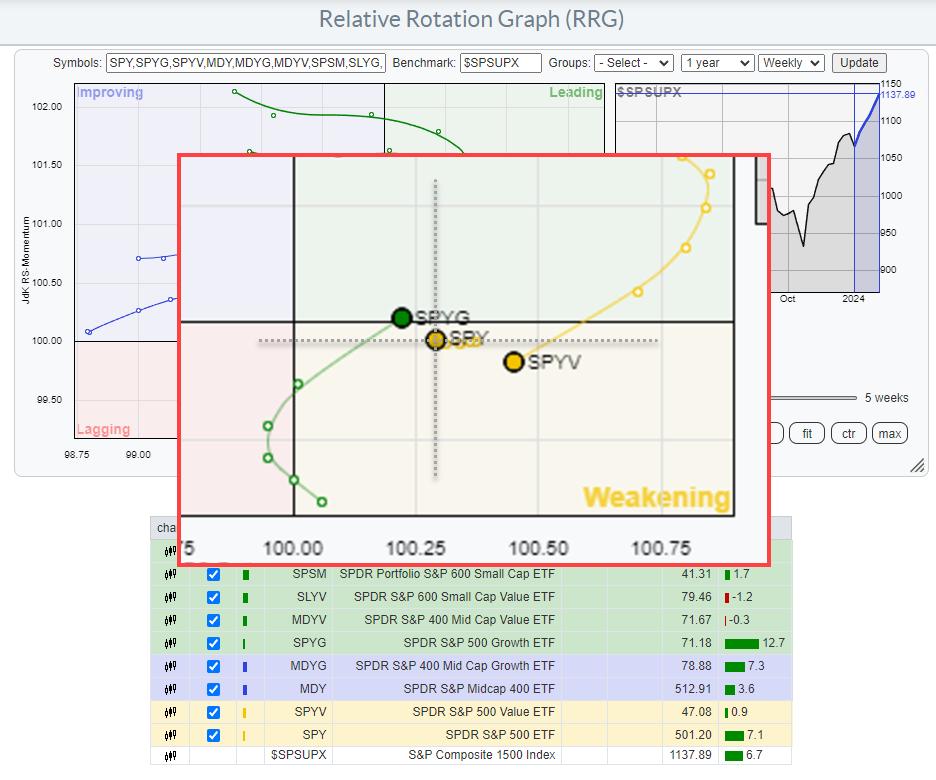

Visualization of RRG’s Market Factors Panel | RRG chart

key

gist

- Import the new Market Factors panel into the Relative Rotation graph

- The same approach using different index series will display different images.

With the launch of a new panel feature in the StockCharts dashboard, RRG chart users have more options! Let’s take a closer look at one in particular.

Market Factors Panel

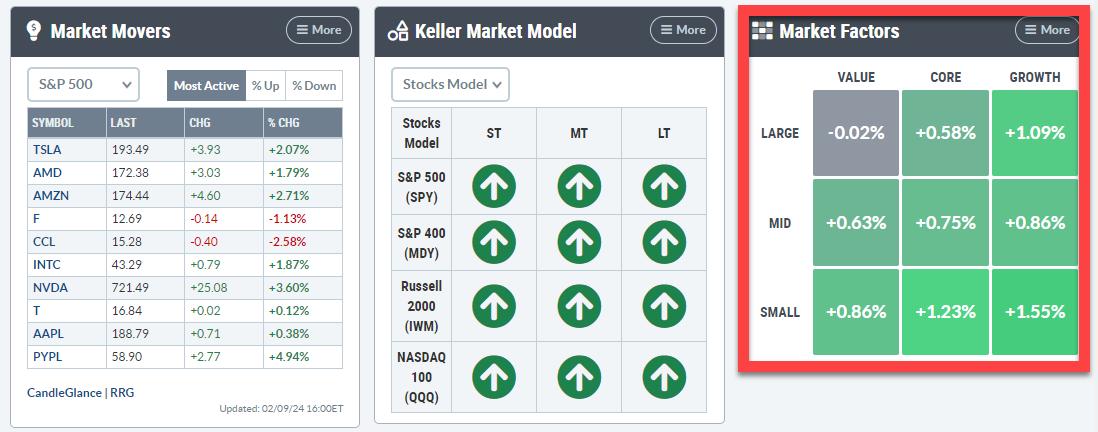

One of the most important new panels available to users is the “Market Factors” panel.

This panel divides the S&P 1500 into nine segments classified by size-value-growth. This is very similar to what is used for the RRG dropdown.

The only difference is that this panel uses the S&P index and only covers the S&P 1500 segment (as we will see). It means growing up with the S&P 400, 500 and 600 and cherishing your brothers and sisters.

Two core RRGs

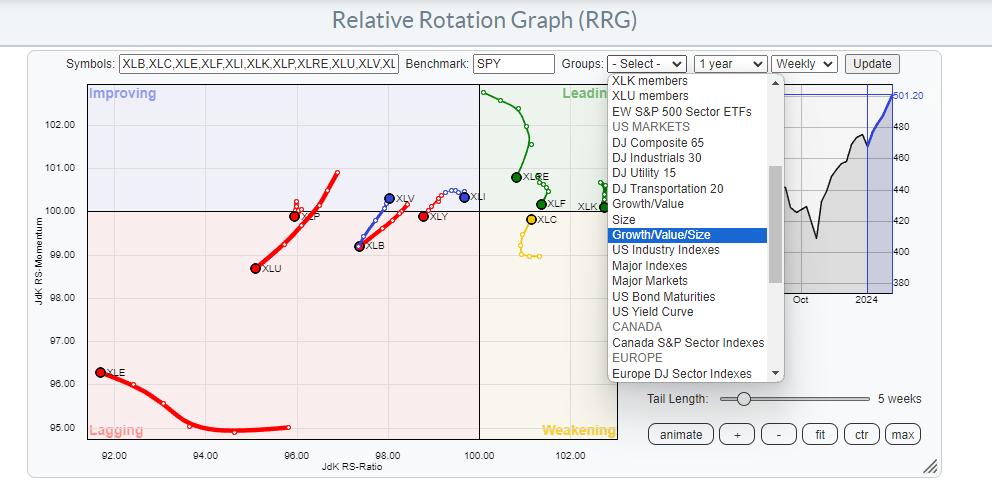

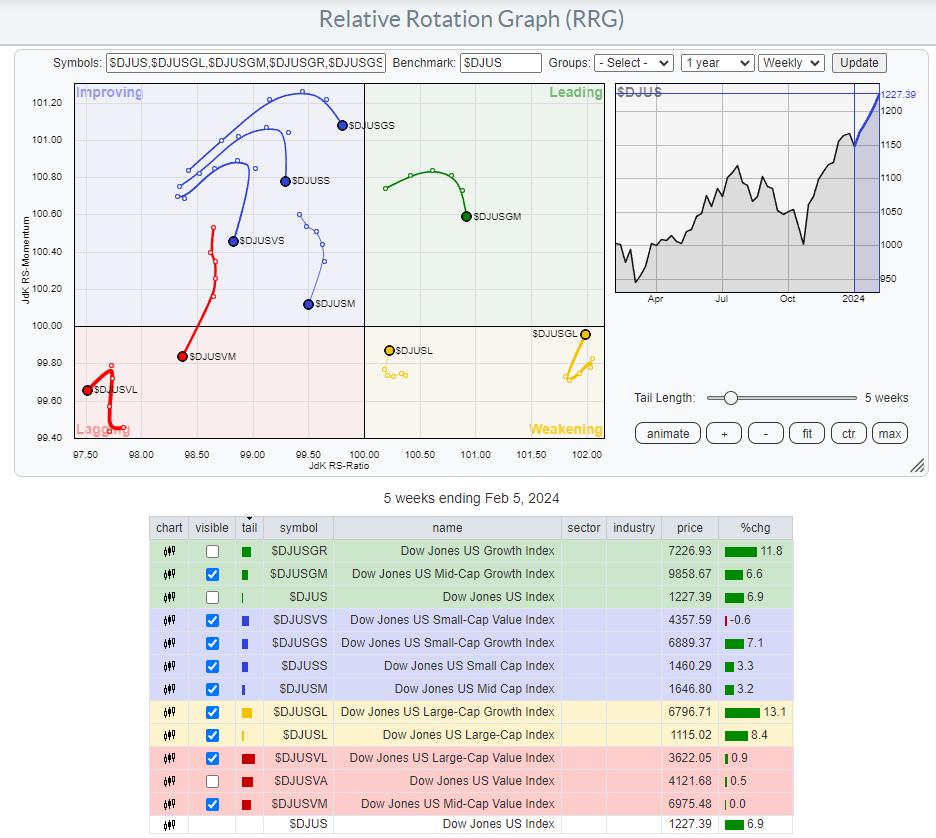

Below are RRGs from the predefined list:

As you can see, I’ve plotted the US Growth and US Value indices, which cover the entire market (all size segments), as well as the DJ US index, which is the benchmark for this graph.

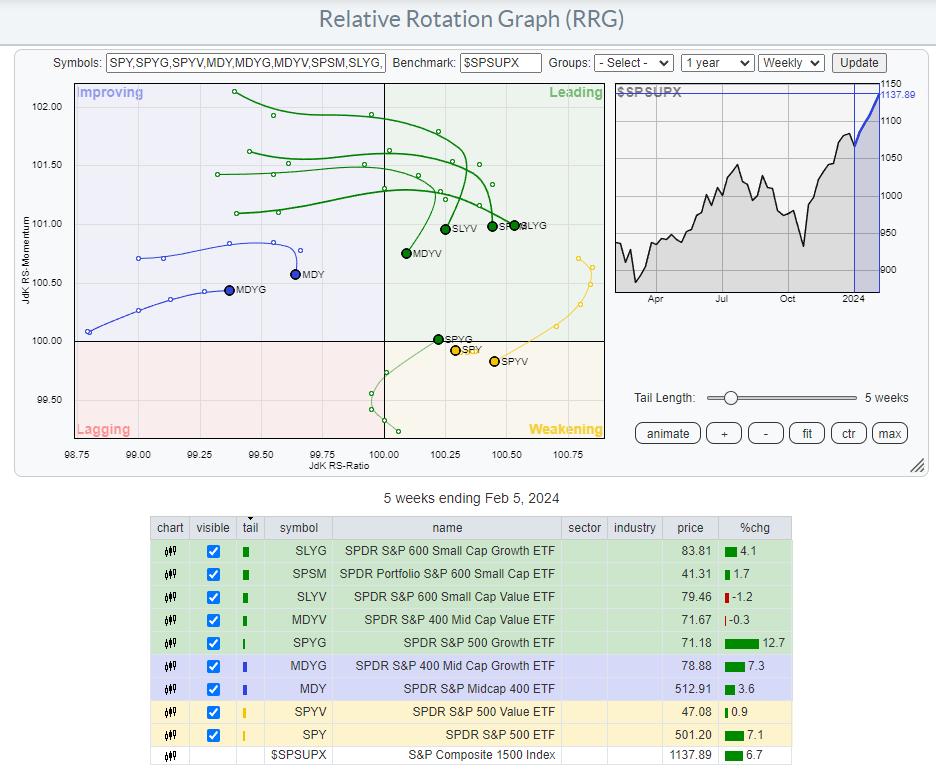

This is an RRG for market factors that uses the same underlying ETFs as the market factors panel.

RRG is linked to a live version of the site (just click on the image) and can be saved as a bookmark in your browser for later retrieval. We’ll also add this to our predefined universe group.

The benchmark for this group is the S&P Composite 1500 Index ($SPSUPX).

Same approach, different images

If you look at these two RRGs, you can see that although they are quite different from each other, they send similar messages in the bigger picture.

The differences are mainly due to the different universes. DJ Group holds 153 shares in the large-cap index, 314 shares in the mid-cap index, and 610 shares in the small-cap index. Therefore, the S&P group is much broader, especially in the large-cap and mid-cap sectors, and this can have a significant impact on the behavior of the index.

I use “Big Picture RRG” which is very high level. This means that much more attention is paid to the general rotation of the various tails relative to each other than to the exact position of the RRG.

One very interesting observation I found in the market factors panel RRG is the location of the SPYG, SPY and SPYV clusters.

What we can learn from this cluster of tails is their position in the RRG and the relative positions among the three tails.

First of all, these are both S&P 500s and therefore large-cap indices, which sit to the right of the benchmark (S&P 1500) and are in a relative upward trend. We can also see that growth relative to value is rapidly improving within S&P 500 sectors. Preferences began to change about five weeks ago, when growth and value began to tail off.

Although RRG’s positioning is different, like DJ’s version, we can see that a group of small and mid-cap stocks in both the growth and value sectors are starting to roll over, and some of them are already heading in a negative direction. . The only groups that are still heading in a positive direction may be large-cap growth and mid-cap growth. However, the latter is debatable as this tail is still within the improving quadrant, maintaining flat momentum at the lowest RS-Ratio readings in the universe. .

This is something to think about over the weekend. This is because it means that the basis for the rally is getting narrower after small and mid-cap stocks once again attempted to participate. This attempt seems to have failed, and the market continues to rise… “Wall of worry?” Only time will tell, but we believe there is good reason to be more cautious and the risk is increasing every day.

#StayAlert Have a nice weekend. –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more